The Dry Spell

Argentina is currently facing a prolonged dry spell that is starting to impact its 2024/25 corn and soybean crops. This dry period is linked to the La Niña climate pattern, which typically brings hotter and drier conditions to South America. In recent years, this phenomenon has been linked to declining water levels in the Paraná River, which directly affects Argentina's export competitiveness, as the river is the main route to the Rosario hub according to S&P Global.

The Economic Importance of the Port of Rosario and Paraná River

The Port of Rosario is strategically located on the Paraná River, about 550 km from the Atlantic Ocean, enabling oceangoing vessels to navigate inland and transport goods directly from Argentina’s agricultural heartland to global markets. This proximity to the river makes Rosario the country’s primary agricultural export hub, with the Paraná River serving as a vital transport route. Over 80% of Argentina’s agricultural and agro-industrial exports pass through the region, with the port complex handling around 70 million tons of grain annually. As part of a larger network along the river, Rosario plays a central role in one of the world’s largest soybean and grain export hubs.

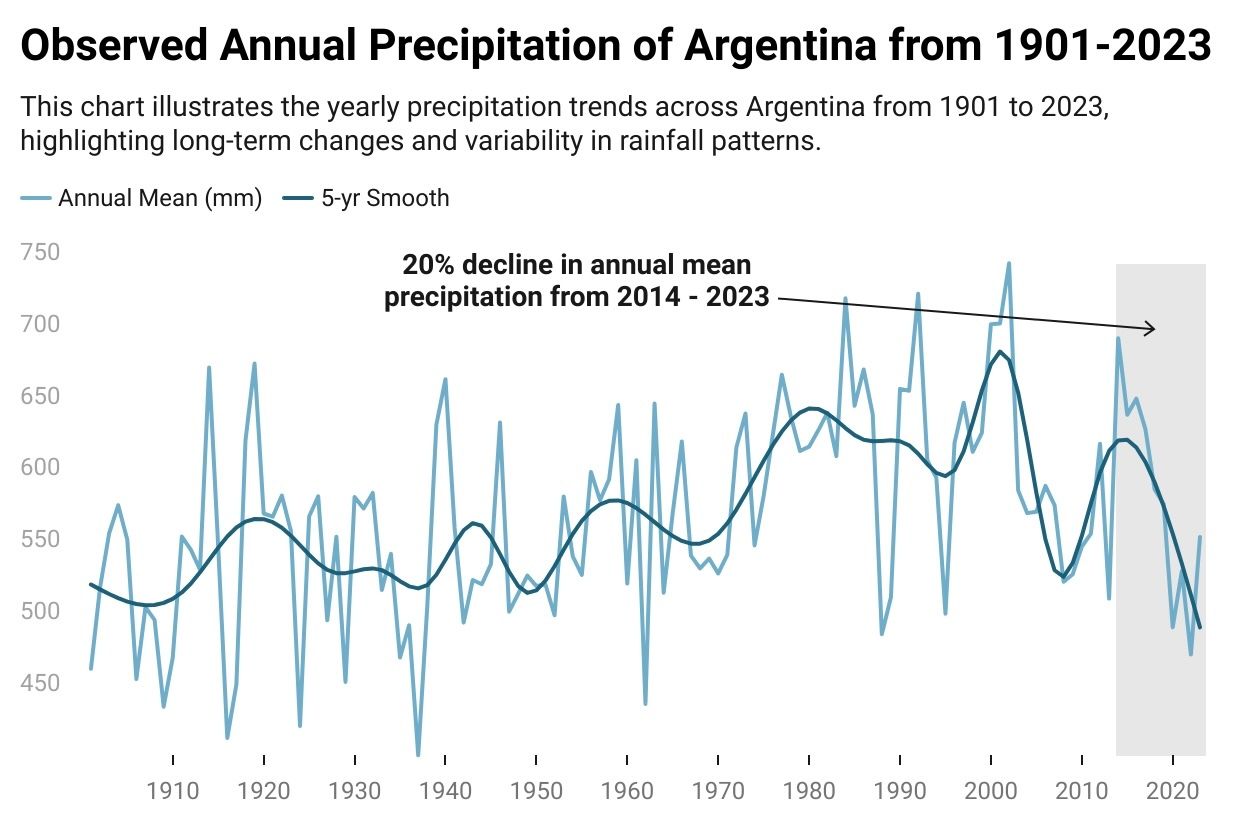

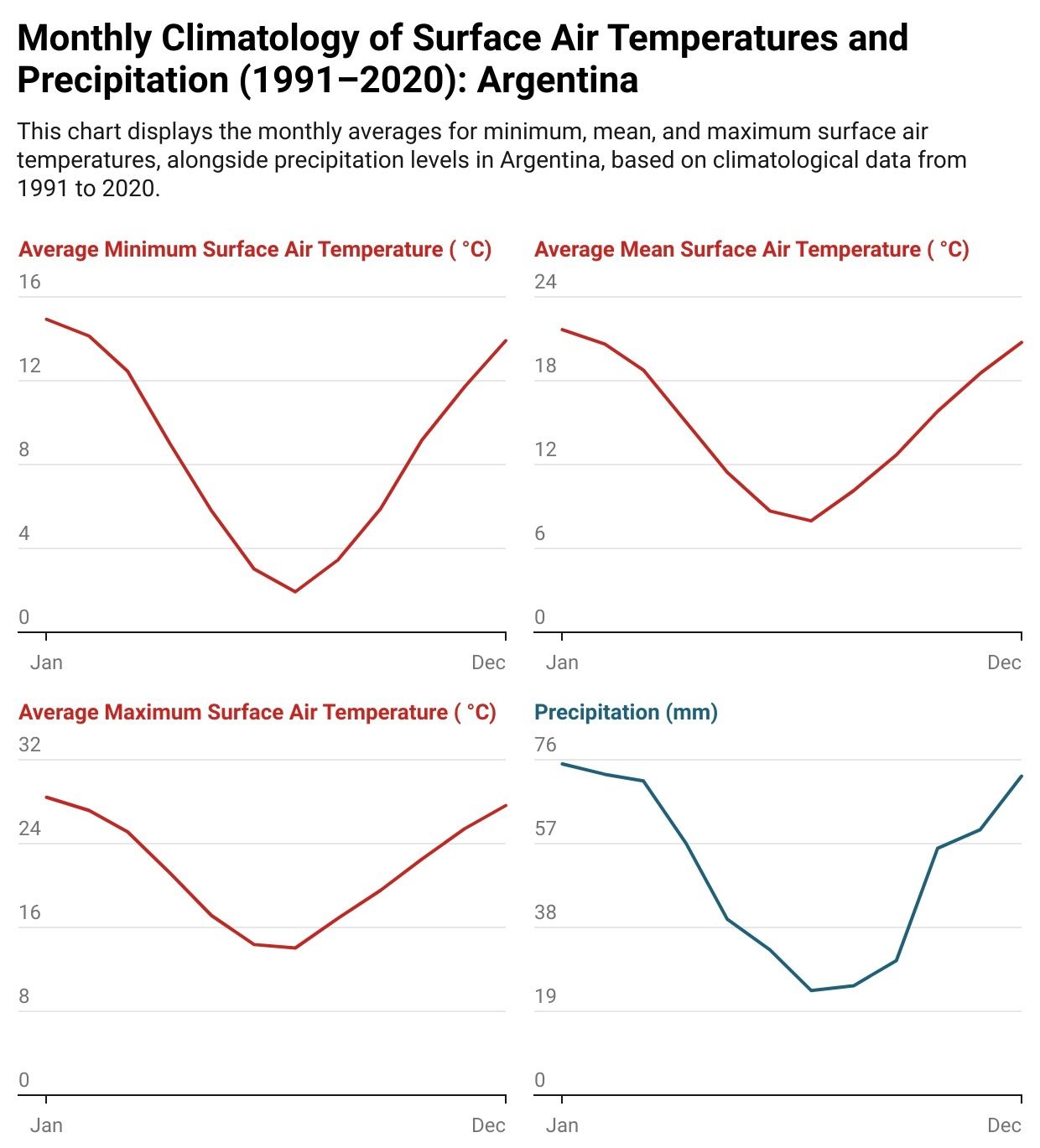

The effects on corn and soybeans are becoming increasingly apparent. According to AHDB, the U.S. National Oceanic and Atmospheric Administration (NOAA) has forecasted a 65% chance of La Niña developing between July and September, and an 85% chance from November to January. Additionally, the World Bank reports that Argentina has seen a 20% decline in annual mean precipitation from 2014 to 2023, with a steady decrease in rainfall over the past decade. However, recent forecasts indicate that rainfall may become more frequent in the second half of January, potentially easing some of the concerns.

