ExxonMobil and Chevron Set for Arbitration

In a high-stakes legal battle that could reshape joint operating agreements (JOAs) across the oil industry, ExxonMobil and Chevron are set to face off in an arbitration hearing in London over ownership rights to a $1 trillion oilfield in Guyana, according to the Financial Times. The dispute centers around Hess’s 30% stake in the massive Stabroek oilfield, which Chevron aims to acquire through its proposed $53 billion takeover of Hess. Exxon, which holds a 45% stake in the field, is asserting its contractual right of first refusal under the terms of the JOA — a clause it believes entitles it to purchase Hess’s share before any sale or transfer occurs. Cnooc, the third partner with 25%, has filed a similar claim.

Joint Operating Agreements

A Joint Operating Agreement (JOA) is a contract between multiple companies involved in a joint venture to explore, develop, and produce oil or gas from a shared field. It outlines each party’s ownership share, rights, obligations, decision-making authority, and crucially, pre-emption rights — the right of existing partners to buy another partner's interest before it’s sold to an outsider. Below is a breakdown of the current case revolving around the Guyana oil field.

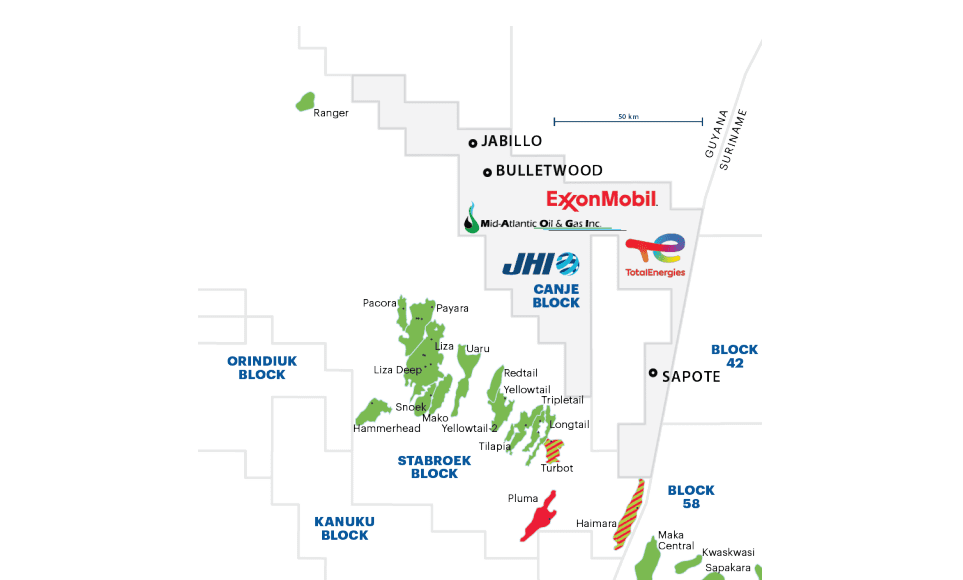

Stabroek Oilfield, Guyana

* Parties: Exxon (45%), Hess (30%), Cnooc (25%)

* Dispute: Chevron plans to acquire Hess.

* Exxon’s Claim: The JOA includes a pre-emption clause that gives it the first right to buy Hess’s stake.

* Chevron’s View: The JOA doesn’t apply to corporate takeovers, only to asset sales.

* Implication: The arbitration ruling may set precedent on whether JOAs cover mergers, not just asset transfers.

The Stabroek block is one of the world’s most valuable recent oil finds, with an estimated 11 billion barrels of recoverable reserves. Analysts project Exxon and its partners could earn $182 billion in profits over the next 15 years, with Guyana receiving more than $190 billion — a transformative figure for the once-impoverished South American nation. Chevron, whose reserves have recently declined, is eager to secure Hess’s assets to bolster growth. However, the case's outcome, which hinges on how narrowly or broadly pre-emption rights are interpreted in the JOA, could disrupt that plan.

The arbitration is private, but industry insiders suggest the ruling may hinge on the interpretation of a few key phrases in the agreement. Legal experts believe the decision will influence how future JOAs are drafted, particularly in M&A contexts where company takeovers may functionally transfer asset ownership. As FT reports, the outcome holds major implications not just for the two oil giants, but for broader contractual norms in the global energy sector.

