Do Stress Tests Still Matter?

On March 27, 2024, the Bank of England launched the 2025 Bank Capital Stress Test, the latest iteration of its systemic risk assessment for the UK’s seven largest banks and building societies. This new test replaces the previous Annual Cyclical Scenario (ACS) framework and is designed to evaluate the resilience of the UK banking system under a range of severe but plausible shocks. The exercise incorporates three key elements: a macroeconomic scenario, a financial markets and traded risk scenario, and a misconduct cost stress.

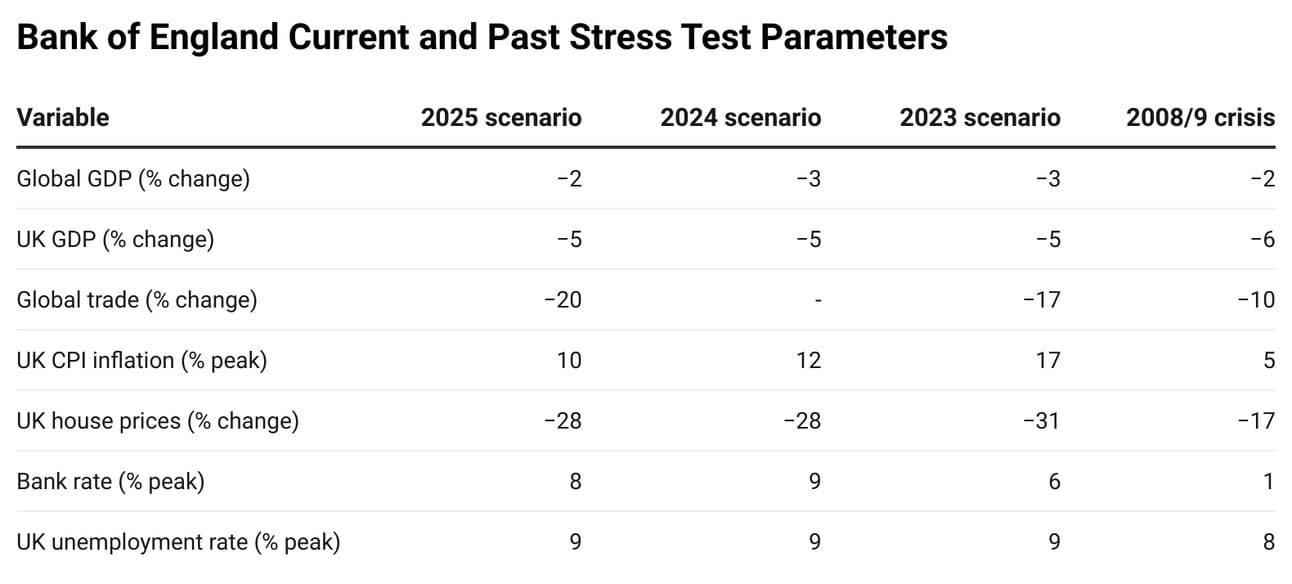

The hypothetical stress scenario models deep, simultaneous recessions in the UK and globally, sharp declines in asset prices, higher global interest rates, and elevated misconduct costs. Key assumptions include a 5% fall in UK GDP, a near doubling of UK unemployment to 8.5%, a 28% drop in UK residential property prices, and Bank Rate peaking at 8% before easing as inflation returns to target.

Source: Bank of England Financial Stability Report

This year’s test is also the first to fully incorporate the IFRS 9 accounting standard, with the Bank adjusting its methodology to ensure no unintended increase in capital requirements. Results, which will be based on both Bank of England and bank-submitted estimates, are expected in Q4 2025 and will inform capital buffer decisions and broader financial stability assessments. Going forward, the Bank plans to conduct this stress test biennially (once every two years) as part of its updated approach to banking system resilience.

Many are eagerly awaiting the results of the 2025 Bank of England stress test to see whether financial institutions can withstand the hypothetical scenario. However, in recent years, stress testing—particularly by the European Central Bank (ECB)—has faced increasing scrutiny. Critics argue that the tests have become “too predictable,” noting that the 2024 ECB stress test resulted in zero failures despite modelling an 8% GDP shock, leading to calls for more rigorous and challenging scenarios. While they have not been conducted for a long time horizon the tests are still being tweaked at every step to ensure accuracy and reliability, the question remains however are they still useful or just another box to check off the list?

