Initial Approach and Negotiations

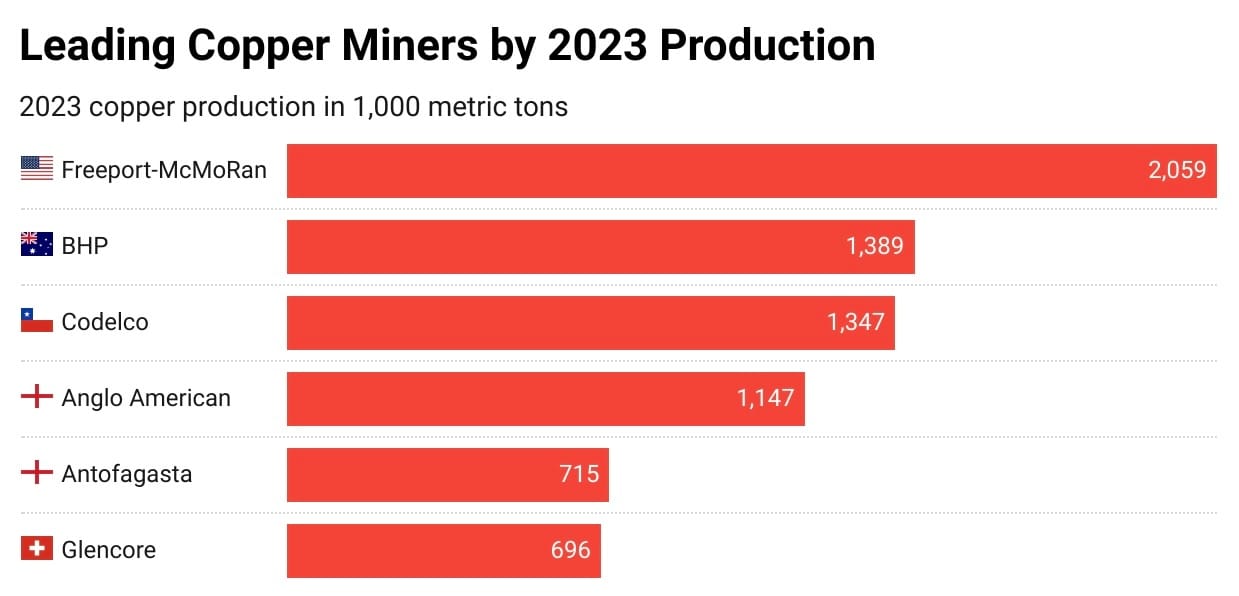

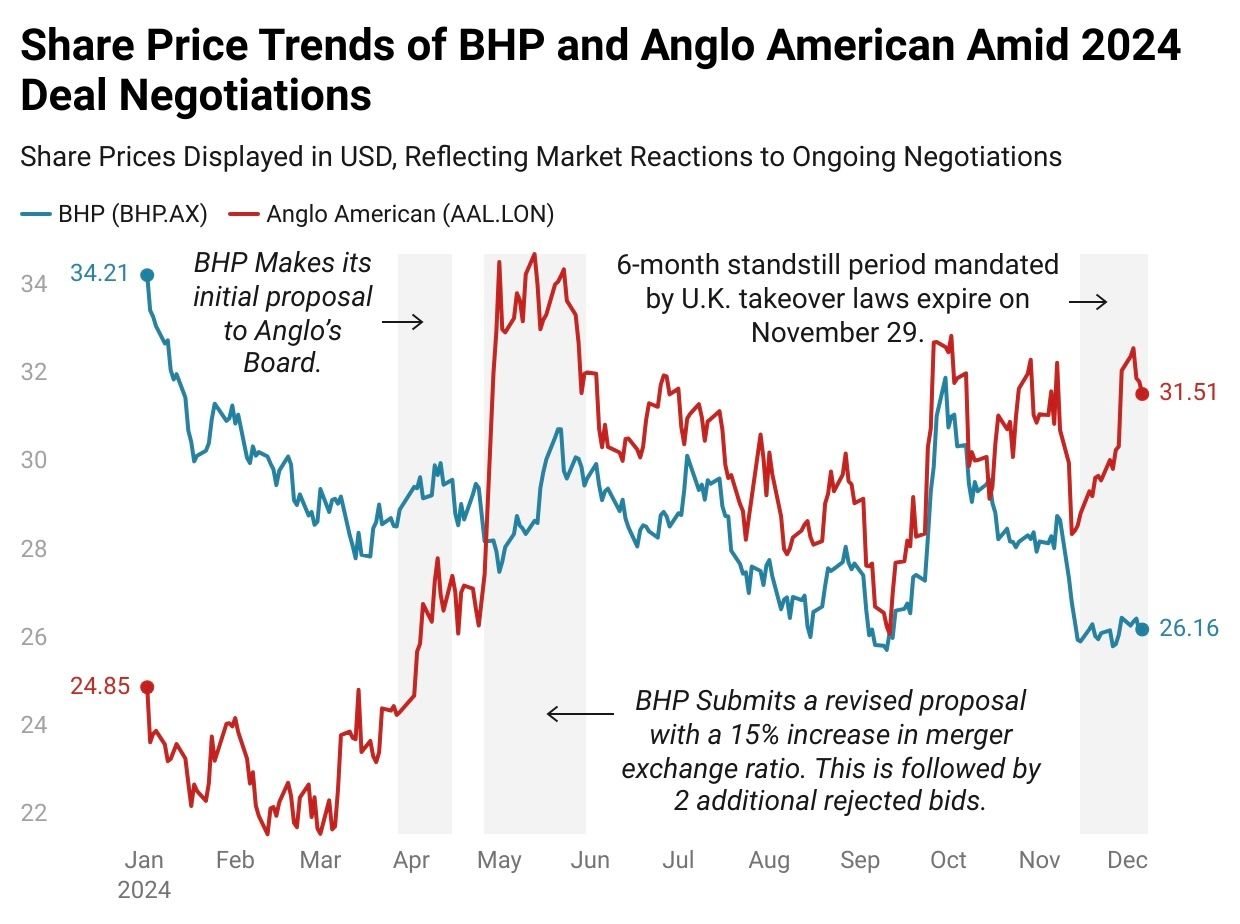

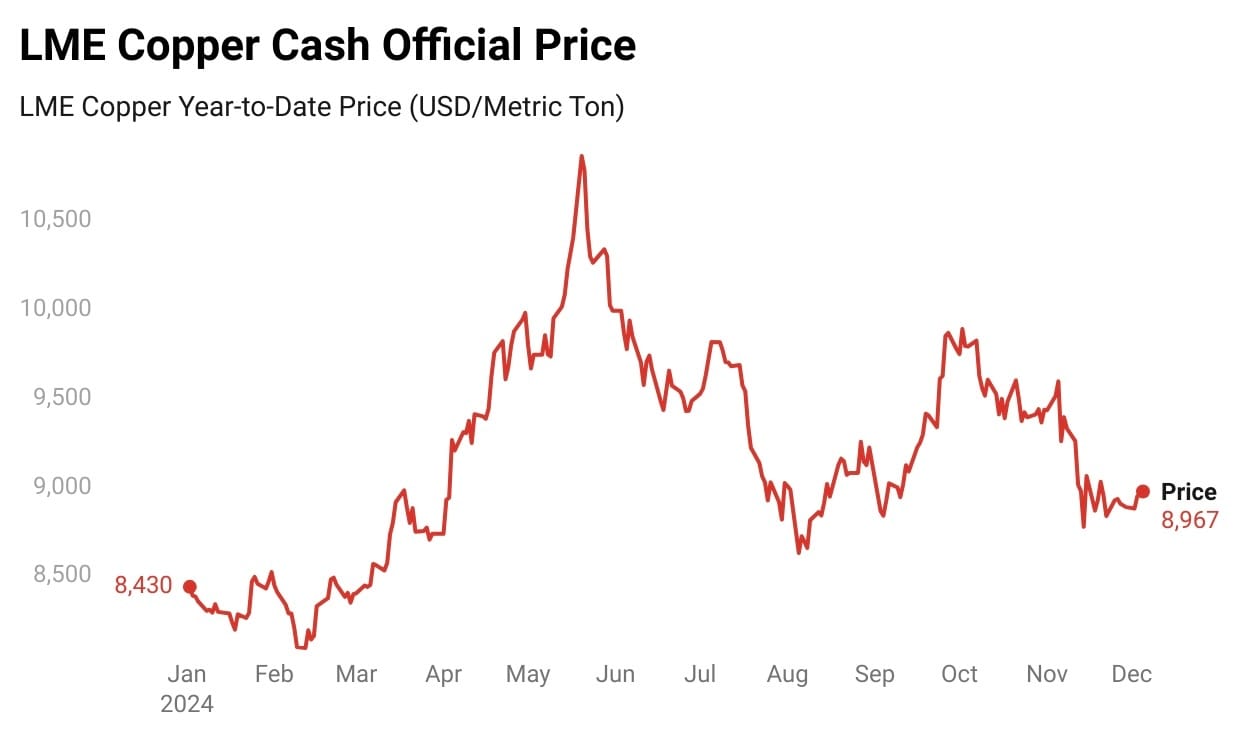

BHP, the world’s largest mining company made its first bid of £31.1 billion ($39 billion) for Anglo American in April 2024, followed by two more increased offers. The proposed deal was valued at $49.2 billion (£38.6bn) in its final form. BHP’s primary interest in targeting Anglo was its copper mines. As the world becomes increasingly electrified, the demand for battery metals, especially copper, has surged. BHP sought to secure a dominant position in this market. A merger would have given the mining giant control of approximately 10% of global copper production, coinciding with copper prices reaching record highs—up about 23% this year according to Mining.com. BHP and Anglo American are amongst the top five copper miners globally. As shown in the figure below, combining both miners would create a copper giant, increasing the combined firm’s copper production to 25% more than that of Freeport-McMoRan, the world’s leading producer as of 2023.

The proposed acquisition has been a major topic of discussion within the copper industry since the bid was made in April. The deal faced challenges due to several complexities cited by Anglo American, including:

The requirement for BHP to spin off Anglo’s majority stakes in South African mining operations.

BHP’s offer of concessions, such as maintaining Anglo’s Johannesburg office and listing BHP shares on the South African market.

The potential for BHP to gain control of approximately 10% of global copper production through the acquisition.

