Western Sanctions

Moscow has a history of using ‘dark fleet’ vessels to ship oil across the globe amid Western sanctions. Estimates suggest the fleet now comprises 600 to 1,400 vessels. It accounts for about 10% of the global wet cargo fleet (which carries liquids). The fleet has expanded by over 300 ships since February 2022 and now handles about half of all Russian oil shipments. Russia may now be expanding its dark fleet to carry liquefied natural gas (LNG), a story the Financial Times has been following since early August. European sanctions on Russian pipeline gas have made eurozone nations increasingly dependent on imported LNG, particularly in the context of Russia’s invasion of Ukraine.

After halting imports of pipeline gas from Russia after its full-scale invasion of Ukraine, Europe’s dependence on shipments of LNG has grown substantially. LNG currently accounts for roughly a third of the EU’s gas demand and 10 per cent of it comes from Qatar.

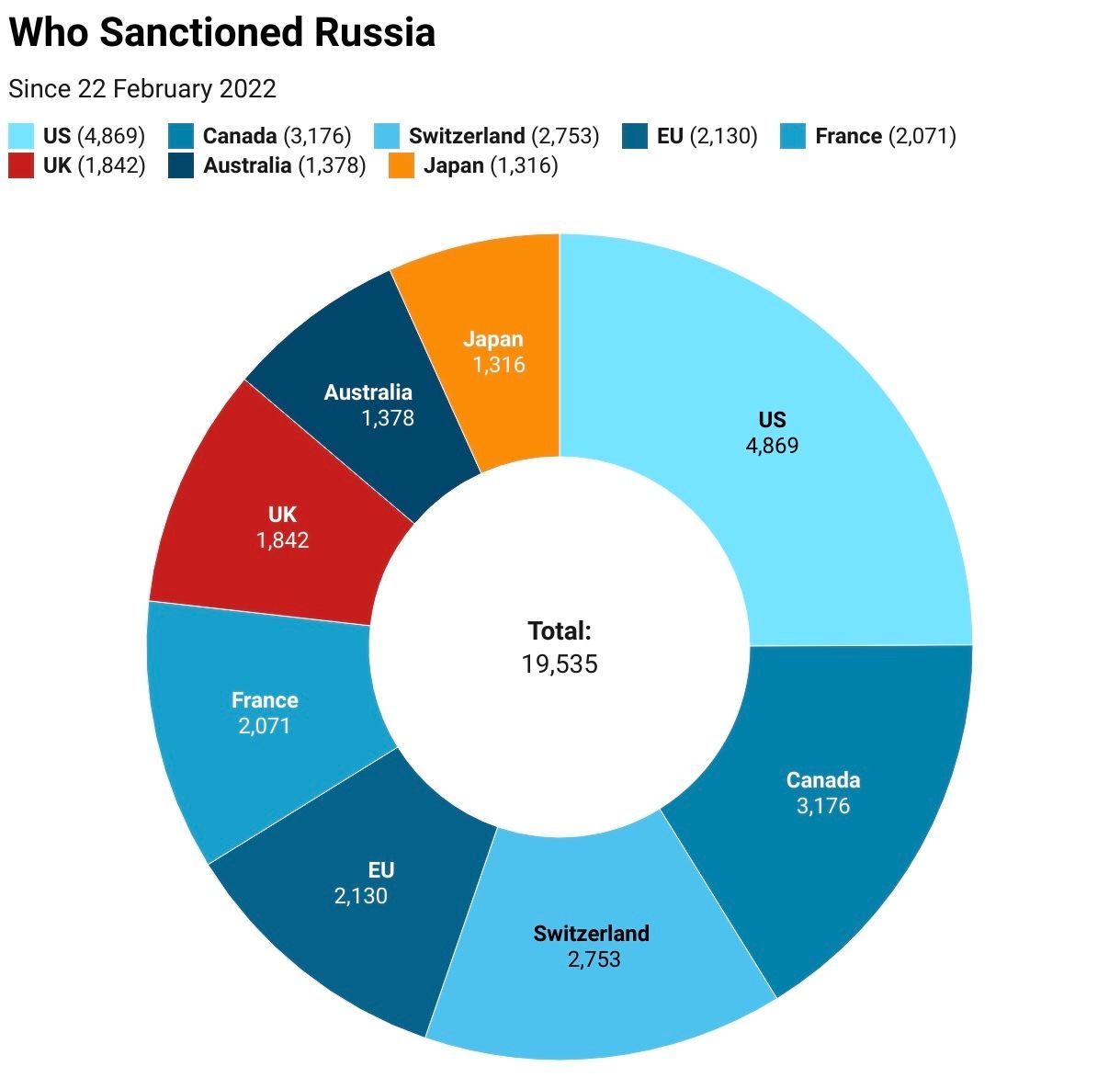

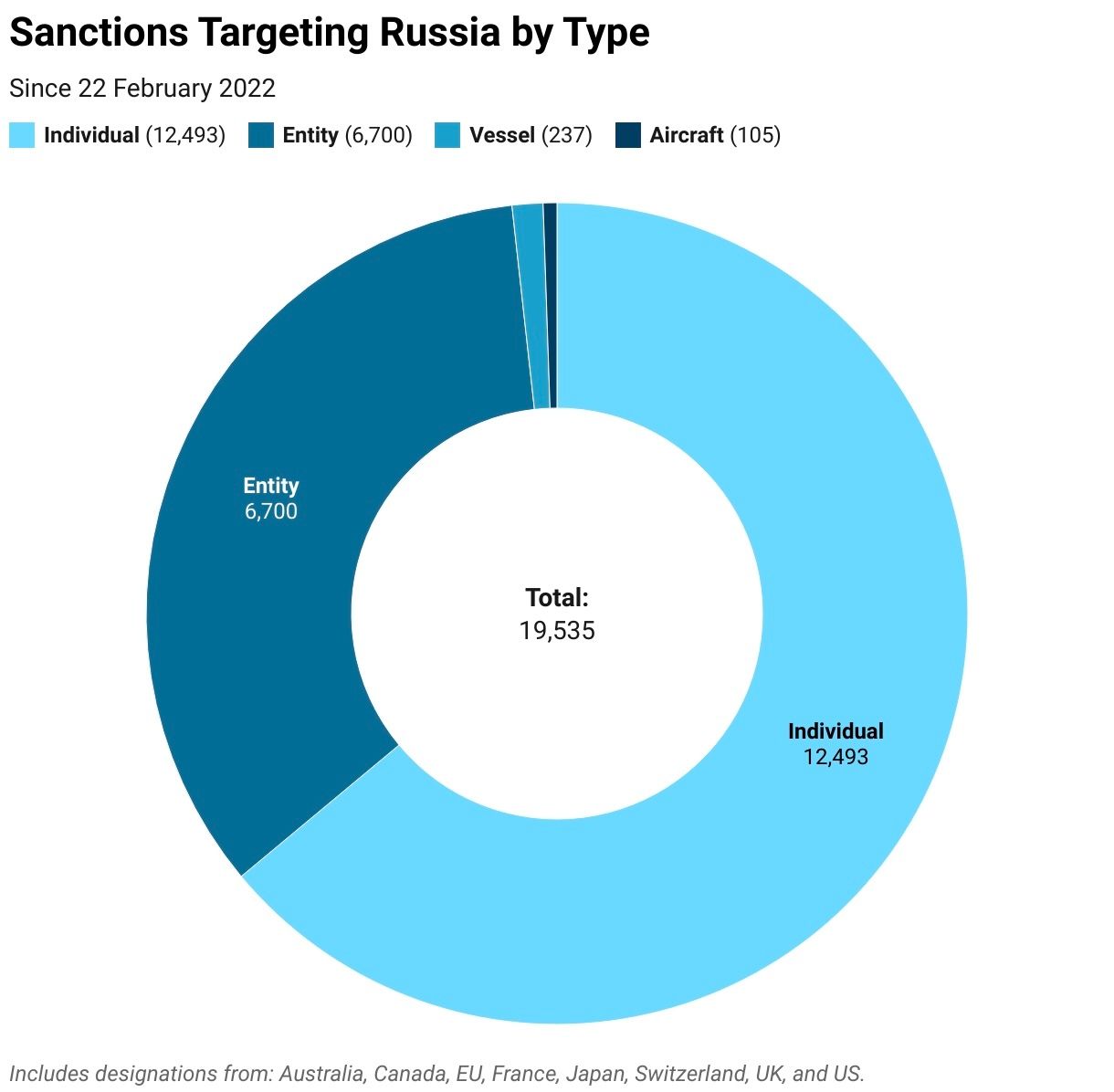

