Defense Spending in the Eurozone

Türkiye has recently emerged as a key supplier of armed drones (Bayraktar TB-2) and armored personnel carriers to Central European NATO members, including Hungary, Poland, Romania, Croatia, and Albania. This is part of a broader surge in arms purchases across the Eurozone over the past decade, driven by rising regional conflicts.

European NATO members' imports of major conventional arms more than doubled between 2015–2019 and 2020–2024. The United States accounted for 64% of these imports, driven primarily by combat aircraft, with over 150 aircraft and 60 helicopters delivered between 2020 and 2024, and an additional 472 aircraft and 150 helicopters currently on order according to Sipri, Stockholm’s International Peace Research Institute.

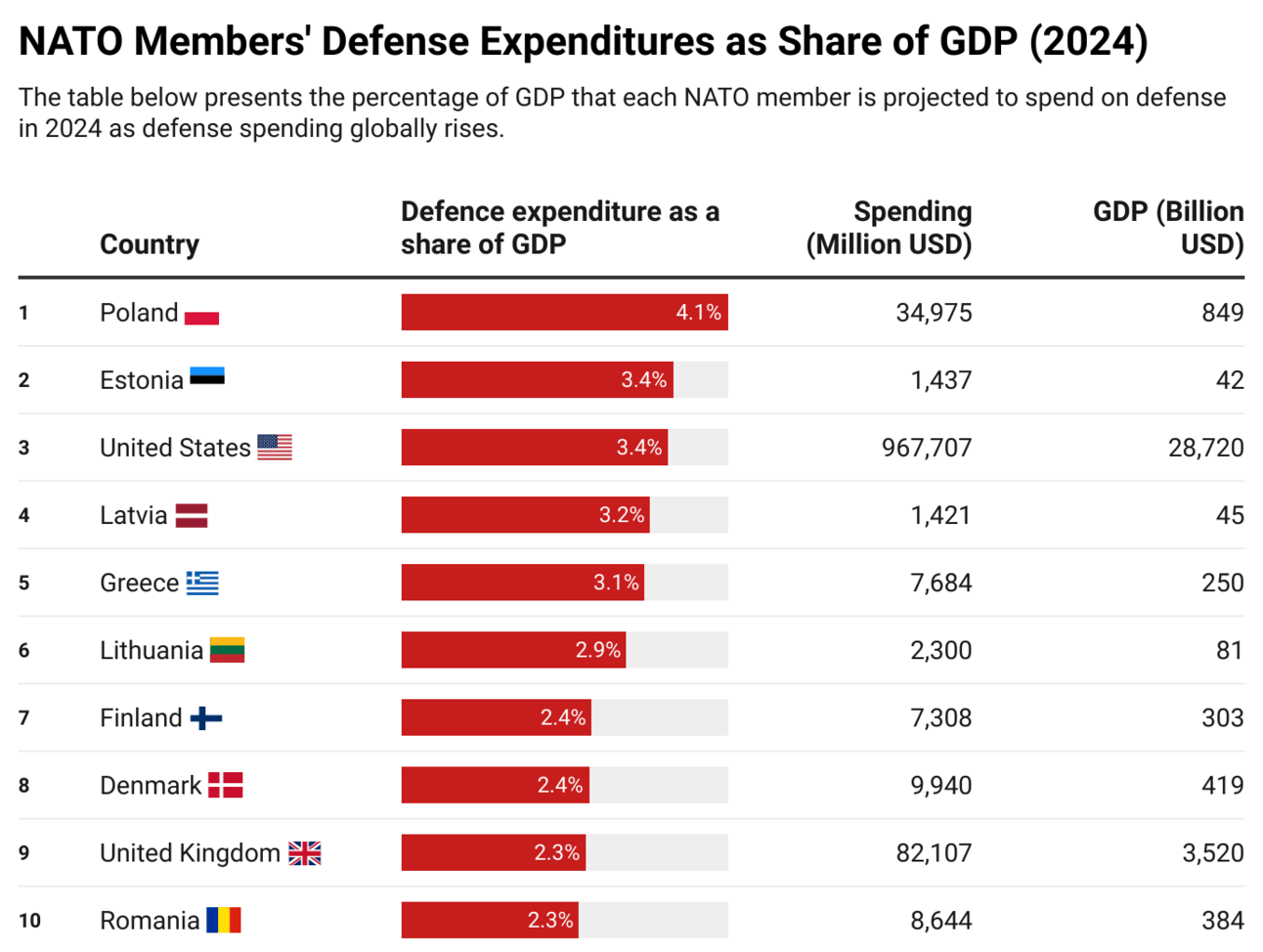

Under the EU's new procurement guidelines ("ReArm Europe"), at least 65% of arms procurement must come from suppliers based in the EU, EEA/EFTA countries (Norway, Switzerland, Iceland), or Ukraine. Consequently, arms imports from outside the Eurozone, including from Türkiye and the United States, must remain limited to 35% of purchases even though the numbers continue to increase. Since the start of the Russo-Ukraine conflict in 2022, defense spending in the Eurozone has surged to record levels, with Poland leading the way by allocating 4.1% of its GDP to defense in 2024. The Buy-European initiative, modeled after North America's Buy America policy, aims to bolster domestic military procurement while also strengthening the euro amid economic weakness, particularly in Germany, the Eurozone's largest economy.

Between 2021 and 2024, total defense expenditure by EU member states rose by over 30%, reaching an estimated €326 billion (1.9% of GDP) in 2024. This trend is expected to continue, with spending projected to increase by another €100 billion in inflation-adjusted terms by 2027. Annual defense expenditures grew from €279 billion in 2023—a 10% increase from 2022—to €326 billion in 2024, marking a further 17% year-over-year rise. As a share of GDP, Eurozone defense spending is projected to climb from 1.8% in 2024 to approximately 2.4% by 2027. Nations are ramping up military spending, leading to significant fiscal impacts and contributing to the euro’s strength over the past year.

The Daily Newsletter for Intellectually Curious Readers

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Fiscal Impacts

Many Eurozone countries already face high budget deficits and rising public debt. France, Belgium, and Italy have entered the Excessive Deficit Procedure, (a mechanism ensuring countries reduce excessive deficits or debt if they violate EU fiscal rules under the Stability and Growth Pact (SGP)) struggling to bring deficits below the EU's 3% GDP threshold. Meeting NATO defense spending targets—estimated at 2.7%-2.9% of GDP by 2027 for France, Italy, and Spain—will further strain national budgets. The Wall Street Journal reported this week that Germany's ambitious defense expansion, which exempts military expenditures from its debt brake rule, is expected to increase its deficit by approximately 1 percentage point in 2025, with further increases projected in subsequent years.

