Copper Remains Critical

The age-old idiom goes, “war never changes,” but the same cannot be said for metals demand. Copper and zinc are critical components in the production of ammunition, particularly in brass—a durable alloy that combines the two metals. A single 155mm standard artillery shell can contain up to one kilogram of copper. According to the Financial Times, U.S. production of such shells doubled last year and is expected to double again this year, driven by efforts to supply Ukraine and replenish strategic reserves.

With Ukraine reportedly firing up to 7,000 shells per day and Russia producing millions of shells annually, the daily consumption of copper is immense. The European Union has increased its 155mm shell production from 230,000 per year before the war to a targeted 1 million annually by the end of 2024, with ambitions to reach 3 million per year by the end of the decade. In the West, the U.S. Department of Defense plans to ramp up annual production of copper-containing 155mm shells from 93,000 to 1.2 million by 2025, further intensifying copper demand.

David Goldman, head of trading at Novion Global brokerage, told the Financial Times that rising defense budgets and rearmament are increasing copper demand from Western militaries by 15–18% annually. He described this as a “critical factor underpinning the metal’s market tightness and long-term demand outlook.” Project Blue estimates that increased military spending is boosting copper demand by approximately 500,000 tonnes per year—roughly 1.5% of global annual demand. However, the precise impact remains difficult to quantify due to the secrecy surrounding national weapon stockpiles. Conflicts such as the Russo-Ukrainian war, the Israel-Hamas war, and tensions between India and Pakistan are all contributing to increased pressure on global ammunition stockpiles.

