M23 and The Congolese Army

M23 (March 23) is a rebel group that emerged in 2012, primarily composed of former Congolese soldiers who defected from the national army. Supported by Rwanda, the group has been involved in multiple conflicts with the Congolese military (FARDC) and the United Nations Organization Stabilization Mission in the Democratic Republic of the Congo (MONUSCO).

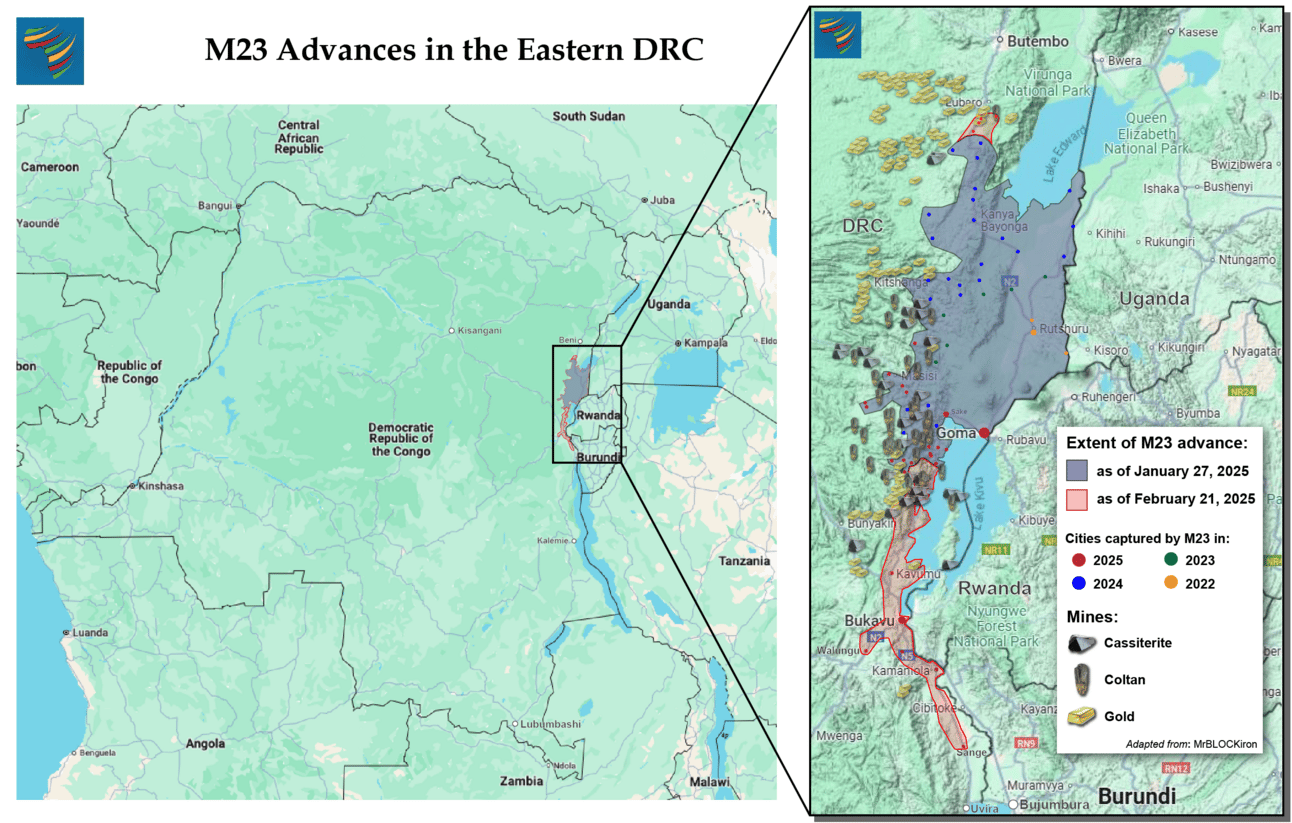

In January 2025, M23 launched a major offensive against the city of Goma, capturing significant parts of it. This campaign was part of a broader resurgence of violence in North and South Kivu provinces, which began in October 2024 after a brief ceasefire. According to the BBC locals insist the M23 is the only armed group which can operate freely, and shoot to kill in broad daylight in Goma. The conflict has strained relations between the DRC (Democratic Republic of Congo) and Rwanda, leading the DRC to sever diplomatic ties in January 2025. International mediation efforts, such as the Luanda process, have faced challenges in achieving lasting peace. Regional forces, including peacekeepers from the Southern African Development Community (SADC) and MONUSCO, have played a crucial role in attempting to stabilize the region. However, these efforts have been met with significant challenges, including casualties among peacekeepers. The recent conflict is rooted in the spillover into Congo of Rwanda's 1994 genocide and the struggle for control of Congo's vast mineral resources according to Reuters.

M23 has cautiously welcomed Angola-mediated negotiations with the DRC government, scheduled to begin on next week on March 18 in Luanda. This marks a potential breakthrough, as President Félix Tshisekedi had previously refused dialogue with the group, labeling it a “terrorist” organization. However, the DRC government has only “taken note” of the proposal without fully committing, while M23 demands a public commitment from Tshisekedi to participate. Meanwhile, international pressure for inclusive talks continues to mount. The U.K. and regional bodies like the East African Community (EAC) have urged broader negotiations, but Kinshasa remains firm in its stance, insisting on negotiating only with Rwanda, whom it accuses of directly supporting M23 militarily.

