What New Tariff Research Can Tell Us

The financial media spotlight this week centered on the Trump administration’s trade policy. As widely anticipated, the administration pledged to impose 25% tariffs on all imports from Mexico and Canada. Additionally, President-elect Trump, set to assume office early next year, announced a further 10% tariff on Chinese goods, which would be applied on top of existing trade taxes. The administration stated that the tariffs would remain in effect until open borders and the illicit trafficking of narcotics from neighboring countries of the United States no longer pose a threat according to a Thursday report from the Financial Times. A report from EY suggests that the proposed tariffs would likely violate USMCA provisions, though Trump may use the agreement’s 2026 renewal as a bargaining tool. Meanwhile, a significant legal challenge to the Chinese tariffs is set for oral arguments on January 8, 2025.

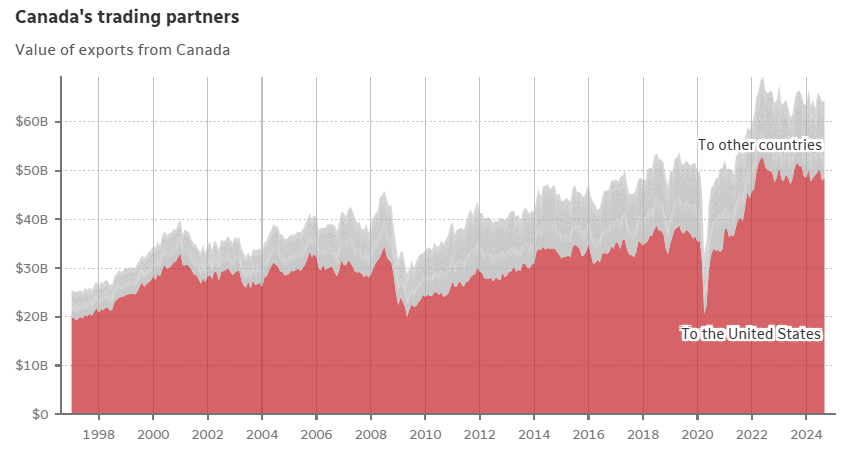

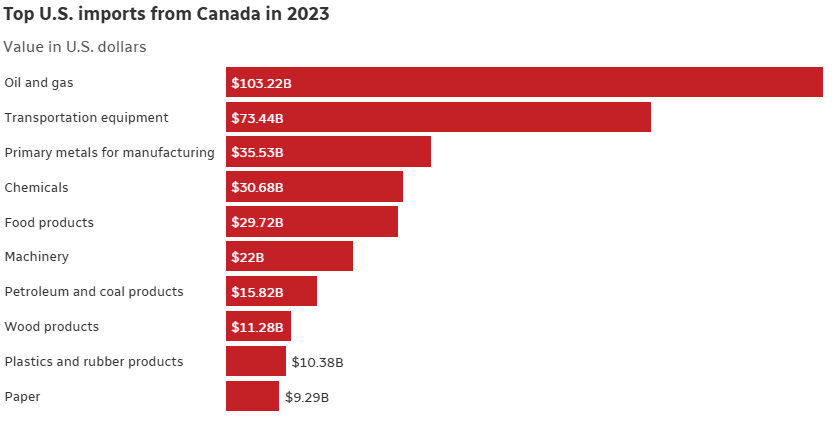

Practitioners and economists alike question whether the tariffs will exempt Canadian energy. If not, the cost of Canadian crude—Canada being the United States’ largest foreign supplier—could rise by 25%. According to Enerknol the U.S.-Canada oil trade has steadily grown over the past decade, with imports increasing by approximately 4% annually between 2013 and 2023. By 2023, Canadian crude accounted for 24% of U.S. refinery throughput, up from 17% in earlier years. Notably, the U.S. imported nearly 3.9 million barrels of crude oil per day from Canada in 2023. In addition to Canadian energy the implications for other goods have some speculating an impending recession with estimated of a potential GDP decline of 1% by the end of 2026 if tariffs are enacted. Along with energy the North American automotive sector is likely to be impacted with over 20% of the supply chain being conducted cross border.