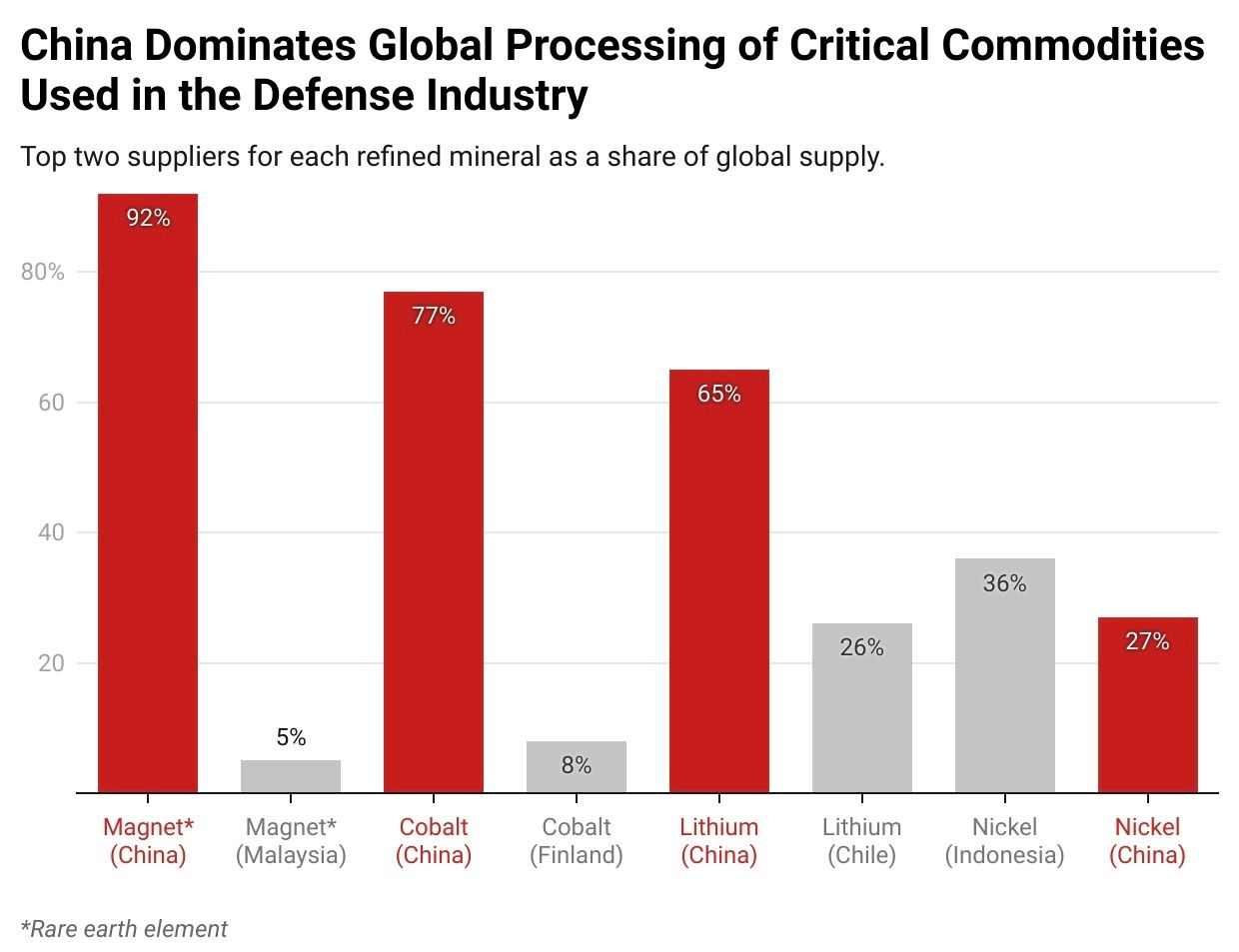

Other critical metals are also in high demand due to their strategic military applications include those listed below where China dominates a significant portion of the processed supply.

Scandium: Valued in aerospace engineering for its exceptional strength-to-weight ratio.

Beryllium: Essential in the construction of fighter jets and missile guidance systems.

Tungsten: Used in armor-piercing ammunition and military-grade armor due to its density and high melting point. Supply disruptions—particularly from Russia and China—have compelled Western nations to seek alternative sources, tightening global markets.

Tellurium, Chromium, Germanium, and Rare Earth Elements: Vital for electronics, semiconductors, and advanced military technologies. Prices for these metals have surged amid rising demand and export restrictions from major producers such as China.

According to the Modern War Institute at West Point, in 2021, global copper usage for military applications was estimated at 2.19 million metric tonnes, accounting for approximately 10.5% of total refined copper production that year. Military demand for copper is expanding rapidly, with annual growth estimated at 14% through at least 2026. At this rate, military copper consumption is projected to reach around 4.22 million metric tonnes by 2026, reflecting the growing importance of copper in defense and strategic industries.