In May 2024, Anglo American rejected all three bids from BHP, citing the complexity of the deal structure and concerns about potentially spinning off Anglo’s South African mining operations due to elevated costs. BHP then entered a six-month standstill period under U.K. takeover rules, which expired in late November, technically allowing BHP to submit a new offer.

Source: Mining.com and FactSet

Meanwhile, Anglo pursued its own restructuring efforts, including selling a 6.6% stake in Anglo American Platinum and securing a $3.8 billion deal for its Australian coal mines. Since BHP’s initial offer in April, Anglo’s share price has risen by 18%, while BHP’s has fallen by 11%, making any future all-share deal significantly more costly for BHP.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Why Exactly is BHP Interested?

Anglo American Copper Assets

With the expiration of the mandatory six-month period under U.K. takeover law, BHP is now free to make another offer for Anglo American and its copper operations. Recognizing the growing demand for copper in batteries and other copper-dependent technologies, BHP views the acquisition of Anglo’s copper mines as a more cost-effective strategy for growth compared to building and expanding its own operations. BHP required under the terms of the offer that Anglo would spin off the iron ore and platinum business lines both situated in South Africa.

Anglo American plans to spin off its less profitable assets located in South Africa where it employs 40,000 and focus on its copper-rich operations in South America, which have proven to be highly lucrative and fast-growing. BHP is eager to be part of this “shareholder-enriching” strategy. Anglo American controls four major copper mines located in South America’s prime copper-producing regions.

Collahuasi (44% ownership) in Chile

Los Bronces (50.1% ownership) in Chile

El Soldado (50.1% ownership) in Chile

