No Victory Over Inflation - Yet

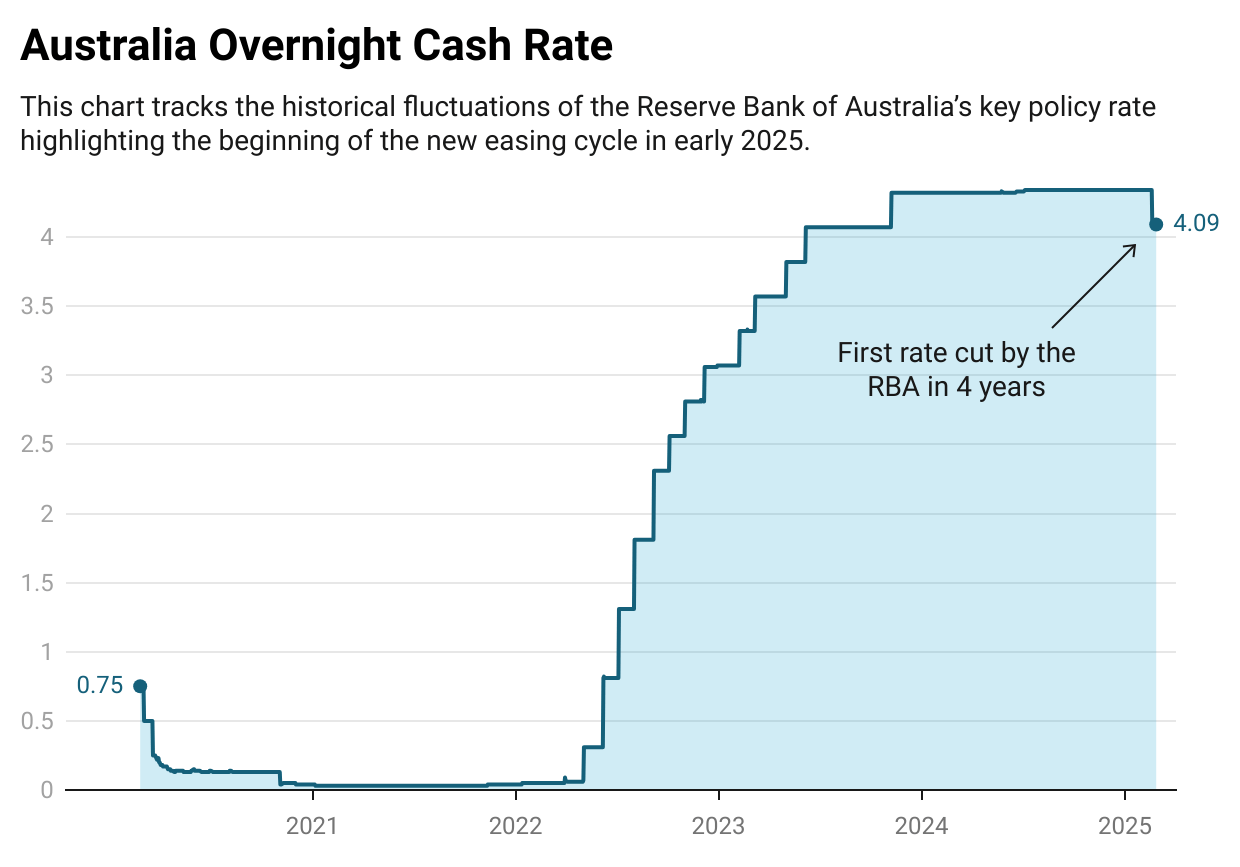

“We cannot declare victory over inflation yet,” is what Reserve Bank of Australia (RBA) Governor Michele Bullock proclaimed early last week as the central bank marked its first rate cut in over four years. Despite signs of easing inflation, the RBA has remained more cautious than its global counterparts, marking its last rate hike of the cycle in late 2023. While Europe and North America have been easing rates for nearly a year, the RBA only introduced its first 25 basis point cut in late February after a subsequent 13 raises since July 2022.