Goldman Sachs has estimated these tariffs would have a significant impact on United States government revenue as well as the price level:

Generate $300 billion in annual U.S. government revenue

Increase core PCE prices by 0.9%

Raise the effective U.S. tariff rate by 8.6%

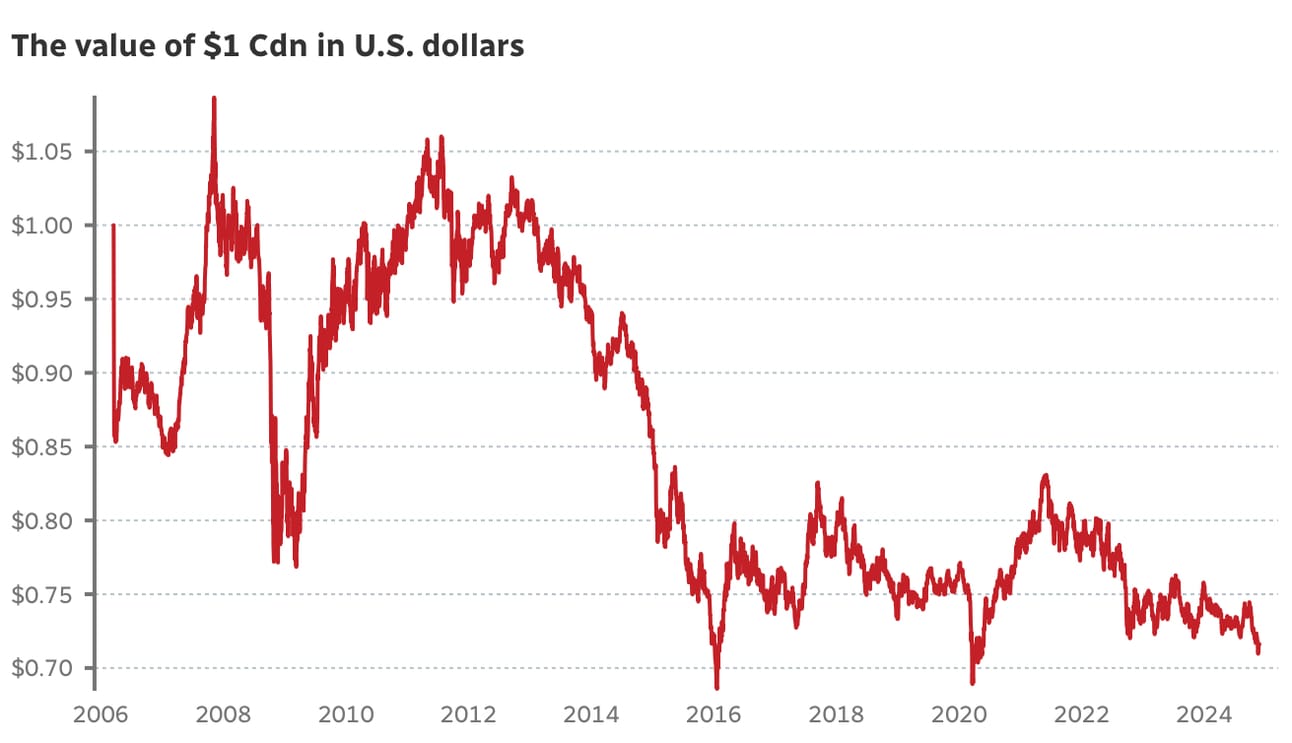

One of Goldman’s most striking forecasts is the potential collateral damage to the already weak Canadian dollar. Goldman projects that the USD/CAD and USD/MXN exchange rates could increase by 13% and 17%, respectively. The announcement earlier this week sparked a sell off in the Canadian dollar and Mexican peso weakling 0.6% and 1.9% against the U.S. dollar respectively. The British pound, Korean won and Australian dollar all declined as well as the Chinese yuan.