Defence financing and spending under the Economic Governance framework

This paper covers possible defence options under the European economic governance framework by reviewing the proposal for a ReArm Europe plan floated by the President of the Commission Ursula von der Leyen. The paper also analyses flexibilities under the EU budget, EIB and ESM financing while also assessing potential market challenges and public procurement.

373.56 KB • PDF File

To ease these fiscal pressures, the European Commission has proposed activating the national escape clause of the Stability and Growth Pact under the "ReArm Europe" initiative. This would allow member states to increase defense spending without triggering the Excessive Deficit Procedure, potentially creating up to €650 billion in additional fiscal space over four years.

In addition, a new EU-backed loan instrument worth €150 billion has been proposed to help member states finance defense investments under more favorable borrowing conditions according to reports from Reuters. The European Investment Bank (EIB) will also expand its role by lifting restrictions on lending to defense firms, facilitating greater access to capital for military production and procurement.

The EU Defense Financing Instrument

The European Union’s €150 billion loan program is set to strengthen the continent’s defense capabilities. The initiative aims to enhance Europe's defense infrastructure and reduce reliance on non-European military suppliers by financing the acquisition of advanced defense equipment and technologies.

Key Features

Loan Allocation: The program provides €150 billion in loans to EU member states for defense-related expenditures.

Eligibility Criteria: To qualify, member states must commit to purchasing defense equipment primarily from European manufacturers, reinforcing the EU's defense industry and ensuring economic benefits remain within Europe.

Procurement Conditions: At least 65% of the defense equipment acquired must come from suppliers within the EU, Norway, or Ukraine as previously mentioned. The remaining 35% can be sourced from non-EU countries with established security agreements with the EU. However, the UK, US, and Turkey are excluded from the program unless they formalize a security and defense partnership with the EU.

Strategic Focus: The funds will be used to procure advanced defense systems, including air defense mechanisms, drones, strategic air transport capabilities, and cybersecurity enhancements.

Implementation Mechanism

Application Process: Member states submit detailed proposals outlining their defense procurement plans, including the specific equipment and suppliers involved.

Evaluation: The European Commission reviews proposals to ensure they align with the program’s objectives and procurement requirements.

Loan Disbursement: Approved funds are allocated to member states to facilitate the acquisition of the specified defense equipment.

