U.S. Monitoring the Situation

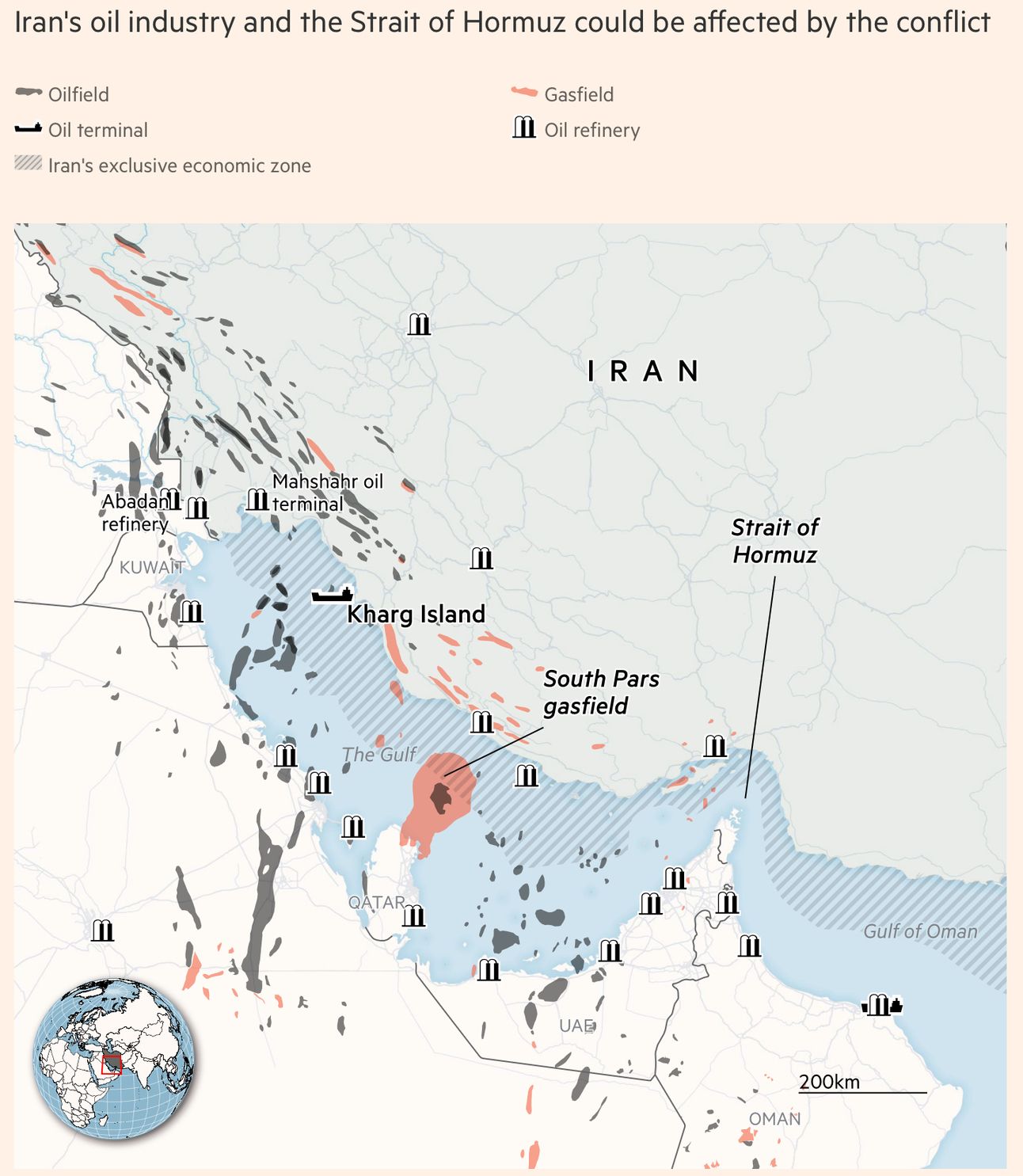

As tensions rise between the U.S. and Iran, Arab Gulf monarchies are racing to protect themselves from becoming collateral damage. While Donald Trump considers possible military strikes on Tehran, leaders across the Gulf — from Saudi Arabia to Oman — have opened direct channels with Iranian officials. Their goal: avoid being pulled into a regional conflict that could threaten their oil exports, military bases, and internal stability. With American military assets stationed across the Gulf, these states fear retaliation if the U.S. acts — especially through the Strait of Hormuz, a key artery for global oil.