The Military-Metal Supply Chain

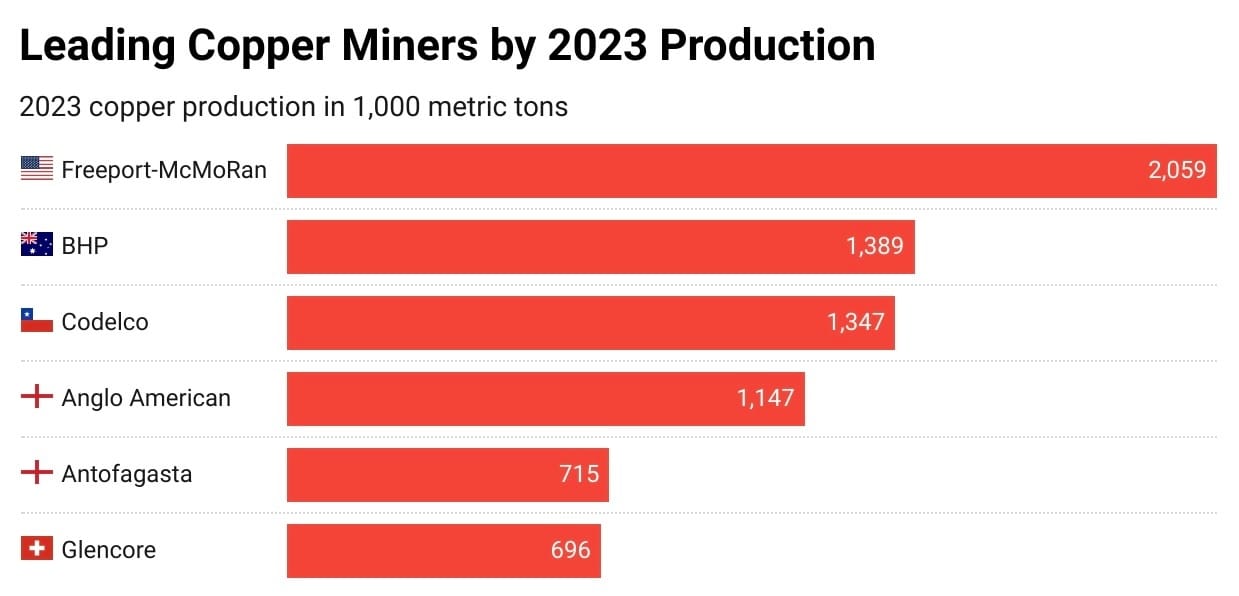

Mapping the Miners

The global defense metals supply chain relies on a diverse group of mining companies that specialize in extracting and processing critical materials essential to modern military applications. From ammunition to advanced missile systems, these raw materials play a central role in national security. Mapping out the key players in each segment not only reveals the structure of this supply chain but also highlights its strategic vulnerabilities.

Copper is foundational to defense manufacturing, particularly in ammunition, electrical systems, and communications infrastructure. Freeport-McMoRan leads global copper production, with over 2 million metric tons mined in 2023. Its Grasberg mine in Indonesia—the world’s second-largest—contributed 816,466 tonnes in 2024 alone. Following closely are Codelco and BHP, while Collahuasi—a joint venture between Glencore, Anglo American, and Mitsui—produced 558,636 tonnes that same year. Kamoa-Kakula, a partnership between Ivanhoe Mines, Zijin Mining, the DRC government, and Crystal River Global, increased its output to 437,061 tonnes, up 11% from 2023.