The prospect of trade taxes, combined with an ongoing easing cycle, is weighing heavily on the already weak Canadian dollar. The loonie has fallen to 70.53 cents against the U.S. dollar, its lowest level in four and a half years. This marks a significant drop from its peak of C$1.21 per USD in May 2021. A weaker Canadian dollar is expected as the Bank of Canada is slightly ahead of the Federal Reserve’s easing cycle.

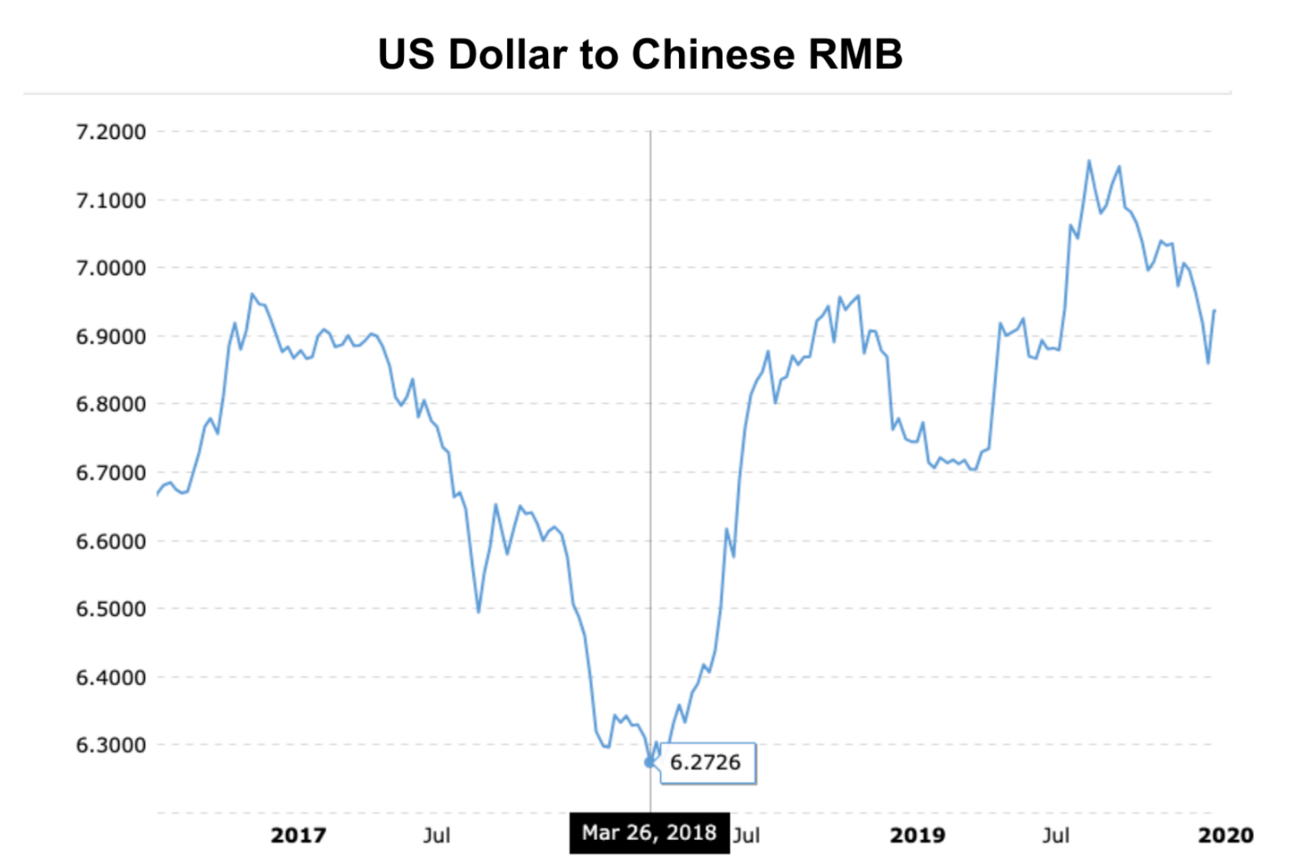

New research published in 2024 (circulated in 2020) on the 2018 and 2019 U.S.-China trade war explores the impact of potential tariffs on exchange rates, offering evidence of how markets react and how exchange rates adjust to mitigate trade barriers. The April 2024 paper by Jeanne & Son in the Journal of International Money and Finance examines the extent to which tariffs are offset by exchange rate adjustments.