Smoke billows in the distance from an oil refinery following an Israeli strike on the Iranian capital Tehran on June 17, 2025 | Atta Kenare | Afp | Getty Images

In recent days, the leaders of Saudi Arabia, the UAE, Qatar, and Oman have all spoken with Iran’s new president, Masoud Pezeshkian, condemning Israel’s offensive and signaling openness to diplomacy. Qatar and Oman have reportedly conveyed Iran’s willingness to talk with Washington — but only if Israel halts its attacks. For U.S. allies in the Gulf, military intervention is seen as the “worst-case scenario come true,” as regional analysts told the Financial Times. Hosting American troops may make them targets, but Gulf leaders also remain uncertain about the U.S.’s willingness to defend them in a wider war.

Although cities like Dubai and Riyadh remain calm, fears persist. In Bahrain, emergency sirens were tested; in Kuwait, citizens watched missiles fly overhead. While Iran is unlikely to provoke the Gulf without direct involvement, the memory of the 2019 drone and missile attack on Saudi oil facilities — attributed to Iran — still looms large. Gulf states have since pursued de-escalation with Tehran, but that détente could quickly unravel if the U.S. strikes.

Source: FactSet

Despite their long-held fears of a nuclear Iran, Gulf rulers are also alarmed by the rising assertiveness of Israel. The UAE and Bahrain signed normalization agreements with Israel in 2020, yet leaders across the region now view Israel’s prolonged war in Gaza and attacks in Syria as dangerously destabilizing. “An imperial Israel, is it good for the region? I don’t think so,” said Abdulkhaleq Abdulla, a Dubai-based scholar. Caught between two regional powers, the Gulf’s monarchies are trying to shield themselves from a conflict that could undermine both their energy exports and their hard-won diplomatic balancing act.

Gulf Companies at Risk

As the Israel–Iran conflict deepens, companies operating in the Gulf are quietly escalating their crisis preparations. Risk advisory firms such as Control Risks, Kroll, and International SOS told the Financial Times they’ve seen a marked increase in demand from multinationals seeking evacuation support, intelligence briefings, and operational risk assessments. While the security situation across major Gulf economies like the UAE, Qatar, and Saudi Arabia remains stable, businesses are no longer treating the war as a distant conflict.

Firms are responding across multiple fronts. Crisis response teams have been activated, staff have been advised to work remotely in high-risk locations like Tehran, and companies are reviewing vulnerabilities in their supply chains and logistics networks. Several have initiated tabletop exercises to rehearse emergency responses, while others are deploying mobile notification systems to keep employees informed. One FTSE 100 firm has instructed managers to prepare plans to maintain shipping operations if the crisis escalates further.

Trade and logistics operators are especially concerned about the potential closure of the Strait of Hormuz, through which a third of the world’s seaborne oil — and much of Qatar and the UAE’s gas exports — flow. While Dubai-based DP World reports that operations at Jebel Ali remain unaffected, it confirmed it is working with authorities to ensure rerouting and alternative transport strategies are in place if the situation deteriorates. Though memories of past disruptions — such as the Houthi attacks on Abu Dhabi in 2022 — linger, most firms are treating evacuation as a last resort. Still, regional clients are asking public relations firms for guidance on messaging in the event of an attack on a financial center. “There are a range of targets that could be in play if this conflict escalates,” said Phil Miles of Kroll. “Businesses need to be thinking beyond just Israel and Iran.”

