Shifting Weather and Risk

The year 2025 has been marked by unprecedented extreme weather events and record-breaking growth in the catastrophe bond market. Through the first half of 2025, the world has witnessed devastating natural disasters that have resulted in over 2,400 deaths and hundreds of billions in economic losses, while the catastrophe bond market has reached new heights with over $17.8 billion in issuance.

Chicago Fed Letter - Catastrophe bonds: A primer and retrospective

Abstract: Since 1997, the catastrophe (CAT) bond market has provided the insurance industry with protections against natural disasters that have grown more frequent and costly. This article explains how CAT bonds work, and then looks at how the market for them has grown in size, coverage, and sophistication over the past two decades. It also explores how and why different types of institutions use CAT bonds to transfer insurance risks.

160.27 KB • PDF File

According to the Financial Times via data provided by Artemis.bm (a data provider on all things catastrophe bonds, reinsurance and insurance linked securities) the entirety of 2024 saw issuances of $17.7 billion. Swiss Re Institute has estimated that there’s a one in 10 chance that global natural cat insured losses will reach at least $300bn for 2025.

Source: FactSet, twelve capital

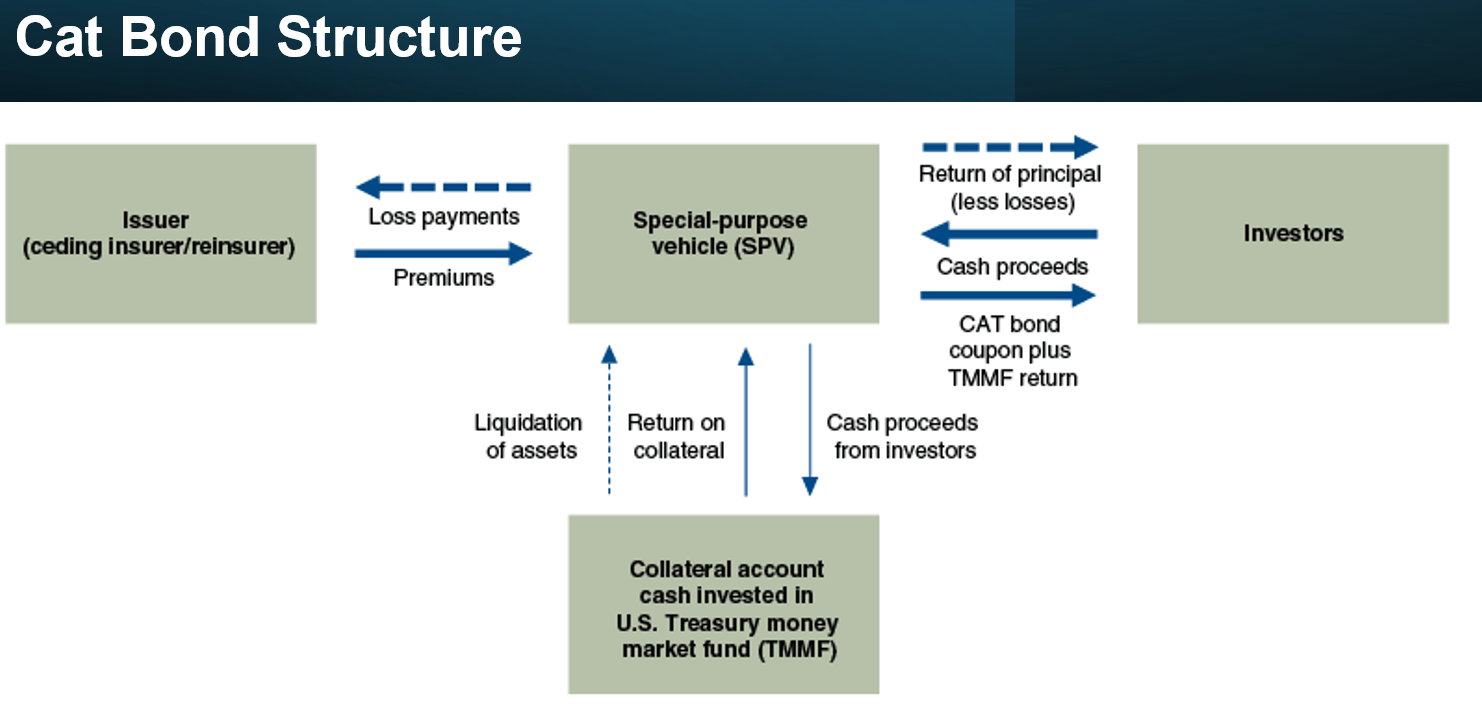

A cat bond—short for catastrophe bond—is a type of insurance securitization. It involves risk-linked securities that transfer a specific set of risks, typically related to catastrophes and natural disasters, from an issuer or sponsor (usually an insurance or reinsurance company) to capital market investors. According to Artermis.bm a key feature of any catastrophe bond is the set of conditions that determine when investors start taking losses. These bonds use “triggers” — clearly defined rules that must be met before any losses are applied to investors’ capital.