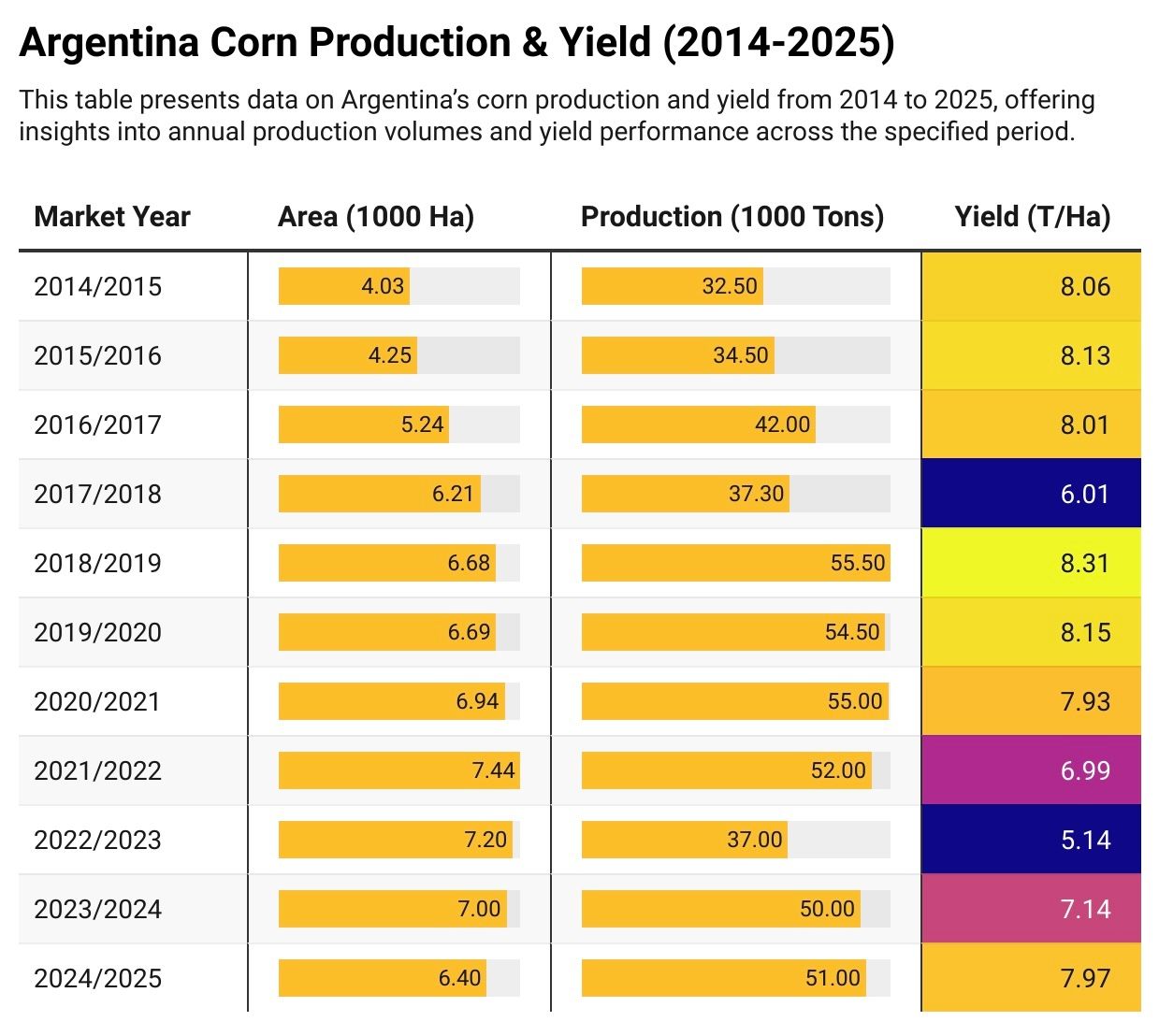

Corn acreage is set to decline by 25% in the 2024/25 crop season, equivalent to a reduction of 6 million acres. Production is forecasted at 48 million tonnes, a 6% drop from the previous year. Early-planted corn, now in the critical pollinating and grain-fill stages, is already showing signs of stress due to insufficient rainfall in December; an important month for precipitation in the country. Meanwhile, soybean production offers a slightly more optimistic outlook, with forecasts at 52 million metric tons—2% higher than last month and an 8% increase from last year. However, this optimism is tempered by the fact that only 81% of the planted area currently has adequate water, down 7 percentage points from earlier estimates according to USDA Crop Explorer.