According to Oilprice.com Chevron, acquiring Hess’s stake in the Guyana oil project is critical to reversing a decline in its oil and gas reserves, which had fallen to their lowest level in more than a decade by the end of 2024. The deal would give Chevron access to a high-growth, low-cost oil basin, significantly enhancing its long-term production prospects. For Exxon, however, retaining control over the Guyana project is essential to maintaining its dominant position in what is quickly becoming one of the most strategic oil basins in the Western Hemisphere. Having assumed early development risks in Guyana, Exxon views Chevron’s potential entry as a direct threat to its influence in the region.

The Stabroek Oil Field in Brief

Production Capacity

The Stabroek Block, a 6.6 million-acre offshore oil reservoir located 120 miles off the coast of Guyana, has become one of the world’s most prolific oil discoveries since ExxonMobil’s first find in 2015. The block holds over 11 billion barrels of recoverable oil equivalent and supports nearly 70% of the workforce in Guyana’s oil industry.

Discoveries and Reserves – Key Milestones:

2015: Initial discovery of Liza-1, featuring a 295-foot oil-bearing sandstone reservoir.

2020: Total resource estimate for the block doubled to 9 billion barrels.

2024: Cumulative production reached 500 million barrels.

2025: Recoverable resources upgraded to 11 billion barrels.

Major producing fields within the block include Liza, Payara, Yellowtail, and Uaru. To date, there have been 22 discoveries across the block. These reservoirs span multiple geological play types, offering multi-billion-barrel exploration potential and reinforcing the block’s long-term strategic value. By 2027, six Floating Production Storage and Offloading (FPSO) vessels are expected to be operational in the Stabroek Block, increasing production capacity to 1.3 million barrels per day.

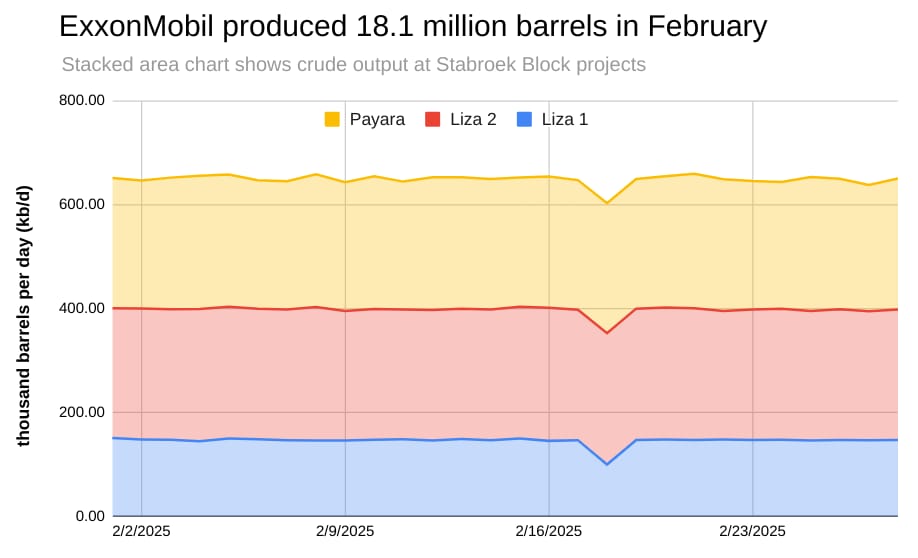

The Liza field, which began production in 2019, represents the first phase of development within the broader Stabroek Block complex. Current production from the block has reached approximately 650,000 barrels per day, with ExxonMobil targeting an ambitious increase to 1.3 million barrels per day by 2027—a level that would surpass the total production of North Dakota’s Bakken region.

Oil Economics

The first five projects in Guyana’s Stabroek Block are among the most competitive in the global oil industry, with breakeven costs ranging from just US$25 to US$35 per barrel of Brent crude. This cost efficiency underscores the strategic value of the basin. On the economic front, the projects have had a significant local impact. More than 2,850 Guyanese are employed in support of operations, and ExxonMobil, along with its contractors, has spent over US$480 million with more than 800 local vendors since 2015, contributing meaningfully to the development of Guyana’s private sector.