Catastrophe Bond Issuance/Structure/Trigger & Payout Example

Issuer/Sponsor: A large insurance company (let’s say “Global Re Insurance”) is exposed to hurricane risks in Florida.

Purpose: Global Re wants to transfer part of that hurricane risk to investors, reducing the impact on its own balance sheet if a major storm hits.

Structure: Global Re sets up a special purpose vehicle (SPV), a separate legal entity that issues a cat bond to investors. Investors buy the cat bond and deposit, say, $200 million into the SPV. The SPV invests this money in safe assets (like U.S. Treasuries) and pays Global Re regular premium payments in exchange for providing risk coverage.

Trigger: The cat bond is linked to hurricane risk in Florida, with a parametric trigger — if a hurricane of Category 4 or above makes landfall in certain Florida counties, the bond is triggered.

Payout: If no qualifying hurricane happens during the bond’s 3-year term, investors get their money back plus interest. If a qualifying hurricane occurs, part or all of the $200 million is used to cover Global Re’s losses, and investors lose that portion of their principal.

Triggers come in different forms. Some are based on the actual losses suffered by the insurance company (called indemnity triggers), while others kick in when total industry losses from a disaster reach a certain amount (known as industry loss triggers). There are also parametric triggers, which are tied to measurable disaster conditions — like wind speed or earthquake magnitude — where losses are triggered if those conditions exceed a preset threshold.

