“The Emotions of Monetary Policy” — A Review of Barry et al. (2025)

The following summary is based entirely on the paper The Emotions of Monetary Policy by Barry, Bruns, Kandemir, Klose, Smirnov, and Tillmann (2025), affiliated with the University of Applied Sciences Mittelhessen and Justus Liebig University Giessen. The paper released in January of this year presents a novel investigation into the facial and vocal cues of ECB Presidents Mario Draghi and Christine Lagarde, asking whether emotions expressed during ECB press conferences shape financial markets. What they find is that monetary policy communication is not only about what is said—but also how it is said, and even how it looks.

The Emotions of Monetary Policy (Barry et al., 2025)

Abstract: We study the full scope of the communication of the ECB presi- dents during the post-meeting press conferences at a high frequency. Based on advances in facial and vocal recognition software and natural language processing, we not just quantify the spoken word of the ECB president, but also measure facial and vocal expressions at the minute frequency. First, the nature and the intensity of emotions differ be- tween President Draghi and President Lagarde as well as between the introductory statement and the Q&A part of the press conferences. Second, average facial expressions during a press conference are cor- related with inflation. Third, facial expressions and vocal arousal can moderate or amplify a hawkish policy message. In particular, posi- tive emotions can support forward guidance statements of the ECB president.

1.87 MB • PDF File

From Words to Emotions

The paper builds on a growing literature that uses natural language processing (NLP) to analyze central bank communication, but it takes this approach one step further. Instead of focusing solely on the content of the ECB president’s words, the authors examine emotional signals conveyed through facial expressions and vocal tone. Their dataset covers 100 ECB press conferences between May 2012 and July 2023, spanning both the Draghi and Lagarde presidencies. These events include not only the prepared monetary policy statements but also the Q&A sessions with journalists—critical moments when policy is explained, justified, and often interpreted in real time.

Source: Barry et al. (2025, p. 10)

