U.S. and U.K. Reach a Landmark Deal

It has been a busy week for British policymakers, with both the Bank of England and Parliament making key announcements about the country’s economic outlook. On May 8, the Bank of England lowered its main interest rate by 0.25 percentage points, bringing the base rate down to 4.25%. This marks the fourth rate cut since last August and reflects continued progress in curbing inflation, which stood at 2.6% in March. The decision was narrowly passed in a surprise 5–4 vote, with some members advocating for a larger cut and others favoring no change a so called 3-way split likely due to the uncertainty of reciprocal tariffs being imposed by the White House. The Bank cited the conservative easing was due to stagnant inflation and rising global economic uncertainty.

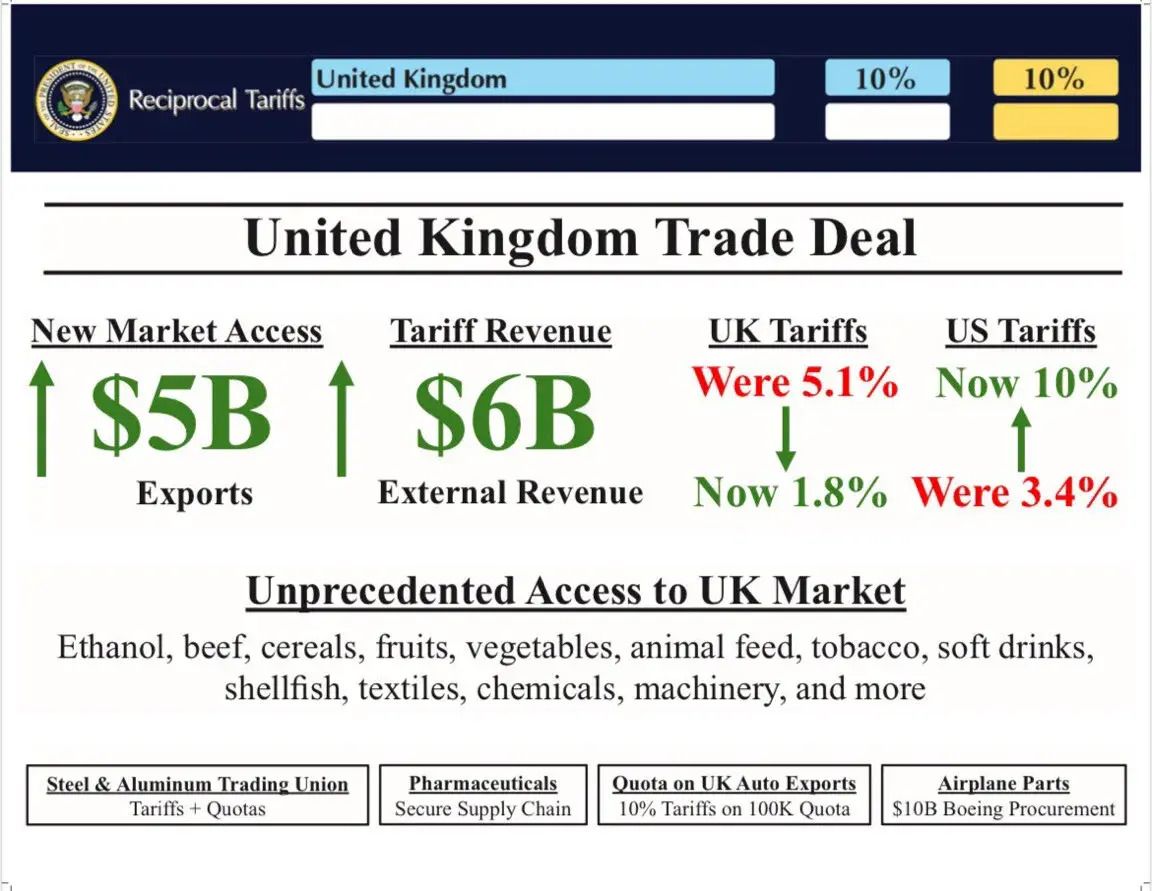

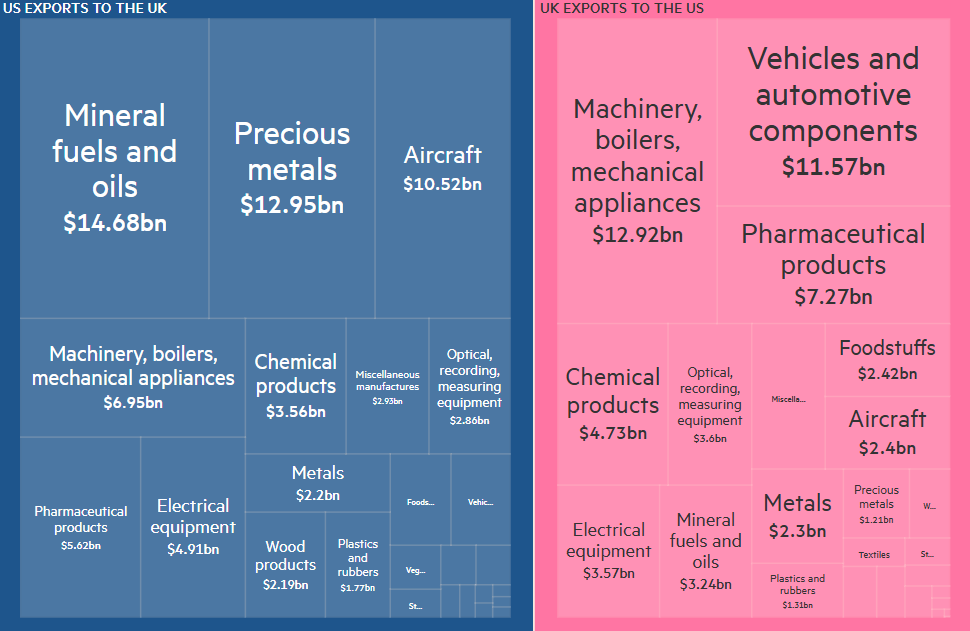

The narrow Bank of England vote coincided with a rare dose of positive economic news: President Donald Trump announced a new trade agreement with the United Kingdom—the first major U.S. trade deal since last month’s imposition of broad “reciprocal” tariffs. While some details are still being finalized, the agreement is described as “full and comprehensive,” and is expected to significantly expand U.S. access to the U.K. market, particularly for American agricultural products, machinery, and industrial goods. In return, the U.S. will lower tariffs on U.K. car imports to 10% and ease levies on steel and aluminum, while the U.K. will reduce certain regulatory barriers on U.S. products.

