Supply Chain Crisis

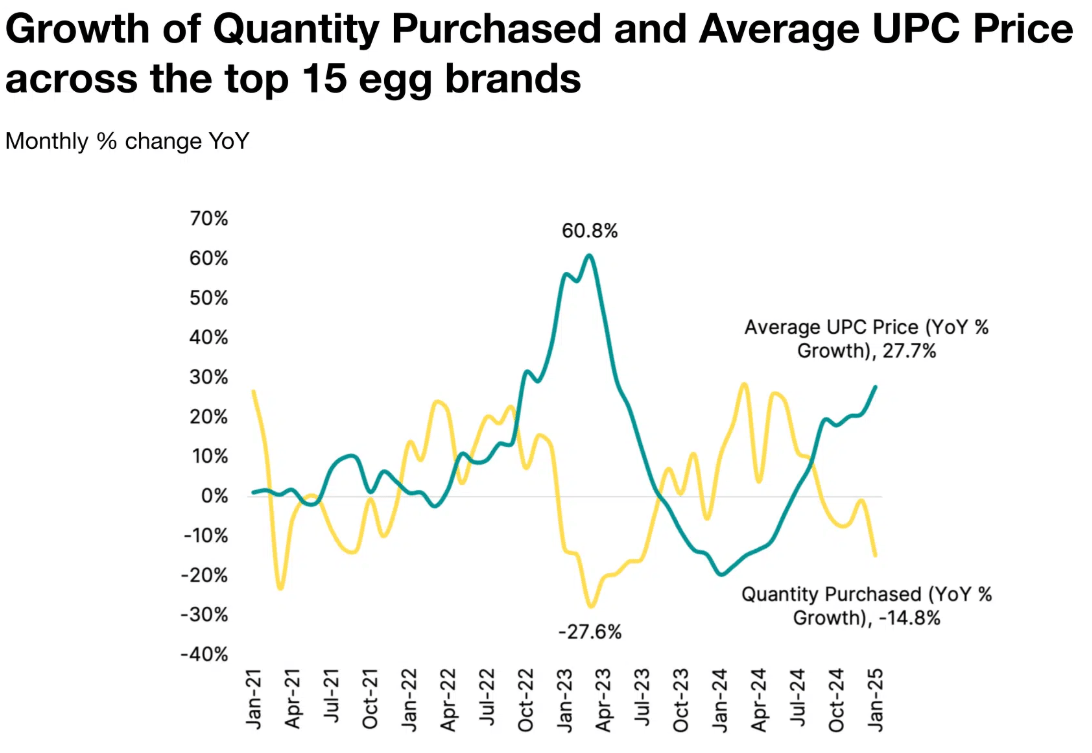

The ongoing avian influenza (HPAI) outbreak, driven by the H5N1 virus and its D1.1 genotype, has severely disrupted global poultry markets, particularly egg supply chains, while also impacting related commodity classes. Over 166 million U.S. birds, primarily egg-laying hens, have been culled since 2022 in efforts to contain the outbreaks, with 30 million lost in 2025 alone according to ThinkGlobalHealth. This has led to an 8% reduction in the national laying flock since 2022. As a result, egg prices have skyrocketed, with the average U.S. price reaching $4.95 per dozen in January 2025—a 45-year high and a 250% increase since 2019. In California, where localized outbreaks have been severe, retail prices have surged to $8.85 per dozen.

Compounding the crisis is a mismatch between the demand for cage-free eggs and available supply. Currently, 40% of U.S. laying hens produce cage-free eggs to comply with state laws in places like California and Colorado, as well as corporate pledges. However, supply is lagging due to two primary factors: the potential higher susceptibility of cage-free flocks to HPAI (a debated issue) and fixed-price contracts for cage-free eggs, which remain well below volatile open-market prices. Further disruptions stem from supply chain bottlenecks, including shortages of refrigerated trucks and labor gaps that exacerbate delays. Additionally, recovery from the crisis is slow—restocking barns after culling takes 9–12 months, and new hens require 19–20 weeks before they begin laying, prolonging supply constraints.

