Gold as a Hedge: The Role of BRICS in Global Reserve Diversification

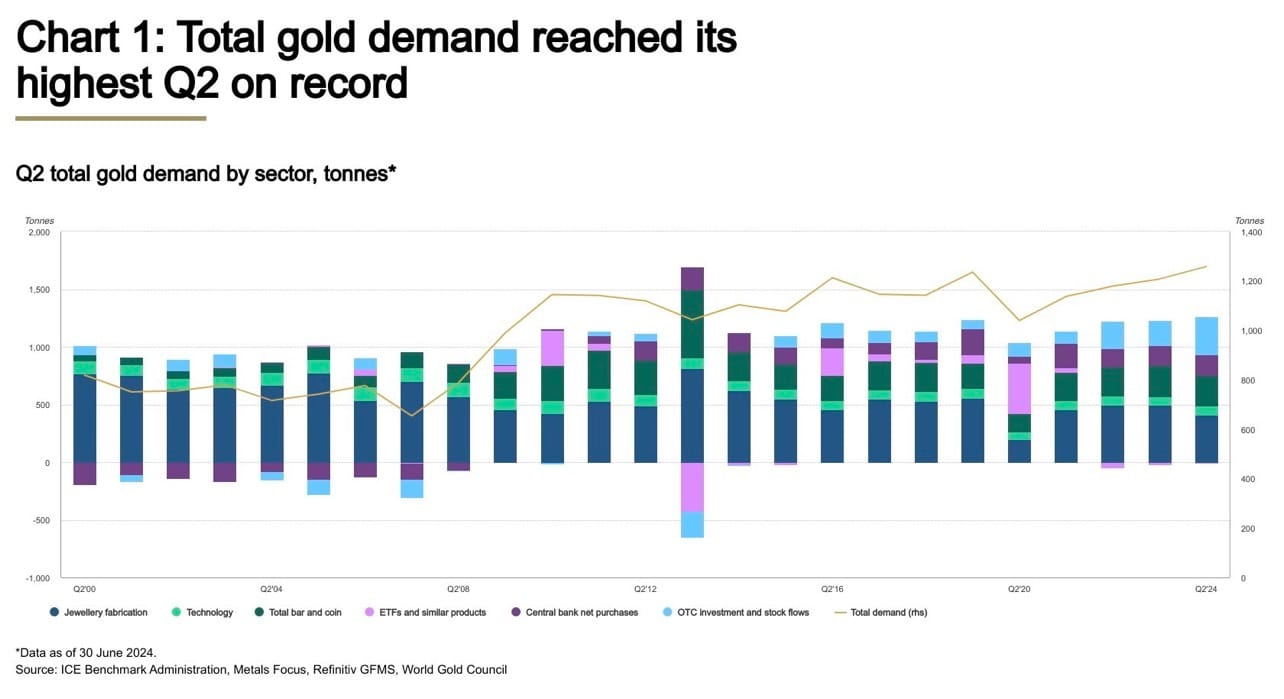

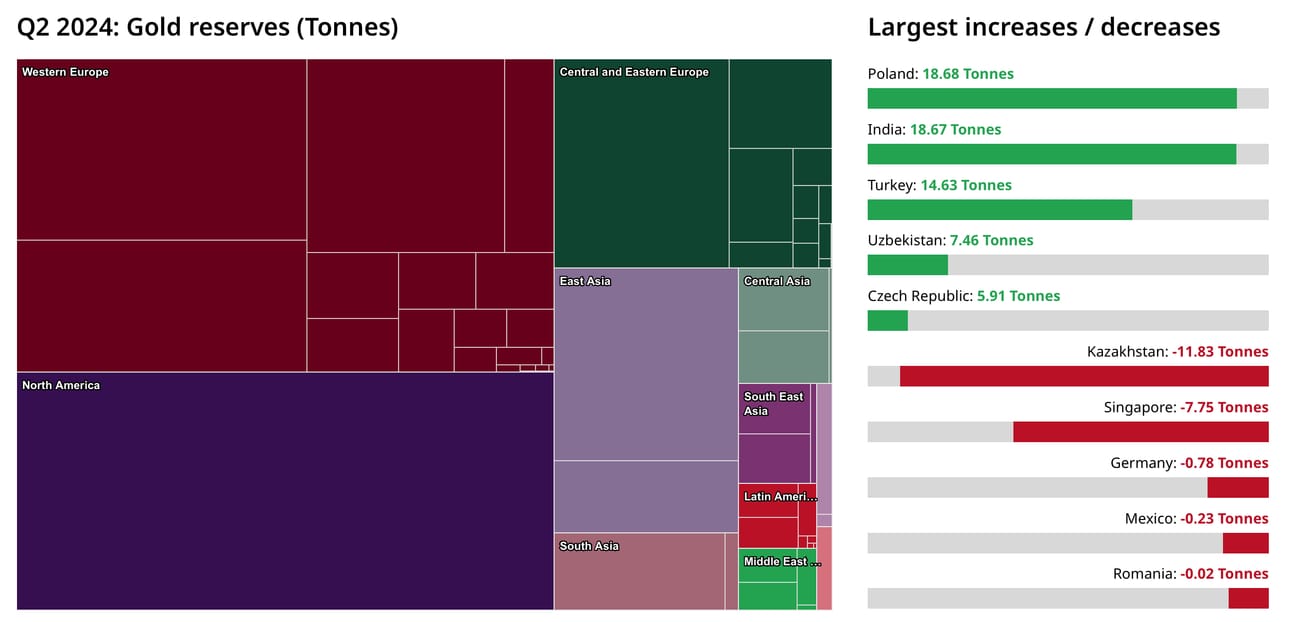

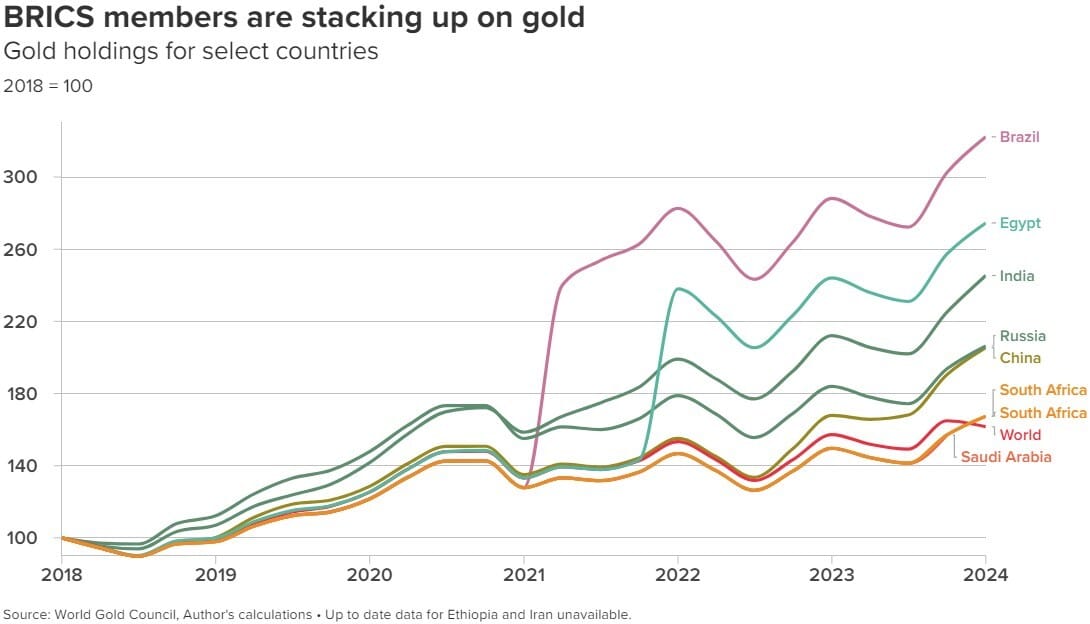

BRICS members along with the discussion on the new framework for a basket based reference currency have also been increasing their gold reserves over the past decade. In Q2 2024, central bank gold reserves reached record highs, according to ICE, with China and India, two BRICS founding members leading the way in purchases. The World Gold Council’s July report noted that net gold buying by central banks reached 183 tons, a 6% increase year-over-year, driven by the need for portfolio protection and diversification.