Over 16,500 sanctions have been imposed on Russia by Western countries, targeting its financial sector, oil industry, technology exports, and individuals linked to the Kremlin. Key measures include freezing approximately $350 billion of Russia’s foreign currency reserves, restricting access to the SWIFT financial messaging system, and the G7’s imposition of a $60 per barrel price cap on Russian oil exports. Furthermore, hundreds of Western companies have exited the Russian market. In response, Russia has developed a “dark fleet” to facilitate the export of its oil to willing buyers such as China and India, bypassing the G7 price cap. This fleet is now being used to transport not only crude oil but also liquefied natural gas (LNG).

A report released on October 10th highlighted that EU sanctions are affecting over three million tonnes of Yamal LNG annually and have effectively halted transhipments from the Arctic LNG 2 project. Jan-Eric Fähnrich, a senior gas markets analyst at Rystad Energy, confirmed this in an interview with LNG Shipping & Terminals. In an effort to curb the Russian dark fleet, the U.K. has sanctioned 25 vessels in this fleet, including 10 in September 2024. These vessels are now barred from U.K. ports and removed from the U.K. ship register. The U.S., U.K., and EU are enhancing information sharing to better track ships engaged in deceptive practices. In December 2023, the International Maritime Organization (IMO) adopted a resolution urging action against dark fleets.

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

The Nature of Dark Fleets

Origin

According to Lloyd’s List Intelligence the term ‘dark fleet’ evolved from a few years ago after select vessels were switching off their tracking transponders to avoid detection and obscure the origin and destination of the oil on the tanker. The practice known as "going dark" became synonymous with the growing fleet of tankers shipping Iranian and Venezuelan oil to willing buyers. However, "going dark" was just one of many evasive and deceptive shipping tactics observed.

What is a Shadow or Dark Fleet?

