A Longstanding Pillar

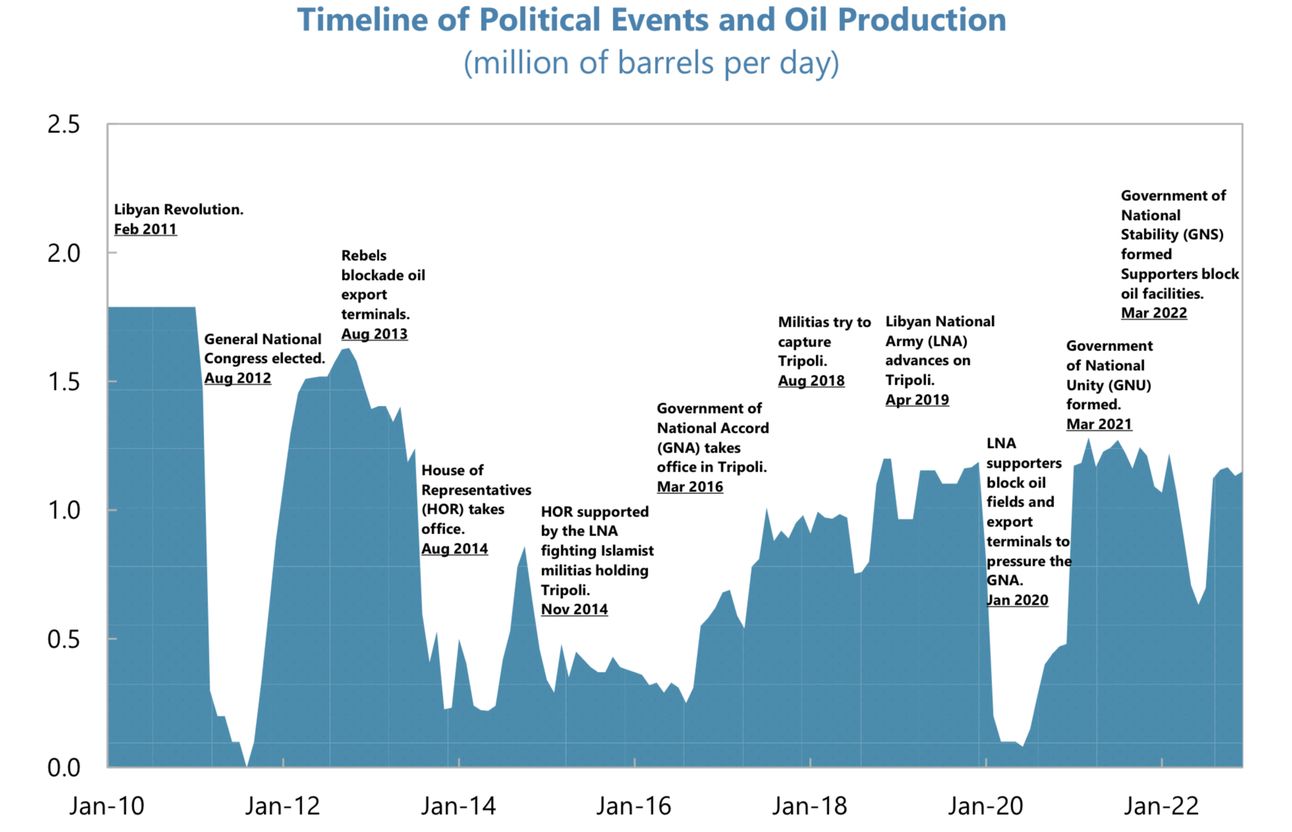

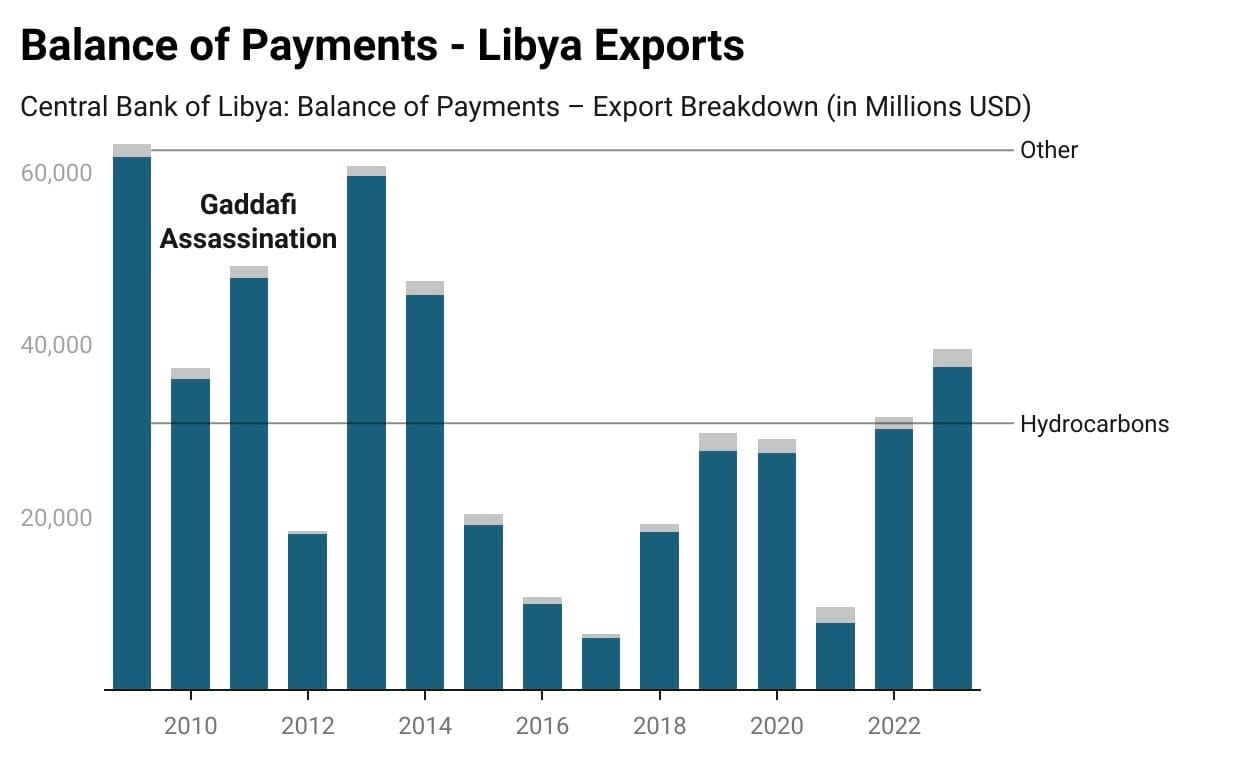

The Central Bank of Libya has been a longstanding pillar in the OPEC member country in controlling the oil revenues within the border. The country most notably relies on hydrocarbons for over 90% of its national revenue. The oil is being extracted at a pace of 1.2 million barrels per day (bpd) prior to the all out shutdown in late August. That output is far below the 1.6 million bpd that was being produced prior to the Gaddafi assassination in 2011 according to Reuters.