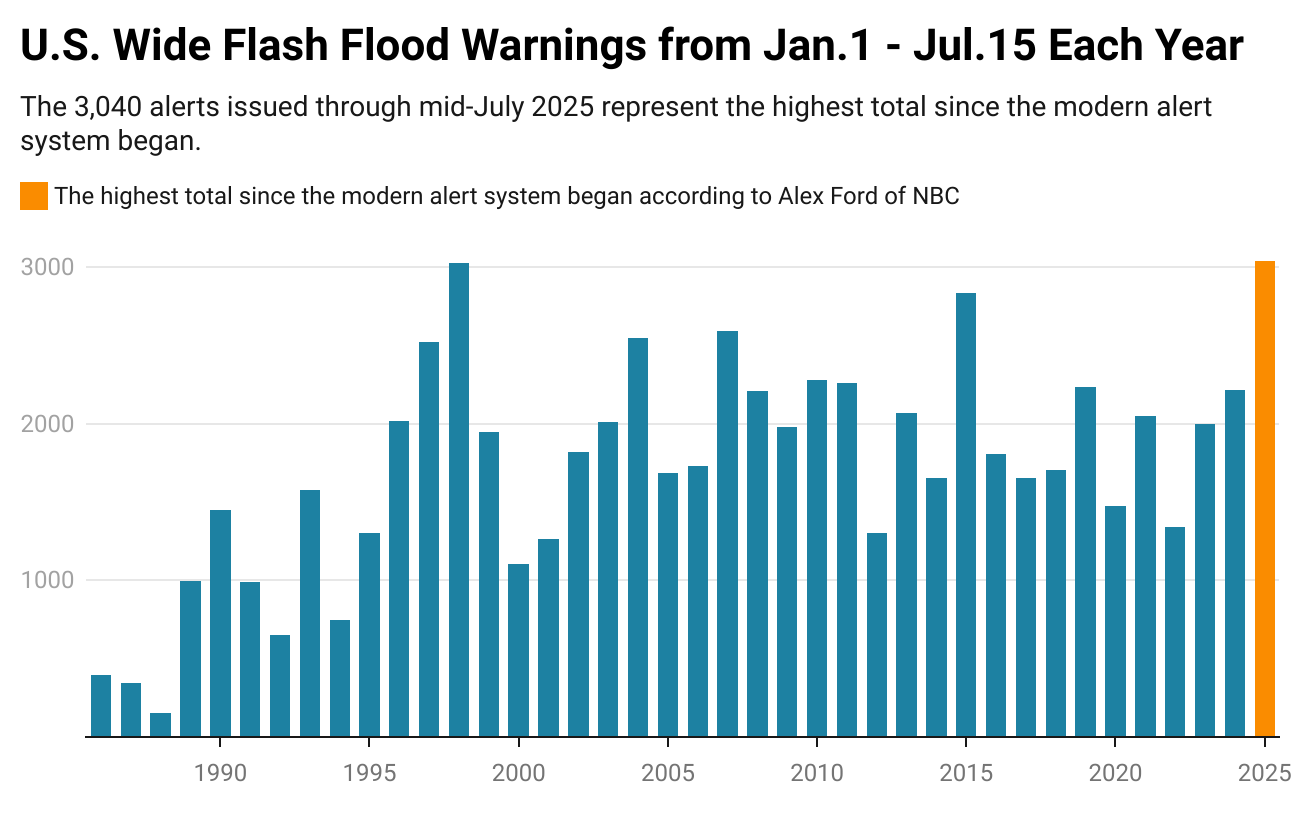

The deadliest extreme weather events of 2025 have been dominated by heat-related disasters and flooding. The European heatwaves that began in May 2025 have claimed over 1,884 lives and continue to impact the region. In the United States, the July Central Texas floods became the deadliest inland flooding event since 1976, killing at least 119 people when the Guadalupe River rose 26 feet in just 45 minutes according to CNN.

Tumultuous Weather in 1H2025

Severe Tornado, Wildfire and Flood Activity

The 2025 tornado season has been exceptionally active, with 1,066 confirmed tornadoes in the United States as of mid-year. Several significant outbreaks occurred, including the March 13-16 outbreak—the most active March tornado outbreak on record—resulting in 43 fatalities and over $6.25 billion in damage. The May 15-16 outbreak featured a high-end EF4 tornado and caused 27 deaths, with 19 fatalities in Laurel County, Kentucky, making it the deadliest single tornado since 2021.

The April 2-7 outbreak led to 24 deaths across multiple states, while the strongest tornado of the year struck Diaz, Arkansas, reaching high-end EF4 intensity with peak winds of 190 mph. Wildfires also brought devastation, especially in Southern California. The Eaton Fire burned 14,021 acres and the Palisades Fire consumed 23,448 acres in January, making them the second and third most destructive wildfires in California history, with 30 deaths and over 17,000 structures destroyed.

In early July 2025, Central Texas, particularly Kerr County and the Hill Country, was devastated by one of the deadliest flood disasters in U.S. history. Triggered by remnants of Tropical Storm Barry and excessive tropical moisture, over 20 inches of rain fell within 72 hours, causing catastrophic flash floods along the Guadalupe River, which rose 26 feet in just 45 minutes.

The disaster left at least 134 people dead—over 100 in Kerr County alone—and more than 100 missing, with summer camps among the hardest hit. Rescue efforts saved over 850 people, but the flooding caused an estimated $18–22 billion in damages across six counties, worsened by limited flood insurance. The combination of extreme rainfall, record heat, hardened drought soil, and steep terrain contributed to the unprecedented severity.