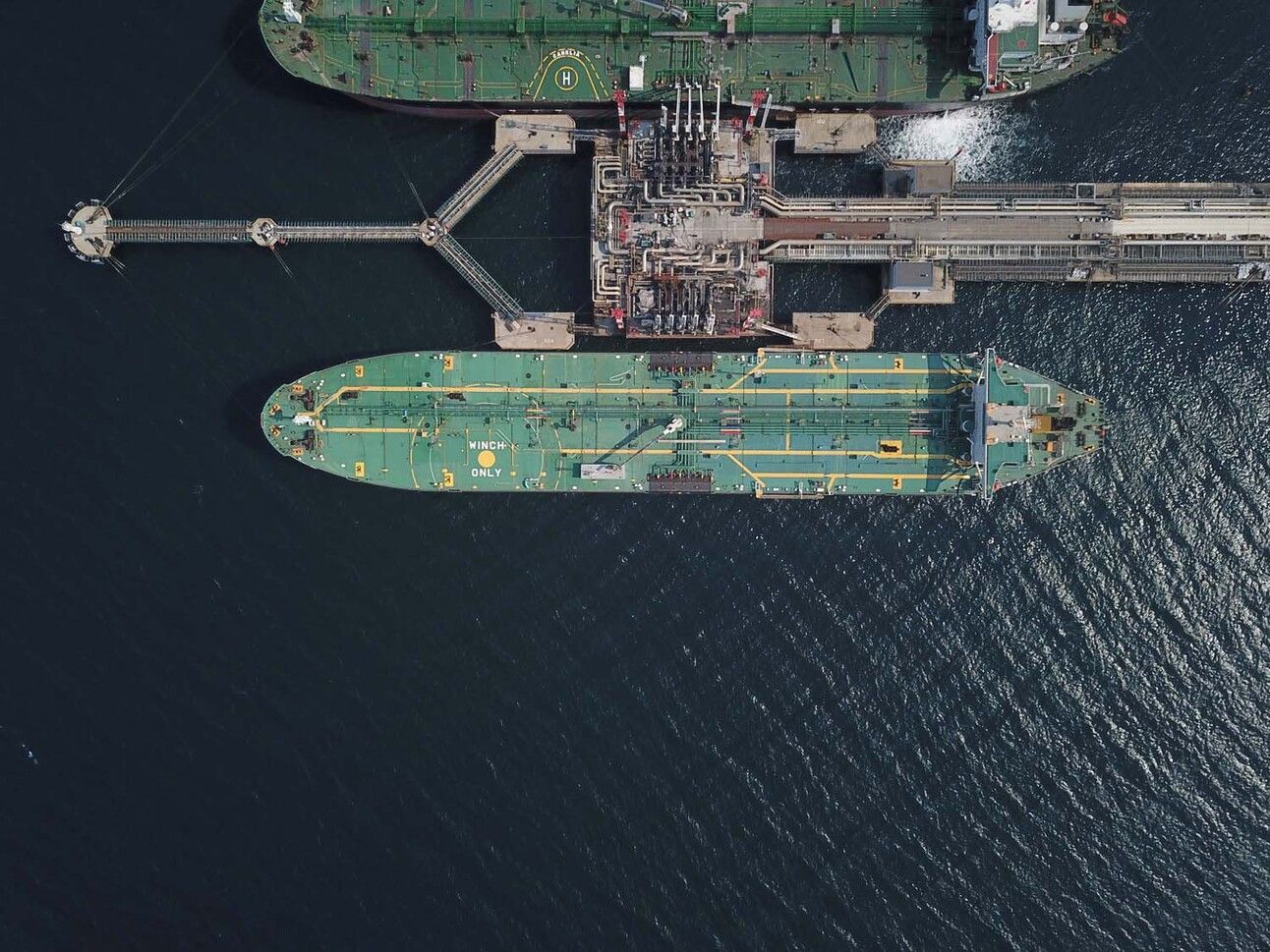

The “dark fleet” or “shadow fleet” consists primarily of older tankers that often have not undergone recent inspections and lack proper maintenance. Ownership of these vessels is typically unclear, and they frequently operate without adequate insurance coverage to evade sanctions and reduce high insurance costs. This situation increases the risk of oil spills or collisions and may allow shipowners to evade liability under relevant liability and compensation treaties.

A fleet of anonymously owned, aging tankers, drawn to the high-risk, high-reward nature of sanctions-evading oil trades, exploits various regulatory loopholes. These dark fleets are naturally aging tankers largely without maritime insurance that will operate outside regular sea regulation for vessels transporting oil or liquefied natural gas. Vessels often engage in ship-to-ship transfers to obscure the origin of their cargo. Identifying dark fleet activities in LNG transportation is easier compared to oil tankers, as there are fewer LNG vessels, making them more noticeable, according to the Financial Times.

The fleet is expanding with the vessels usually possessing the following characteristics:

Older vessels, often 15-20 years old.

Smaller capacity compared to modern tankers.

Use of older systems such as steam propulsion.

Ownership transferred to shell companies in non-sanctioning countries such as the UAE.

Registration under non-White List flags indicates that a ship has been registered in a jurisdiction that is not fully compliant with international regulations.