Your job called—it wants better business news

Welcome to Morning Brew—the world’s most engaging business newsletter. Seriously, we mean it.

Morning Brew’s daily email keeps professionals informed on the business news that matters, but with a twist—think jokes, pop culture, quick writeups, and anything that makes traditionally dull news actually enjoyable.

It’s 100% free—so why not give it a shot? And if you decide you’d rather stick with dry, long-winded business news, you can always unsubscribe.

New Additions

According to Deloitte, the core stress test will be conducted only in odd-numbered years (e.g., 2025, 2027, 2029). However, the transition from a deposit-based to a total lending-based threshold for inclusion will not affect the list of banks required to participate. The alternating cycle of active and inactive years requires banks to enhance automation and documentation processes to manage capacity fluctuations effectively.

The scenario design has evolved to become more countercyclical, meaning that stress scenarios will be more severe during economic expansions to ensure banks maintain adequate capital buffers even when economic conditions are favourable. Notably, the 2025 test includes a less extreme inflation surge compared to previous iterations, reflecting a shift in macroeconomic conditions and the evolving risk environment. Additionally, the stress test expands its risk coverage by formally incorporating non-cyclical threats such as climate risk and misconduct costs. These exploratory exercises require banks to develop new data sources and modelling techniques to capture risks that do not necessarily follow traditional economic cycles.

On the capital buffer front, test results could lead to adjustments in the UK Countercyclical Capital Buffer (CCyB) rate or individual bank capital requirements if capital ratios fall below key thresholds. This reinforces the Bank of England’s priority that institutions remain resilient enough to continue lending during periods of stress. The criteria for participation remain focused on systemic importance, with eligibility largely tied to institutions holding at least 5% of UK lending or being designated as Global or Other Systemically Important Institutions (G-SIIs/O-SIIs). While there is potential for broader participation in future tests, any expansion would require a thorough cost-benefit analysis.

According to the Financial Times the 2025 Bank of England stress test features milder conditions than the 2024 supply shock scenario, which assessed the impact of UK inflation surging to 12% and a 3% decline in global GDP as shown in the graphic above. The central bank has adjusted its assumptions for the latest test, including delaying the peak of the crisis and reducing its overall severity. These modifications aim to offset the full implementation of IFRS 9, ensuring that changes in accounting standards do not result in unintended increases in capital requirements.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

The Evolution of Who and What?

