China’s Easing Cycle

The People’s Bank of China (the nation’s central bank) embarked on a ‘loose’ monetary policy effort earlier in the year announcing a stimulus package in September. The measures in the stimulus package included a 0.5 percentage point reduction in the reserve requirement ratio (RRR), which injected approximately 1 trillion yuan ($137 billion) into the financial system. Additionally, the central bank cut the seven-day reverse repo rate by 20 basis points to 1.5%.

The package also included major mortgage policy reform. The minimum down payment for second homes was lowered to 15%, matching that of first homes. Existing mortgage rates were reduced by 50 basis points through refinancing, saving borrowers an estimated 150 billion yuan in interest. Additionally, the PBoC strengthened its re-lending facility for housing inventory purchases, raising the share of re-lending funds from 60% to 100% according to LGT Research. In November, the PBoC also increased reverse repo operations, injecting 800 billion yuan into the banking system to address local government debt, compared to 500 billion yuan in October. Analysts are expecting at least another 50 basis point reduction in the Chinese short-term rate before year end.

The Ripple Effects of Evergrande’s Collapse on China’s Banking Sector

The Evergrande crisis had significant effects on China’s monetary policy and exposed risks within the banking sector, with broader economic implications. The collapse has led to potential write-offs of over $300 billion in Evergrande-related debt, creating substantial challenges for banks and lenders.

Property values have declined for sixteen consecutive months, dropping by 6% in major cities. This downturn has severely destabilized the real estate sector, which accounts for 25% of China’s GDP.Some regional banks, such as the Bank of Cangzhou, experienced deposit withdrawals as depositors grew concerned about Evergrande’s exposure. In response, financial institutions have tightened their collateral requirements and enhanced risk management practices to mitigate further fallout.

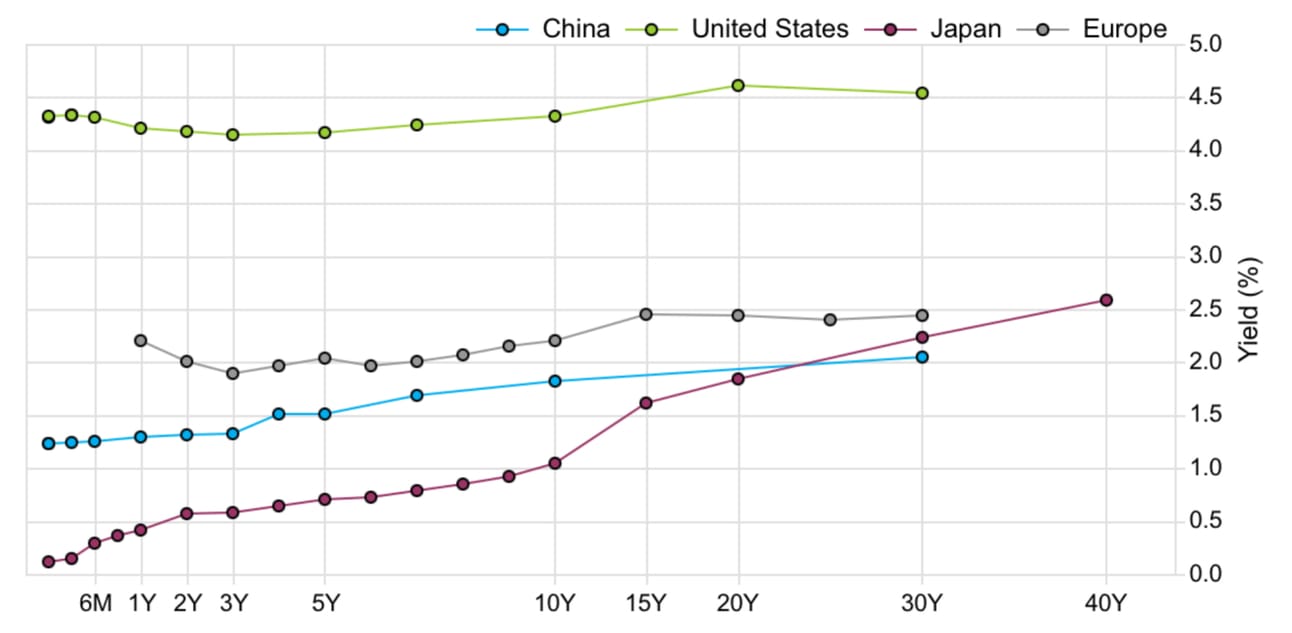

Yields remain well below their American counterparts based on the figure below provided by FactSet. The lower reserve requirement coupled with fiscal stimulus has dampened the treasury curve. The weighted average interest rate on loans hit historic lows, with the one-year Loan Prime Rate (LPR) at 3.45% and the over-five-year LPR at 3.95% according to the Q1 2024 Monetary Policy Report form the PBoC.