The paper suggests that there is a theoretical expectation that tariffs are offset by currency adjustments, with the tariff-imposing country’s currency appreciating or the targeted country’s currency depreciating as seen in the above figure. Using a calibrated model, the authors find that the 2018-19 U.S.-China trade war likely had minimal impact on the U.S. dollar but significantly depreciated the Chinese renminbi. This conclusion aligns with high-frequency event analysis, which shows that tariff-related news accounted for at most 20% of the dollar’s effective appreciation but around 66% of the renminbi’s effective depreciation during that period. The authors also note that their findings also supports earlier research of Matveev and Ruge-Murcia (2023), who discovered that tweets by the U.S. President regarding the potential termination of NAFTA led to a 2 to 5 basis point appreciation of the U.S. dollar against the Mexican peso and Canadian dollar within five minutes. These tweets also had a similar impact on forward rates according to the authors.

The existing literature and perspectives on how exchange rates influence and are influenced by trade tensions provide valuable insights into potential developments next year, should tariffs be imposed on U.S. trading partners.

What We’re Searching With.

Oh, the internet. It can be a scary place… but less so with Freespoke. Freespoke is a search engine that does a few important things differently:

News results show all sides with media biases labeled (left, middle, right)

Their new election portal delivers unbiased election coverage so you can make up your own mind

No adult content by default – they’re a partner in protecting your families from bad content.

Freespoke is the search platform that respects your privacy and doesn’t manipulate the information you find online.

The Relationship Between Exchange Rates and Tariffs

Direct Exchange Rate Effect

When a country imposes tariffs on imports, the domestic currency often strengthens. This occurs due to reduced demand for foreign goods, increased domestic production, and shifts in relative prices between domestic and foreign products. The magnitude of the offset of the exchange movement depends on the Import and export elasticities measure how responsive the quantity of imports and exports is to changes in price. These elasticities significantly influence the extent to which exchange rate movements offset the effects of tariffs.

The Workings of Import Elasticity and Exchange Rate Offsets

Larger Import Elasticity Increases the Offset: If import demand is highly elastic (sensitive to price changes), a tariff-induced appreciation of the domestic currency will cause foreign goods to become cheaper in domestic currency terms, even with tariffs. This price adjustment reduces the effectiveness of tariffs in discouraging imports, leading to a larger exchange rate offset.

Larger Export Elasticity Decreases the Offset: If export demand is highly elastic, the appreciation of the domestic currency (caused by tariffs) makes domestic goods more expensive for foreign buyers. This dampens export demand, reducing the net impact of exchange rate movements and limiting the offset.

One can think of these offsets like a thermostat in a climate-controlled room: When you impose a "tariff" (adjust the thermostat to heat the room), the system (economy) reacts. If the windows are open (high import elasticity), cold air rushes in more easily, making it harder to warm the room, and the thermostat works harder to compensate—similar to a larger exchange rate offset reducing the tariff's impact.

Conversely, if the windows are tightly sealed (low export elasticity), the heat stays inside, and the system doesn't need to work as hard to maintain the desired temperature, resulting in less offset and a more effective tariff.

In essence, the balance between these elasticities determines how much exchange rate movements counteract the intended effects of tariffs on trade balances. This all depends heavily on assumptions including full employment, if the tariffs are implemented immediately etc..

The imposition of tariffs appears to directly influence the feedback channel through exchange rate movements. The paper discussed in the previous section from the Journal of International Money and Finance found that news of U.S. tariffs led to an appreciation of the dollar and a depreciation of the renminbi, with the impact on the renminbi being more than twice as large as that on the dollar. In contrast, news of Chinese tariffs did not have a statistically significant effect on either the dollar or the renminbi. The study is conducted at a fairly high frequency taking exchange rates at ten-minute intervals in the surrounding hours of a tariff announcement.