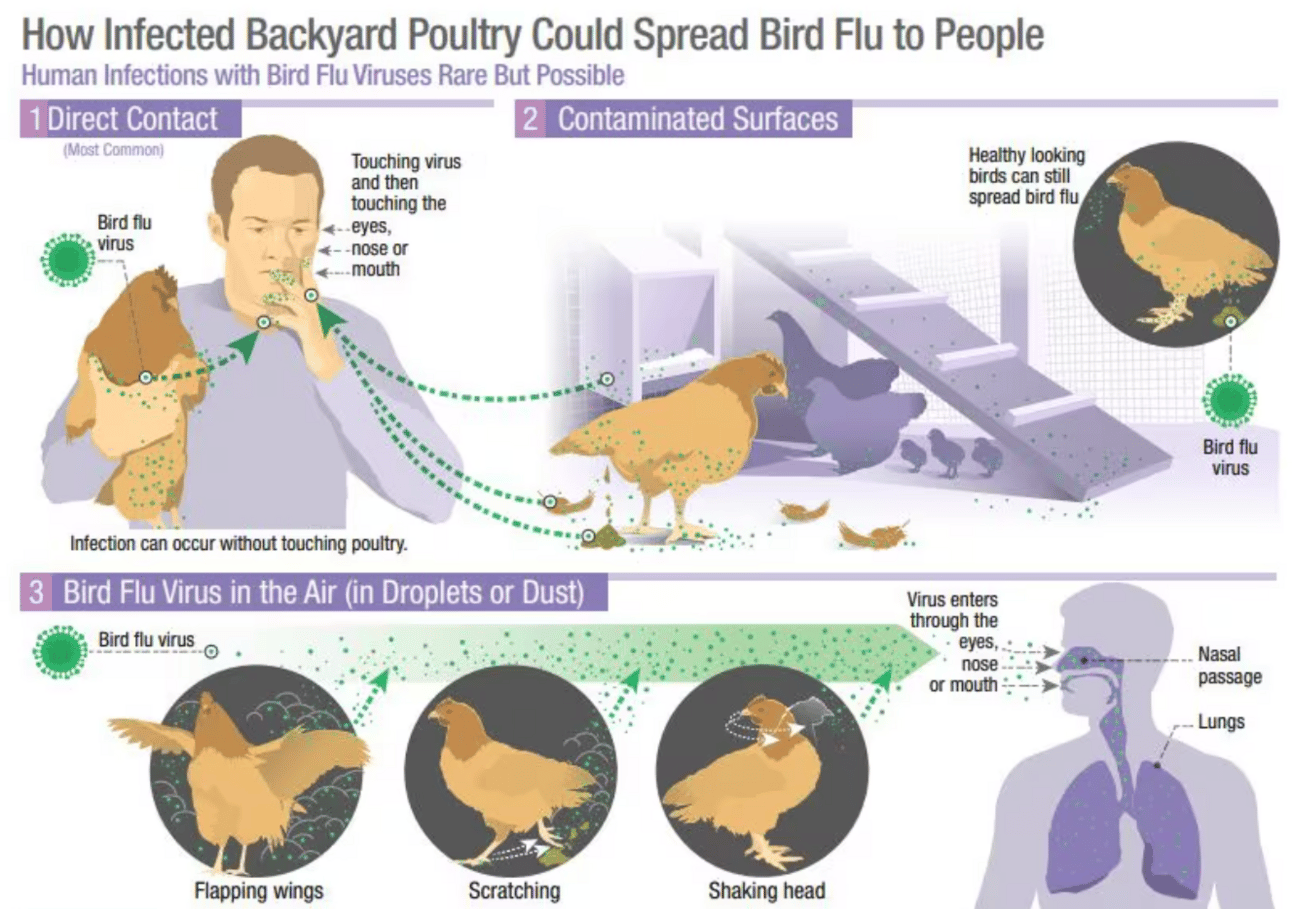

The influenza has also reached Canada, with CBC News reporting on Thursday that preliminary results indicate avian flu in Canada geese found dead in eastern P.E.I. Seventeen dead geese were discovered on the ice of Vernon River in eastern P.E.I. and delivered to the Atlantic Veterinary College's virology lab for testing. The news outlet also reported that while sick Canada geese pose little risk to the general public, the danger is higher for those who handle sick or dead wildlife. According to the U.S. Center for Disease Control (CDC) Avian influenza spreads primarily through direct contact, as infected birds shed the virus via saliva, feces, and nasal secretions. Another major route is environmental contamination, where the virus can survive for weeks in cold temperatures, spreading through contaminated water, feed, or equipment.

Several key factors contribute to the spread of the virus. Wild birds, particularly migratory waterfowl such as ducks and geese, act as natural reservoirs for low-pathogenic avian influenza (LPAI). Since 2022, the highly pathogenic avian influenza (HPAI) H5N1 strain has adapted to spread more effectively among wild birds, facilitating global transmission through migration routes. Additionally, poultry practices play a significant role, as live markets, contaminated farm equipment, and inadequate biosecurity measures can amplify outbreaks such as the one we are seeing in early 2025.

Cut Through Noise with The Flyover!

One Email with ALL the News

Ditch the Mainstream Bias

Quick, informative news that cuts through noise.

Mitigation Efforts

Trade restrictions imposed due to the outbreak have severely limited poultry exports, impacting economies that rely on these goods. In developing countries, where the poultry sector is labor-intensive, job losses have been particularly pronounced, exacerbating economic vulnerabilities. Canada, however, has been relatively insulated from extreme price spikes seen in the U.S. due to its supply-management system and the prevalence of smaller farms averaging 25,000 hens. While prices are still rising, the increases have been more gradual compared to the sharp surges seen across the United States.