Rwanda’s involvement in the conflict remains a major point of contention. According to Reuters UN experts confirm that Rwanda has deployed between 3,000 and 4,000 troops alongside M23, enabling its battlefield dominance. Kigali denies direct involvement, instead citing security threats from the FDLR, a Rwandan rebel group operating in eastern DRC. Meanwhile, Uganda and Burundi’s roles further complicate the regional landscape. Ugandan forces have entered Ituri Province, officially to combat the Allied Democratic Forces (ADF) rebel group, but their proximity to M23’s movements has raised suspicions of possible coordination.

At the same time, Burundi’s withdrawal from South Kivu reduces the risk of direct clashes with Rwanda but further weakens Kinshasa’s defenses. Beyond the military dynamics, economic stakes in the region are high. M23’s control over mineral-rich areas and critical trade routes, particularly those along Lake Kivu, grants Rwanda de facto access to valuable resources, including gold, coltan, and other strategic minerals as seen in the figure from ACSS.

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Commodity Supply Chains

Tin Supply Shock

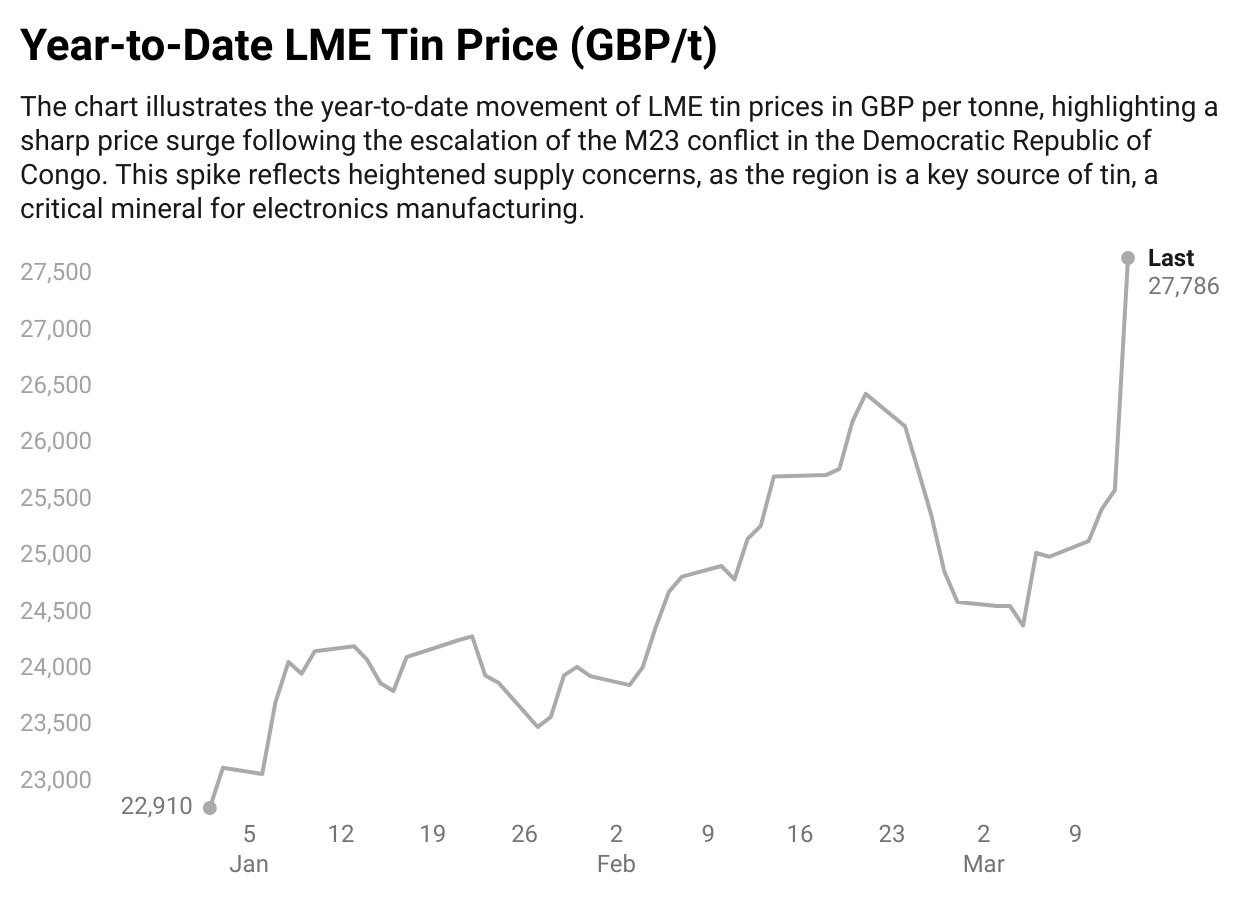

The temporary closure of Alphamin Resources’ Bisie mine, which accounts for 6% of global tin supply, due to M23 rebel advances near North Kivu, caused a sharp reaction in the market. Tin prices surged 7.4% in a single day, reaching $37,100 per tonne in London—the highest level since 2022. This disruption has further tightened an already strained market according to Mining.com, compounding shortages from Myanmar’s Wa State. As a result, tin prices have risen 25% year-to-date, while LME tin stocks have dropped by 27% since December 2024, exacerbating supply concerns.