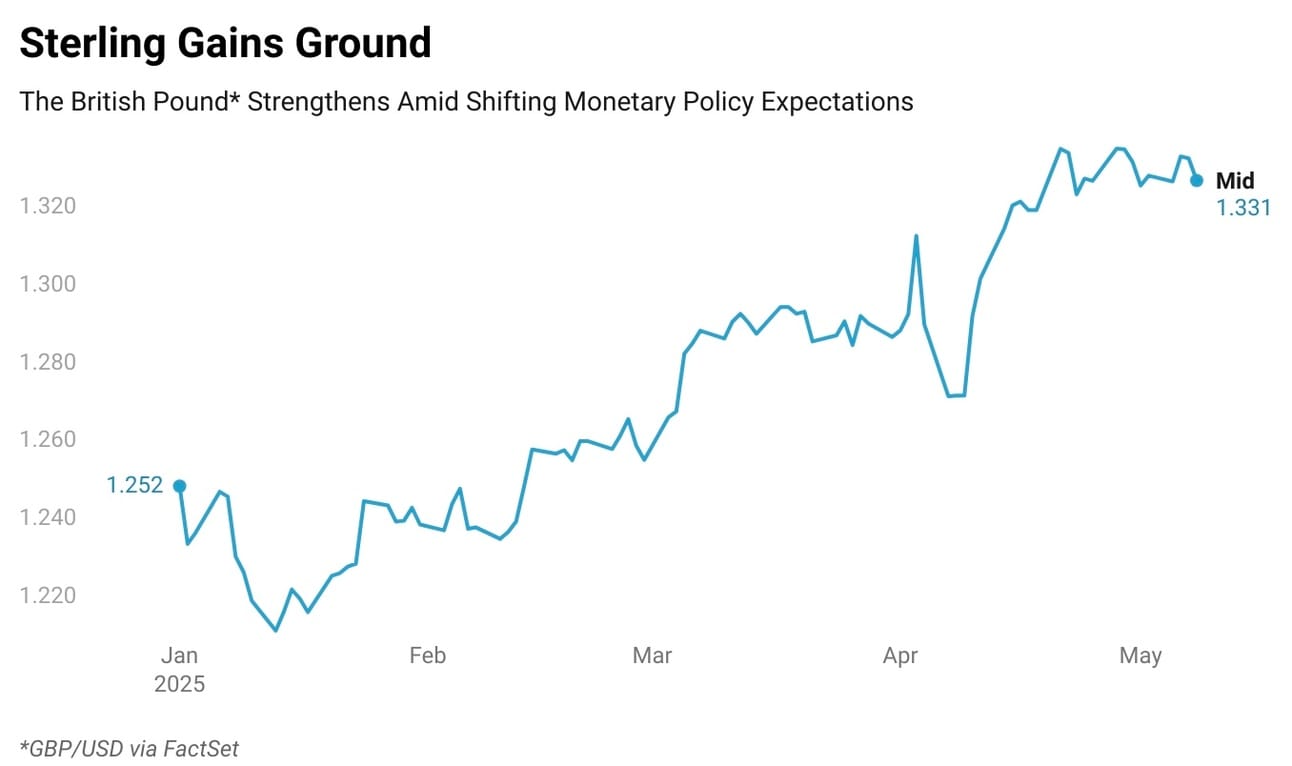

The British pound strengthened following the Bank of England’s rate cut and the announcement of a U.K.–U.S. trade deal. Despite the central bank lowering its main interest rate by 0.25 percentage points to 4.25%, the pound rose by about 0.2% to $1.3311, rebounding from an earlier dip in the session. This upward move was somewhat unexpected, as rate cuts typically weaken a currency. However, the gain was attributed to the surprising split among policymakers—some of whom favored keeping rates unchanged—which signaled a more cautious approach to further easing and tempered expectations of additional rapid cuts.

In an interview with Bloomberg early Thursday, Bank of England Governor Andrew Bailey expressed no concern over recent strength in the pound. He noted that while sterling