Quellaveco (60% ownership) in Peru

These copper assets are particularly valuable due to their scale and alignment with growing market demand. Developing a new copper mine with an annual capacity of just 100,000 tonnes would require an investment of approximately $3.5 billion according to Mining.com. In contrast, Anglo’s mines, such as Collahuasi and Quellaveco, each produce four times that amount.

Cost of Copper Capacity

The capital intensity for new copper mines has increased dramatically over the years. In 2000, the cost ranged from $4,000 to $5,000 per tonne of production capacity, rising to an average of $10,000 per tonne by 2012.

Currently, costs can reach as high as $44,000 per tonne of production capacity. Copper mining primarily relies on two methods: open-pit mining, which accounts for 90% of production and is used for near-surface deposits, and underground mining, employed for deeper deposits requiring tunnel systems.

Examples of recent capex for copper projects include:

•Copper Mountain Mine: $43,994 per tonne capacity ($441 million total)

•Red Chris Mine: $16,725 per tonne capacity ($669 million total)

•Quebrada Blanca Phase 2: Approximately $7.5 billion total construction cost

Additionally, copper demand is projected to grow at a compound annual growth rate (CAGR) of 2.7% between 2022 and 2033, driven by the rapid expansion of energy transition sectors, which are growing at 13% annually. The copper division has also shown strong performance, with total output guidance for 2024 projected at 730,000–790,000 tonnes. Analysts value the copper assets at approximately $35 billion, reflecting their significance within the portfolio. Additionally, copper sales saw a substantial increase of 31.5%, rising from $5,599 million in 2022 to $7,360 million in 2023.

