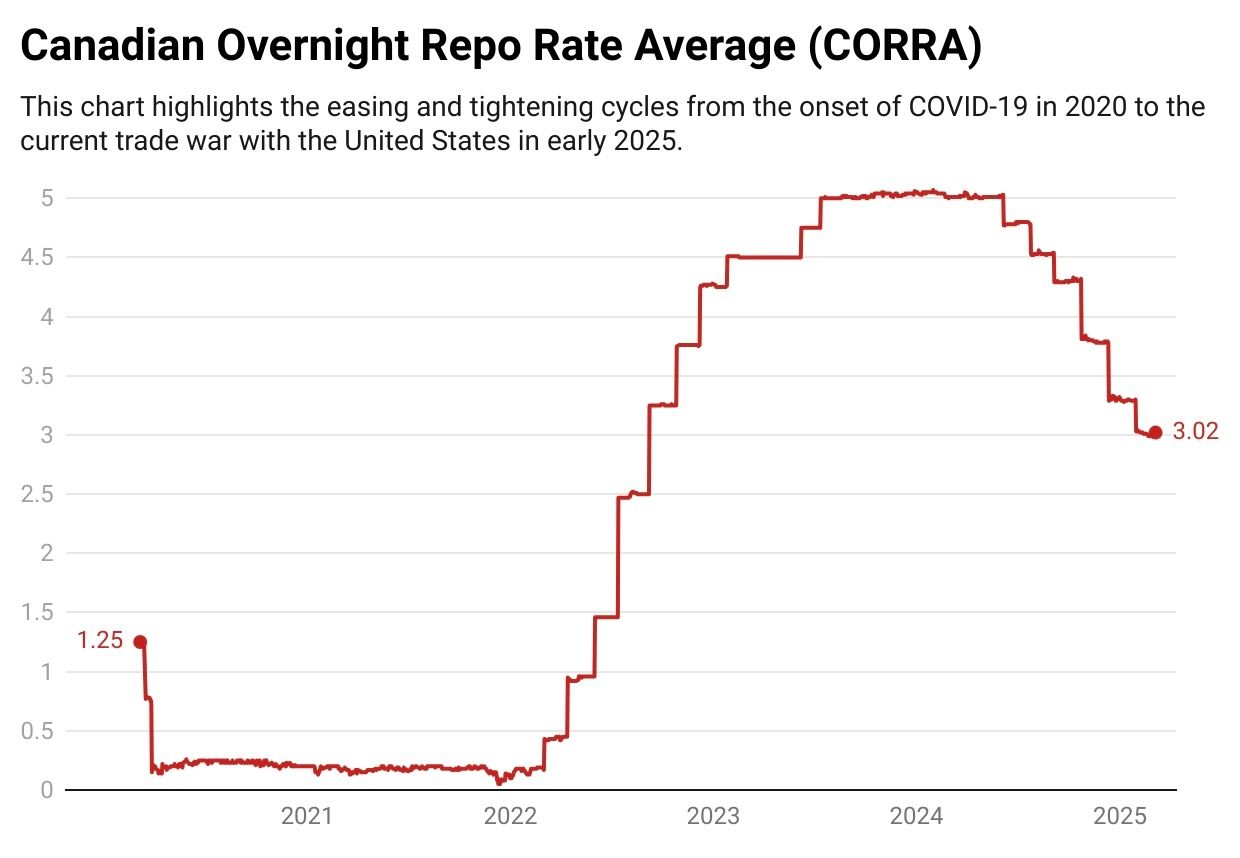

Pace of Easing Set to Increase

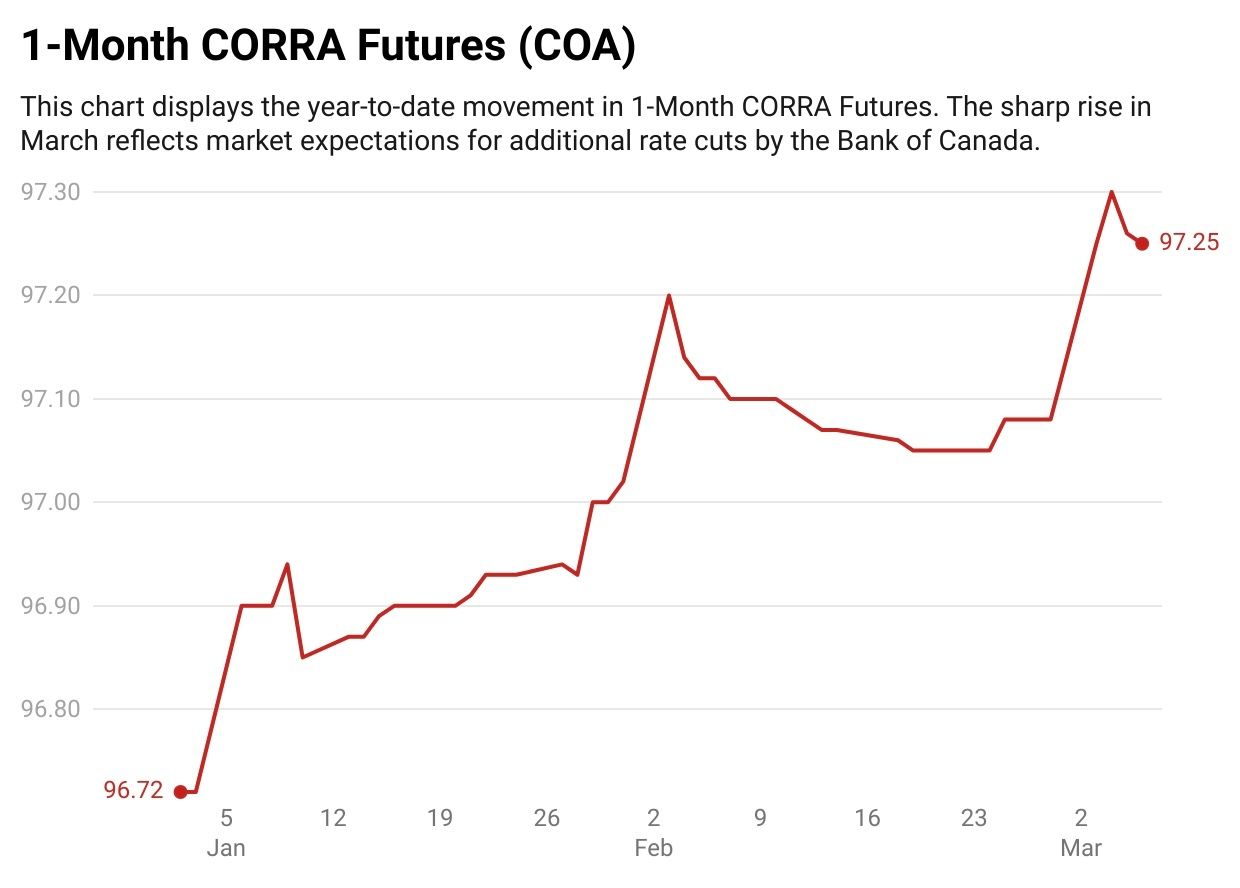

The evolving trade tensions between Canada and the U.S. are expected to significantly influence the Bank of Canada’s monetary policy, with analysts broadly anticipating accelerated interest rate cuts to counteract economic headwinds. The latest round of tariffs—25% on most Canadian goods and 10% on energy exports—along with Canada’s retaliatory surtaxes, have heightened recession risks, prompting economists to revise their rate forecasts. A White House official provided additional context on the tariff exemptions that were announced late Wednesday afternoon, noting that while 50% of Mexican imports and 36% of Canadian imports are covered under USMCA, many other goods—such as avocados—are not included due to high compliance costs. Despite this, such items have often been treated at customs as if they were USMCA-compliant and have generally not faced tariffs. The official suggested that affected producers could register for compliance to avoid the 25% tariff for a month but deferred to the U.S. Trade Representative for further details on which products will ultimately remain subject to tariffs.