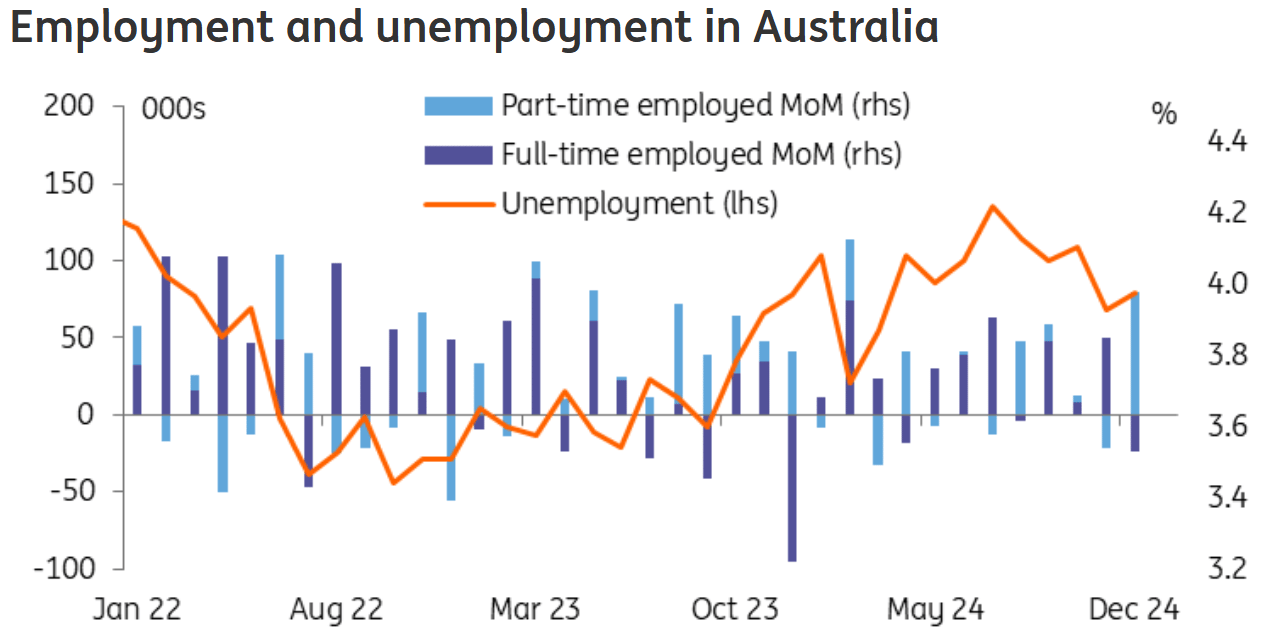

The RBA noted in their February statement that underlying inflation has moderated, dropping to 3.2% in the December quarter, and that higher interest rates are helping balance aggregate demand and supply. Wage pressures have eased and private demand remains subdued, though some labor market data suggest conditions might be tighter than previously thought. Despite progress, the central forecast for inflation has been revised upward slightly, highlighting that easing policy too much, too soon could stall disinflation and leave inflation above the target range.

The central bank also reiterated that the outlook for domestic economic activity remains uncertain, with weak output growth and ambiguous prospects for household spending recovery. International factors, including geopolitical and policy uncertainties, further complicate the picture. In this context, even after a rate cut, the RBA maintains a restrictive monetary policy stance and underscores its commitment to sustainably returning inflation to the 2–3% target range, while remaining prepared to adjust policy based on evolving data. We could describe the central bank's actions as a cautious exploration, echoing the measured tone conveyed by Governor Bullock during her press conference last Tuesday.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