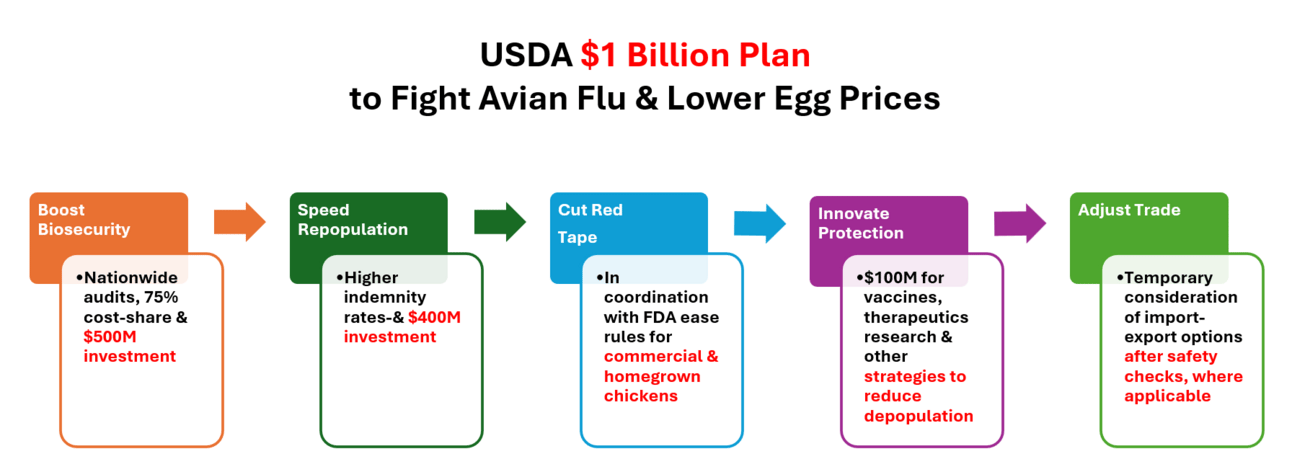

In response to the crisis, the USDA has launched a $1 billion mitigation plan on Thursday to address the outbreak. Enhanced Biosecurity ($500M) will expand wildlife biosecurity assessments to prevent wild bird transmission, responsible for 83% of cases. The plan includes deploying 20 epidemiologists to audit farms and funding 75% of critical upgrades, along with mandatory audits for outbreak-affected farms to maintain indemnification eligibility. Farmer Financial Relief ($400M) will provide increased reimbursements for culled flocks and streamline approval processes for farms to restart operations post-outbreak. Vaccine Development ($100M) focuses on funding research for H5N1 vaccines and therapeutics to reduce culling needs, with conditional approval granted for a Zoetis poultry vaccine while trade impact assessments continue. Regulatory Reform involves reviewing state laws like California’s Proposition 12, which increases costs, and easing requirements for backyard poultry operations. Lastly, Temporary Egg Imports are being negotiated, with plans to import 420 million eggs from Turkey in 2025 while maintaining strict food safety standards. The USDA also noted immediate relief could come from import expansion, slightly easing prices within weeks. Full market stabilization is expected in 3–6 months as farms rebuild flocks and biosecurity measures take effect. However, ongoing risks remain due to wild bird migration patterns.

The Spillover

Poultry, Meat and Dairy

Repercussions are also being seen in a range of commodity markets beyond eggs, particularly poultry, meat, and dairy. Broiler chicken production growth is expected to slow to 1.6% in 2025, down from 1.7% in 2024, due to the effects of HPAI and rising feed costs. Major producers like Tyson Foods, which has a capacity of 45 million head per week, have already scaled back operations in response to these challenges according to S&P Global. Additionally, price gaps between premium poultry products, such as organic options, and conventional items have narrowed as consumers shift toward more affordable choices during supply shortages.

The outbreak has also raised concerns about cross-species transmission. The D1.1 strain has infected dairy cows and contaminated milk supplies in Nevada, signaling potential risks to the broader agricultural sector. Beyond livestock, wild birds and mammals—including marine species—are experiencing increased biodiversity threats, further complicating containment efforts.