How They Remain Undetectable

AIS Manipulation

One of the primary tactics used to circumvent sanctions is manipulating Automatic Identification System (AIS) signals. AIS spoofing involves vessels transmitting false location data to make it appear they are operating in a different area. For instance, the LNG carrier Pioneer was confirmed by satellite imagery to be loading cargo at the sanctioned Arctic LNG 2 terminal, while its AIS signal misleadingly showed it anchored in the Barents Sea, 800 miles away. Another method, known as “going dark” which was previously discussed involves ships disabling their AIS broadcasts entirely to avoid detection. Though less common, as it attracts increased scrutiny, this practice also complicates enforcement efforts.

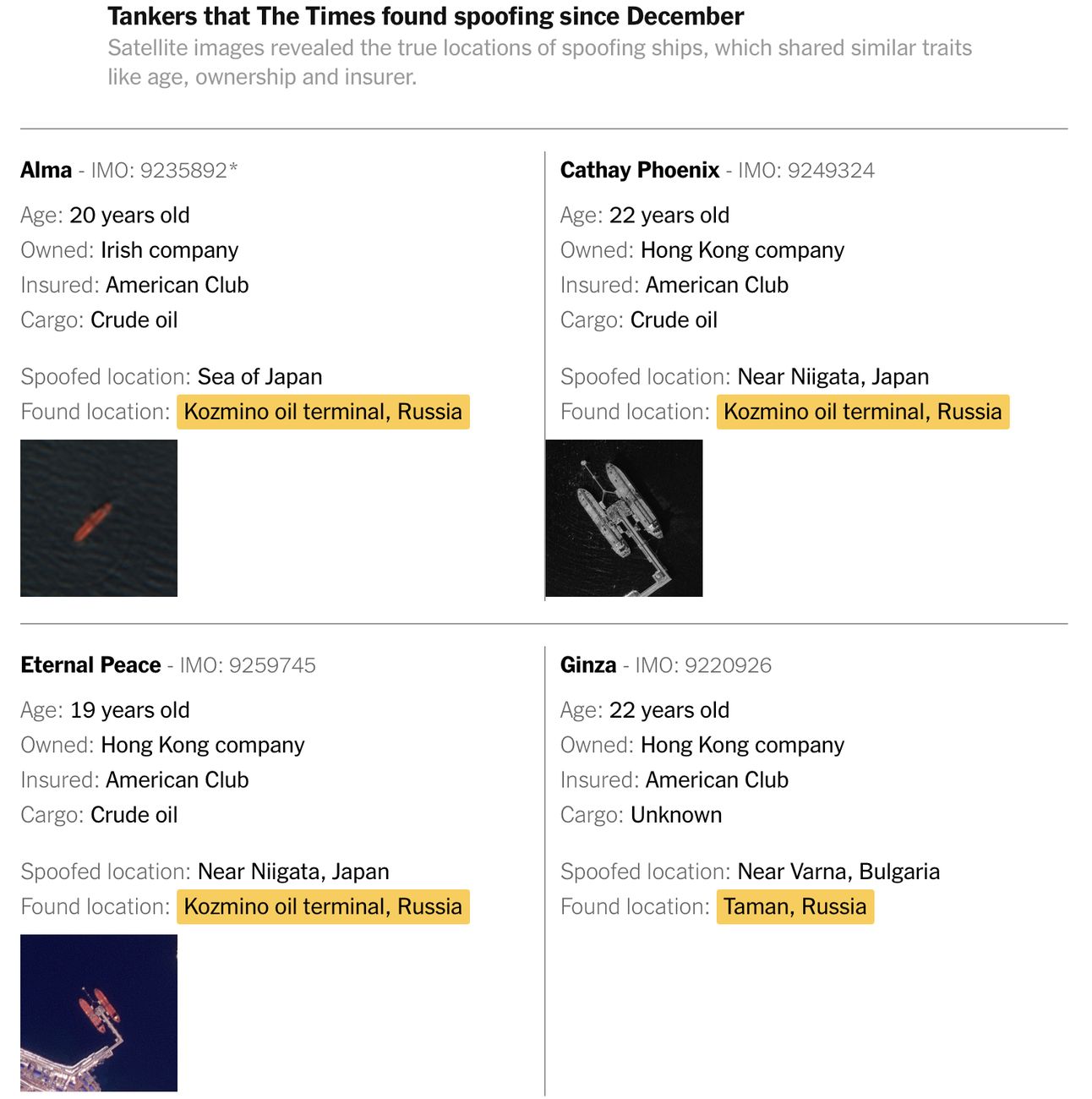

A 2023 article by SkyTruth demonstrated how AIS manipulation is exploited by Russian tankers to obscure the actual location of the vessel. SkyTruth presents evidence that between January and May 2023, four tankers—GINZA, TIVY GOLD, KATSUYAMA, and LOURA B—broadcast false positions in the Black Sea, likely to evade detection by monitoring authorities as they entered Russian ports.

One of these ports, Taman, experienced explosions on May 3 2023, reportedly due to a drone attack. A combination of satellite imagery and data from the tankers’ AIS reveals that while they broadcast positions in the western Black Sea near the coasts of Bulgaria and Romania, sometimes for weeks, their true locations were near the Kerch Strait, 400 miles to the northeast. These findings follow a December report identifying a Russian-flagged oil tanker, KAPITAN SCHEMILKIN, that was also producing false broadcasts, marking the first detection of a Russian-flagged tanker sending false AIS signals.

The New York Times reported a similar pattern of location “spoofing,” with multiple tankers displaying false locations while actually being near the Russian Kozmino Oil Terminal. This terminal is a key hub for Russian oil exports to Asian markets, particularly China and India. Transneft, the Russian pipeline operator, expects terminal loadings to reach 46 million tons by the end of 2024, approaching its 50 million-ton capacity.