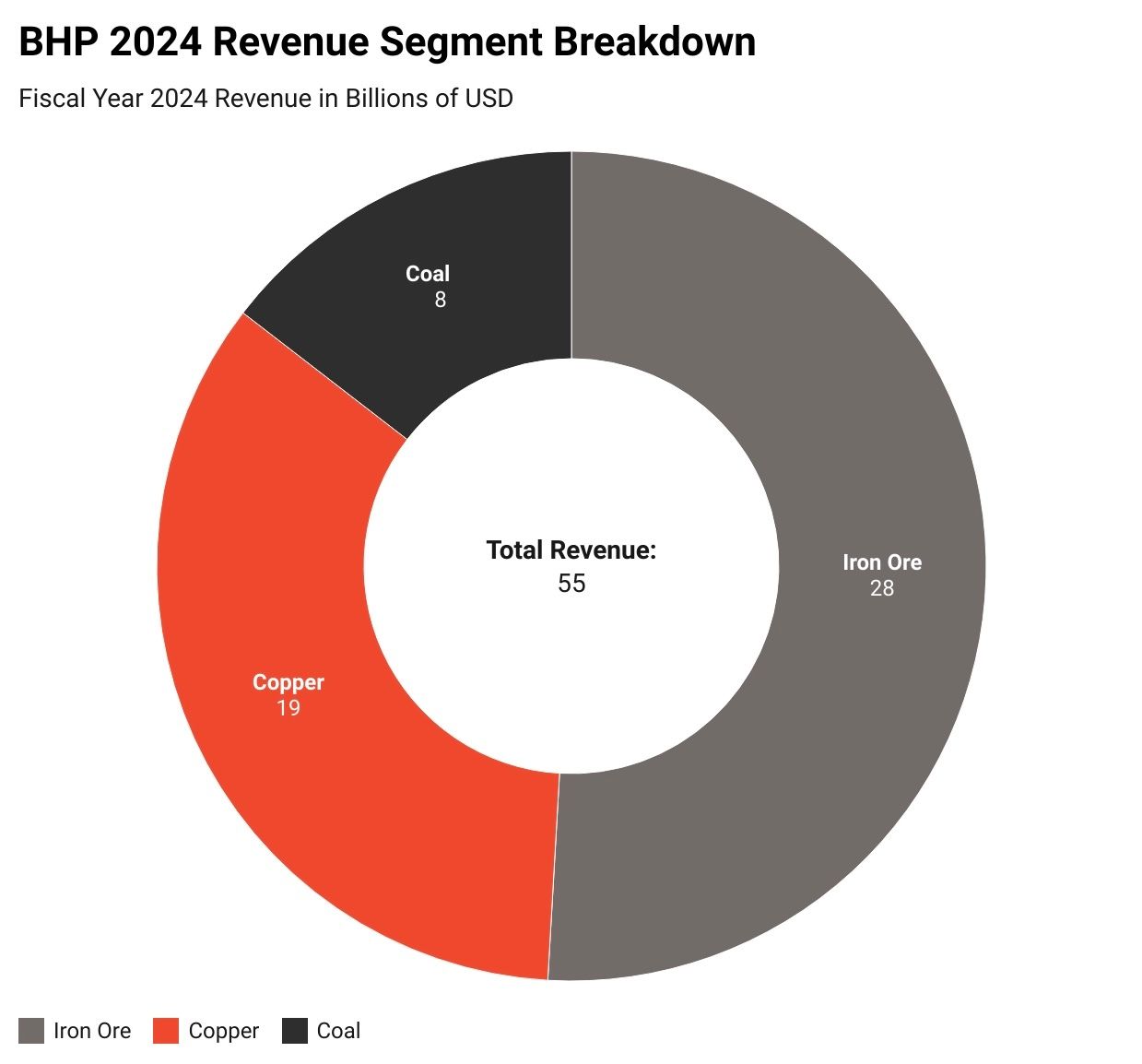

BHP Evolving Revenue Mix

The majority of BHP’s business is being done in the iron ore segment according to their 2024 fiscal year reporting. The firm’s coal segment is shrinking with revenue down 30% year-over year and copper revenue rising 16% over the same time horizon. On the 18th of November BHP announced its plans to invest $10.7–$14.7 billion over the next decade in its Chilean copper operations. Key components of this investment include $7.3–$9.8 billion for new projects at the Escondida mine, set to begin in 2028, and $2.8–$3.9 billion allocated to the Pampa Norte division.