Market expectations for the Bank of Canada’s upcoming meetings have shifted notably. For the March 12, 2025, meeting, markets now price in an 80% chance of a 25-basis-point cut, with some analysts advocating for a more aggressive 50-basis-point reduction. Looking ahead, projections suggest that the policy rate, currently at 3%, could fall to 2.75% by April and as low as 2.0% by July, depending on the duration of the tariffs and the broader economic fallout. The central bank’s response will largely depend on the severity of economic disruptions. Recession risks have become a primary concern, as prolonged tariffs could shrink Canada’s GDP by up to 2.4% within a year, with unemployment potentially rising above 8%. Given that Canada exports 20% of its GDP to the U.S., key industries like autos, steel, and agriculture face significant trade disruptions. Markets are already reacting to these risks, with a weaker Canadian dollar (trading at CAD 0.69/USD) and equity selloffs reflecting deteriorating investor sentiment.

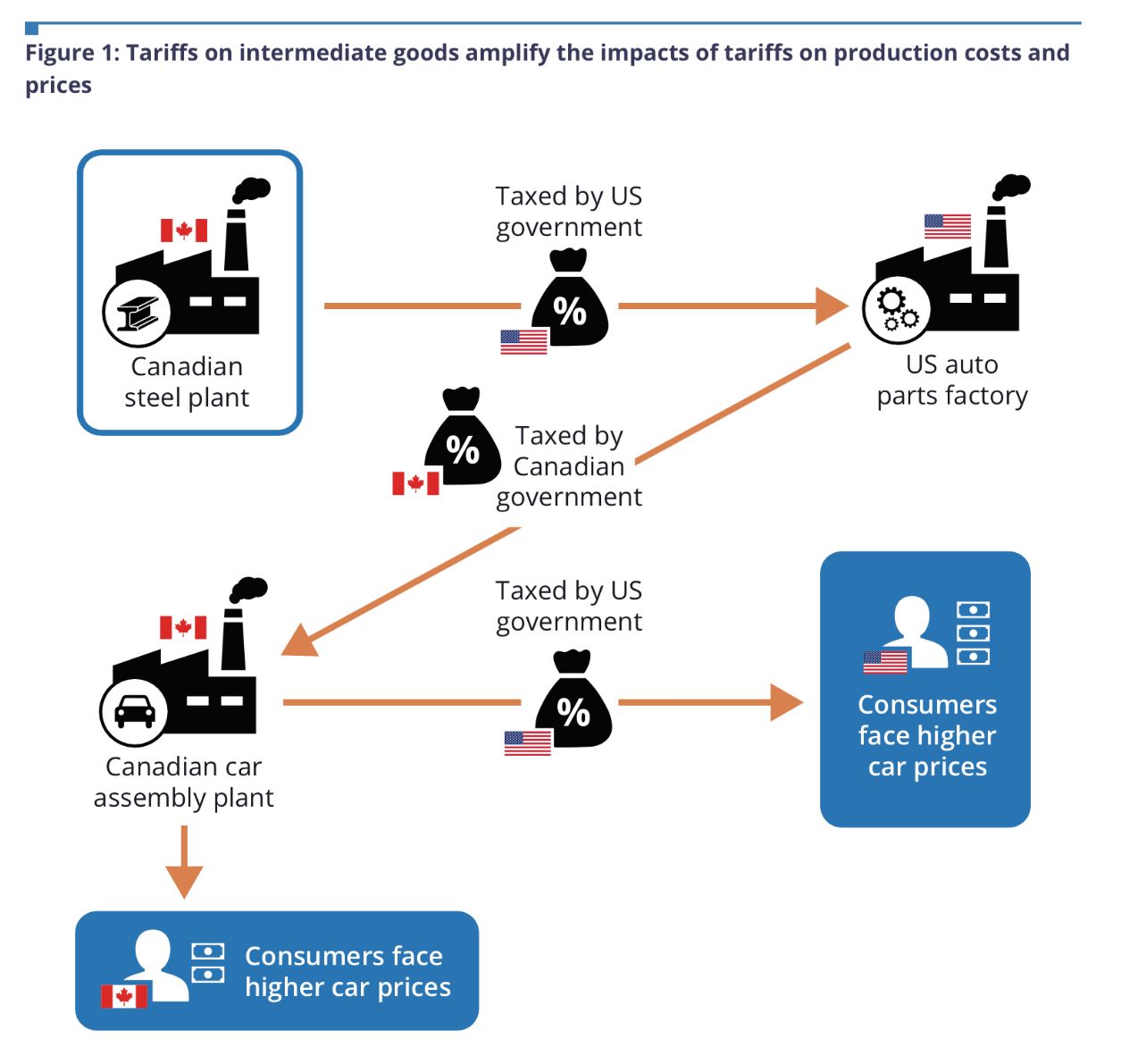

Intermediate goods, which are essential inputs in production processes, make up a significant portion of cross-border trade between Canada and the U.S. Recent data highlights the deep integration of North American supply chains. According to Scotiabank about 75% of intermediate goods produced in Canada are exported to the U.S., with key categories including machinery, equipment, and energy resources—critical inputs for U.S. manufacturing and energy sectors. On the import side, Canada sources 34% of its intermediate goods from the U.S., including chemicals, plastics, and electronic components. These imports play a crucial role in supporting Canadian industries such as automotive manufacturing, where U.S.-made parts are assembled into finished vehicles.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