Source: FactSet

The market reaction to the fall stimulus, which was largely expected was a substantial decrease in China’s interest rates across the board. The 10-year bond yield has dropped below 2%, reaching 1.9636%, its lowest level in 22 years. Similarly, 30-year bond yields have declined to 2.164%, falling below their Japanese counterparts for the first time in nearly two decades. This bond market rally persists despite efforts by Chinese authorities to moderate it. China’s easing cycle began shortly after the Federal Reserve’s first reduction to the U.S. overnight rate in September. This allowed China to lower its domestic borrowing costs without triggering a sharp yuan devaluation. Despite the Fed’s shift to an easing stance, the interest rate gap between U.S. and Chinese yields remains far apart.

Could your portfolio benefit from owning shares in healthcare?

95% accurate, patented lung cancer detection

Partnered with Bio-Techne, Moffitt Cancer Center, & more

Put prevention in your portfolio

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.cizzlebio.com

Bond Yields Remain Low

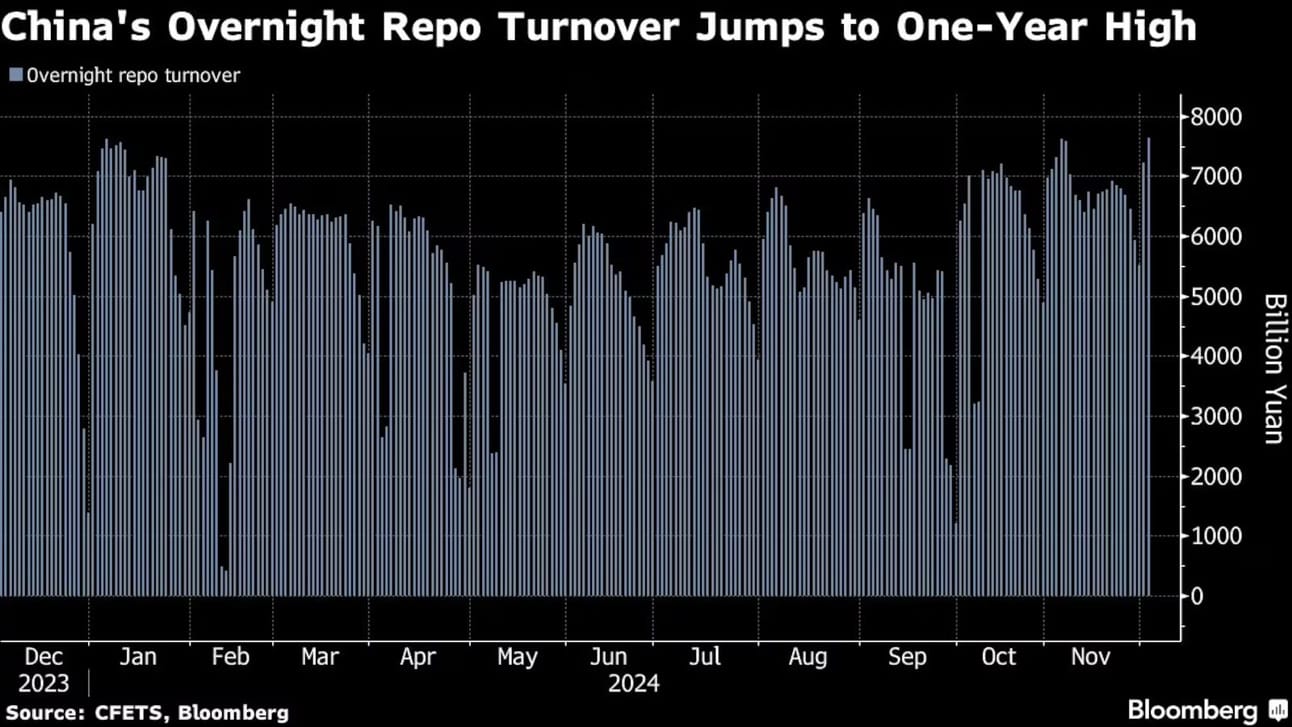

Earlier Volume Declines

Chinese investors’ demand for safe-haven assets has surged to its highest level since 2015, driven by ongoing deflationary risks and continued stimulus measures. However, there was an interim decline in the volume of 10-year government bonds, dropping by as much as 90% during certain periods, according to an August Bloomberg report. This sharp drop in liquidity poses significant challenges for policymakers. The situation is further complicated by increased investor demand for long-dated government bonds, driven by:

Persistent weakness in the real estate market

A widespread perception of an economic slowdown

Limited alternative for risk bearing investment opportunities

Bond market activity has since rebounded in early December, with overnight repurchase contracts surging to 7.6 trillion yuan (US$1.04 trillion), the highest level since August 2023. The heightened activity in the repo market indicates an increase in the volume of treasuries being used as collateral in these agreements. On Wednesday, the 10-year bond yield fell by three basis points to 1.96%, while the overnight repo rate rose by five basis points to 1.39%.