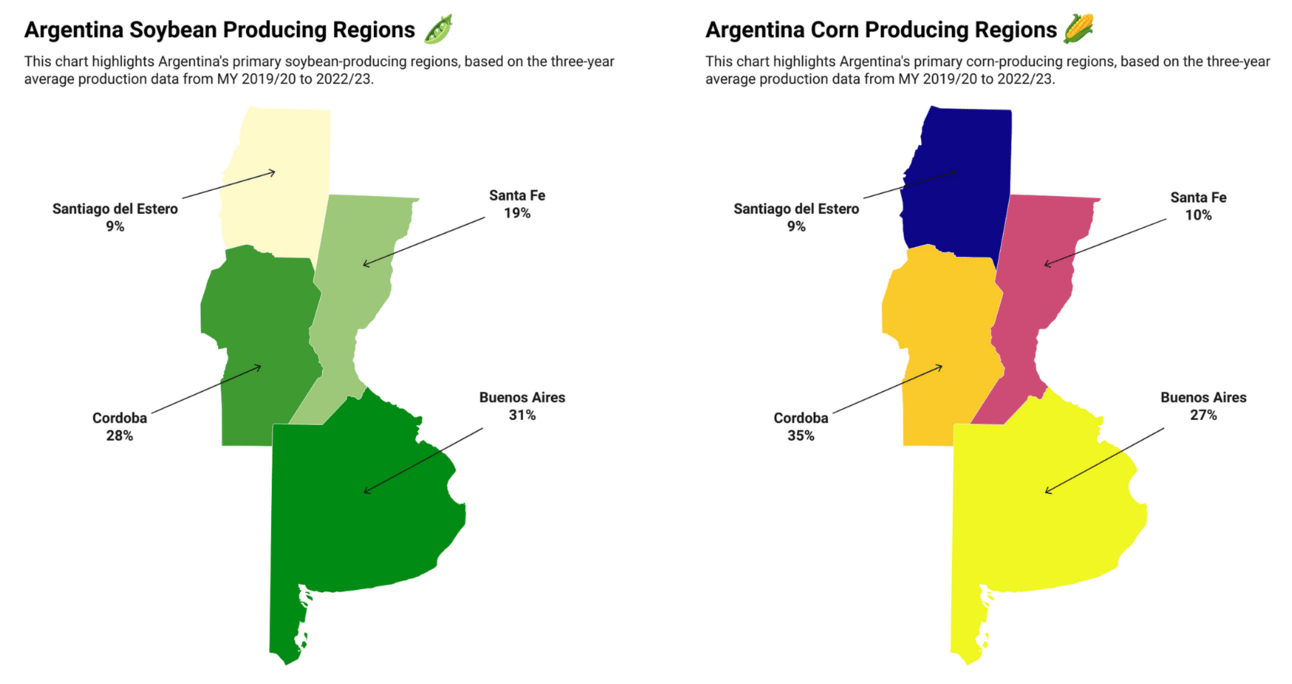

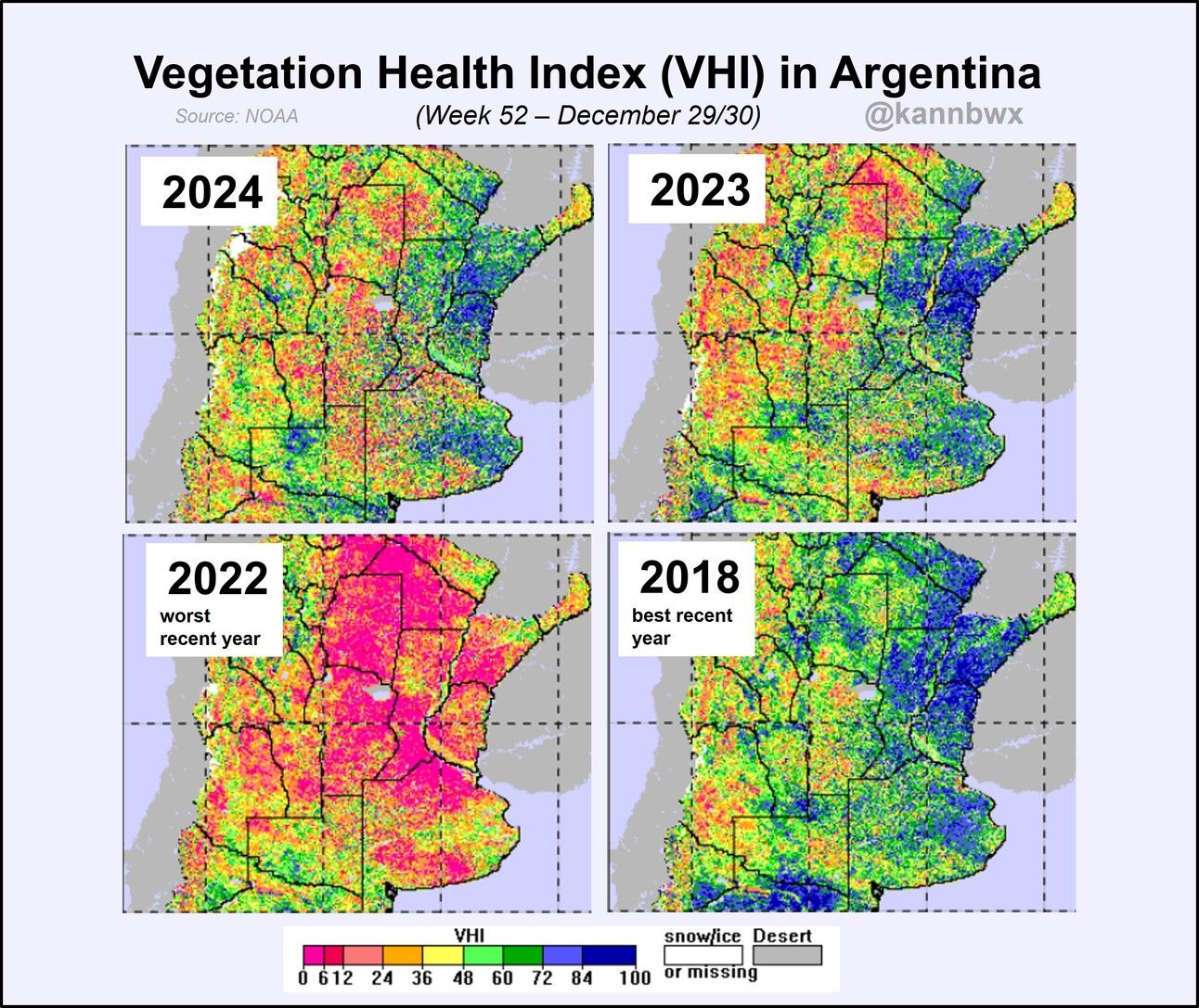

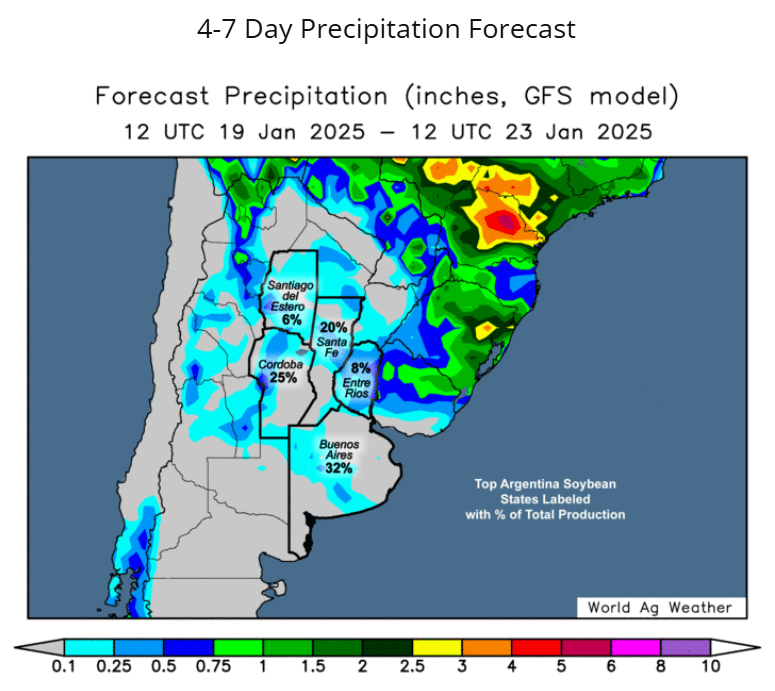

Chicago corn and soybean futures have climbed in response, with soybeans rising 1.29% to $10.04 per bushel and corn up 0.78% to $4.54 per bushel. As the world’s largest exporter of soybean oil and meal and the third-largest exporter of corn, Argentina plays a pivotal role in maintaining global supply chains. The ongoing drought has heightened fears of tighter supplies, which, coupled with weather-driven uncertainties, has added to recent market volatility. The same regions depicted below also produce the majority of the country’s soybeans and corn. Buenos Aires alone accounts for an estimated 31% of soybean production and 27% of corn production. The Buenos Aires Grain Exchange expects 50-75 millimeters (2-3 inches) of rain to fall on the agricultural region between January 16 and 22.

10x Your Outbound With Our AI BDR

Scaling fast but need more support? Our AI BDR Ava enables you to grow your team without increasing headcount.

Ava operates within the Artisan platform, which consolidates every tool you need for outbound:

300M+ High-Quality B2B Prospects, including E-Commerce and Local Business Leads

Automated Lead Enrichment With 10+ Data Sources

Full Email Deliverability Management

Multi-Channel Outreach Across Email & LinkedIn

Human-Level Personalization

Grain Market Impact

Corn

Argentina’s corn production is expected to reach 50 million mt in Market Year (MY) 2023-24, a 65% increase compared to the previous season, according to Guido D’Angelo, senior economist at the Rosario Board of Trade. Grain exports are projected to double, benefiting from production gains and logistical challenges in Brazil, where drought conditions and low water levels are expected to raise freight costs and reduce competitiveness. Additionally, the new government under President Javier Milei has pledged to introduce gradual reforms, including reduced export duties and greater support for farmers, potentially boosting Argentina’s corn production and export capacity in the long term based on reports from S&P Global.