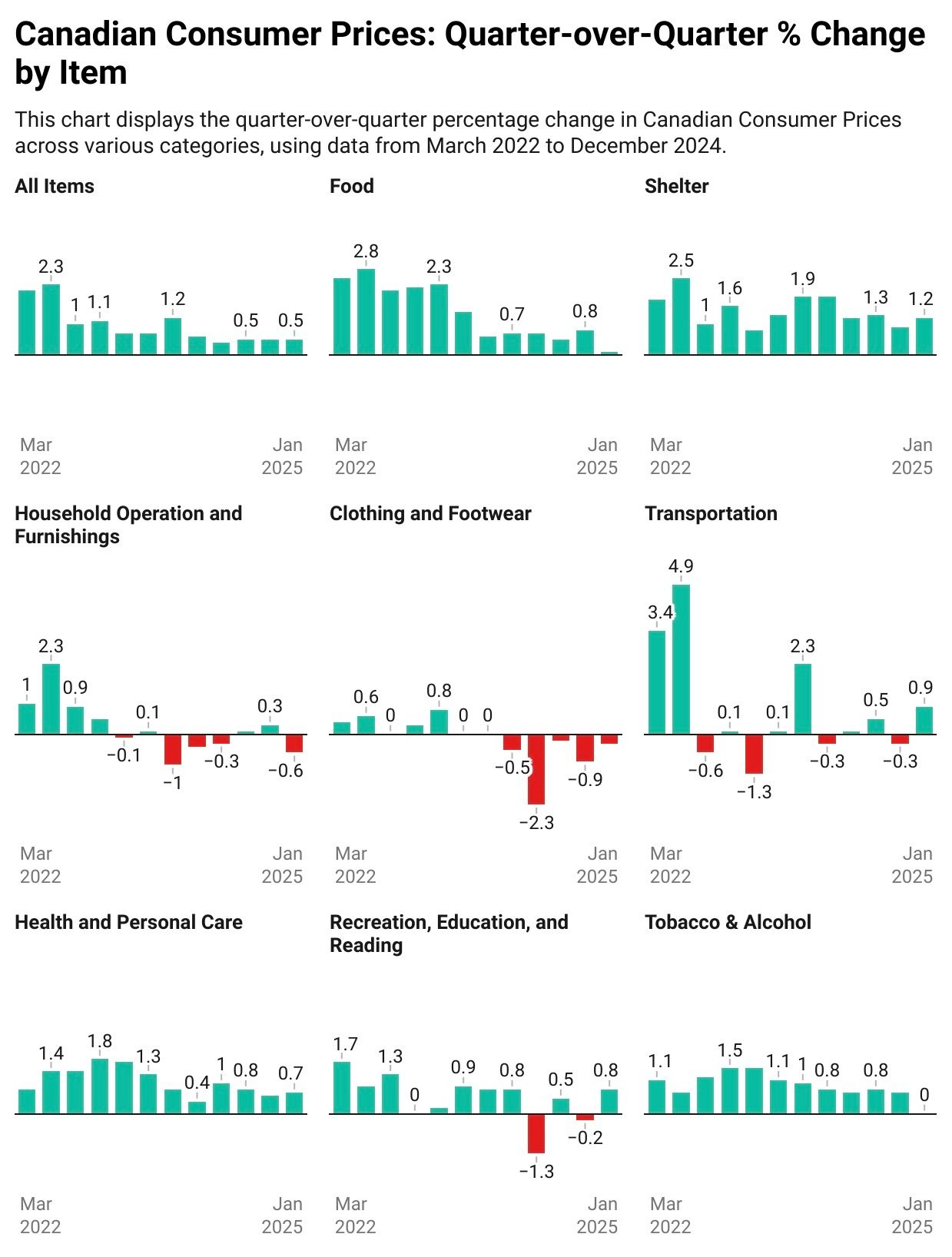

Inflation Ebbs and Flows

The trade tensions are creating mixed inflationary pressures for Canada. On one hand, retaliatory tariffs and currency depreciation could temporarily push up import prices, particularly for consumer goods, adding to inflationary concerns. However, the Bank of Canada views these tariff-driven price increases as transitory and remains focused on broader economic risks. Its models suggest that excess supply from weakened demand could ultimately dampen inflationary pressures over time, reinforcing the case for monetary easing.

One key challenge is managing the trade-off between rate cuts and inflation—aggressive monetary easing could further weaken the Canadian dollar, but policymakers see it as necessary to counteract rising recession risks. The duration of the trade war will also play a crucial role in shaping policy decisions. If tariffs are short-lived, rate cuts may be limited to 50–75 basis points, but a prolonged dispute could push the policy rate below 2%. Additionally, economists emphasize that monetary policy alone cannot fully address supply-side shocks, highlighting the need for federal fiscal stimulus to complement rate cuts and support economic stability.

Canadian inflation has remained near the Bank of Canada’s 2% target in early 2025, though sectoral volatility and persistent core price pressures have marked the landscape. In January 2025, inflation rose to 1.9% year-over-year, slightly up from December’s 1.8%, staying within the Bank’s target range. Core inflation, however, exceeded expectations, with trimmed-mean and median core measures holding at 2.7%, while the exclusion-based core rate climbed to 2.1%. Month-over-month, CPI increased 0.1% in January after a 0.4% decline in December.

The Bank of Canada has already implemented rate cuts totalling 1.25% since mid-2024, with markets expecting further cuts, bringing the policy rate down to 2.5% by mid-2025. Despite these cuts, elevated core inflation rates (2.1-2.7%) indicate ongoing domestic price pressures, although the central bank views shelter-driven inflation as likely to ease gradually. Based on the figure above inflation has slowed in recent quarters to the Bank of Canada target range but still remains elevated for key items such as shelter.