has appreciated against the U.S. dollar in recent weeks, it has weakened against other trading partners, resulting in a balanced overall position. Bailey also emphasized that currency movements are already factored into the Bank’s forecasts and policy decisions.

Inflation and Growth

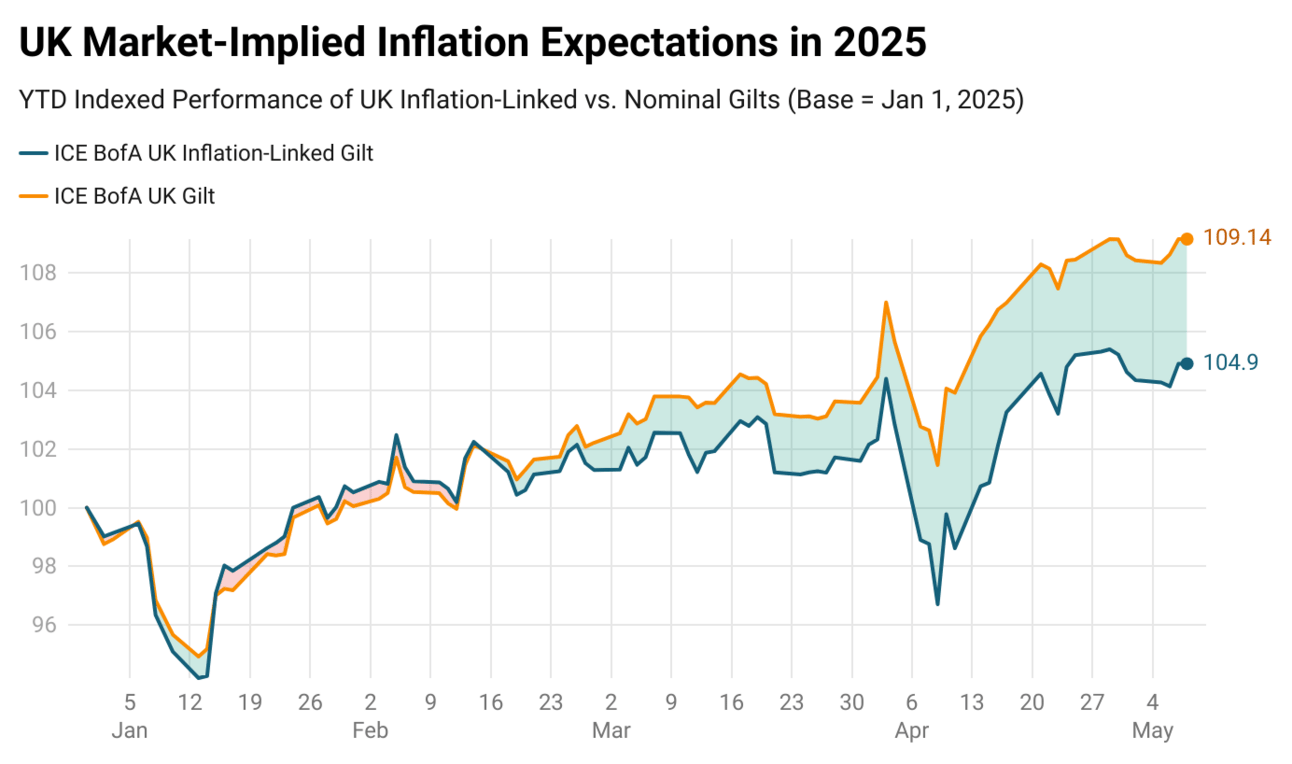

Reuters reported that in the quarterly forecast update released Thursday, the Bank of England trimmed its inflation expectations for the year. It now sees inflation peaking at around 3.5%, slightly below the previous forecast of 3.75%, though still above the most recent official reading of 2.6% in March. The Bank also brought forward its projection for returning to the 2% inflation target, now expecting to reach it by the first quarter of 2027—nine months earlier than forecasted in February.