Source: BHP Filings

The overall capital intensity for these projects is estimated at $23,000 per tonne of copper equivalent. BHP plans to invest $10.7–$14.7 billion over the next decade in its Chilean copper operations. Key components of this investment include $7.3–$9.8 billion for new projects at the Escondida mine, set to begin in 2028, and $2.8–$3.9 billion allocated to the Pampa Norte division. The overall capital intensity for these projects is estimated at $23,000 per tonne of copper equivalent. BHP’s decision to allocate additional capital to copper is unsurprising, as it remains one of the company’s fastest-growing segments, particularly following the rejection of its bid for Anglo American.

Anglo American’s Ties to South Africa

The Founding of Anglo American

The single factor that analysts are citing that led to the breakdown of the proposed deal by BHP was the mandatory spin off of Anglo’s South African assets. Now Anglo American has significant ties with South Africa being founded there in 1917 by Sir Ernest Oppenheimer in Johannesburg. The terms stipulated that Anglo American would need to divest its shares in Kumba Iron Ore and Anglo American Platinum (Amplats) by distributing them to its shareholders before any deal takes place. Currently, Anglo American owns 78.6% of Amplats and 69.7% of Kumba. BHP previously divested its South African assets in 2015 through South32 and is likely not interested in Anglo’s operations in the country.

BHPs Commitment

BHP stated that, as part of its increased presence in South Africa, it intends to build on Anglo American’s legacy of social investment and value creation. The company outlined several commitments, including sharing the costs of increased South African employee ownership in listed businesses if required to secure regulatory approvals.

BHP also announced plans to establish a Mining Centre of Excellence to drive research, development, training, and promote South Africa as a premier mining destination. It pledged to maintain employment levels at Anglo American’s Johannesburg office to support the acquired South African assets, Anglo Platinum, and Kumba, and to continue funding Anglo American’s charitable commitments in South Africa. Additionally, BHP committed to supporting local procurement, ensuring continued access for South African investors through its Johannesburg Stock Exchange listing, and maintaining Anglo American’s existing undertakings with the South African Reserve Bank and National Treasury, to the maximum extent practicable. These efforts would be estimated to last 3-years according to the announcement from BHP.

The decision to spin off South African assets will have ramifications for the country’s economy. According to analysis from JPMorgan, developed-market funds would sell $9.4 billion in stock, while emerging-market investors would purchase $5.1 billion, leading to a net outflow. JPMorgan based its estimates of index fund holdings in Anglo American on publicly available data. The analysis also cited that spinning off the two companies would add $14.2 billion to the market capitalization of the MSCI South Africa index.