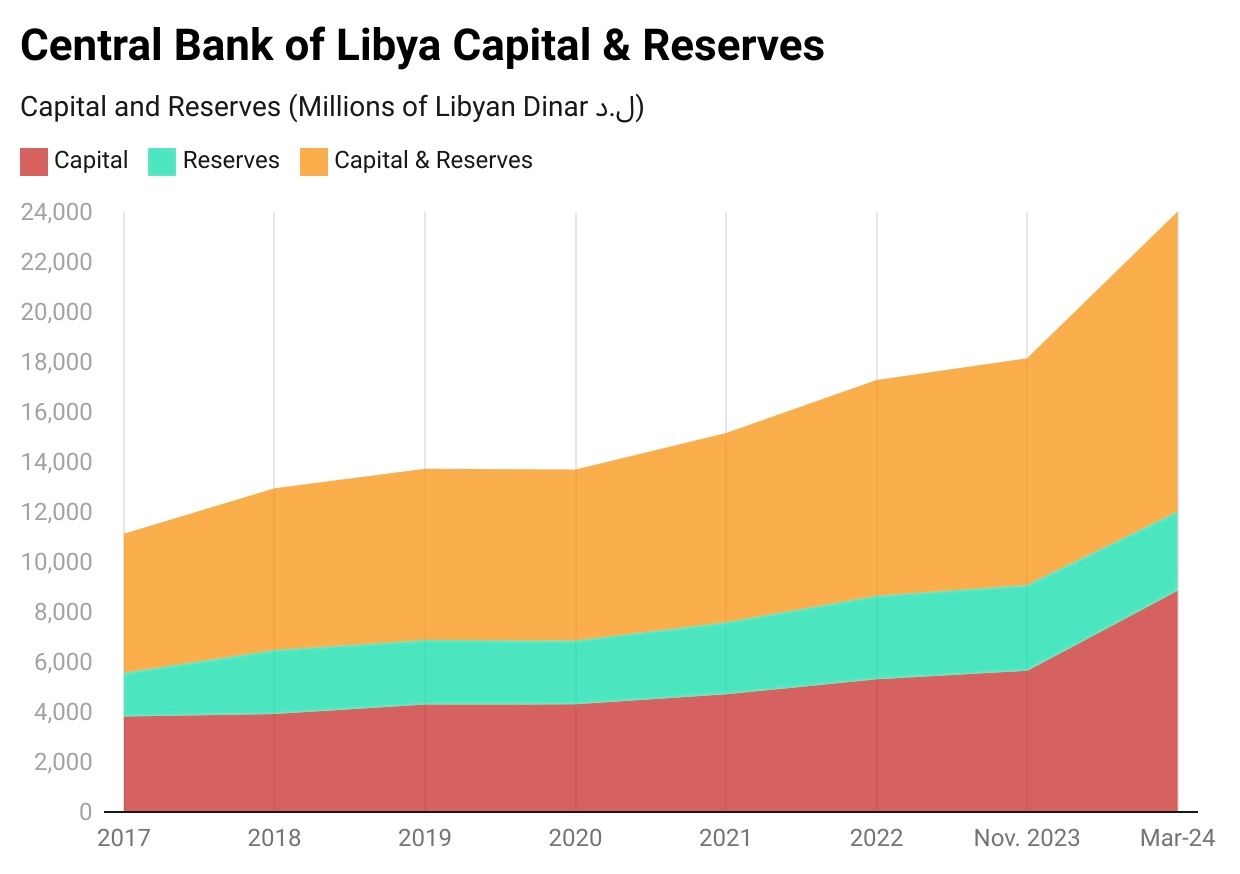

Source: Central Bank of Libya

The implications of having a divided nation with billions in oil revenue is that it is controlled by the Central Bank of Libya and more specifically the now defunct governor Sadiq al-Kabir. Much of this month’s gyration in oil prices with Brent and WTI nearing sub $70/barrel has been on the back of the renewed conflict between the central bank and east and west factions. A UN-backed administration known as the Government of National Unity, or GNU, is based in Tripoli in the west, and its rival, known as the House of Representatives, is based in the east, in Tobruk.

In late August 750,000 barrels went offline soon after a committee from the Tripoli government took over the premises of the central bank in the coastal city. Armed groups then began intimidating staff into operating the institution, according to Kabir, who said he then fled to an undisclosed location.

U.S. crude is a good substitute for light sweet Libyan barrels, and it can make the journey fairly quickly across the Atlantic