A Look at the Data

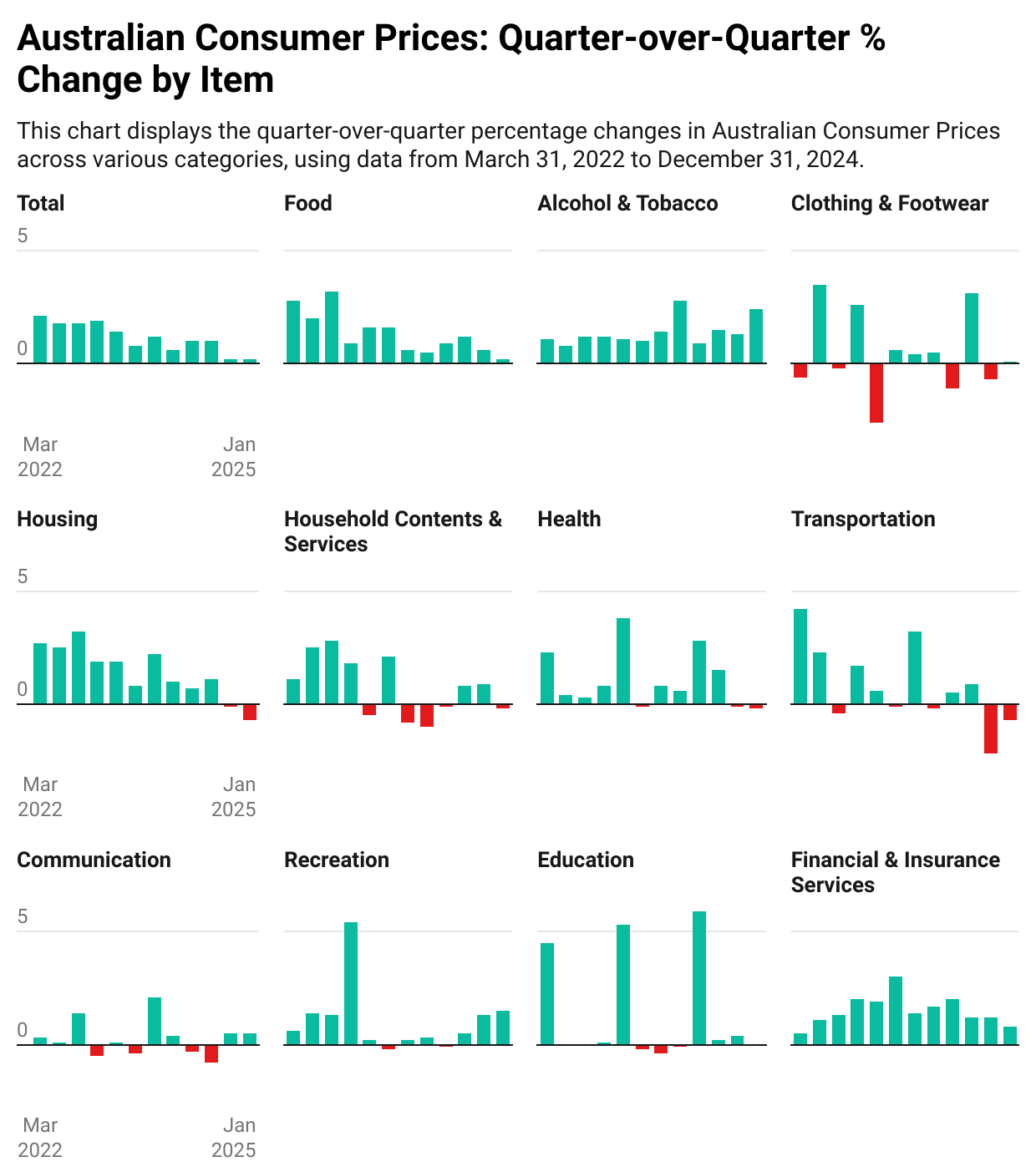

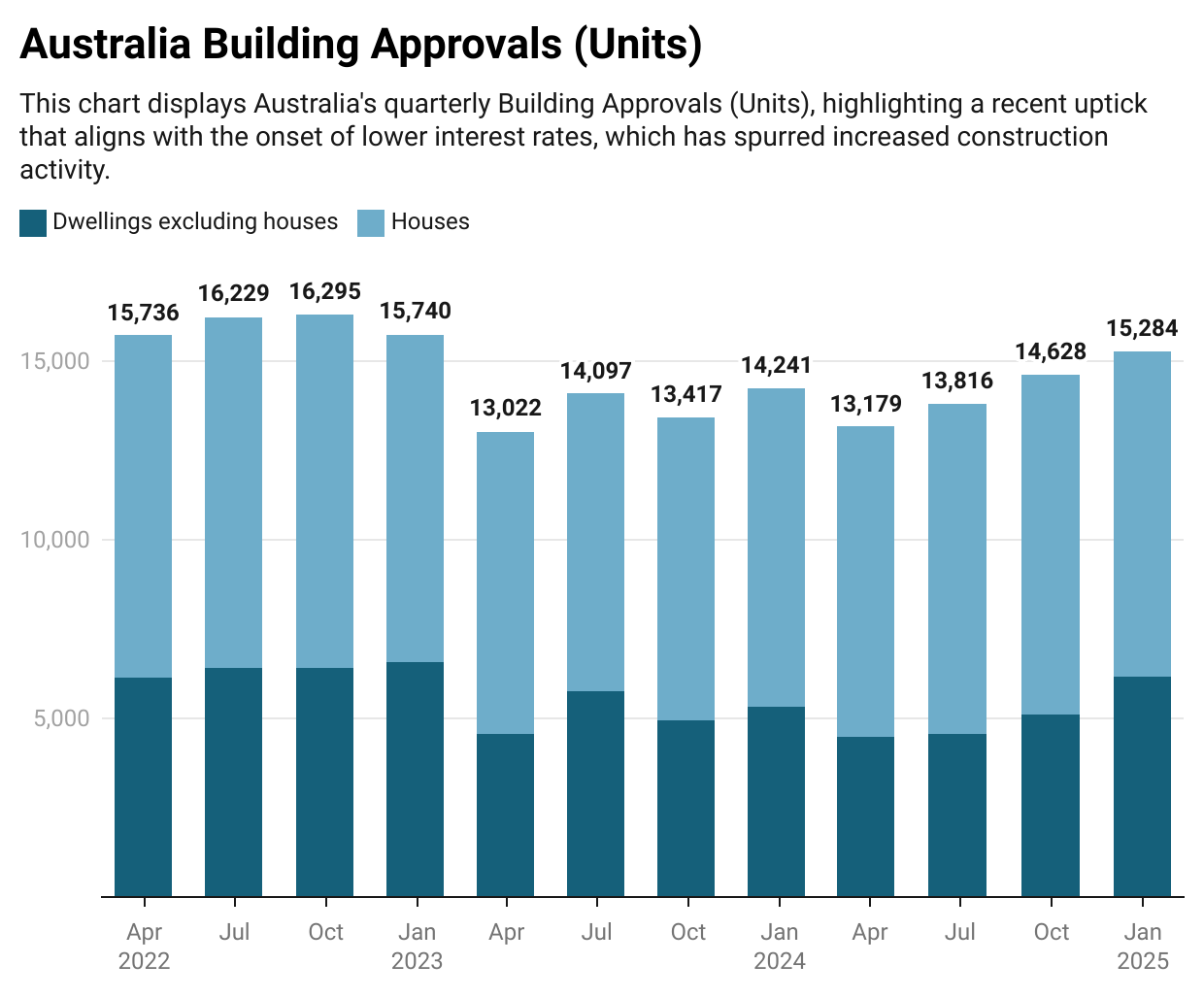

Housing

Australia’s inflation trends in January 2025 demonstrated notable stability, as the monthly CPI held steady at 2.5% year-on-year, mirroring December 2024’s reading and keeping inflation within the Reserve Bank of Australia’s target range of 2–3%, though just slightly below market expectations of 2.6%. Underlying pressures were evident, with the trimmed mean (core inflation) nudging up to 2.8% from 2.7% in December, and when excluding volatile items and holiday travel, the CPI increased to 2.9% compared to 2.7% the previous month. Key contributors to this inflationary trend according to the Australia Bureau of Statistics (ABS) included rising costs in food and non-alcoholic beverages (up 3.3%), housing (up 2.1%), and a sharp 6.4% increase in alcohol and tobacco prices, although these were partially offset by slower growth in rents and new dwelling prices amid rising electricity costs.

The Australia Property Update cited that the increase in electricity prices had been following the conclusion of significant state and federal cost-of-living energy bill relief schemes. According to the ABS, electricity prices declined by 11.5% over the 12 months leading up to January, after a substantial 17.9% drop in the year ending December 2024. The ABS notes that while the annual decrease in electricity prices has moderated, January 2025 saw an 8.9% rise, impacting some Queensland households that had exhausted their $1,000 state government rebate. However, CommSec points out that the increase in electricity costs was offset by a slowdown in housing expenses, an outcome that should reassure policymakers about the overall direction of inflation.

Unemployment

The RBA is exercising cautious optimism amidst its current rate-cutting cycle, balancing concerns around inflation with encouraging signs in the labor market. Unemployment remains resilient at 4.2%, still lower than pre-pandemic levels, despite some softening in full-time employment. Wage growth slightly eased in Q4 2024, but remains a focal point for the RBA, particularly if productivity stagnates—raising further concerns about its impact on inflation. The RBA has revised its unemployment peak forecast down to 4.2%, signaling tighter-than-expected labor market conditions according to the Australian Institute of Company Directors.