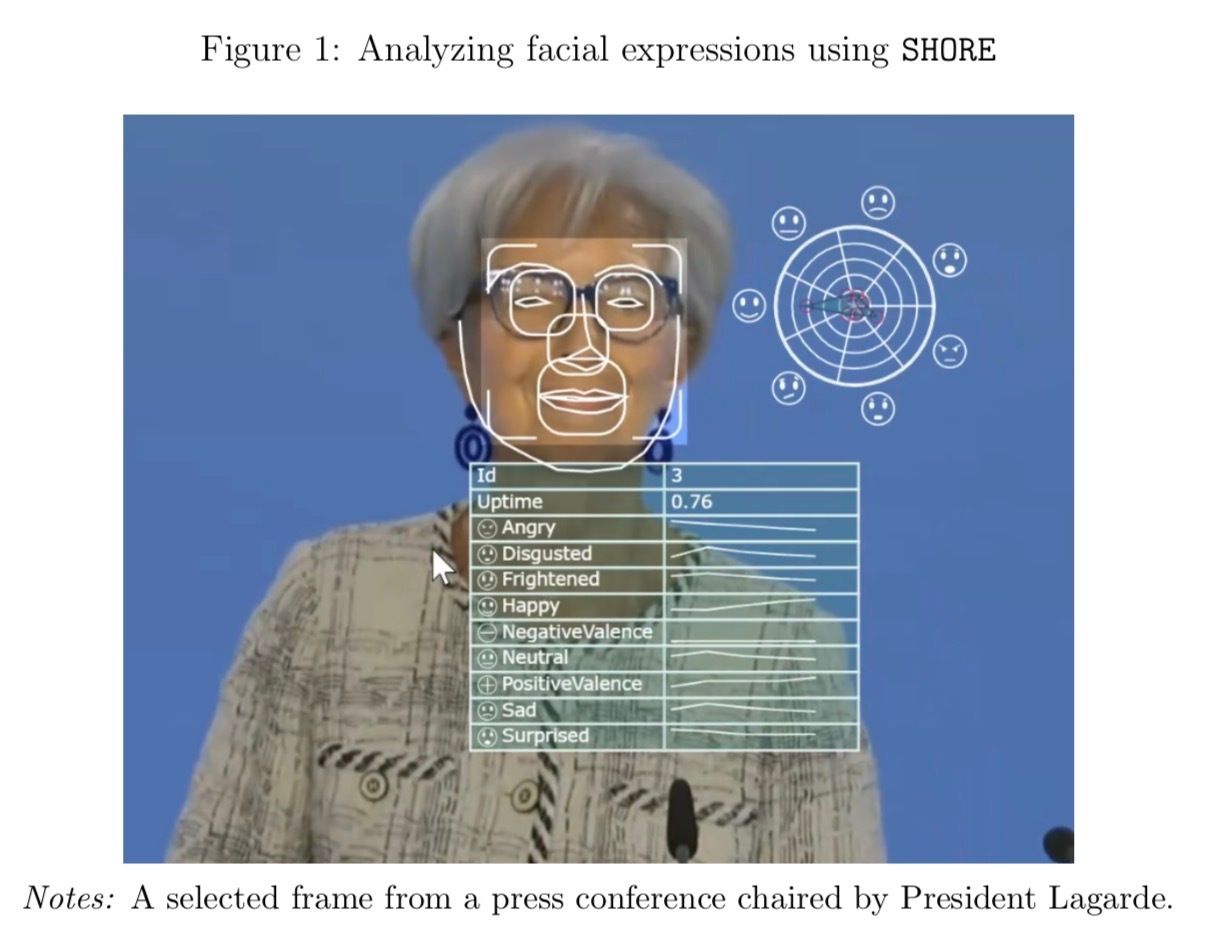

To achieve this, the authors combine facial recognition software (SHORE), audio emotion classification models (w2v2-L-robust-12), and hawkish/dovish text analysis using a fine-tuned BERT model. All data are aligned at the minute frequency and linked with high-frequency market data, including 10-year bond yields from Germany, France, Italy, and Spain, the EuroStoxx 50 index, the Bund future, and the euro-dollar exchange rate. The goal is to determine whether financial markets respond not only to the content of central bank communication but also to the emotions surrounding it over a short-term event window.

Methodology: A Multimodal Sentiment Approach

The authors construct three emotion streams from each press conference video. First, they use SHORE to measure facial expressions—quantifying emotions such as “happy,” “sad,” “angry,” “surprised,” “disgusted,” and “frightened,” along with overall valence (positive or negative tone). Second, they extract vocal features using the VAD (Valence-Arousal-Dominance) framework, which assigns scores for emotional engagement and control. Third, the content of the speech is transcribed using Whisper and categorized using a custom-trained BERT model to label each sentence as hawkish, dovish, or neutral.

Each minute of the press conference is classified either as part of the president’s prepared introductory statement or the unscripted Q&A portion. This classification allows for comparison between scripted and spontaneous speech and helps isolate the effects of emotional expression.