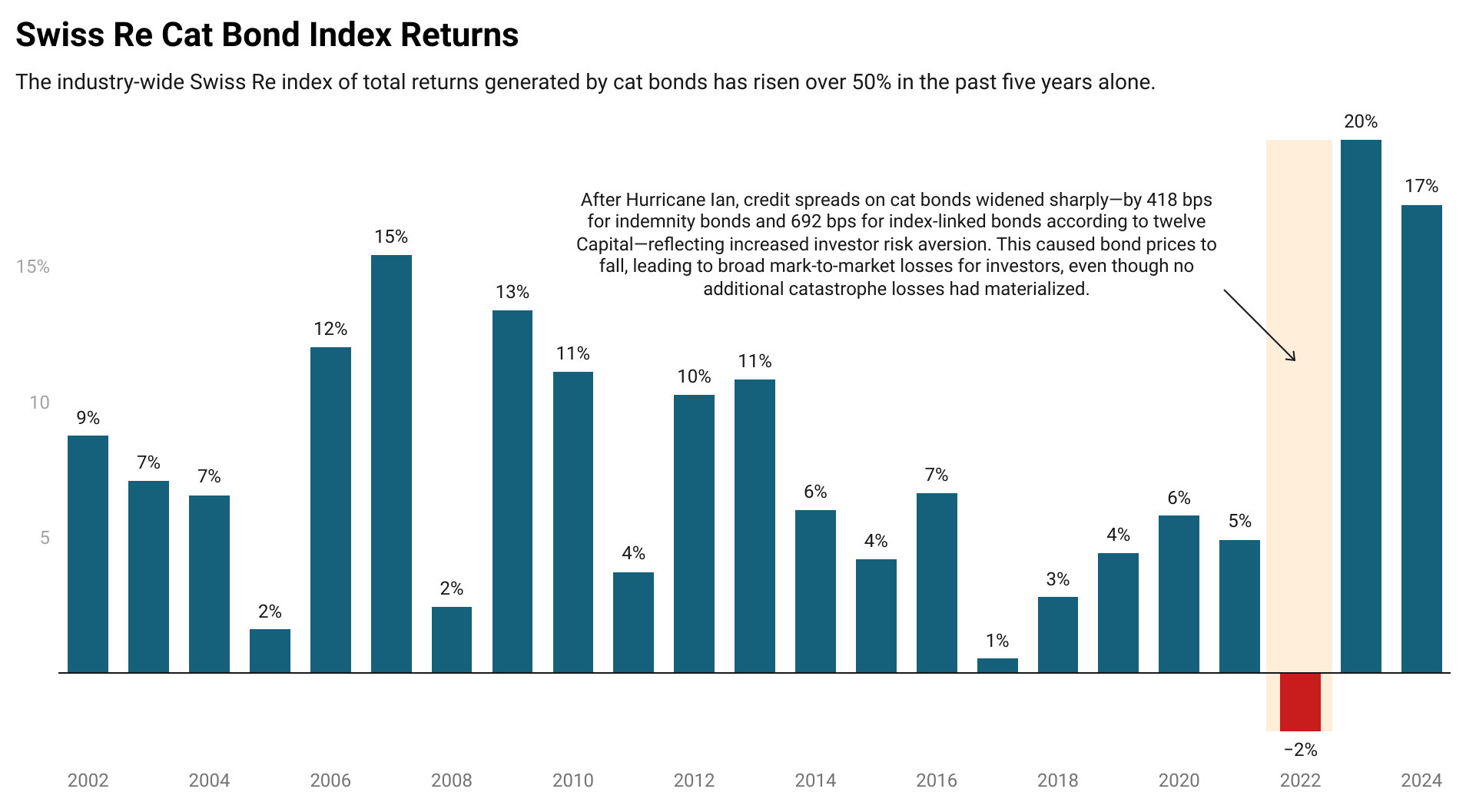

Demand Driven by Weather

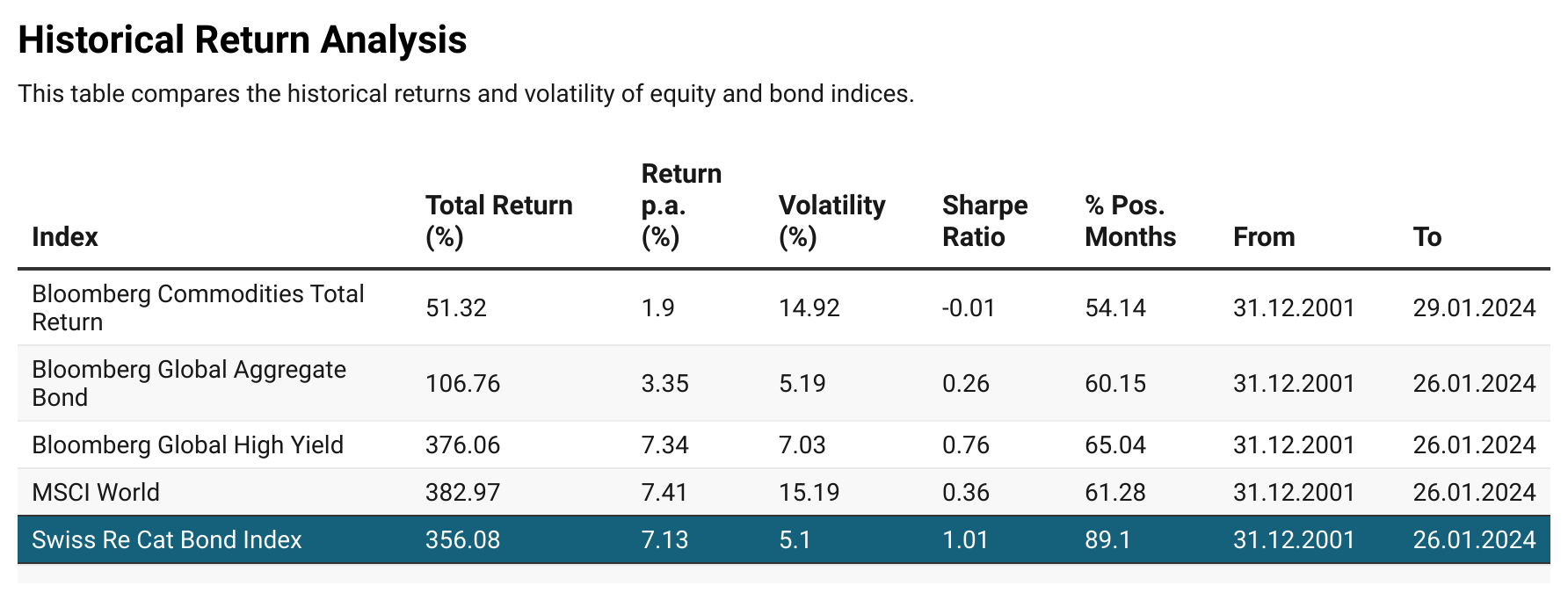

Several factors have contributed to the explosive growth in cat bond issuance especially in the first half of 2025. Strong investor demand has been a key driver, with many investors attracted to cat bonds for their high yields and low correlation with traditional financial markets. This demand has been supported by attractive pricing, as cat bonds have consistently offered yields in the range of 10-15%, significantly higher than those of traditional bonds. In addition, the asset class provides valuable diversification benefits, with returns largely uncorrelated to broader market volatility, making them an appealing option for portfolio managers.

Lastly and arguably the most important is the increasing frequency and severity of extreme weather events, driven by climate change, have amplified the need for alternative risk transfer mechanisms, further fueling the market’s growth. CAT bonds allow reinsurers to transfer a portion of their largest “tail risk” exposures—rare but potentially catastrophic events—to global capital markets. This helps reinsurers protect their solvency and free up capital, enabling them to stay active in disaster-prone markets and continue writing new business after extreme events.

The Development of The Catastrophe Bond Market

Issuers and Investors

The Chicago Fed posits that cat bonds are primarily issued by three types of institutions: insurance companies, reinsurers, and state catastrophe funds. Each uses cat bonds in different ways to transfer specific insurance risks off their balance sheets. A key distinguishing feature across these issuers is the trigger mechanism—the method used to determine when a payout is made to the issuer.

There are three common types of triggers:

Indemnity triggers, which pay out based on the actual losses experienced by the issuer, functioning similarly to traditional reinsurance contracts.

Industry loss triggers, which are based on aggregate losses to the insurance industry as estimated by an independent third party.

Parametric triggers, which pay out based on measurable physical characteristics of the catastrophic event, such as wind speed or earthquake magnitude or category of storm.