Applying this methodology to the current trade landscape involving Canada and Mexico, any retaliatory tariffs imposed or announced by these U.S. trading partners are unlikely to have a significant effect on their respective currencies. Such actions would likely have a smaller impact on exchange rates overall. The USD would likely remain largely unaffected or experience only minimal depreciation. Meanwhile, the CAD might recover slightly if markets perceive the retaliation as a balancing force. However, this outcome would depend on the scale and scope of Canada's response which has yet to be determined.

The Mexican peso experienced significant volatility following tariff announcements, initially plummeting nearly 2% on Trump's 25% tariff threat and hitting its weakest level since March 2022. It later stabilized, rebounding by over 1% in after-hours trading and recovering losses due to eased trade tensions and positive diplomatic developments.

But even after a modest recovery, the Mexican currency remains roughly 8 per cent weaker against the US dollar compared with pre-election levels, a far cry from the tearing rally earlier in the year. The reaction has not been contained to the currency market: investors demanded 10.6 per cent, the highest yield on record, at an auction of 30-year Mexican debt on Tuesday.

The peso's movements were influenced by Banxico's dovish stance, lower inflation expectations, and domestic fiscal concerns, which contributed to a 20% depreciation this year. Improved market sentiment followed Trump’s favorable remarks about his discussion with President Sheinbaum.

Offset Evidence from The 2018 U.S.-China Trade War

As discussed earlier the devaluation of the Chinese Yuan was significant compared to the appreciation of the U.S. Dollar during the 2018 U.S.-China Trade War. For U.S. importers The devaluation of the RMB (as shown in the figure below actually softened the impact of tariffs as American companies were able to purchase more goods from China at the time. Due to the depreciation Chinese businesses stay competitive in foreign markets despite the higher tariffs imposed on their goods. A weaker currency makes exports less expensive for buyers using stronger foreign currencies, effectively lowering the price of Chinese products in international markets. This allowed Chinese exporters to partially absorb the cost of tariffs without significantly raising prices for foreign buyers, enabling them to maintain or even expand their market share.

By making their goods more affordable, the currency devaluation helped offset some of the revenue losses caused by tariffs. Additionally, the weaker RMB reduced the overall financial impact of tariffs on many Chinese manufacturers, even though some faced higher costs for raw materials or intermediate goods imported from the U.S., which became more expensive due to the same currency depreciation. In essence, the weaker RMB acted as a natural counterbalance, softening the blow of tariffs and preserving competitiveness in global trade. During Trump's first term, China allowed the yuan to depreciate by approximately 28–30%, offsetting about 70% of the U.S. tariff increases as tariffs rose from 3% to 20%. According to JPMorgan, a further depreciation of 10–15% is expected.

Canadian and Mexican Monetary Policy

Both the Bank of Canada (BoC) and Mexico's central bank (Banxico) have initiated rate cuts ahead of the Federal Reserve, reflecting divergent monetary policies. The BoC took a decisive step by reducing its target overnight rate by 50 basis points to 3.75%, citing weaker economic indicators and achieving inflation control within its 1–3% target range. In contrast, Banxico has adopted a more cautious approach, implementing a 25 basis point cut to 10.25%, bringing total rate cuts for the year to 75 basis points, with the potential for further reductions as inflation improves. Looking ahead, the BoC appears confident in its stabilized inflation target but remains watchful of risks, while Banxico plans gradual rate reductions, constrained by U.S. trade policy uncertainties, with another 25 basis point cut expected in December.

The Mexican economy is projected to grow by 2.0% in 2024, reflecting a slowdown compared to the previous year. The significant interest rate differential between Mexico and the United States continues to shape currency dynamics this year. Depending on the retaliation of all three key trading partners with the U.S. the dollar has shown significant strength in recent months and looks to continue heading into the new year.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.

:max_bytes(150000):strip_icc()/GettyImages-968819844-f084399962054d939aff07fd3946132e.jpg)