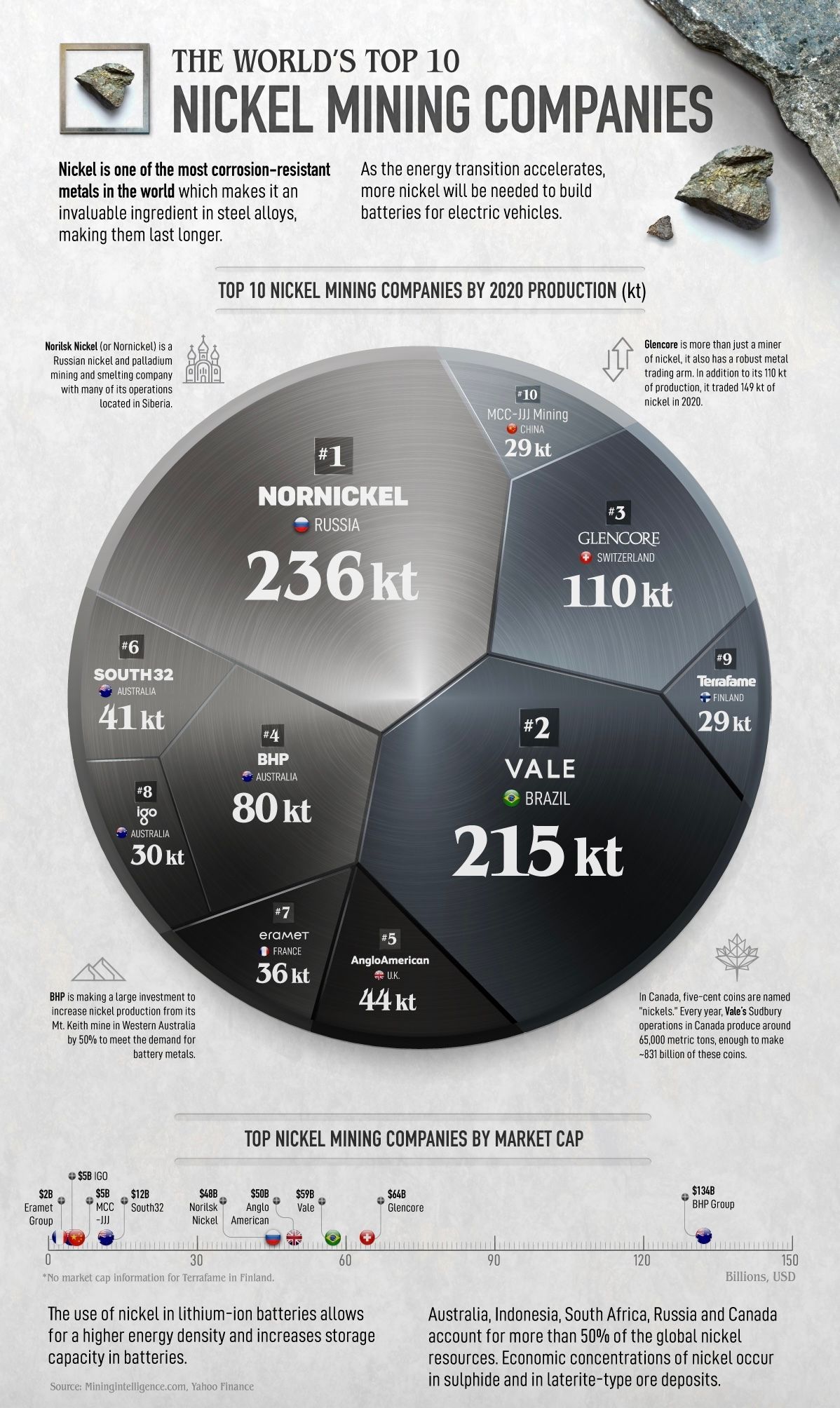

Closely linked to copper in both processing and application, nickel is crucial for superalloys used in jet engines, naval vessels, and missile systems. The top global producer is Nornickel, with 236.0 kt in 2020, followed by Vale (214.7 kt), Glencore (110.2 kt), BHP (80.0 kt), and Anglo American (44.0 kt). As demand grows for cleaner production methods, both Nornickel and Vale are innovating to reduce carbon emissions. Notably, Vale’s Long Harbour plant produces nickel with a carbon footprint roughly one-third of the industry average—an important step given the dual need for sustainability and defense readiness.

Often extracted alongside nickel and copper, cobalt is indispensable for producing high-performance alloys and lithium-ion batteries used in defense platforms. The Democratic Republic of Congo dominates global cobalt output, with CMOC Group leading through its Kisanfu and Tenke Fungurume mines, which yielded 25.5 and 22.5 thousand tonnes, respectively, in 2023. Eurasian Resources Group contributed another 22.61 thousand tonnes via its Metalkol RTR Project, while Glencore’s combined DRC operations produced over 37 thousand tonnes.

While less publicized, tungsten is a strategic metal prized for its density, heat resistance, and use in armor-piercing munitions and aerospace components. Major players include A.L.M.T. Corp., a leader in tungsten carbide tool manufacturing; ATI (Allegheny Technologies), which provides tungsten-based alloys for industrial and defense purposes; and Buffalo Tungsten Inc., which specializes in tungsten powders. Umicore N.V. adds recycling capabilities to the chain, while WOLFRAM Company JSC offers technical-grade tungsten for precision applications. Together, these companies ensure a steady supply of this niche yet vital resource.