While global risks, such as potential U.S. trade disruptions under the current Trump administration, and ongoing geopolitical issues cloud the outlook, the RBA cautiously navigates a delicate stance. Domestic demand remains sluggish, despite some uncertainty about the impact of household savings and past rate hikes. The central bank suggests that while the current 4.1% cash rate remains restrictive, room for cuts exists, with neutral rate estimates closer to 3.5%. However, the RBA emphasizes a "slow and shallow" path of rate cuts contingent on confirming disinflation trends with upcoming inflation data, as J.P.Morgan Asset Management anticipates further reductions by late 2025.

The Path Forward

More cuts may be on the horizon, with ING Think forecasting a total of 100bps of RBA easing in 2025—including the February cut—which would bring rates to a terminal level of 3.35%. The likely trajectory will depend on key data releases in the coming quarters, including the impact of renewed U.S. protectionist policies on some of Australia’s largest trading partners. A "slow and shallow" easing cycle—similar to the Fed and ECB—could include pauses in easing if:

Trimmed mean inflation stalls above 2.7%

Unemployment falls below 4%

Global trade tensions escalate

Although not everyone agrees on the easing cycle even though it has already begun. The Melbourne Institute for Applied Economic and Social Research discussed in January that an alternative approach in February may be best. Associate Professor Sam Tsiaplias warns that despite inflation remaining within the RBA’s target range since July 2024, a rise in quarterly inflation suggests lingering risks. He advocates a “wait-and-see” approach before committing to cuts. In contrast, Dr. Issac Gross from Monash University argues that if official ABS data confirms the trend, gradual rate cuts could begin in 2025. However, a strong labor market and government subsidies for power bills and rent assistance may complicate the inflation outlook, potentially delaying cuts until May.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.