Stylized Facts: Presidents, Emotions, and Inflation

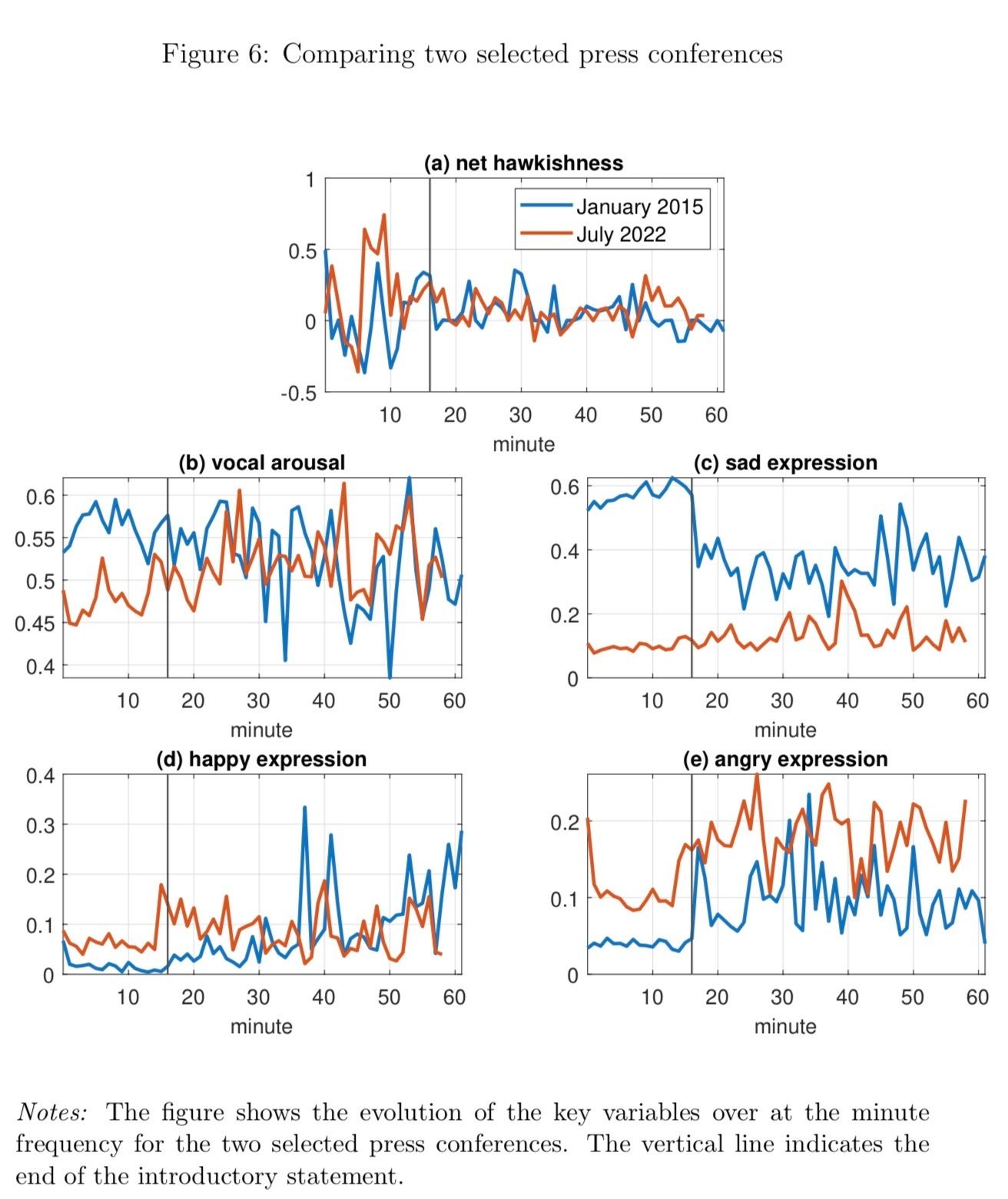

The results show that emotional expression varies meaningfully across presidents, press conference segments, and time. Lagarde tends to display more “happy” and “angry” facial expressions, while Draghi is more frequently “sad”. For instance, during the introductory statements, Draghi’s facial expressions were classified as 62% sad on average, compared to just 15% for Lagarde. Conversely, Lagarde averaged 17% angry expressions during her statements—substantially higher than Draghi’s 4.6%. These differences suggest a shift in communication style between the two presidencies.

Source: Barry et al. (2025, p. 24)