Obscuring Vessel Ownership Structure

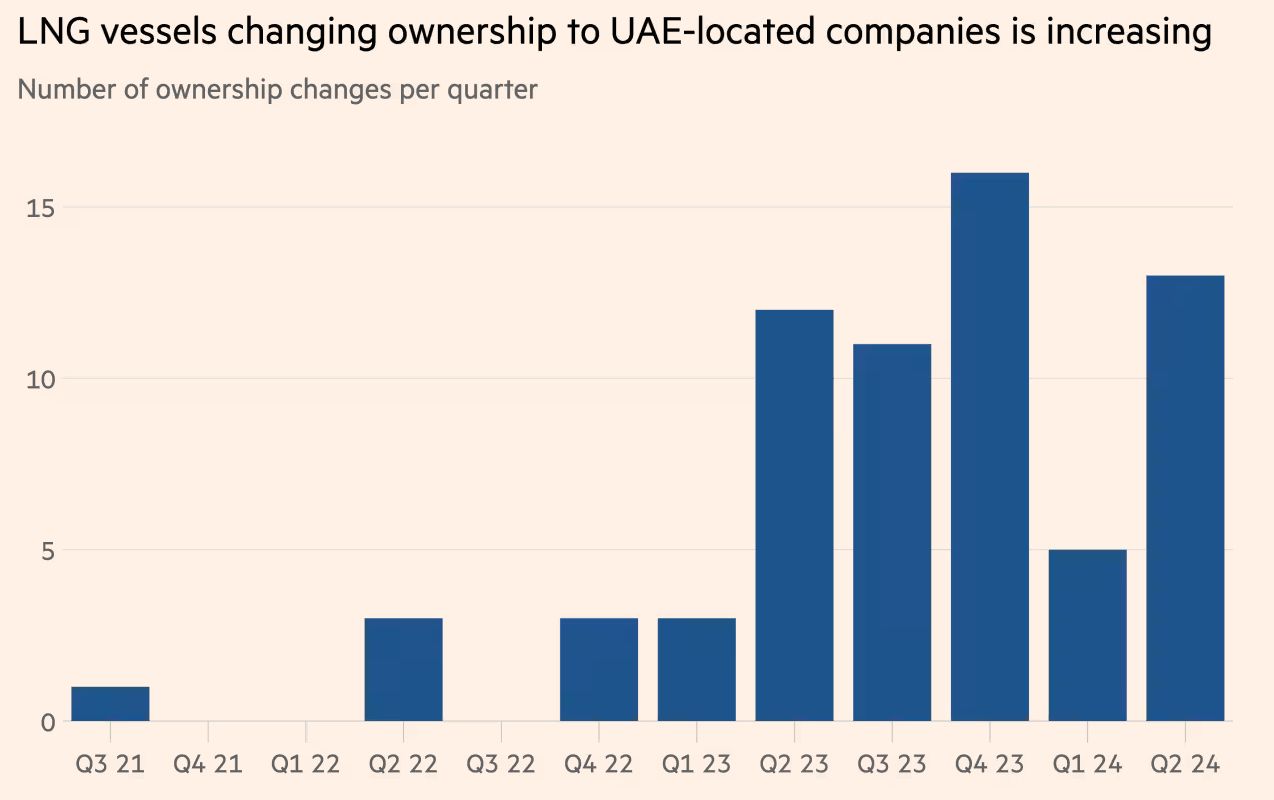

In addition to location spoofing reports indicate that many Russian vessels are bypassing sanctions by transferring ownership to shell companies in non-sanctioned countries with low transparency, such as the UAE. Earlier this year, the Financial Times reported a sharp increase in ownership changes for LNG vessels to UAE-based companies, which are likely still operated by Russian entities. This practice allows Russian vessels to evade sanctions and continue operations under the guise of new ownership, exploiting regulatory loopholes in countries with less stringent oversight.

Source: Financial Times

According to consultancy firm Windward, more than 50 LNG vessels changed ownership to companies located in the UAE from the second quarter of 2023, whereas such transactions were previously rare as shown above in the graphic from the Financial Times. According to a report by the Observers, three tankers, built in 2005, 2002, and 2003, were purchased in April, May, and February 2024 by Nur Global Shipping, a company previously unknown in the LNG sector, according to several analysts. Nur Global Shipping is based in the United Arab Emirates, a country notorious in the shipping industry for providing minimal information on vessel ownership. Its address is linked to one of the UAE’s free zones, which allow foreign investors to establish businesses while benefiting from various advantages, including tax incentives. Setting up a business in these free zones can be done online for €3,000, without the need to visit the country.

The website is minimal and offers little information beyond the standard services provided by the company. Established in 2022, it is relatively new to the LNG sector.

LNG Prices on the Rise

A report from the Observers in August detailed an investigation revealing satellite images from that month showing two liquefied natural gas (LNG) tankers docked at the Arctic LNG 2 port, a Russian LNG production mega-project sanctioned by the United States. These tankers transmit false GPS coordinates and are linked to opaque companies reportedly based in Dubai, suggesting they may be part of a “dark fleet” designed to export LNG and circumvent existing U.S. sanctions. On August 23, the United States added the two LNG tankers to its sanctions list.