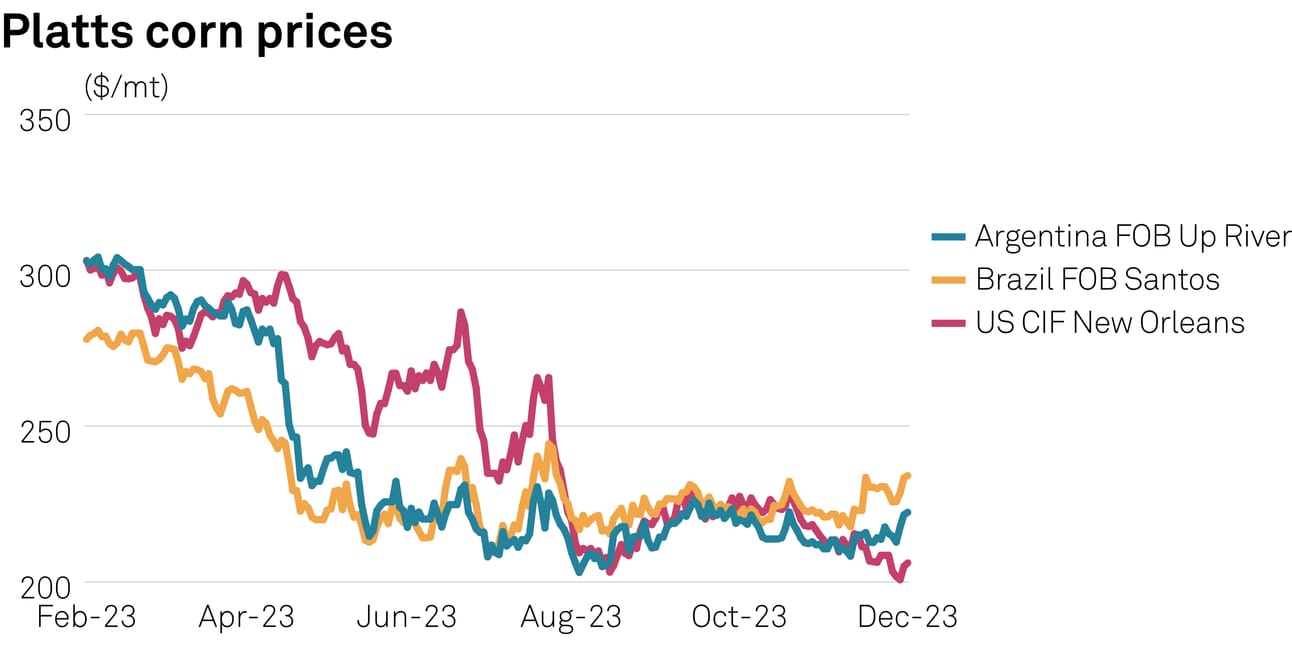

As of Thursday morning, CBOT corn prices remain near a 13-month high, driven by ongoing dry conditions. The recent uptick in prices, as shown in the figure above, is directly linked to the weather patterns over the past few months affecting growers in South America, particularly in Argentina and Brazil. Drought is not the only driver of higher corn prices in recent months. Drought is not the only factor driving higher corn prices in recent months. Corn stunt disease has also severely impacted Argentina’s corn crops. Transmitted by leafhoppers, this bacterial disease has caused a projected 25% reduction in the planted corn area for the 2024/25 season, marking the largest decline in 17 years. As a result, production forecasts have been significantly lowered, with estimates now at approximately 48-51 million metric tons for the upcoming season in line with the below estimates from the USDA.