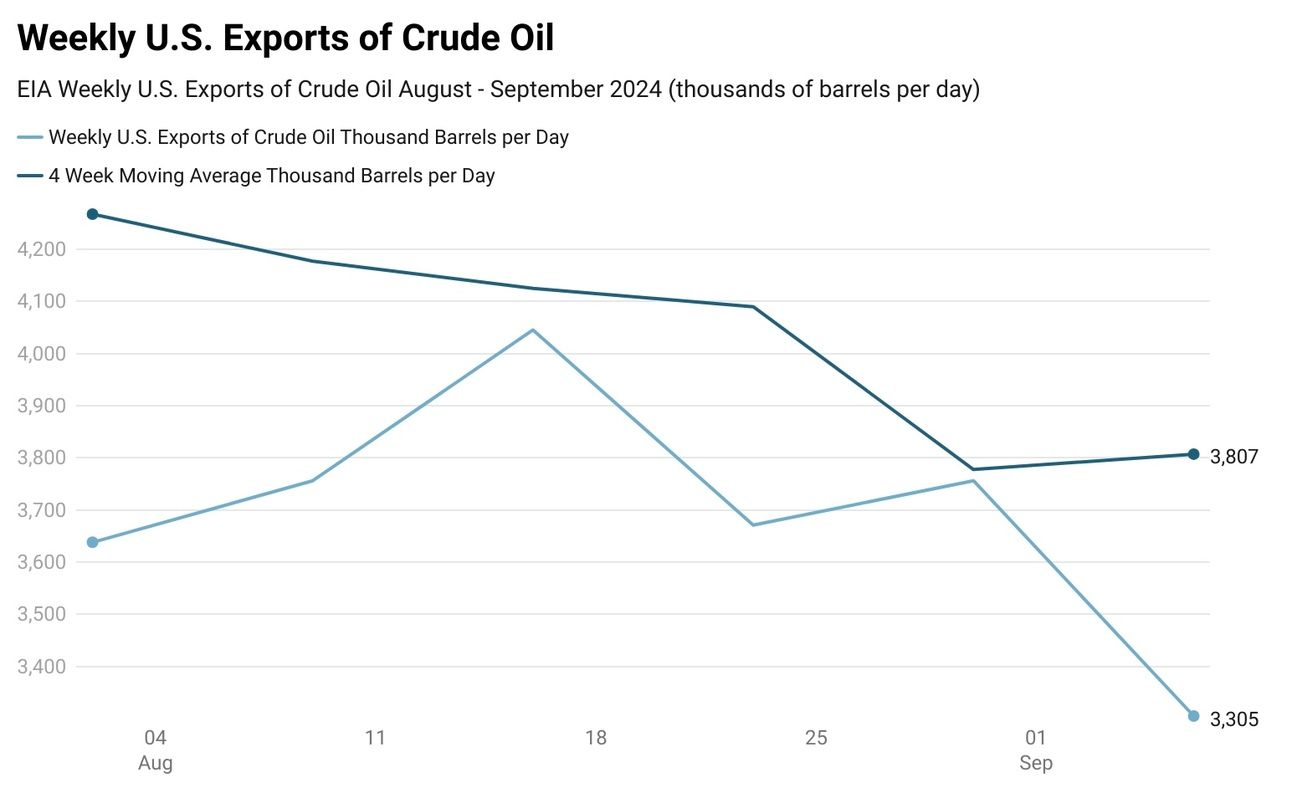

With the African oil offline in early September cushing oil is becoming a substitute with Europe's imports of WTI Midland hitting 1.43 million barrels per day in August, good for a 24% month-on-month increase according to OilPrice.com. While WTI Midland exports to Europe have increased in recent weeks, overall U.S. benchmark oil exports are lower this year and have slowed over the past month, as shown below according to data from EIA.