Cobalt and Coltan Disruptions

M23’s territorial gains now include Rubaya, the DRC’s largest coltan-producing area, which yields approximately 1,000 tons annually, along with cobalt-rich zones crucial for electric vehicle (EV) battery production says Eco-Business. According to UN estimates, M23 earns around $800,000 per month from coltan taxation, further solidifying its financial position.

The Importance of Coltan - The Conflict Mineral

Coltan (columbite-tantalite) is a vital mineral due to its high niobium and tantalum content, essential for modern electronics, medical devices, and aerospace engineering. It enables miniaturization in consumer technology, enhances heat resistance in jet engines, and supports medical implants due to its biocompatibility. With over 60% of the global supply sourced from the DRC, coltan is a geopolitical flashpoint, fueling armed conflicts and raising ethical concerns as a “conflict mineral.” Additionally, its extraction has led to severe environmental degradation, particularly in ecologically sensitive regions, making its supply chain both critical and controversial.

These developments pose significant risks to global supply chains, particularly as the DRC holds over 60% of the world’s cobalt reserves, with Chinese firms dominating extraction and processing. International manufacturers, including Apple, are facing legal scrutiny for allegedly sourcing conflict minerals, prompting the European Union to pressure for the cancellation of a minerals trade deal with Rwanda.

Copper Market Shifts

China’s dependence on the DRC for copper has intensified, with 62% of its refined copper imports now coming from the country’s off-exchange “EQ copper” producers Reuters reported on Wednesday, up from 50% in 2022. This increase comes despite ongoing instability in the region. Analysts predict that China will continue boosting its EQ copper imports as a hedge against potential U.S. tariffs on scrap metal. However, concerns about quality and the informal nature of these supply channels remain a key risk factor.

The Democratic Republic of Congo’s primary copper deposits in Haut-Katanga and Lualaba provinces (southeastern DRC) are not currently under direct threat from M23 rebel advances, which remain concentrated in the conflict-prone eastern regions. The copper/cobalt belt located in the southeast region of the republic produces 2.3 million tonnes of copper annually and remains stable, unaffected by the ongoing conflict in the east.

Broader Implications

The withdrawal of SADC peacekeepers and M23’s continued westward expansion now threaten key mining hubs in South Kivu, raising the likelihood of prolonged disruptions across multiple commodity markets. The instability has triggered significant investor reactions, with Alphamin’s stock surging 22% on the Toronto Stock Exchange following the tin price spike, highlighting the market’s sensitivity to supply shocks. Additionally, the conflict has intensified global scrutiny over so-called “blood minerals.” The DRC has filed lawsuits against Apple for alleged complicity in conflict mineral sourcing and is pushing for EU sanctions to curb illicit mineral trade.

Key trading routes are also being blocked as shown in the figure provided by Bloomberg. Kamituga, a major gold-mining town, contributes 12–17% of South Kivu’s total gold output. It lies along the RN2 economic corridor, linking to Bukavu, where traders sell gold. The area has faced threats from armed groups like M23, which seek to tax and control gold production and trade.

Rwanda’s Motive: A Battle For Natural Resources?

Rwanda has justified its involvement in eastern DRC as a response to security threats from the FDLR, but UN reports suggest this threat is overstated, serving as a pretext for deeper intervention. A key underlying motive appears to be resource exploitation, as eastern DRC is rich in critical minerals like coltan, gold, tin, and tungsten as discussed in the previous section. Rwanda’s mineral exports surged by 50% in 2023, with coltan—much of it allegedly smuggled from DRC—positioning the country as the world’s top exporter, highlighting the economic incentives behind its actions.

What is the Democratic Forces for the Liberation of Rwanda (FDLR)?

The Democratic Forces for the Liberation of Rwanda (FDLR) is a Hutu rebel group operating in eastern DRC, formed in 2000 by remnants of the perpetrators of the 1994 Rwandan genocide. Rwanda considers the FDLR a significant security threat, citing its presence as justification for military interventions in the DRC. However, UN reports and analysts argue that the group’s actual threat level is often exaggerated.

Analysts are apparently unsure of the exact motive of the Rwanda backed M23 according to VOA News Claude Gatebuke, a Rwandan genocide survivor and coauthor of the book Survivors Uncensored, said Rwanda is not the only backer of the M23. Citing Uganda is also backing M23 along with Rwanda to take control of RDC’s eastern provinces which are rich in natural resources. It is no secret that the republic is rich in resources, from gold to uranium, and has been for quite some time, making it a target for neighbouring countries. While Rwanda frames the conflict as an effort to secure its borders, discussions about mineral tax revenue suggest the true aim is expanding control over Africa’s key resource regions.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.