The EU’s 450 million citizens "should not have to rely on 340 million Americans to defend us against 140 million Russians, who have been unable to defeat 38 million Ukrainians," said EU Defense Commissioner Andrius Kubilius. Nations are increasingly aware of the importance of domestic military procurement, not only for strengthening internal security and alliances but also for bolstering the euro. As Europe ramps up defense spending, the increased demand for domestically produced equipment supports the currency, contrasting with the U.S. dollar’s role in global arms sales and military financing.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

The Euro

Renewed Investor Confidence

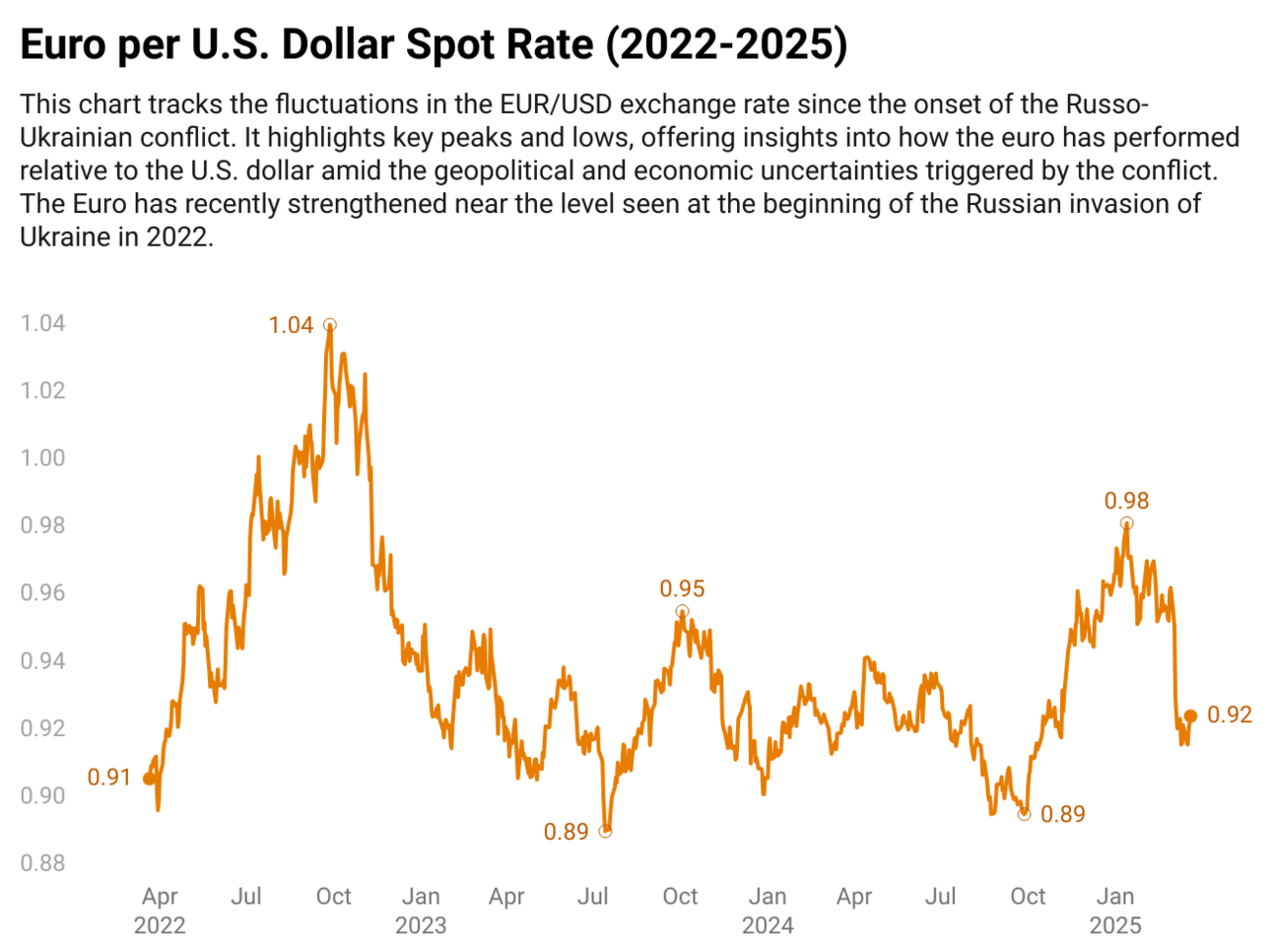

The euro has seen significant appreciation, driven by Europe’s ambitious defense spending plans. In early March 2025, the euro surged to its highest levels of the year against the U.S. dollar, surpassing 1.06 USD/EUR—its strongest position since November 2024. Analysts, who previously predicted euro-dollar parity, have now revised their forecasts, with some expecting further strengthening toward 1.08 USD/EUR by year-end.