Sources: CIA; marinetraffic.com, FT research

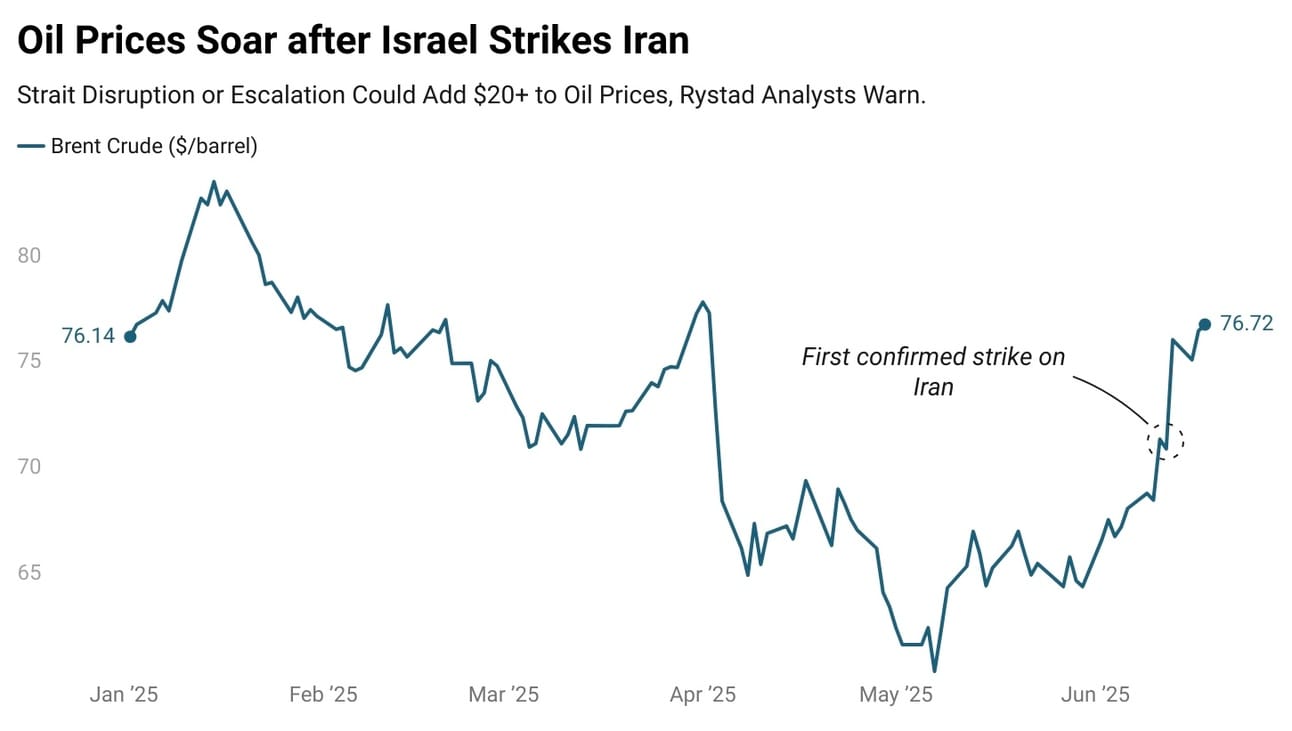

Oil prices have surged sharply, with Brent and WTI jumping over 4% in a single day as fears of supply disruptions drive a sustained risk premium. Analysts warn that if Iran’s 1.1 million barrels per day (bpd) in oil exports are halted, Brent could remain 15–20% above pre-crisis levels — and may spike as high as $120–$130 if the Strait of Hormuz is closed.

Iran, OPEC’s third-largest producer, pumps about 3.3 million bpd and exports over 2 million. The Strait of Hormuz — a critical chokepoint near Iran — handles roughly 20% of global oil flows. Any U.S. military action or further escalation raises the risk of Iranian retaliation against shipping through the strait, threatening a severe disruption to global supply. While Saudi Arabia and the UAE have spare capacity estimated at 3.5 million bpd combined, most other OPEC+ members have little flexibility due to years of underinvestment and sanctions. A prolonged outage of Iranian supply could overwhelm the group’s ability to stabilize the market, leaving oil prices exposed to further geopolitical shocks.

Saudi Arabia and UAE Under Pressure

Quotas

According to Reuters, Saudi Arabia and the United Arab Emirates are the only OPEC+ members with the capacity to quickly ramp up oil production, with a combined potential increase of around 3.5 million barrels per day (bpd), analysts and industry sources said. Concerns that Israel may target Iranian oil facilities—potentially cutting off Iran’s primary revenue stream—have helped drive oil prices higher, with Brent crude rising nearly 7% to trade above $74 per barrel on Friday. Saudi Arabia, the de facto leader of OPEC, has taken the lead in accelerating production increases, in part to penalize members that have exceeded their quotas under OPEC+ agreements. Despite recent hikes, the group still maintains around 4.5 million bpd in output cuts that were put in place over the past five years to stabilize the market.

Saudi oil production is expected to rise above 9.5 million bpd in July, giving the kingdom additional capacity of roughly 2.5 million bpd if needed. The UAE has stated that its maximum production capacity is 4.85 million bpd and reported April crude output at just over 2.9 million bpd—figures largely validated by OPEC’s secondary sources. However, the International Energy Agency (IEA) estimated UAE output at 3.3 million bpd in April and believes it could raise production by another 1 million bpd. BNP Paribas projects even higher figures, estimating UAE output between 3.5 and 4.0 million bpd.