Soybean

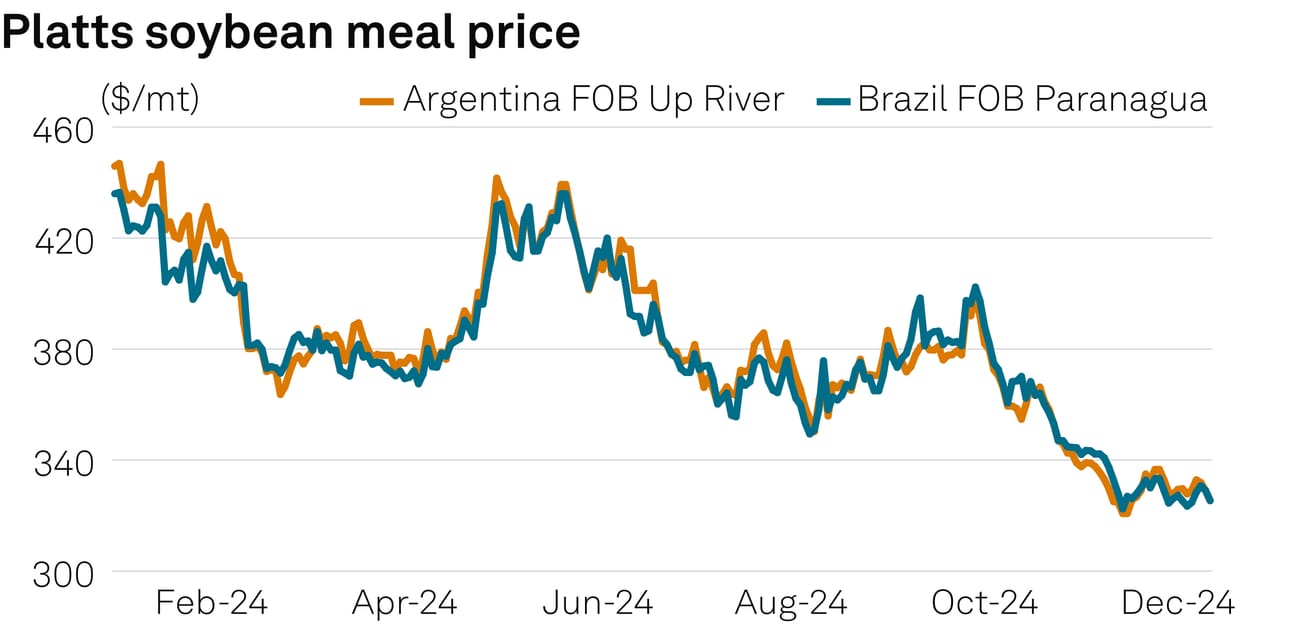

Despite the dry spell, according to a report from S&P Global, substantial soybean meal outputs are anticipated in Argentina, putting downward pressure on local prices, further exacerbated by declining Chicago Board of Trade futures. On December 13, Platts, part of Commodity Insights, assessed the Argentinian FOB Up River outright price for January at $325.40/mt, marking a 30.4% year-over-year decline. Spot FOB prices in Argentina have been at four-year lows. This trend is expected to benefit domestic poultry and pork producers, who rely on soybean meal as a key ingredient in animal feed.