Europe and Asia

The U.S. alone has lost 166 million birds, while Europe and Asia have seen 50 million and 120 million culls, respectively. This has led to a 4.3% decline in global chicken meat output in 2024 and a 6% drop in egg production year-over-year.

The economic losses have been staggering, with the U.S. poultry sector incurring $3 billion in direct costs from culling, disinfection, and lost sales. Global poultry export revenue fell by 18% in 2024, and Brazil, the world's top exporter, lost $1.2 billion due to import bans from key markets like China. Price volatility has also surged, with U.S. chicken breast prices hitting $6.20 per pound in 2025 (+72% vs. 2022), EU poultry rising 33%, and egg prices in Japan and South Africa soaring over 40%. Wholesale turkey prices in the U.S. averaged $1.98 per pound in 2024—an 89% increase from pre-pandemic levels.

Trade restrictions have further disrupted markets, with over 70 countries imposing import bans on poultry from outbreak zones. China blocked all U.S. poultry from affected states, and Saudi Arabia halted EU imports for over eight months in 2024. While Brazil gained market share in the Middle East, strict EU biosecurity rules limited its expansion. In response to these challenges, major firms like Tyson and JBS accelerated acquisitions of smaller farms to enhance biosecurity, while producers increased spending on AI-powered barn monitoring, antiviral feed coatings, and worker quarantine protocols. Some Asian markets pivoted toward duck meat, while Europe expanded lab-grown chicken trials.

Regional variations have shaped the outbreak's impact. In the U.S., large-scale farms suffered the most losses, particularly in Iowa and Minnesota. Free-range and organic farms in the EU faced disproportionate culls due to higher exposure to wild birds. Meanwhile, Canada's supply-managed system helped keep retail chicken price hikes at 14%, compared to over 40% in the U.S. The crisis has also rippled across industries, with feed demand for corn and soybeans falling 8%, vaccine manufacturers like Zoetis and Merck investing $900 million in mRNA poultry vaccines, and labor disruptions leading to layoffs in U.S. processing plants while automation accelerated in Europe.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.