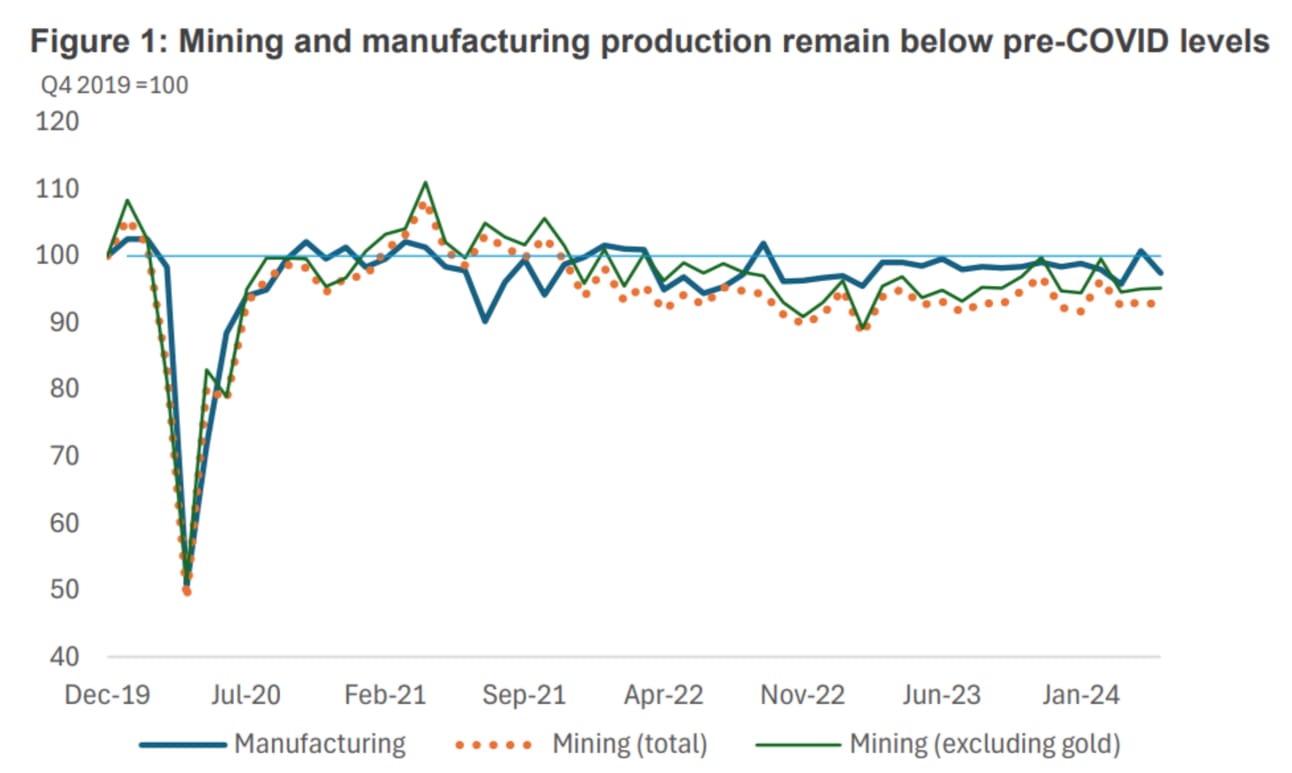

With mining production in South Africa still below pre-COVID levels based on the figure above, BHP is shifting its focus to other regions, such as Chile and Australia, prioritizing copper over iron ore and platinum, which are key components of Anglo American’s South African operations.

The Current Stand Still and Outlook

BHP’s Stance

Current Status

The mandatory standstill period preventing BHP from making a new offer expired on November 29, 2024. Although earlier statements suggested BHP had moved on, the company clarified that these comments were not intended as a formal withdrawal under U.K. takeover regulations.

Recent Developments

BHP CEO Mike Henry has been engaging with key stakeholders in South Africa, including government officials and the Public Investment Corporation (PIC), indicating preparations for a renewed bid. The PIC, Anglo American’s second-largest investor, has already requested a “meaningful revision” of BHP’s previous proposals.

Anglo American’s Response

In response to the failed merger attempt, Anglo American has undertaken significant structural changes over the past 6-months, including:

Focusing on copper and premium iron ore assets.

Planning the demerger of Anglo American Platinum.

Considering the divestment of De Beers (diamonds).

Exploring options for its nickel assets.

The latest rejected offer valued Anglo American at $49.2 billion, with BHP offering Anglo American shareholders 17.8% of the combined entity.

Prized Copper

Global copper production is projected to reach 22.9 million tonnes in 2024, marking a 3.2% increase from 2023. This growth is fueled by significant expansions, including a 303% surge in production at Chile’s Quebrada Blanca mine, a 3.3% rise in the Democratic Republic of Congo’s (DRC) output to 2.9 million tonnes, and a 7.4% increase in Russia’s production to 965.4 kilotonnes.

On the pricing front, copper is expected to hit record highs in Q4 2024, with analysts forecasting an average price of $10,265 per ton a 14% premium to current prices. This bullish price outlook is driven by several factors: anticipated Federal Reserve rate cuts, a 3.95 trillion yuan ($560 billion) stimulus package from China, seasonal Q4 demand strength, and tightening market fundamentals. There is no doubt that both BHP and Anglo American will continue to expand their copper assets as the outlook is ripe.

Source: FactSet Commodities

Demand is expected to rise, with the refined copper market valued at $269 billion in 2024 and projected to grow at a CAGR of 5.4% through 2030. This growth is driven by sector-specific increases, including:

Electric Vehicles: 14.3% CAGR

Solar Power: 5.6% CAGR

Wind Power: 9.3% CAGR

Traditional Industries: 1.4% CAGR

While demand and growth projections remain strong, a deal has yet to be finalized, with the South African assets continuing to pose a significant challenge for BHP.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.