According to TotalTec under the production-sharing agreement (PSA), ExxonMobil, Hess, and CNOOC are permitted to recover up to 75% of annual production revenue to offset their development and operational investments. By the end of 2024, cumulative cost recovery is expected to surpass $31 billion, including major capital-intensive projects such as the $10 billion Yellowtail development. ExxonMobil projects that full cost recovery will be completed by 2026 or 2027, at which point Guyana’s share of oil revenues will increase substantially.

In terms of fiscal benefits, Guyana receives a 2% royalty on gross revenues and 50% of the profit oil—net revenues after cost recovery. Since 2019, more than $5.4 billion has been deposited into the country’s Natural Resource Fund, supporting investments in infrastructure, healthcare, and education. On the corporate side, ExxonMobil, Hess, and CNOOC collectively reported $614.6 billion in profits in 2023, with total investments across six sanctioned projects reaching $55 billion.

Chevron vs. Exxon

The Heart of the Conflict: Right of First Refusal Interpretation

The dispute between ExxonMobil and Chevron hinges on the interpretation of a “right of first refusal” (ROFR) clause embedded within the Joint Operating Agreement (JOA) governing the Stabroek Block partnership. This clause is intended to preserve consortium stability by granting existing partners the opportunity to purchase a departing partner’s interest before it is sold to an outside party. The central issue is whether Chevron’s proposed acquisition of Hess Corporation activates this provision.

ExxonMobil and CNOOC contend that the ROFR clause should apply, arguing that Hess’s valuation is overwhelmingly tied to its stake in the Stabroek Block—estimated to account for roughly 70% of its total value. From their perspective, the distinction between an asset sale and a corporate merger becomes blurred when the target company’s value is so heavily concentrated in a single asset. ExxonMobil CEO Darren Woods has questioned why the company should forfeit its contractual rights simply because a partner structured the sale as a corporate acquisition.

In contrast, Chevron and Hess assert that the ROFR clause pertains solely to direct asset transfers, not to full corporate mergers. Their position is that Chevron is acquiring Hess as a whole legal entity, not the Stabroek Block asset in isolation. As such, they argue the transaction falls outside the scope of the JOA’s ROFR clause.

Strategic Implications for Chevron

The stakes of this arbitration extend well beyond Chevron’s immediate bid to acquire Hess—they strike at the core of the company’s long-term strategic direction and reserve sustainability. As of the end of 2024, Chevron’s oil and gas reserves had declined to 9.8 billion barrels, marking their lowest level in over a decade. This has heightened pressure to secure new, high-quality assets to stabilize its reserve replacement ratio and underpin future production growth.

The proposed acquisition of Hess represents Chevron’s largest potential deal in recent years and is central to CEO Mike Wirth’s strategy to reinvigorate the company’s performance relative to its peers. While Hess retains meaningful operations in North Dakota’s Bakken Shale, analysts estimate that its Guyana assets alone are worth approximately $40 billion—considered the crown jewel of the transaction. Securing access to these reserves would position Chevron in one of the world’s few remaining high-growth, low-cost oil basins.

The protracted legal uncertainty surrounding the arbitration has already imposed significant strategic costs. Since announcing the deal in October 2023, Chevron has operated in a holding pattern, constrained from pursuing other major acquisitions while the outcome remains unresolved. This strategic paralysis is particularly problematic amid a tightening landscape for large-scale acquisition opportunities.

If the arbitration outcome favors ExxonMobil and CNOOC, Chevron would be forced to re-evaluate its acquisition pipeline in a highly competitive environment. A failed bid could intensify investor concerns over Chevron’s long-term growth prospects, particularly beyond 2030, and its ability to keep pace with larger rivals such as ExxonMobil. In anticipation of a favorable outcome, Chevron has already acquired roughly 5% of Hess’s outstanding shares on the open market, while merger-arbitrage funds have amassed over $10 billion in Hess stock in expectation of deal closure.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.