At the top of the defense materials hierarchy are rare earth elements (REEs), which are integral to radar systems, guidance technologies, and electric propulsion. The U.S.-based MP Materials operates the Mountain Pass mine in California—the only fully operational rare earth mining and processing facility in the country—producing high-purity neodymium and praseodymium (NdPr). Australia’s Lynas Rare Earths remains the largest separated rare earth producer outside China, providing crucial diversification in global supply. Meanwhile, NioCorp Developments is advancing the Elk Creek project in Nebraska, a promising source of niobium, scandium, and other REEs. Ucore Rare Metals complements this effort with plans for a Louisiana-based separation facility and upstream exploration in both Canada and the U.S.

Strategic Implications for Mining Companies and Defense Supply Chains

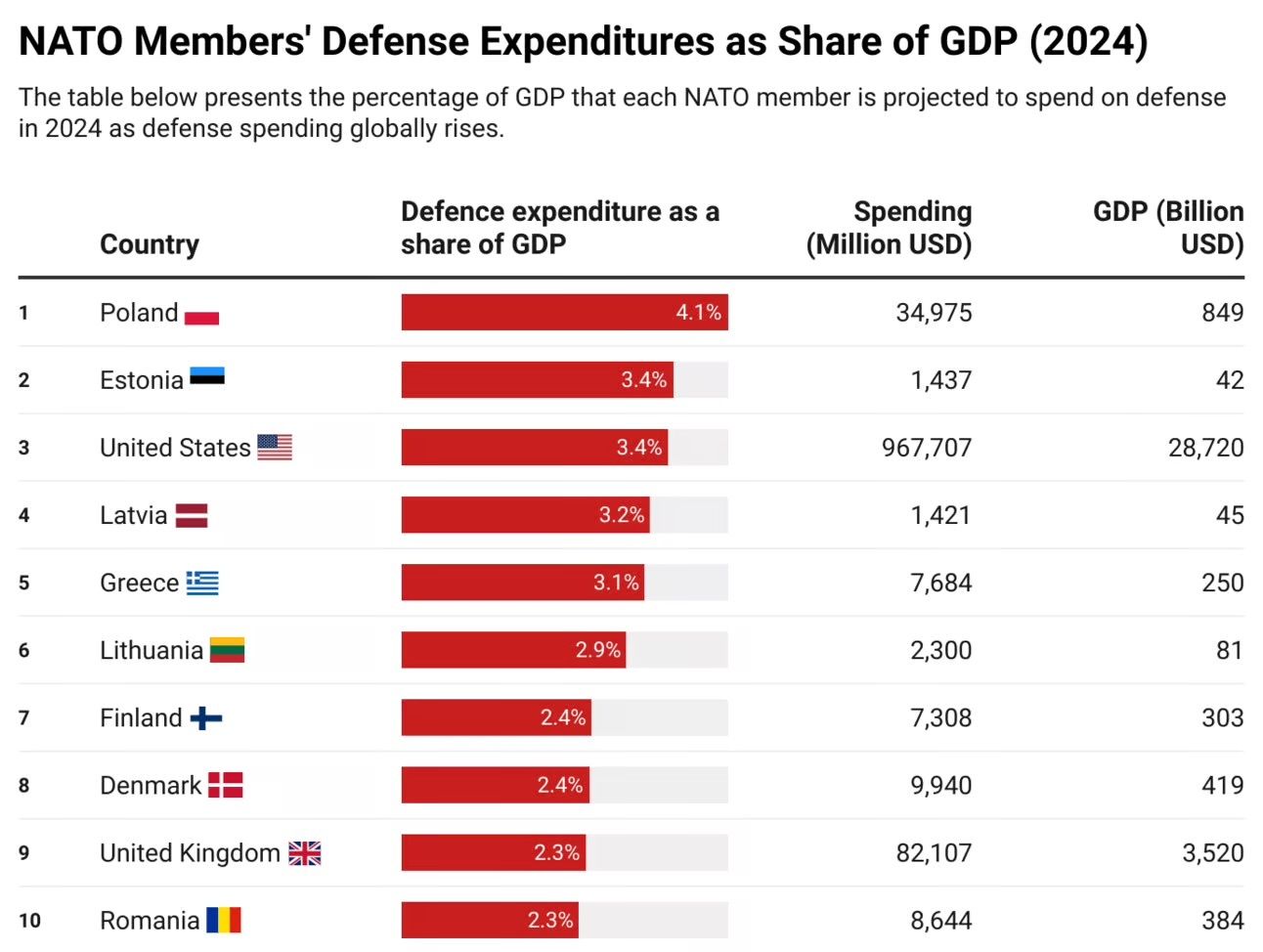

The rising global demand for defense-critical metals, compounded by geopolitical tensions and supply chain vulnerabilities, has significant strategic implications for both mining companies and national defense supply networks. Ensuring the steady flow of these materials is now seen not just as an economic imperative, but as a matter of national security.

To address potential disruptions, NATO has identified 12 defense-critical raw materials and outlined a roadmap aimed at safeguarding Allied supply chains. This comprehensive plan consists of five lines of action, including strategic stockpiling, expanding recycling capacity, and promoting material substitution. The goal is to mitigate risks that could compromise deterrence or operational readiness.

A key challenge in securing critical minerals lies in the geographic concentration of supply. For example, China dominates the rare earths market, while the Democratic Republic of Congo supplies the majority of the world’s cobalt. In response, governments and companies are investing in diversification strategies. MP Materials, for instance, received $58.5 million to build the first fully integrated rare earth magnet manufacturing facility in the U.S., establishing a domestic supply chain that includes recycling. Similarly, NioCorp Developments is evaluating the feasibility of incorporating rare earth magnet recycling into its Elk Creek critical minerals project in Nebraska, reinforcing North American supply resilience.