Members have been shifting away from dollar-denominated reserves, increasingly opting to hold more gold in foreign accounts. According to the IMF, while the dollar remains the dominant global currency, its share in central bank reserves has fallen to 59%, the lowest level in 25 years. Demand over the past two years has doubled as the metal reached an all time-high earlier this year on the backs of strong retail demand in India and China. Since 2024, Chinese and Indian households have significantly increased their investment in gold, excluding jewelry. Between Q1 2023 and Q1 2024, Chinese gold investments rose by 68%, while Indian investments increased by 19%, according to data from the World Gold Council. This surge in gold purchases appears to be a strategy to diversify investments amidst sharply declining property and equity markets in China and rising savings capacity in India.

What does this mean for the move towards de-dollarization among BRICS members? Gold is emerging as an intermediate hedge as BRICS nations work on developing a new trading currency. In the interim, gold serves as a means for major economies to reduce their reliance on the US dollar. In Russia, Sberbank has already taken steps toward providing a universal currency backed by gold. In December 2022, Sberbank launched a cryptocurrency stablecoin backed by gold. An even more promising development has been the introduction of “gold checking accounts” in Russia, allowing individuals to send digital grams of gold to various accounts—essentially accomplishing what GoldMoney set out to do in 2001.

Become an AI-Powered Finance Decisions to get 10x ROI on your money (free AI masterclass) 🚀

More than 300 million people use AI, but less than 0.03% use it to build investing strategies. And you are probably one of them.

It’s high time we change that. And you have nothing to lose – not even a single $$

Rated at 9.8/10, this masterclass will teach how you to:

Do market trend analysis & projections with AI in seconds

Solve complex problems, research 10x faster & make your simpler & easier

Generate intensive financial reports with AI in less than 5 minutes

Build AI assistants & custom bots in minutes

Impact on Global Gold Demand: A Potential Shift in the Global Market

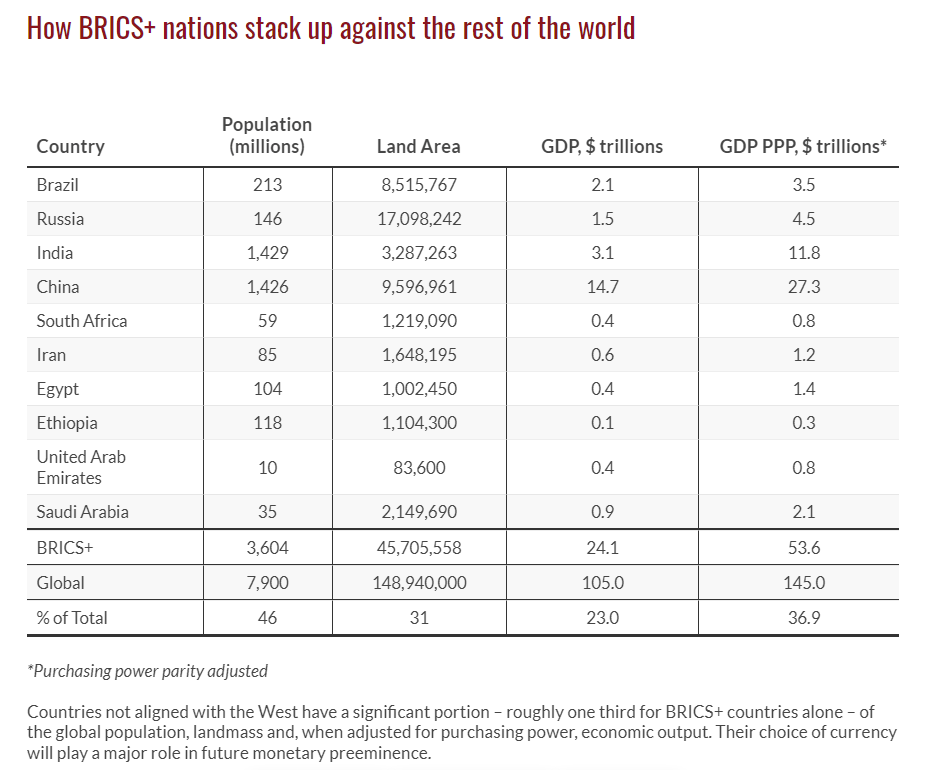

BRICS+ nations, which now include new members such as Iran and Saudi Arabia, may have differing policies and economic goals, but they share a common objective: de-dollarization. The growing demand for gold among global central banks in recent years is no coincidence and marks a key step toward reducing reliance on the U.S. dollar. A July report from Kitco noted that GIS highlighted Russia’s aggressive efforts to increase its gold reserves, with gold now accounting for over 29% of the country’s total reserves, up from just 11.8% six years ago.

Other nations within the Sino-Russian sphere of influence, as well as some perceived as neutral, also began stockpiling gold around the same time.

If all BRICS+ nations continue purchasing gold and reduce their reliance on USD reserves, the emergence of a dominant alternative currency could be closer than expected. According to Kitco, BRICS+ countries collectively account for approximately 33% of the global population and landmass, when adjusted for purchasing power and economic output. According to the GIS report, the dollar’s share of global foreign exchange reserves—excluding gold—has fallen from over 70% in 2000 to around 55% in 2023, after adjusting for U.S. dollar appreciation, based on research from the International Monetary Fund. When including gold, the dollar’s share has dropped below 50%.

The demand sine 2018 has gained momentum in an effort to protect reserves from political turmoil and rising prevalence of military conflict particularly in the Middle East and Europe. Gold reserves began increasing in 2019 and surged following the onset of the pandemic, rising from around 10% to nearly 16% today. Central banks now collectively hold over 35,000 tonnes of gold, representing nearly 20% of all gold ever mined with Brazil leading the way based on the below figure from the World Gold Council.

Currency Stability

Further to the increase in global gold demand from BRICS members there is also the idea being floated of the BRICS currency being backed by gold. Member nations have been the largest buyers of gold since 2022, which some interpret as preparation for a gold-backed currency.

However, experts are divided on the feasibility of this idea. While a gold-backed currency could reduce volatility compared to fiat currencies not backed by physical assets, some critics argue that it would simply function as “another gold derivative” and may not address the complexities of international trade. Strategist David Woo, for instance, has questioned the logic behind the proposal, stating that it “makes no sense whatsoever.” The effectiveness of such a currency would largely depend on its adoption and perceived stability compared to the U.S. dollar.

Despite these discussions, there is currently no definitive launch date for a BRICS currency. The upcoming 2024 BRICS summit may shed more light on this potential development. In the meantime, some experts believe that BRICS nations are more likely to focus on increasing the use of local currencies in trade and developing alternative payment systems to reduce dollar dependence, rather than launching a new currency outright. Much of the speculation surrounding a gold-backed BRICS currency remains hypothetical, with its actual impact on global markets yet to be determined.

Transform the way you run your business using AI (Extended Labour day Sale)💰

Imagine a future where your business runs like a well-oiled machine, effortlessly growing and thriving while you focus on what truly matters.

This isn't a dream—it's the power of AI, and it's within your reach.

Join this AI Business Growth & Strategy Masterclass and discover how to revolutionize your approach to business.

In just 4 hours, you’ll gain the tools, insights, and strategies to not just survive, but dominate your market.

What You’ll Experience:

🌟 Discover AI techniques that give you a competitive edge

💡 Learn how to pivot your business model for unstoppable growth

💼 Develop AI-driven strategies that turn challenges into opportunities

⏰ Free up your time and energy by automating the mundane, focusing on what you love

🗓️ Tomorrow | ⏱️ 10 AM EST

This is more than just a workshop—it's a turning point.

The first 100 to register get in for FREE. Don’t miss the chance to change your business trajectory forever.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.