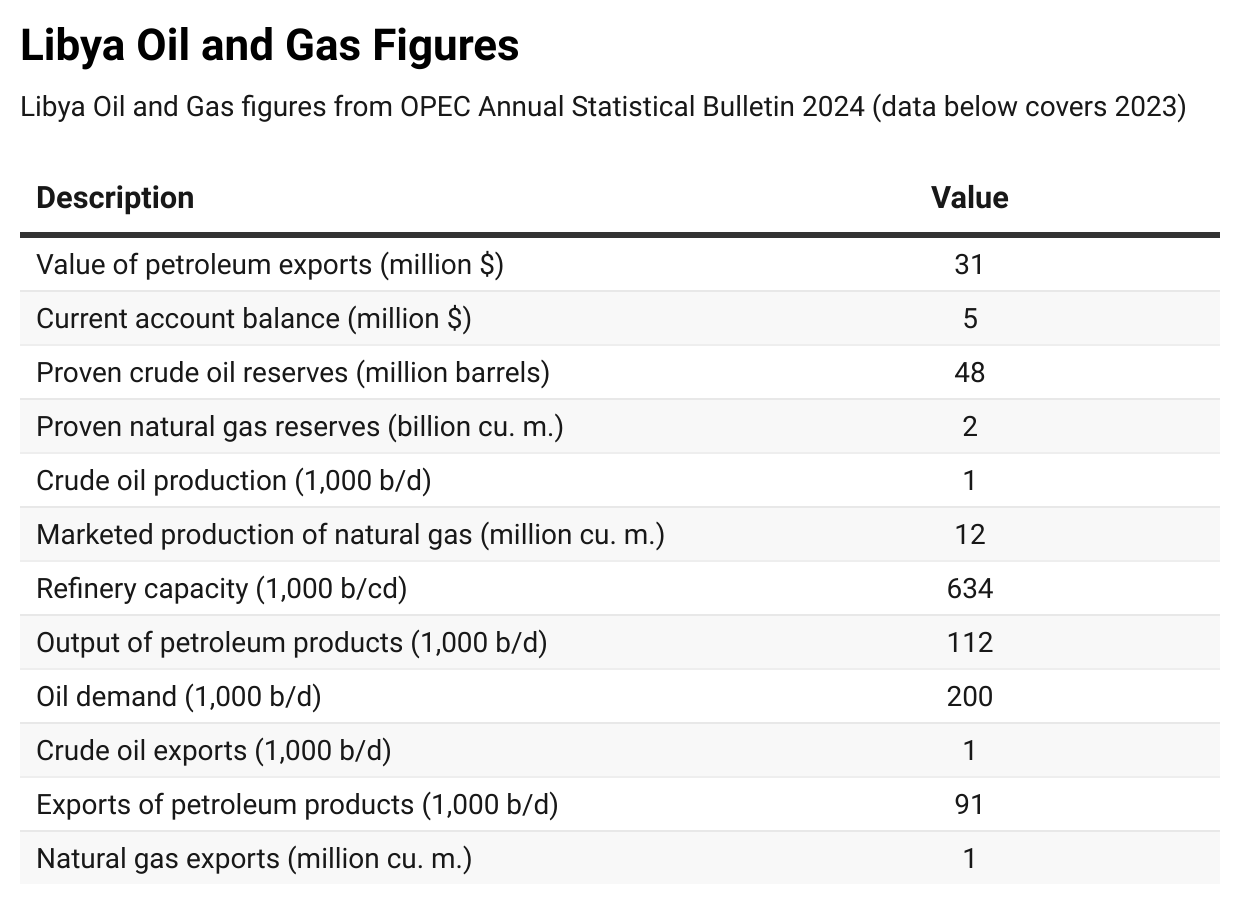

Libya’s significance in Africa should not be overlooked, as the country holds the largest proven oil reserves on the continent, accounting for over 40% of the total. In understanding how the conflict arose we can examine how the Central Bank of Libya is situated within the country’s political and banking system which differs from that of a ‘traditional’ monetary policy regime.

Central Bank of Libya and The National Oil Company

Central Bank of Libya (CBL)

The Central Bank of Libya (CBL) is the only authorized depository for state oil revenues. As discussed above 90% of revenue is derived from state oil, thus implicating whoever controls and governs the CBL in effect controls the economy. Since the fall of the Gaddafi regime in 2011 the CBL has been able to keep a steady level of oil reserves supported largely by a fixed exchange rate, the IMF cited a tax on foreign exchange transactions helped to boost government revenue and support reserves between 2016 and 2020.

In March 2011, Farhat Bengdara, the governor of the Central Bank of Libya, resigned and defected to the rebel side in the Libyan Civil War, after arranging for most of Libya’s external assets to be frozen and made unavailable to the Gaddafi government. The CBL introduced a capital control measure in 2015 following the split of Libya into east and west, the control measure was to preserve foreign currency reserves, the subsequent devaluation of the dinar in 2021 relaxed capital restrictions.

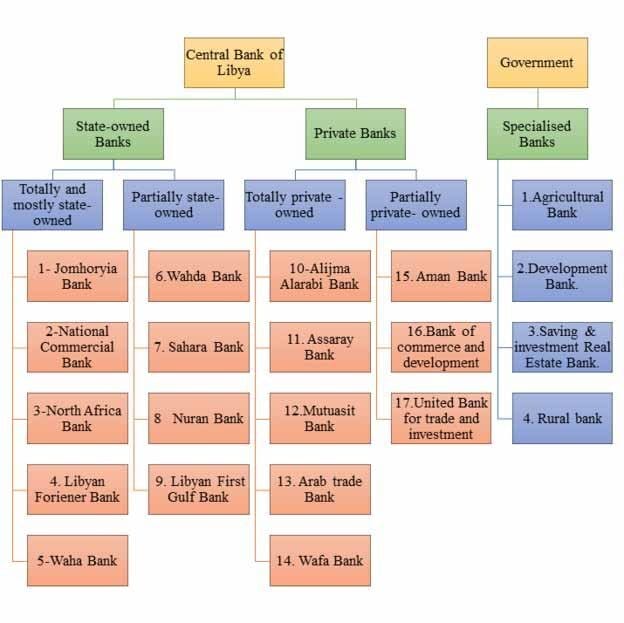

As shown in the flow chart of financial institution ownership, the Central Bank of Libya (CBL) controls the four major national banks and holds 70% of the total banking system assets and 80% of total credit, according to a 2023 IMF report. The bank’s main branch is located in Libya's largest capital city, Tripoli.