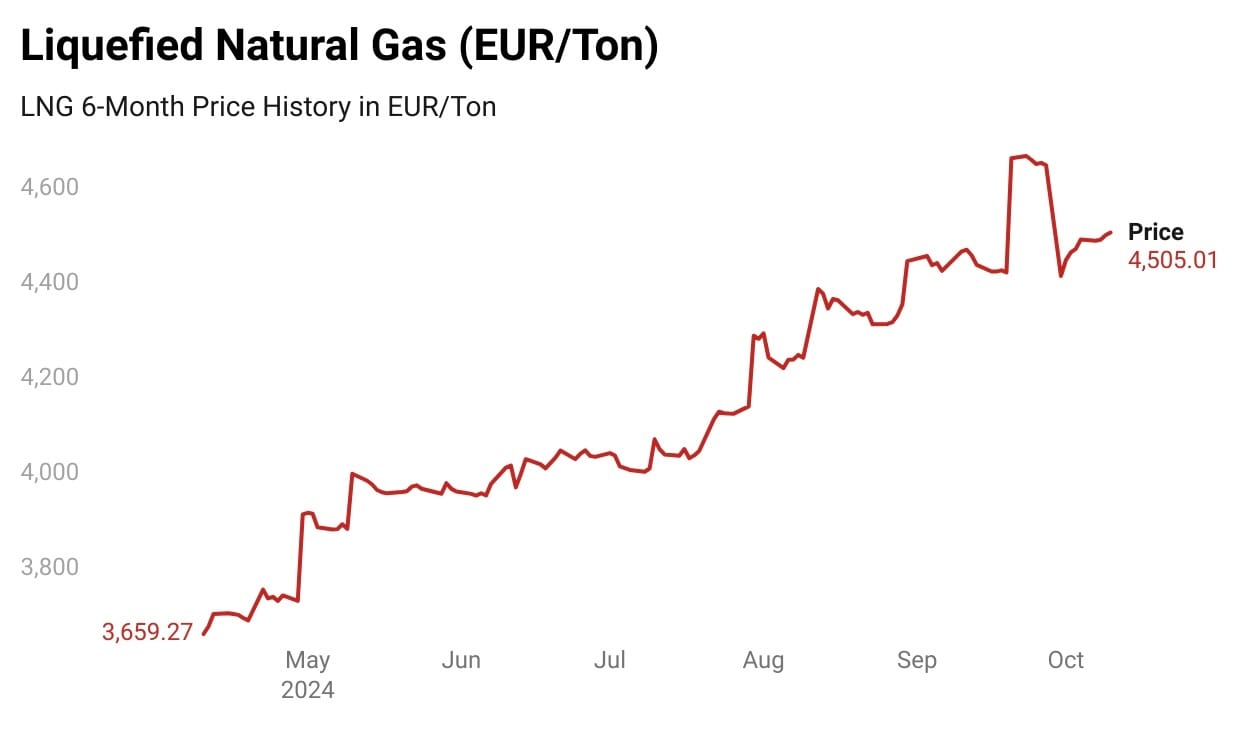

The rise of the dark fleet coincides with a 25.53% increase in LNG prices since the beginning of 2024. The TTF month-ahead price was assessed at €37.75/MWh ($42.24/MWh) on Sept. 27, which is still relatively elevated compared to historical averages. According to S&P Global Europe will still require LNG to meet winter demand. Commodity Insights forecasts LNG imports to the EU and UK in the fourth quarter at approximately 362 million cubic meters per day, a 6% decrease year-on-year but higher than the year-to-date average. Since the Russian invasion of Ukraine, Europe has deployed new floating LNG import infrastructure, with more floating storage regasification units (FSRUs) set to be operational in Q4. The much-anticipated Alexandroupolis FSRU is scheduled to begin commercial operations on October 1, while two additional FSRUs are expected to start operations in Germany—one at Stade and another at Wilhelmshaven.

Source: FactSet

The recent August report from the Financial Times highlights challenges in accurately tracking Russian LNG shipments, particularly due to imperfect satellite imagery and voluntary vessel draft reporting. This uncertainty raises concerns about potential covert transfers of Arctic LNG 2, which could support Russia’s wartime economy while still keeping prices elevated.

Experts indicate that LNG ship-to-ship (STS) transfers, such as those happening near Kildin Island in the Arctic, are becoming more common as part of this effort. However, this operation faces logistical constraints, including a smaller fleet of LNG carriers and fewer available ports compared to oil transfers, making the task more complex. Despite this, Russia is expected to find buyers, particularly among BRICS nations like China and India, who have shown interest in Russian energy exports.

Ultimately, the opacity of data and evolving shipping tactics, including spoofing and diversions, mean that full certainty about the extent of these operations remains elusive.

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.