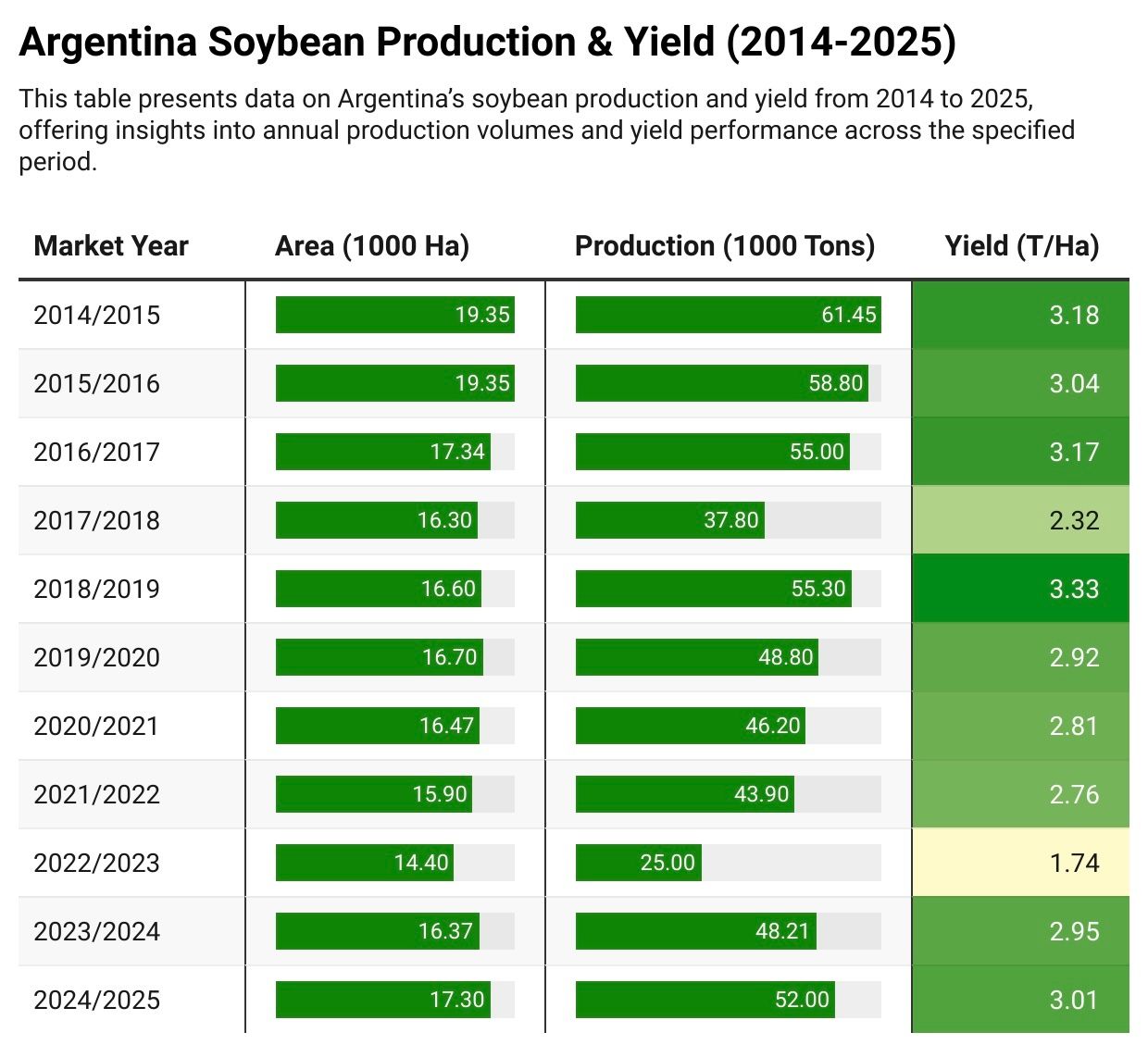

According to Reuters, there is a recent bright spot for Argentina’s soybean crop. Newly planted soybeans are currently in good condition, with 53% of the crop rated as good or excellent last week—a five-year high for this time of year. Only 4% of the crop is in poor condition, slightly higher than last year’s 2% but significantly lower than the double-digit figures observed over the previous three years. The USDA forecasts Argentina’s soybean production at 52.0 million metric tons (shown in the figure below), an increase of 2% from last month and 8% from last year. The Rosario Grains Exchange projects production at 53–53.5 million metric tons, while some local industry analysts are even more optimistic, estimating the crop could reach as high as 53 million metric tons.

Future Considerations

Weather

While dry conditions have been persistent forecasts indicate that Argentina’s agricultural heartland may receive 50-75 millimeters (2-3 inches) of rain between January 16 and January 22, potentially alleviating some of the ongoing drought stress. Reuters cited that February rain could save the crop but this would depend on timing. The Vegetation Health Index (VHI) shown below for December 2024 was comparably worse than the same period in 20223 as shown in the eastern growing regions.

Over the weekend, a few showers were reported in western and southwestern Argentina, but most of the country remained dry. Temperatures ranged from the mid-90s to low 100s and are forecasted to rise further this week, reaching the upper 90s to mid-100s. Limited rainfall is expected, along with declining soil moisture levels. The 4-7 day precipitation forecast shown below for Buenos Aires and Córdoba, two key soybean and corn growing regions, is minimal, with expected rainfall of less than 1 millimeter.

Karen Braun also provided an update earlier in the week, on January 14, noting that LSEG’s weather model now predicts a few showers but far less rainfall than is needed. According to Argus, soybean harvesting is nearing completion at 92.7%, while corn still has progress to make, with 87.4% harvested. Argus also reported that corn moisture conditions are currently 81.5% optimal and 18.5% normal, compared to the previous week’s 88% optimal and 12% normal.

Price Volatility

The CVOL Index for corn has edged higher in recent weeks but remains near the lows for the year, particularly compared to other agricultural products like wheat. The skew ratio for corn is also near yearly lows, reflecting little relative demand from traders for upside or downside options. Soybeans tell a similar story, with the CVOL Index hovering near yearly lows despite a recent uptick. The skew ratio for soybeans sits close to one, signaling balanced positioning in the options market and no strong directional bets.

The upcoming World Agricultural Supply and Demand Estimates (WASDE) report is anticipated to be a key market catalyst. For the January 10, 2025, release, the corn market is pricing in 53% volatility, while soybeans are at 47%. These figures are well above the typical implied volatility range of 17-20%, reflecting heightened expectations for significant market movement following the report.

Trump taking office on January 20th is sure to impact grain markets. Soybeans remain highly exposed to trade tensions with China. During the 2018–2019 trade war for example:

U.S. soybean exports to China collapsed, falling from $14 billion to just $3 billion.

Total agricultural export losses soared past $27 billion.

Another trade war could trigger a sharp drop in soybean exports, potentially by hundreds of millions of tons.

While corn is less vulnerable than soybeans, it’s not immune to the ripple effects of trade disruptions:

Retaliatory tariffs could wipe out as much as 90% of U.S. corn exports to China.

A stronger U.S. dollar, bolstered by Trump’s policies, could erode the competitiveness of U.S. corn in global markets.

Many farmers are concerned about potential losses, with 42% of surveyed farmers believing U.S. agriculture is at risk of a trade war resulting in decreased exports. If Argentina's crop regions receive ample rainfall heading into February, they may still face challenges that prevent them from addressing any potential global deficit.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.