In December 2021, the Tripoli-based and Bayda-based Central Bank of Libya (CBL) governors met in Tunisia and agreed to initiate the unification process. By August 2023, the CBL officially announced the completion of its reunification under Governor Saddek Elkaber. This reunification led to improvements in banking supervision and monetary policy coordination, advancing the country’s reform agenda.

In 2023, Libya faced a fiscal expansion driven by falling hydrocarbon prices and rising expenditures. In response, the CBL tightened foreign exchange restrictions and introduced a temporary tax on foreign exchange purchases to address pressures on reserves and the exchange rate. Additionally, the CBL began efforts to expand coverage and update the Consumer Price Index (CPI) basket to better track inflation, with the new index expected in 2025.

However, in August 2024, CBL Governor Sadiq al-Kabir and several officials were forced to flee Libya due to threats from armed groups. The Tripoli-based Government of National Unity attempted to seize control of the CBL, resulting in a suspension of banking operations and a liquidity crisis. The UN Support Mission in Libya (UNSMIL) is currently working with stakeholders to resolve the leadership dispute and address the closure of oilfields by eastern authorities. UN-mediated talks have made progress, with rival factions continuing discussions to reach a final agreement on the central bank crisis. Reuters also reported earlier this week that the 30 international financial institutions the central bank works with have suspended all transactions, the only contact that remains is with the International Monetary Fund (IMF), U.S. Treasury and JPMorgan.

National Oil Company (NOC)

Established in 1970 the state owned oil company controls a majority of the industry across the country. A main player in controlling Libya's oil revenues which reached $6 billion in Q1 2024, with an expected annual revenue of $25 billion for the year, the National Oil Company is often caught in the middle of the conflict between eastern and western factions. According to News.Az from 2013 to the onset of COVID-19 in 2020, the periodic halts in oil production and exports resulted in losses exceeding $180 billion USD. Only the truce between western and eastern forces (albeit temporary) allowed production to be restored to nearly 1.2 million barrels per day. Prior to the 2011 revolution, Libya was one of the world’s leading oil exporters, producing over 1.8 million barrels per day with fewer periodic outages.

The Libya Review reported in late June that the Libyan National Oil Corporation (NOC) announced an ambitious plan to drill 121 new wells in 2024 to explore and develop the country’s natural oil and gas resources. In a statement, the NOC outlined its strategy to boost oil production through new wells and the maintenance of existing infrastructure. The plan also includes maintaining approximately 1,335 wells to ensure sustainable production, though specific locations and timelines have not yet been disclosed.

The NOC aims to exceed crude oil production of 1.5 million barrels per day by the end of 2025, with a goal of reaching 2 million barrels per day within three years. However, this depends on the continued operation of oil fields and ports, which are currently undergoing individual force majeure processes. Last week, the NOC cancelled several Es Sider cargoes, and according to two trading sources, it has also cancelled cargoes of Amna and Brega crude grades, Reuters reported.

The political and monetary landscape that influences the oil market stems from the conflict and division of the country over the past 13 years since the fall of the Gaddafi regime in 2011.

A Divided Libya

East and West Libya (2011-2014)

The 2014 split of Libya can be traced back to February 2011, when a “day of rage” sparked the Libyan revolution. The Atlantic Council provides a detailed timeline of how the revolution evolved into the 2014 split between eastern and western Libyan factions. Below is a summary of the key events leading to this division. For an in-depth look at the political developments from 2011-2018, please refer to the Atlantic Council’s comprehensive analysis.

2011: Libyan Revolution

Feb 15 - 17: Protests begin in Benghazi, escalating into the Libyan revolution.

Feb 24: Militias seize Misrata from Gadhafi’s forces.

Mar 17: UN imposes a no-fly zone; NATO airstrikes begin.

Oct 20: Gadhafi is killed; the NTC declares Libya liberated.

2012: Transition and Tensions

Jul 7: Elections held for the General National Congress (GNC).

Aug 8: GNC replaces the NTC; political instability increases.

Sep 11: Attack on the US consulate in Benghazi highlights security issues.

Oct 14: Ali Zidan becomes prime minister but struggles with governance.

2013: Rising Challenges

Apr 11: US and UK withdraw diplomatic staff due to security concerns.

May 5: GNC passes the Political Isolation Law, increasing political polarization.

Aug 17: Ibrahim Jadhran’s oil field blockade exacerbates regional tensions.

2014: Fragmentation

Feb 20: Libya elects a committee to draft a new constitution.

Mar 11: GNC is dissolved; Abdullah al-Thinni appointed interim prime minister.