Looking at the Data

Modelling Uncertainty

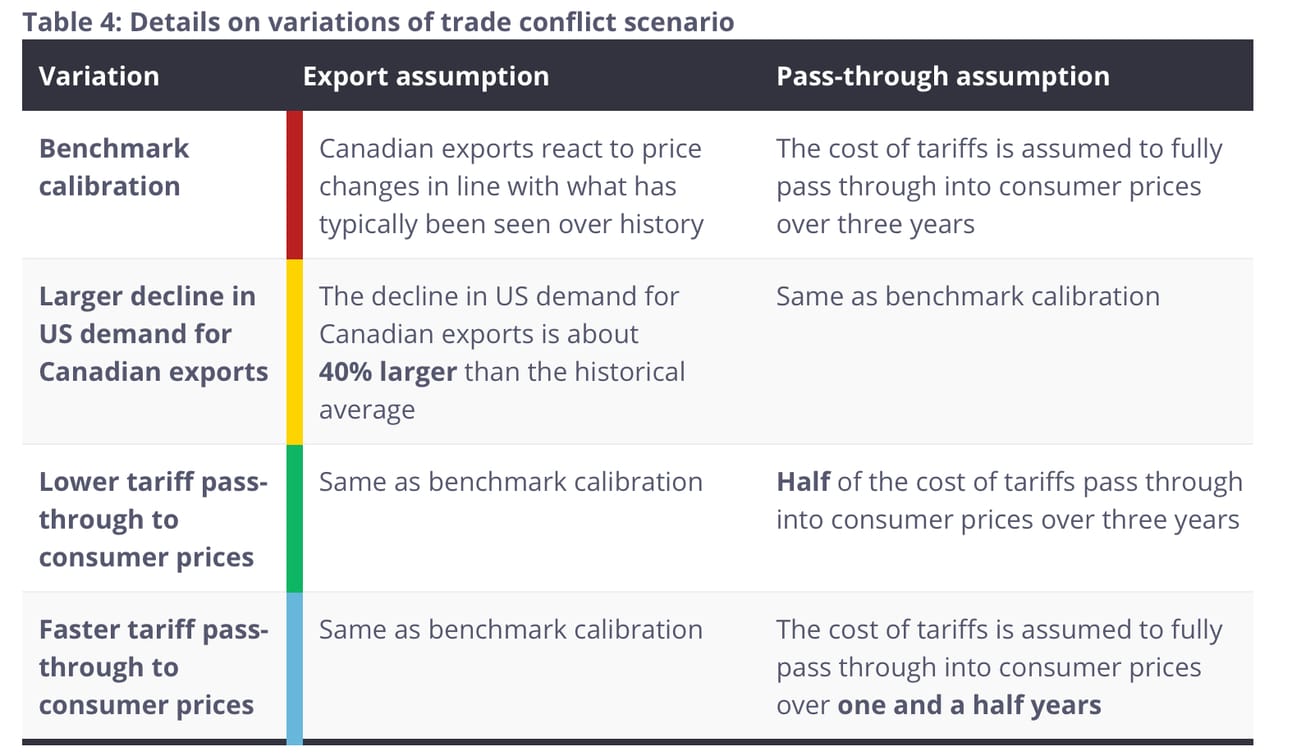

The Bank of Canada’s analysis highlights several key uncertainties that could significantly impact economic projections. One major concern is export sensitivity, as historical models may underestimate the decline in U.S. demand for Canadian goods. A drop in exports 40% larger than expected could amplify GDP losses and accelerate CAD depreciation. Another uncertainty lies in price pass-through—if only half of tariff costs are passed on to consumers, rather than the full amount assumed, inflation could initially decline despite weakening growth. Additionally, the delayed effects of past rate cuts, totalling 300 basis points since June 2024, are still unfolding, making it challenging to accurately calibrate future policy decisions.

The central bank has outlined various scenarios on how trade conflicts with the U.S. could impact Canadian exports and the broader economy. It also assessed how tariffs would pass through different sectors. With increasing rhetoric around “Buying Canadian,” domestic demand for U.S. products is expected to decline, reducing import volumes. According to the Bank of Canada, the costs of tariffs imposed on U.S. goods would gradually be passed on to consumers over a three-year period, influencing inflation and spending patterns.

Long-term Framework Risks

The uncertainty surrounding reciprocal tariffs and ongoing delays for products governed under CUSMA/USMCA pose long-term risks to Canada’s economic framework. The Bank of Canada’s inflation-targeting strategy is increasingly pressured by structural challenges that could disrupt its traditional policy approach. Frequent supply shocks, including trade wars and geopolitical conflicts, may require a more adaptive strategy beyond conventional demand management tools.

Additionally, persistent tariff effects could increase inflation volatility, destabilizing price expectations and potentially forcing tighter monetary policy even as economic growth weakens. As Deputy Governor Sharon Kozicki emphasized, the Bank must carefully “balance upside inflation risks from higher costs with downside risks from weaker demand.” With tariffs threatening to erase recent economic gains, policymakers face one of the most complex economic landscapes in decades.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.