The PBoC’s Attempted Intervention

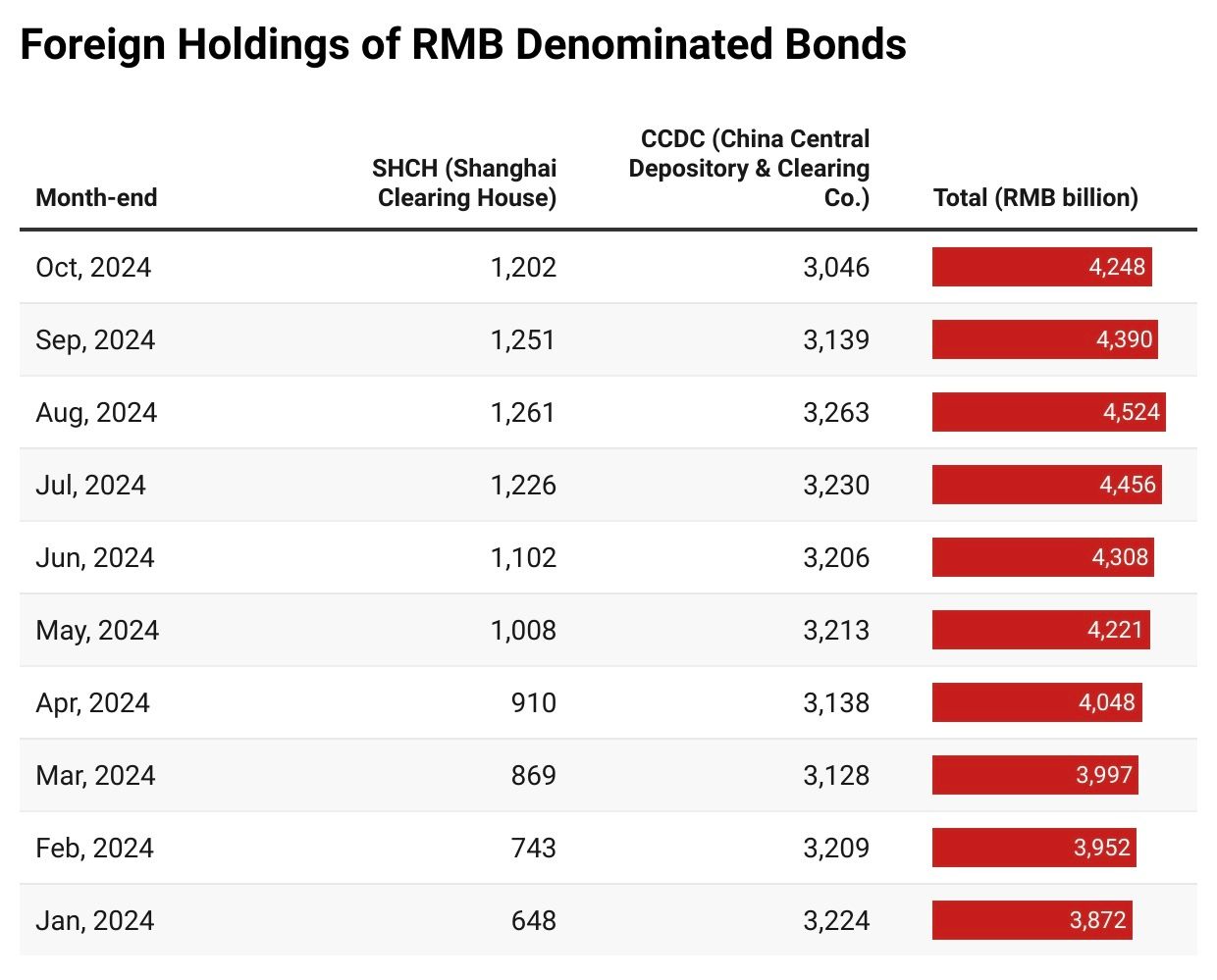

The PBoC faces a critical decision in avoiding the formation of a treasury bubble, as foreign holdings of renminbi-denominated treasury assets have risen substantially since early 2024. According to data from China Bond Connect in the figure below, total foreign holdings of RMB-denominated bonds have increased by approximately 10%, or 376 billion yuan, since January. Additionally, regional banks and financial institutions have significantly ramped up their sovereign bond purchases, with net purchases rising 61% year-over-year to 1.55 trillion yuan in the first half of 2024.

