The Commodity of Today and Tomorrow

DeepSeek AI is fundamentally reshaping the AI landscape by driving the commodification of artificial intelligence through key innovations in cost efficiency and technical advancements including being open source. The company has achieved remarkable cost reductions, training its latest model for just $6 million, significantly less than the hundreds of millions spent by U.S. competitors. However, Microsoft recently alleged that DeepSeek may have illegally obtained OpenAI’s data to develop its model, raising questions about whether these cost savings stem solely from efficiency gains or if they benefited from external intellectual property. This challenges the assumption that cutting-edge AI development requires massive capital expenditure. The evidence presented by Microsoft in an attempt to protect Open AI suggests:

Users testing DeepSeek’s AI reported it often claimed to be ChatGPT and referenced OpenAI’s policies.

David Sacks, Trump’s AI advisor, stated there is “substantial evidence” of knowledge extraction from OpenAI’s models.

DeepSeek’s parent company High-Flyer has not responded to these allegations.

On the technical front, DeepSeek optimizes resources through innovative methods that enhance efficiency. Unlike major corporations that typically rely on 16,000 Nvidia chips, DeepSeek initially claimed to operate with only 2,000, significantly reducing hardware costs. Again skeptics are speaking out with many suggesting the company may actually have access to as many as 55,000 chips but has refrained from disclosing this, potentially due to U.S. export restrictions on advanced AI hardware to China.

Additionally, DeepSeek employs a mixture of expert techniques, which efficiently distributes data analysis across specialized model components. By minimizing data transfer overhead between models, DeepSeek further enhances performance and reduces computational strain. These innovations position DeepSeek at the forefront of AI development, proving that high-performance AI can be achieved with a leaner, more cost-effective approach- though questions remain about the full extent of its resources and methodology.

The shockwave DeepSeek sent through global markets was just one of the many consequences of its January 27, 2025, announcement, which triggered a massive selloff that erased approximately $1.2 trillion from U.S. and European technology equities. The Nasdaq 100, heavily weighted toward tech stocks, dropped as much as 3.6%, while the Philadelphia Semiconductor Index plunged 9.2%—its largest percentage decline since March 2020. Among major tech companies, Nvidia suffered the most severe blow, plummeting 17% and losing approximately $600 billion in market value—the largest single-day loss in U.S. stock market history. Microsoft fell 3.8%, Alphabet declined 4.2%, and Meta Platforms dropped 3.1%, reflecting widespread investor concerns over the announcement’s implications for the AI and semiconductor industries.

This commodification trend suggests that AI technology may evolve much like oil or grain where multiple providers offer similar capabilities, driving competition and reducing costs. Just as crude oil from different producers is largely interchangeable and traded globally, AI models could become standardized products, accessible to a wider range of businesses. Similarly, the way grain markets function with price competition and efficiency gains determining success - mirrors the trajectory AI is taking as firms find ways to develop advanced models with fewer resources. DeepSeek AI’s success demonstrates that cutting-edge AI can be built without massive computational investments if in fact Open AI’s data was not used in the process.