The report also references that insurance companies represent the largest share of cat bond issuance, accounting for approximately 60% of total issuance between 1997 and 2017. They primarily favor indemnity triggers, as these align payouts directly with their own losses, offering more precise protection for specific portfolios of underwritten policies. However, this precision comes with a trade-off: indemnity-triggered bonds typically have longer payout periods, often taking two to three years to settle, compared to around three months for industry loss or parametric-triggered bonds.

Reinsurers are the second-largest group of catastrophe bond issuers. Unlike insurance companies, reinsurers do not sell insurance policies directly to individuals or businesses. Instead, they take on the risk from policies originally underwritten by other insurers. As a result, after a catastrophic event, reinsurers must wait for primary insurers to assess and report their losses before they can determine the full extent of their own financial exposure.

State catastrophe funds form the third main group of cat bond issuers. These are public entities designed to support the insurance market in specific regions vulnerable to natural disasters. The two largest examples in the United States are:

The California Earthquake Authority (CEA), which provides earthquake coverage in California.

The Florida Hurricane Catastrophe Fund (FHCF), which supports the hurricane insurance market in Florida.

Catastrophe bond investors are primarily seeking the spread. These bonds are issued as floating-rate securities, where investors receive a fixed spread over an index or the return on high-quality collateral, typically invested in short-term money market funds. The index or collateral return compensates investors for the time value of money and is unaffected by the bond’s embedded insurance risk, resetting periodically based on prevailing short-term interest rates. The spread, on the other hand, compensates investors specifically for taking on the insurance risk.

A 2015 report by PartnerReviews breaks down what is driving the spread. The risk premium, or margin, is not fixed; it varies based on peril zone and modeled expected loss. Shifting perceptions of risk and relative value also cause margins to change over time. Importantly, the true expected loss is unknown—modeled expected loss is only an estimate. This estimation uncertainty causes the margin to be closely linked to expected loss levels. Peak peril zones (e.g., Florida hurricanes) typically carry higher margins due to portfolio concentration risks for ILS (insurance linked securities) investors, while diversifying peril zones (e.g., Turkish earthquakes) command lower margins. Additionally, for risks with comparable expected losses, the market charges higher margins on complex or less homogeneous risks (e.g., commercial property versus personal lines) because the greater uncertainty in estimating expected losses leads to a higher required risk premium according to Niraj Patel the author of the report and an ILS Portfolio Manager.

More Investment Products On The Way?

According to the Financial Times, catastrophe bonds are attracting a broader range of investors, highlighted by the launch of the first catastrophe bond exchange-traded fund (ETF) on the New York Stock Exchange in April. Pete Drewienkiewicz, CIO at Redington, described them as “the juicy part of the fixed income spectrum,” offering high yields compared to shrinking corporate bond spreads.

Under normal circumstances, the fund invests at least 80% of its net assets in catastrophe bonds. Catastrophe bonds, also known as event-linked or insurance-linked bonds, are structured securities whereby insurers or reinsurers transfer specific risks, typically those associated with severe events such as catastrophes or natural disasters, to capital market investors. The fund is non-diversified.

The rising cost of traditional reinsurance, driven by extreme weather losses and higher asset prices, has further boosted demand for cat bonds. New investors now include large institutions, hedge funds, endowments, and family offices, according to Artemis editor-in-chief Steve Evans who spoke to the Financial Times. The weather linked instrument offers comparable yield to a similar basked of high-yield debt while remaining more efficient in risk-adjusted returns.

The demand from institutions across the board is rising as many chase the yield while being largely uncorrelated to other market factors. While catastrophe bonds and other ILS instruments are largely uncorrelated with equities and broader financial markets, they are still exposed to idiosyncratic tail risk tied to large and unexpected insured loss events. For example, Hurricane Katrina in 2005, one of the costliest natural disasters in history, caused a sudden contraction in reinsurance capital precisely when demand surged, leading to significant market dislocation. This event not only pushed up reinsurance premiums but also drove a recalibration of catastrophe models (e.g., RMS updates), with higher assumptions for hurricane severity and frequency.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.