Source: FactSet

Investor confidence has been bolstered by substantial fiscal stimulus linked to defense spending, particularly through initiatives like ReArm Europe, which allocates approximately €800 billion. This surge in public investment has improved Europe’s economic outlook, increasing demand for euro-denominated assets and reinforcing the currency’s resilience.

Germany’s shift in fiscal policy has played a crucial role in supporting market optimism. The country’s announcement of a €500 billion infrastructure fund, alongside exemptions from its debt brake rules, signals a commitment to long-term defense and economic stability. As Europe’s largest economy ramps up spending, investors view this as a strong indicator of sustained growth, further strengthening the euro.

Potential Risks and Uncertainties

Despite the recent appreciation of the euro, there are several risks and uncertainties surrounding its future trajectory that could temper its strength.

Many Eurozone countries already face significant challenges with strained public finances, including high deficits and elevated debt levels. Increased defense spending, while boosting short-term economic growth, could exacerbate fiscal imbalances, particularly in nations like France, Italy, and Belgium. This situation may eventually trigger market concerns about debt sustainability, potentially leading to higher borrowing costs and widening sovereign yield spreads. If markets lose confidence in fiscal stability, it could weaken the euro over time.

In the short term, a large portion of the increased defense spending is expected to result in higher imports, as Europe’s domestic defense production capacity remains limited. This shift could negatively impact Europe’s current account balance, potentially offsetting some of the positive pressures on the euro caused by stronger demand for its assets.

The boost in government spending may also increase inflationary pressures across the Eurozone. Should inflation continue to rise, the European Central Bank (ECB) might be forced to maintain higher interest rates for an extended period or even raise them further. While higher rates typically support the currency, persistent inflation coupled with economic stagnation could complicate the ECB’s decision-making process and pose challenges for long-term euro stability.

Comparisons to USD & Historical Cases

U.S. Dollar's Historical Reaction During Wartime Periods

Building on the uncertainties surrounding the euro, it’s also useful to consider how the U.S. dollar has historically reacted during similar periods of heightened military spending, providing a useful comparison for the euro’s current trajectory.

During World War II, U.S. defense spending skyrocketed from 1.4% of GDP in 1940 to over 37% in 1945, significantly boosting economic activity and reducing unemployment. While this fiscal stimulus had a major impact on domestic growth, the U.S. dollar, under the Bretton Woods system, was pegged, limiting direct currency fluctuations. The primary effect was economic expansion rather than currency volatility, differing from the current situation with the euro’s appreciation.

Following WWII and throughout the Cold War, military expenditures reinforced America’s geopolitical dominance, supporting global confidence in the dollar as a safe-haven currency and a global reserve asset. These military-driven financial flows helped strengthen the dollar's international role but didn’t lead to immediate volatility or appreciation directly tied to military spending announcements.

In more recent conflicts, such as the Vietnam War and the post-9/11 wars, while defense spending initially provided economic stimulus, it eventually led to inflationary pressures, higher deficits, and stagflation during the 1970s. These conflicts did not result in sustained dollar appreciation. Instead, they contributed to economic instability and inflation, which weakened investor sentiment toward U.S. assets, offering a stark contrast to the current strengthening of the euro amid Europe’s defense spending surge..

Market Sentiment & ECB Response

ECB policymaker Robert Holzmann recently suggested that the ECB might discuss whether it could support Europe's planned €800 billion increase in defense spending in the future. However, he clarified that no formal discussions have taken place, and ECB President Christine Lagarde downplayed the likelihood of the ECB directly financing defense spending, emphasizing that this is not the bank's purpose. ECB Vice President Luis de Guindos also acknowledged that increasing EU defense expenditures is a top priority, but stressed the importance of ensuring fiscal stability in line with EU budgetary rules. He emphasized that maintaining budget stability must remain central to Europe's defense spending initiatives.

Klaas Knot, governor of the Dutch central bank and a senior ECB policymaker, pointed out that while Europe's increased defense spending is justified, it complicates predictions regarding inflation and monetary policy. Higher defense outlays are expected to elevate debt levels and create conflicting pressures on inflation, making monetary policy decisions more challenging. Meanwhile, ECB Governing Council member Olli Rehn stated that increased military expenditures would not necessarily slow interest rate reductions by the ECB. He emphasized that monetary policy decisions would depend on broader economic conditions and inflation outlook rather than solely on defense spending increase.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.