The unprecedented demand for sovereign debt in China has prompted the PBoC to take decisive action. In April, when yields hit interim lows, the central bank ceased providing cash through open market operations for the first time since 2020. This move contributed to the largest weekly cash withdrawal in four months, aimed at supporting yields. Since then, the PBoC has issued over 10 warnings about the risks of a potential bubble. Measures implemented include conducting stress tests on financial institutions’ bond exposures and undertaking direct market interventions to cool the bond rally. As previously mentioned the intervention has still not curbed yields hitting their lowest levels since the early 2000s.

Fast forward to December, Reuters reported that the yuan came under renewed pressure against the dollar on Thursday, erasing some initial gains. Markets reacted to a report suggesting China may weaken the yuan to mitigate the impact of U.S. trade tariffs. While analysts do not expect an immediate deliberate weakening of the currency, the news adds further pressure on yields. While this is concerning, it may offer some benefits during the ongoing period of fiscal stimulus from the PBoC.

Chinese government bonds “remain the top option for many investors in a limited field for risk-free yield,” Lynn Song, chief China economist at ING Bank NV wrote in a note. “The low yields represent the government with a rare window of low-cost financing at a time when fiscal stimulus support and refinancing of debt are both useful.”

The PBoC is expected to maintain its loose monetary policy into 2025, financing its easing measures through decade-low interest rates. However, there is a risk of a liquidity trap within the Chinese economy. Despite extensive stimulus efforts, as the central bank approaches the zero-lower bound, its ability to stimulate further may become ineffective, similar to Japan’s 20-year battle with deflation.

Policy Outlook

Evidence from The November Policy Report

Given the large stimulus, one might expect Chinese investors to shift their capital into equities or other risk-bearing investments rather than treasuries. However, the record rally in bonds suggests that the public is pricing in further stimulus and reacting to ongoing weak economic data, which the PBoC is undoubtedly monitoring. The PBoC has played a significant role in driving record flows into treasuries, with bond fund assets growing 39% since early 2023. Bond funds now represent over one-third of all Chinese fund assets, while stock funds account for just 9% of the total.

In its Q3 2024 Monetary Policy Report, released in November, the PBoC reaffirmed its commitment to:

Maintaining an accommodative monetary policy stance

Ensuring adequate liquidity at reasonable levels

Supporting key areas, including technology, green development, and inclusive finance

Preventing systemic financial risks while promoting stable economic growth

In contrast, the Q2 2024 policy outlook emphasized a more flexible and appropriate approach, focusing on high-quality economic development. The PBoC also prioritized risk prevention in key areas such as real estate and local government debt, signaling concerns over these sectors. Additionally, it highlighted efforts to improve the monetary policy transmission mechanism to increase the effectiveness of its measures.

This shift between Q2 and Q3 highlights a pivot back to a more accommodative stance, with the PBoC focusing on stabilizing the economy through targeted sector support and risk management. Despite high-level language, the outlook suggests that Chinese markets could see additional stimulus moving forward or at least a commitment to provide support as long as it is needed.

Additional Sources

Below is a compilation of additional online sources to learn more about fixed income data specific to China.

Trading Platforms

Electronic Access Systems

CFETS RMB Trading System (the official PBOC-designated trading venue)

Tradeweb

MarketAxess [1]

Data Sources

Central Securities Depositories

China Central Depository & Clearing Co. (CCDC)

Shanghai Clearing House (SHCH)[1][4]

Market Information

ChinaBond website (operated by CCDC)

Shanghai Clearing House website

CFETS closing yield curves

Monthly bulletins and market statistics[5]

Access Methods

Trading Mechanisms

Bond Connect: Allows offshore investors to access all cash bonds in the China Interbank Bond Market (CIBM)

CIBM Direct: Provides direct access to approved institutional investors[1][2]

Sources

[1] Trading Mechanism | Bond Connect https://www.chinabondconnect.com/en/Northbound/Trading-And-Settlement/Trading-Mechanism.html

[2] Emerging Markets | Bond Connect | Tradeweb https://www.tradeweb.com/our-markets/institutional/emerging-markets/bond-connect/

[3] 9 things to know about China's bond markets - Allianz Global Investors https://www.allianzgi.com/en/insights/outlook-and-commentary/9-things-to-know-about-china-bond-markets

[4] [PDF] China bond market insight 2021 - Bloomberg Professional Services https://assets.bbhub.io/professional/sites/10/China-bond-market-booklet.pdf

[5] [PDF] Inter-Bank Bond Market in the People's Republic of China https://www.adb.org/sites/default/files/publication/630391/asean3-inter-bank-bond-market-prc.pdf

Own a stake in Alaska’s oil reserves.

Estimated 300 million barrels of recoverable reserves

Royalty-based model reducing operational risks

Projected 25+ years of reliable, high-margin royalty income

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.