May 17: Operation Dignity led by Khalifa Haftar clashes with Islamist militias.

Jul 13: Operation Libya Dawn counterattacks Haftar’s forces; the GNC is replaced by the House of Representatives (HoR).

Aug 23: Libya Dawn takes over Tripoli, forcing the HoR to relocate to Tobruk.

The power struggle between competing factions, instability, and clashes between militias led to the political and territorial fragmentation of Libya in 2014. At the end of 2014, Libya essentially had two rival governments, one in the capital City of Tripoli and one in Tobruk. Haftar’s forces controlled must of eastern Libya (Tobruk).

Conflicts Post Fragmentation

From 2015 to 2020, the UN made several attempts to reconcile Libya’s rival factions. In December 2015, the Libyan Political Agreement established the Government of National Accord (GNA) to unite the eastern House of Representatives (HoR) and the western General National Congress (GNC). While the GNC eventually ceded power, the HoR did not recognize the GNA. Concurrently, Khalifa Haftar’s Libyan National Army (LNA), supported by Egypt and the UAE, expanded its control in the east and pushed ISIS out of key areas. In April 2019, Haftar launched an offensive to capture Tripoli from the GNA, which was backed by Turkey and Qatar. After over a year of conflict, the GNA repelled Haftar’s forces. A permanent ceasefire was signed in October 2020, and in March 2021, a new interim Government of National Unity (GNU) was formed to lead Libya until elections.

Where We Are Today

As of this morning, Bloomberg reported that UN-led talks failed to resolve the impasse over control of the Central Bank of Libya. The long-standing conflict continues to revolve around control of oil revenues, a significant source of wealth, with peace between the eastern and western factions remaining elusive. Few tankers are departing ports and the majority of production remains dark at this time. Looking to OPEC+ output decisions and the price of Libyan crude could provide evidence of what comes next.