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

The Process of Commodification

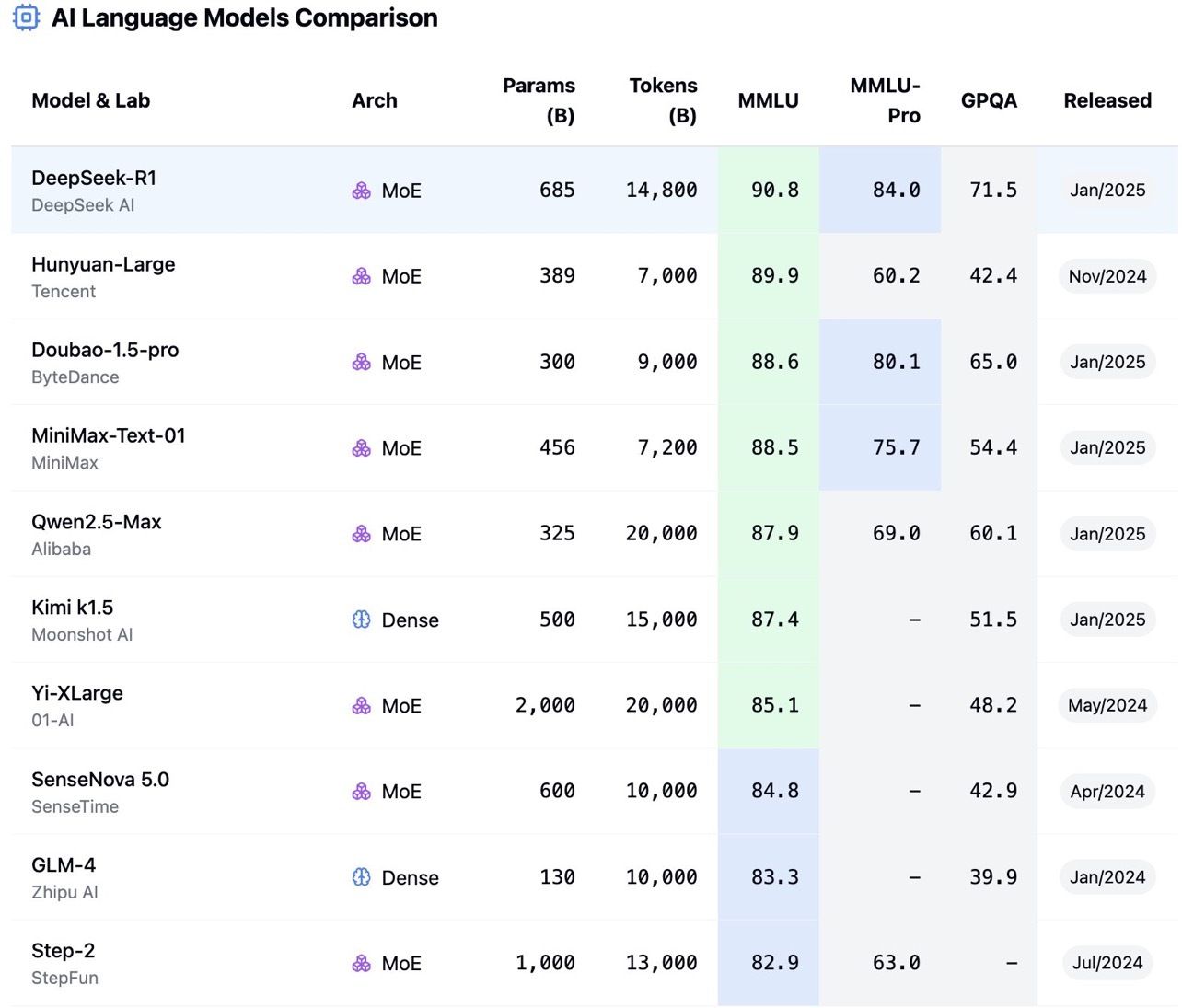

If AI models become heavily commoditized, many believe that unique underlying training data will be the key competitive advantage for industry leaders. Undoubtedly, more companies like DeepSeek will emerge, with each new model iteration costing less than its predecessor and most important of all it will likely be open source. Evidence of this trend is already apparent, as numerous AI models continue to be developed in China, as shown in the figure below.

Where the unique edge comes in much like hard or soft commodities is in the data. Models are able to be fine tuned to achieve specific results dependent on the underlying data they are trained with. This raises an intriguing possibility: could AI training data eventually be traded like a commodity, with futures contracts allowing firms to secure access to high-value datasets? Just as crude oil, wheat, or copper are standardized and traded on global exchanges, AI data could follow a similar trajectory, evolving into a market where companies hedge against price volatility and shortages.

For this to happen, several factors would need to align. First, AI training data would require standardization, much like how oil is categorized by grade (Brent, WTI) or how agricultural commodities are classified by type and quality. Different datasets—ranging from proprietary consumer behavior records to government data or industry-specific training sets—could be priced and traded based on their uniqueness, accuracy, and regulatory compliance. The increasing demand for high-quality, legally vetted data, particularly in the wake of stricter privacy laws like GDPR and CCPA, could drive firms to secure future access through structured contracts.

Another critical driver would be the ongoing need for AI retraining. Just as factories require a steady supply of raw materials, AI models depend on fresh, high-quality data to remain relevant. If supply constraints emerge—whether due to regulatory restrictions, competitive exclusivity, or simple scarcity—companies may turn to data futures as a way to hedge against potential disruptions. In such a scenario, AI data exchanges could emerge, facilitating spot transactions and long-term contracts, much like traditional commodity markets.

Of course, several challenges would need to be addressed before AI data could function as a true commodity. Privacy concerns, ownership rights, and data verification would require robust legal and technical frameworks. Unlike traditional commodities, data is not a finite physical resource, making issues like duplication and quality assurance critical to market credibility. Additionally, liquidity would be a key consideration—without a broad and consistent market of buyers and sellers, AI data futures could struggle to gain traction.

Yet, as the AI arms race intensifies and the costs of cutting-edge models continue to decline, the value of proprietary, high-quality data will only grow. In this future, it’s not far-fetched to imagine AI training data being bought, sold, and hedged in the same way companies today secure their access to oil, grains, or metals—transforming data into one of the most valuable commodities of the AI age.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.