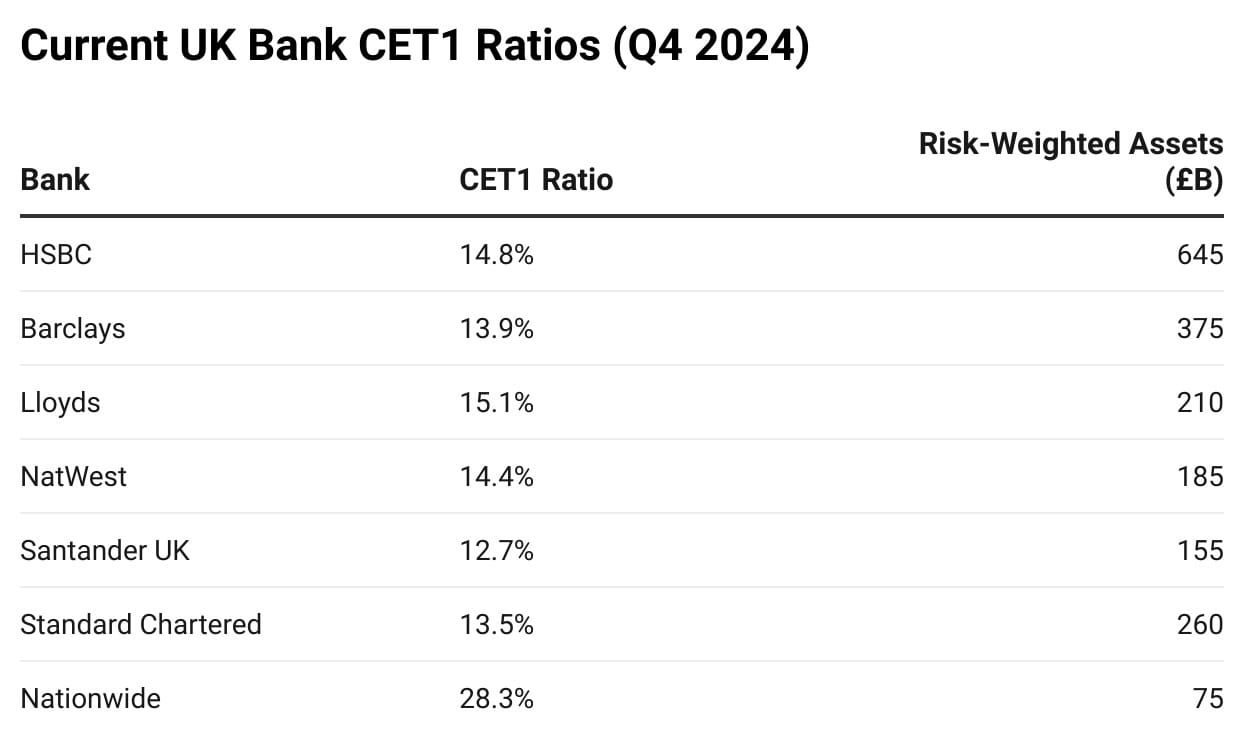

According to the Bank of England, the seven financial institutions participating in the 2025 stress test account for 75% of real lending in the British economy. The banks and building societies included are Barclays (BARC.L), HSBC (HSBA.L), Lloyds Banking Group (LLOY.L), Nationwide, NatWest Group (NWG.L), Santander UK (SAN.MC), and Standard Chartered (STAN.L).

The Bank of England’s stress tests have evolved over the years, assessing the resilience of the UK banking sector under adverse economic conditions. In 2016, RBS failed the test, with its capital ratio falling to 6.1%, below the 4.5% threshold, highlighting vulnerabilities in the system. By 2019, all seven major UK banks successfully met the required hurdle rates, demonstrating improved capital strength. The 2021 test found that UK banks could absorb up to £200 billion in losses while maintaining lending to households and businesses. In 2023, the Bank of England conducted its first climate risk stress test, revealing that 15% of UK mortgage books were exposed to high flood risk, underscoring the growing focus on environmental vulnerabilities.

Unlike the pass/fail approach used in other jurisdictions, the Bank of England employs hurdle rates to assess capital adequacy but publicly identifies weaker-performing institutions. Over time, UK banks have built stronger capital buffers, aligning with global trends that have seen Common Equity Tier 1 (CET1) ratios rise from 7% in 2009 to 14.2% in 2024. Stress testing frameworks have also expanded beyond traditional credit risks to include climate, cyber, and geopolitical threats, ensuring the banking sector remains prepared for emerging challenges.

The Common Equity Tier 1 (CET1) ratio is a key measure of a bank’s financial strength, comparing its highest-quality capital—such as common shares and retained earnings—to its risk-weighted assets, which include loans and investments adjusted for risk. This ratio serves as a crucial buffer to absorb unexpected losses, with higher CET1 levels indicating greater resilience. Under Basel III regulations, the global minimum CET1 requirement is 4.5%, though regulators often impose additional buffers.

The Bank of England (BoE) uses CET1 ratios to establish capital requirements, conduct stress testing, and supervise banks. UK banks must meet a minimum CET1 of 4.5%, but additional buffer add-ons apply, including the Capital Conservation Buffer (+2.5%), the Countercyclical Buffer (0-2%, set at 1% in 2025), and the G-SIB surcharge (1-3.5% for global banks like HSBC). As a result, most UK banks face a total effective CET1 requirement of 8-11%.

Stay Tuned for Part 2

Don’t miss Part 2 of The New Bank of England Stress Test on Monday, March 31, where we explore the potential impact on markets, lending, and policy. Thank you again for joining us and don’t forget to subscribe below for weekly updates delivered to your inbox every Friday.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.