OPEC+ Considerations and Libyan Crude Implications

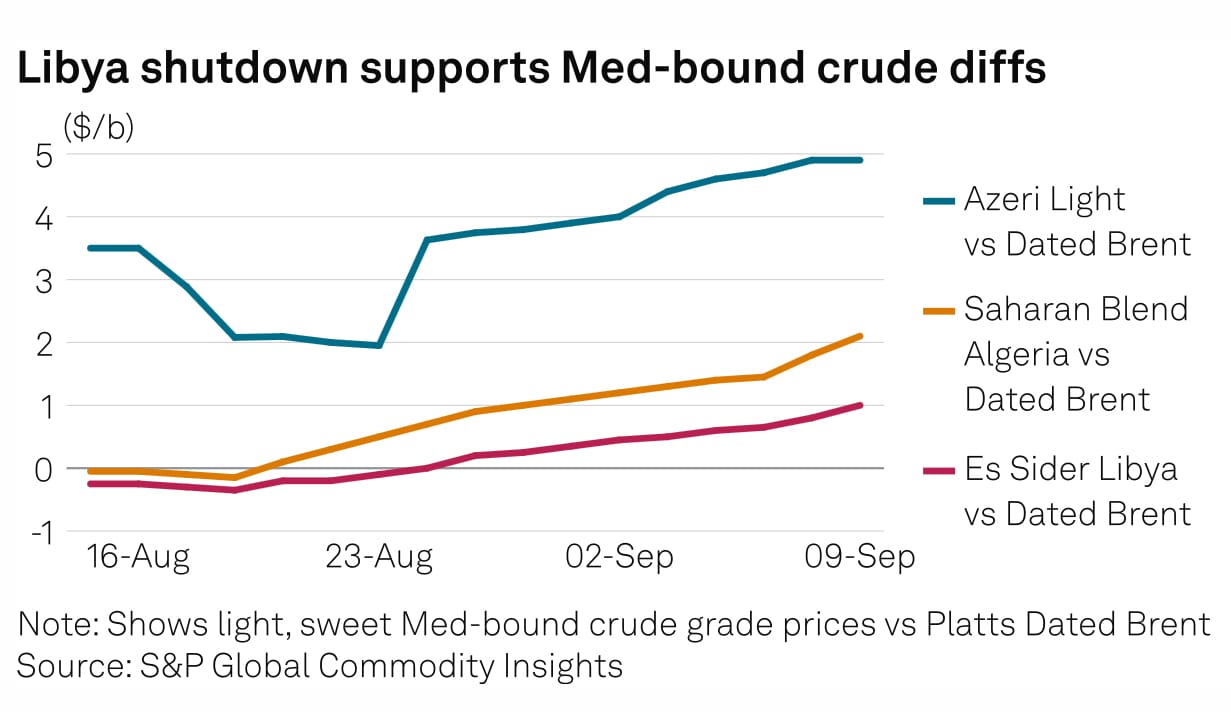

The footage above shows British Petroleum (BP) searching for oil in Libya around 1957, featuring several explosions. The video is a stark contrast to what might be considered simpler times in managing hydrocarbons in the country. Fast forward to today, and the OPEC member reportedly had no crude oil tankers depart as of Tuesday. However, this hasn’t shaken the selling sentiment, pushing crude benchmarks near $70/bbl. According to Platts Global, Azeri Light CIF Augusta was priced at a $3.77/b premium to Dated Brent on Sept. 9, the highest since late January. Similarly, Saharan Blend was assessed at a $0.97/b premium to Dated Brent on Sept. 5, also a seven-month high. Libyan crude has seen a boost, with much of its production still offline going into mid-September.

Dating back to the fall of the Gaddafi regime in 2011 and the beginning of the Libyan Revolution the country has undergone many events that have contributed to its volatile oil production. Hydrocarbon production prior to the recent shutdown was expected to grow by around 15% according to Libyan authorities. This was after the GNS formed a support for the oil blockade in 2022 in which production again dropped off to roughly half a million barrels per day of production.

Reminiscent of the 2020 oil blockade, which was part of a failed campaign to capture Tripoli in 2019-20, the East-based Libyan National Army instigated a nine-month blockade of oil fields and export terminals. This reduced oil output by three-quarters, to about 0.3 million barrels per day. The blockade coincided with global pandemic containment measures, leading to a decline in oil prices. As a result, Libya experienced a 30-percent contraction in nominal GDP.

Platts reported earlier this week that Libyan crude exports have gradually resumed loading from eastern ports. However, there seems to be some disagreement (as seen on X from #oott commentators—Organization of Oil Trading Tweeters). At the time of writing, Libya’s rival regional governments are reportedly moving closer to a political deal under UN-brokered talks. According to reports, an agreement is expected on Thursday, which includes appointing a new central bank governor.

Reports emerged later in the week that Libyan oil exports fell by approximately 81% last week, according to Kpler data. The National Oil Corporation (NOC), Libya’s state-owned oil firm, canceled cargoes amid a crisis over control of the central bank and oil revenues. Current production levels were unclear. Despite the decline, Libya was still exporting crude last week, but at a significantly reduced rate—194,000 barrels per day (bpd), compared to over 1 million bpd the previous week.

As far as exports are concerned, Libya primarily exports oil from the Es Sider port in the eastern part of the country. In August, Libya exported 3.9 million metric tons (mmt), while the monthly average for 2024 up until August has been 4.2 mmt, equivalent to approximately 1.03 million barrels per day (bpd). The trade is largely facilitated by Aframax tankers, with Italy being the top destination in both 2023 and 2024, accounting for more than 37% of total exports in 2024. Italy is followed by Spain, Greece, the UK, and, to a lesser extent, the US.

In 2021, Libya was the seventh-largest crude oil producer in OPEC and the third-largest producer of total petroleum liquids in Africa, following Nigeria and Algeria. By the end of 2021, Libya held 3% of the world’s proved oil reserves and 39% of Africa’s proved reserves. Despite these significant reserves, political instability and militia attacks on oil infrastructure have hampered investment in Libya’s oil and gas sectors. Since 2011, these issues have also limited exploration and development efforts.

Although Libya is an OPEC member, according to EIA it is exempt from the production cuts imposed by the OPEC+ agreement. The sharp decline in global oil demand growth, driven by China in recent months, has triggered a significant sell-off in oil markets. Brent crude futures have fallen from over $82 per barrel in early August to a nearly three-year low, just below $70 per barrel on September 11, despite substantial supply disruptions in Libya and ongoing crude inventory draws. Despite OPEC's August output being the lowest since January, the group pumped 26.36 million barrels per day last month, a decrease of 340,000 bpd from July, according to a Reuters survey. This marks the lowest total since January 2024.

The standoff continues, but OPEC may face a substantial surplus if the Libyan standoff is short-lived. The disruption (one cargo departing every 2-3 days) seems to have done little to support prices over the past 2 weeks as Chinese crude demand remains center stage

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.