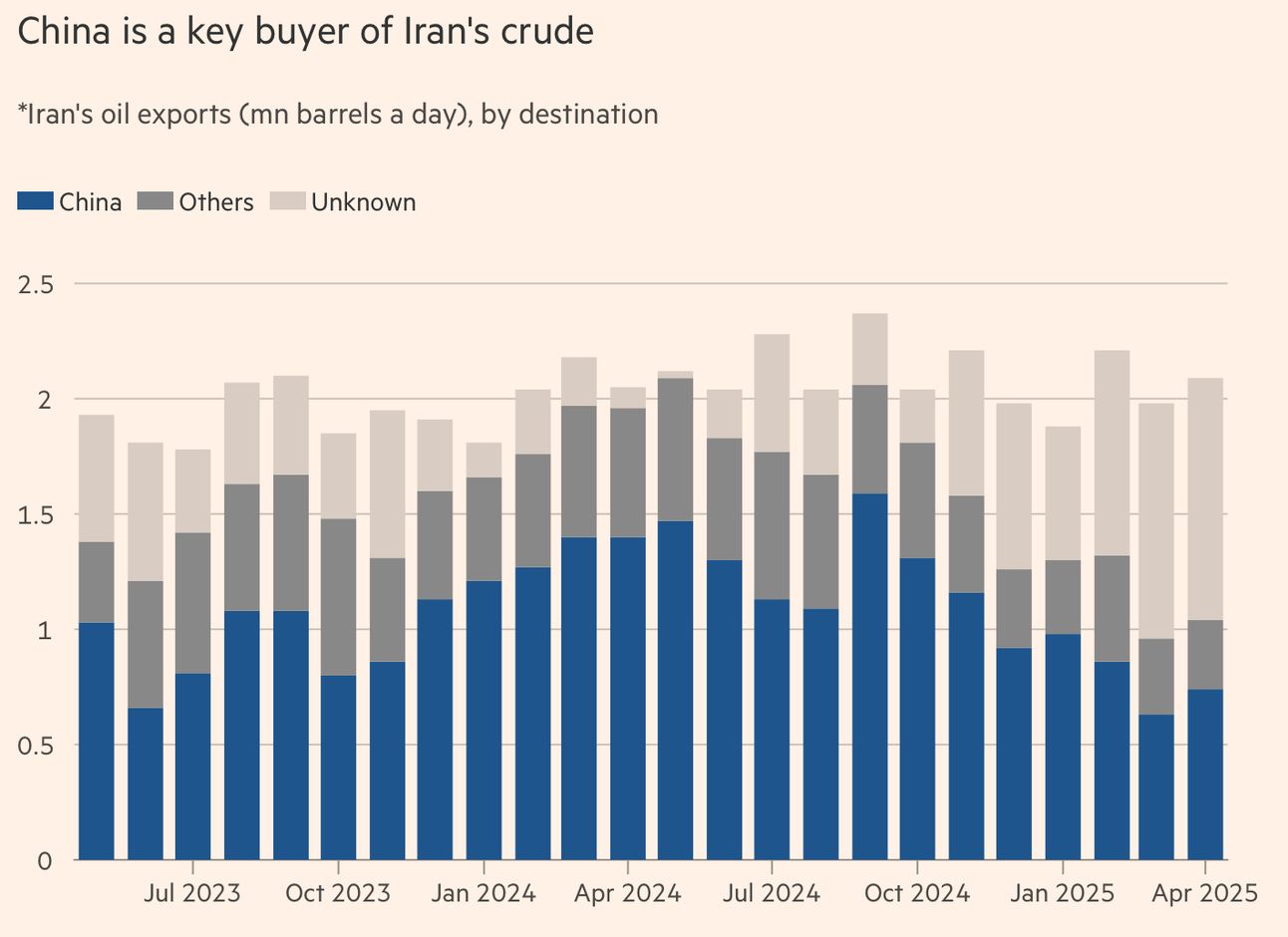

China and Iran

The Financial Times reported that Israel’s recent attacks on Iran threaten to severely disrupt China’s energy security by jeopardizing its access to key oil suppliers and undermining Beijing’s broader geopolitical ambitions in the Middle East. China has long relied on discounted Iranian crude and Gulf-state oil to meet the needs of the world’s largest oil-importing economy. Beijing has also used its deepening ties with Tehran to expand its influence in the region. Now, rising tensions risk cutting China off from Iran—one of its key energy partners—while exposing the fragility of its strategic reliance on Gulf oil flows.

Chinese President Xi Jinping called for de-escalation, urging all sides to prevent further conflict, while criticizing U.S. interference in what China considers “normal trade” with Iran. Experts note that if Israel’s attacks escalate or if Iran retaliates by closing the Strait of Hormuz, it could severely impact China’s crude supply. In 2024, Iran was shipping about 2.4 million barrels per day (bpd), with China accounting for 1.6 million bpd. But by April 2025, Chinese imports had dropped to 740,000 bpd amid rising fears of new U.S. sanctions. China also receives relabeled Iranian oil via intermediaries like Malaysia, a tactic used to circumvent restrictions. Meanwhile, China imported an average of 11.1 million bpd overall in 2024, with Iran supplying up to 15% of that volume at its peak.

While analysts at Fitch believe OPEC+ could potentially replace lost Iranian exports in the short term, the broader concern is a regional spillover. Hundreds of billions of dollars in oil and gas pass through the Strait of Hormuz each year en route to China, with major suppliers including Saudi Arabia, the UAE, and Qatar. More than a quarter of China’s LNG imports in 2024 came from Qatar and the UAE. S&P Global notes that while China holds 15 long-term LNG contracts with these states, any disruption could force it to buy on the volatile spot market at higher prices. Though China does not disclose strategic reserve levels, estimates suggest it has roughly 90–100 days’ worth of oil cover.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.