Alongside geographic diversification, innovation plays a critical role in strengthening the defense supply chain. Research into new materials and advanced recycling methods is accelerating. Indonesia, leveraging its status as the world’s largest nickel ore producer, is exploring the use of Inconel 718 (IN718)—a nickel-based superalloy—for military-grade armor and other defense systems. Meanwhile, breakthroughs in graphene technology promise transformative applications, from lightweight bulletproof vests and wearable sensors to high-capacity, long-duration batteries for defense platforms.

Recycling and Substitution: Mitigating Future Supply Risks

Military Metal Recycling Programs

The U.S. Department of Defense has implemented extensive programs to recover and reuse metals from military equipment, creating both economic and strategic value. One of the flagship initiatives is the Precious Metals Recovery Program (PMRP), run by the Defense Logistics Agency (DLA) Disposition Services. Over the past three decades, this program has saved taxpayers nearly $300 million by recycling valuable metals from decommissioned military assets. In a single fiscal year, the agency recovered nearly 5,000 ounces of gold, over 200,000 ounces of silver, and 150 ounces of other precious metals. Operating as a closed-loop system, PMRP ensures that end-of-life items bearing precious metals are processed, refined, and reissued to government supply contracts at stable, below-market prices.

Beyond precious metals, the Strategic Material Recovery and Reuse Program (SMRRP), guided by the Strategic and Critical Material Stock Piling Act, targets broader shortfalls in critical materials. For instance, it has addressed germanium supply gaps by recovering parts from Army depots, and also focuses on superalloys used in turbine engines—materials rich in rhenium, tantalum, tungsten, niobium, and high-grade chromium and manganese. A notable initiative between DLA Distribution Oklahoma City and Tinker Air Force Base has already recovered 225,000 pounds of raw nickel cobalt-based alloy, moving toward a 344,000-pound goal. Overall, military recycling efforts are on a large scale. Through the Scrap Sales and Recovery (SSR) contract, about 324 million pounds of scrap were processed in fiscal 2017, up significantly from 240 million pounds in 2013, reflecting growing efforts to decommission aging equipment and optimize material reuse across the defense supply chain.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.