Source: ICE BofA Fixed Income

The figure above illustrates easing inflation expectations albeit still elevated, as strong demand for gilts persists. This year, nominal returns on British Treasury bonds have outpaced those of inflation-indexed securities. The caveat is show in a recent survey suggesting that U.K. households expect inflation to remain elevated in the near term. According to the Citi/YouGov survey, inflation expectations for the year ahead rose to 3.9% in February 2025—the highest level in over a year—up from 3.5% in January. Similarly, the Bank of England/Ipsos Inflation Attitudes Survey reported that median expectations for inflation over the next year increased to 3.4% in February 2025, up from 3.0% in November 2024. Expectations for the subsequent twelve months rose to 3.2%, while five-year-ahead expectations climbed to 3.6%.

The Bank raised its growth forecast for 2025, now projecting GDP to expand by 1%, up from 0.75% in its February outlook. This revision reflects a stronger-than-expected end to 2024 and solid economic data at the start of 2025. However, the Bank noted that the first-quarter growth surge appeared erratic, estimating the underlying quarterly growth rate at just 0.1%. Additionally, the Bank introduced new alternative economic scenarios, replacing its earlier focus on domestic inflation persistence and labor market tightness.

The Pound Expects Less Easing?

The Monetary Policy Committee was notably divided, with two members voting to keep rates unchanged and two advocating for a larger cut. This unexpected split signaled a less aggressive easing trajectory than markets had anticipated, reducing the likelihood of back-to-back rate cuts. As a result, the pound received a modest boost, reflecting traders’ reassessment of the Bank’s policy stance.

Source: FactSet

The presence of policymakers favoring no change reinforced a more hawkish tone within the committee, which tempered market expectations for rapid or sustained monetary easing. This shift in sentiment strengthened the pound, as investors now anticipate that rates may remain elevated in the near term. Adding to the currency’s momentum was renewed optimism surrounding the U.K.’s forthcoming trade deal with the United States as previously mentioned. The prospect of reduced tariff uncertainty and improved bilateral trade relations supported investor confidence, further contributing to the pound’s appreciation.

What the Trade Deal Means for the Sterling And Policy Path

The British pound experienced short-term volatility following news of the trade deal. It initially surged 0.5% overnight but pared gains to just +0.1% against the U.S. dollar as more details emerged. Markets responded cautiously, given the limited scope of the agreement and the Bank of England’s simultaneous interest rate cut. Specific sectors, such as automotive and steel, received targeted relief—U.S. tariffs on British car exports were reduced from 27.5% to 10%, and tariffs on steel and aluminum dropped from 25% to zero. This provided modest support for companies like Jaguar Land Rover and U.K. Steel. However, the broader 10% tariff on most U.K. goods remains in place, dampening the potential for a stronger currency rebound. Analysts emphasized that the deal merely reinstates pre-tariff trade terms rather than introducing new growth opportunities, limiting its long-term impact on the pound.

With the coinciding rate cut the central bank cited that U.S. tariffs would have course be a potential drag on growth and inflation. The BoE projected that the U.S. tariffs could reduce U.K. GDP by 0.3% over the next three years, though they might also lower inflation due to cheaper import prices. Governor Andrew Bailey welcomed the trade deal but warned that broader global trade tensions continue to cloud the economic outlook. The Bank reiterated a cautious, data-dependent approach to future rate cuts, emphasizing a “gradual” trajectory amid volatile trade conditions.

According to a recent piece by the Financial Times trade experts interpret the agreement as a broader signal of Washington’s intent to use economic policy to fortify national security by limiting Chinese inputs in industries deemed sensitive, such as steel and pharmaceuticals. The inclusion of Section 232 investigations—mechanisms to assess whether specific imports threaten U.S. security—makes clear that future tariff reductions will hinge on shared geopolitical objectives. This raises concerns among U.K. industry groups, which are seeking greater clarity on the terms and implementation of the deal, including potential quotas and the timeline for benefits.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.