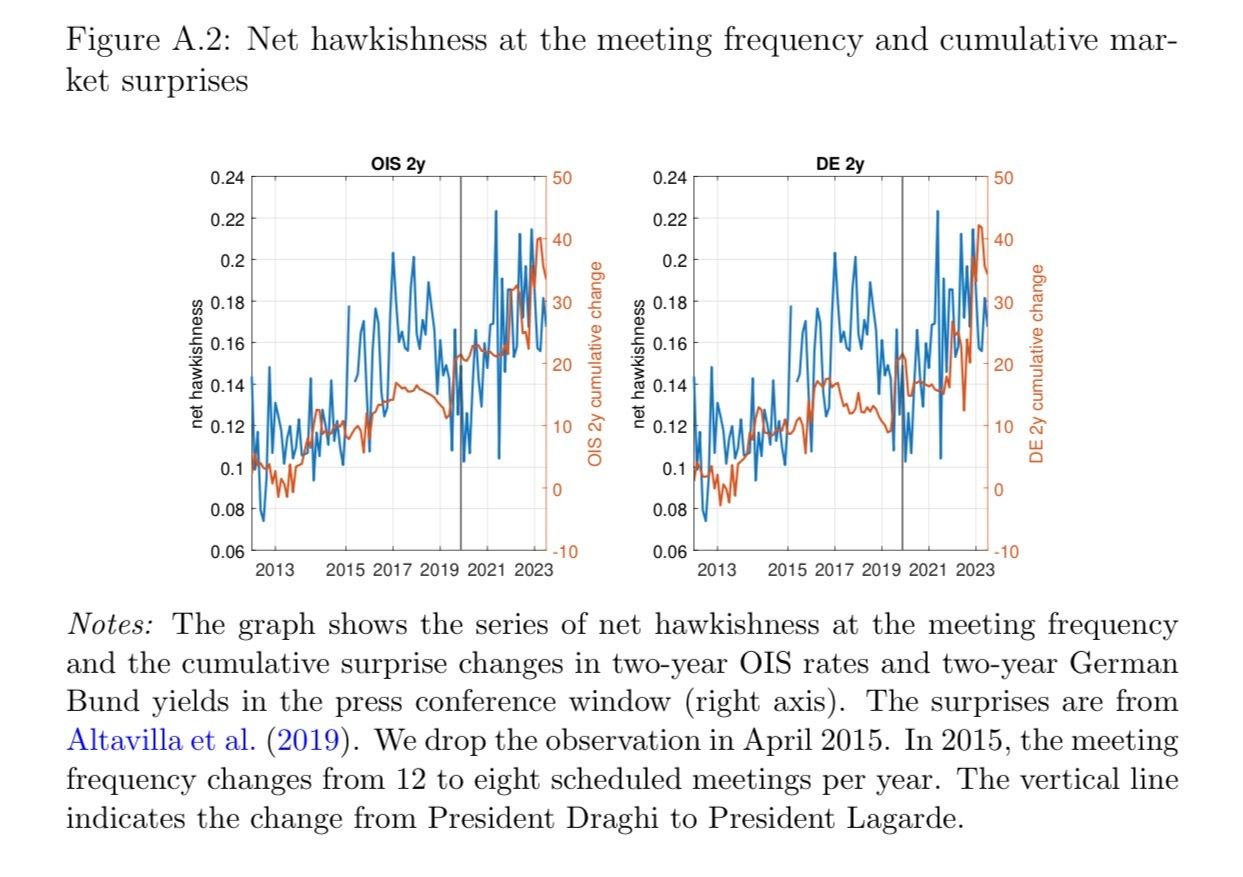

The paper also documents a strong co-movement between facial expressions and macroeconomic conditions, particularly inflation. Higher inflation levels are associated with more “angry” expressions, even after controlling for the structural break between Draghi and Lagarde. In a regression model using headline inflation as the independent variable, a one percentage point increase in inflation raises angry expressions by 0.009 and lowers vocal arousal by 0.002. The relationship holds even when measuring the absolute deviation of inflation from the ECB’s 2% target.

Market Reactions

The study finds that emotional tone can either reinforce or dilute the effect of a hawkish or dovish statement. For example, under Draghi, hawkish sentences during the introductory statement were statistically associated with higher vocal arousal (+0.021) and more sad expressions (+0.015), and less happiness (−0.005). During the Q&A, a similar relationship holds, though arousal and sadness remain stronger predictors. Under Lagarde, however, these links are weaker, suggesting a more emotionally consistent delivery regardless of policy content.

Interestingly, when the researchers allow for nonlinear effects by including squared hawkishness in their regression models, they find that both highly hawkish and highly dovish statements tend to provoke stronger emotional reactions—especially under Draghi. For example, extreme statements (positive or negative) are associated with significantly lower happiness and higher sadness.

The authors estimate several panel regressions linking minute-by-minute asset price movements to emotional and textual features. For President Draghi’s introductory statements, they find that happy facial expressions are associated with falling bond yields and rising stock prices. A one-unit increase in happiness leads to a statistically significant drop in German and French yields, a rise in the bund future, and a depreciation of the euro. Vocal arousal has the opposite effect: it raises yields and strengthens the euro, signaling a more hawkish market interpretation.

Source: Barry et al. (2025, p. 55)

However, hawkishness in Draghi’s words alone did not significantly move markets—unless combined with positive emotional cues. In fact, the authors find a clear amplification effect when hawkish content is delivered with a happy expression. For instance, under Draghi, the coefficient on the interaction between hawkishness and happiness is large and positive for bond yields: markets respond more strongly to hawkish statements if delivered with a positive tone.

Under Lagarde, the findings are slightly different. Hawkishness in her statements directly moves markets, particularly during the introductory statement. A one-unit increase in hawkishness increases German yields by 0.003 and Italian yields by 0.007. However, emotions still matter. An angry facial expression enhances the hawkishness effect: when Lagarde looks angry while delivering hawkish content, bond yields rise more sharply—especially in riskier countries like Italy and Spain.

Affective Transmission of Policy

Barry et al. (2025) convincingly demonstrate that the emotions conveyed in central bank communication—via facial expressions and vocal tone—have measurable effects on financial markets. Their results show that emotions can amplify or mute the market response to monetary policy, particularly when the signals are clear and consistent.

This has implications for how analysts interpret policy communications, and perhaps for how central banks train their spokespersons. When forward guidance or hawkish statements are delivered with congruent emotional signals—happiness for easing, anger for tightening—markets respond more sharply. In this sense, central banks transmit not just policy, but affect.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.

Disclaimer

This special edition of The Triumvirate Research newsletter is intended solely for educational and informational purposes. It is not monetized, contains no advertisements, and offers commentary on the publicly available research paper “The Emotions of Monetary Policy” by Barry et al. (2025), hosted on SSRN. Figures included are used under fair use for the purpose of academic discussion and are fully credited to the original authors. No copyright infringement is intended.