A Potential Red Sweep🔴

What initially seemed as a coin flip turned out to be rather decisive into the early morning hours of November 6. Trump secured his second presidential victory by winning crucial battleground states, including Pennsylvania, Georgia, North Carolina, and Wisconsin. Exit polls indicated that voters’ top concerns were democracy (35%), the economy (31%), abortion (14%), immigration (11%), and foreign policy (4%). With this win, Trump becomes only the second president in U.S. history to reclaim the White House after being voted out, following Grover Cleveland in 1892.

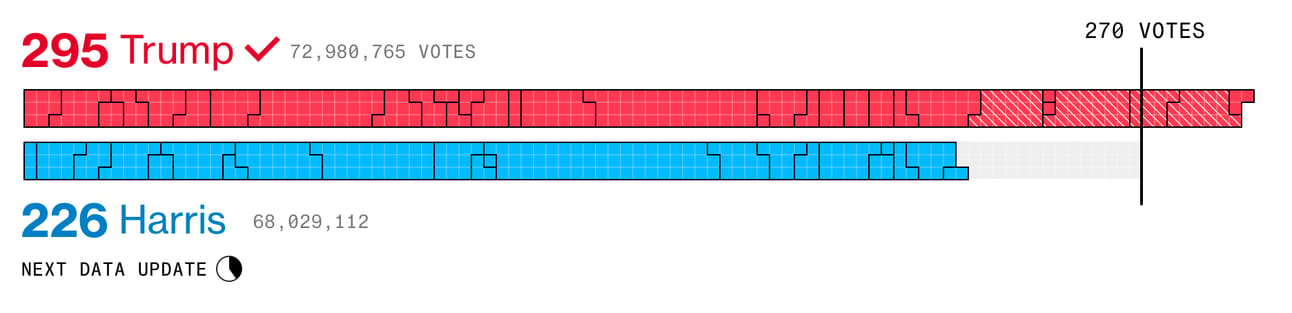

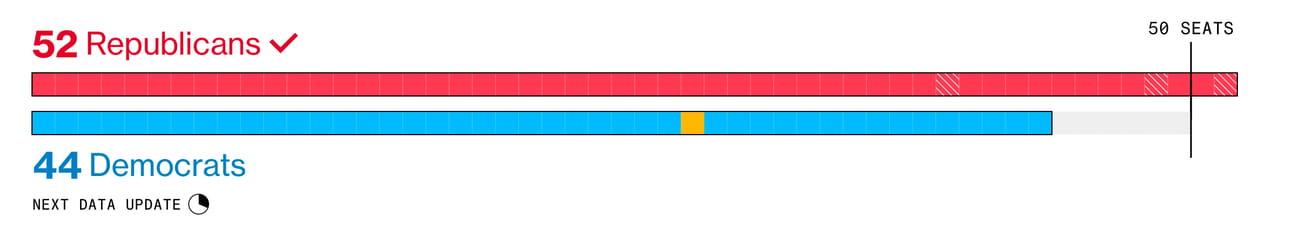

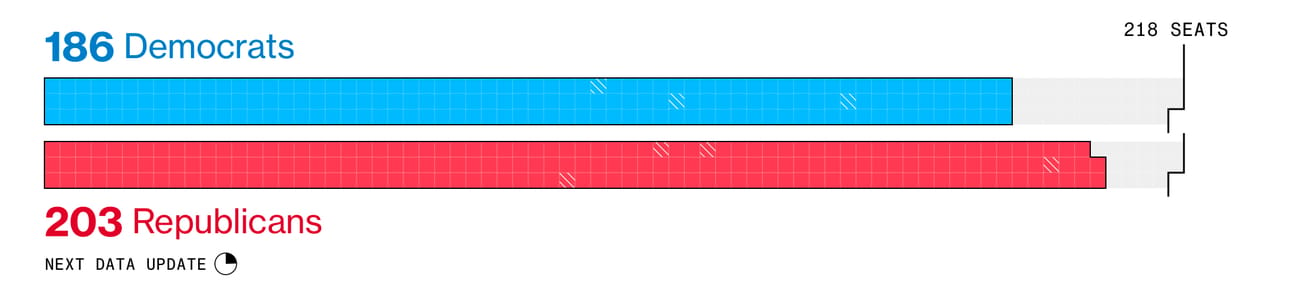

Trump secured 295 electoral votes, with additional votes potentially forthcoming as Nevada and Arizona remain unconfirmed at the time of writing. The GOP also secured control of the senate with a standing of 52 to 44 seats and is expected to keep their majority in the house which currently stands at 202 to 186, with 218 needed for a majority.

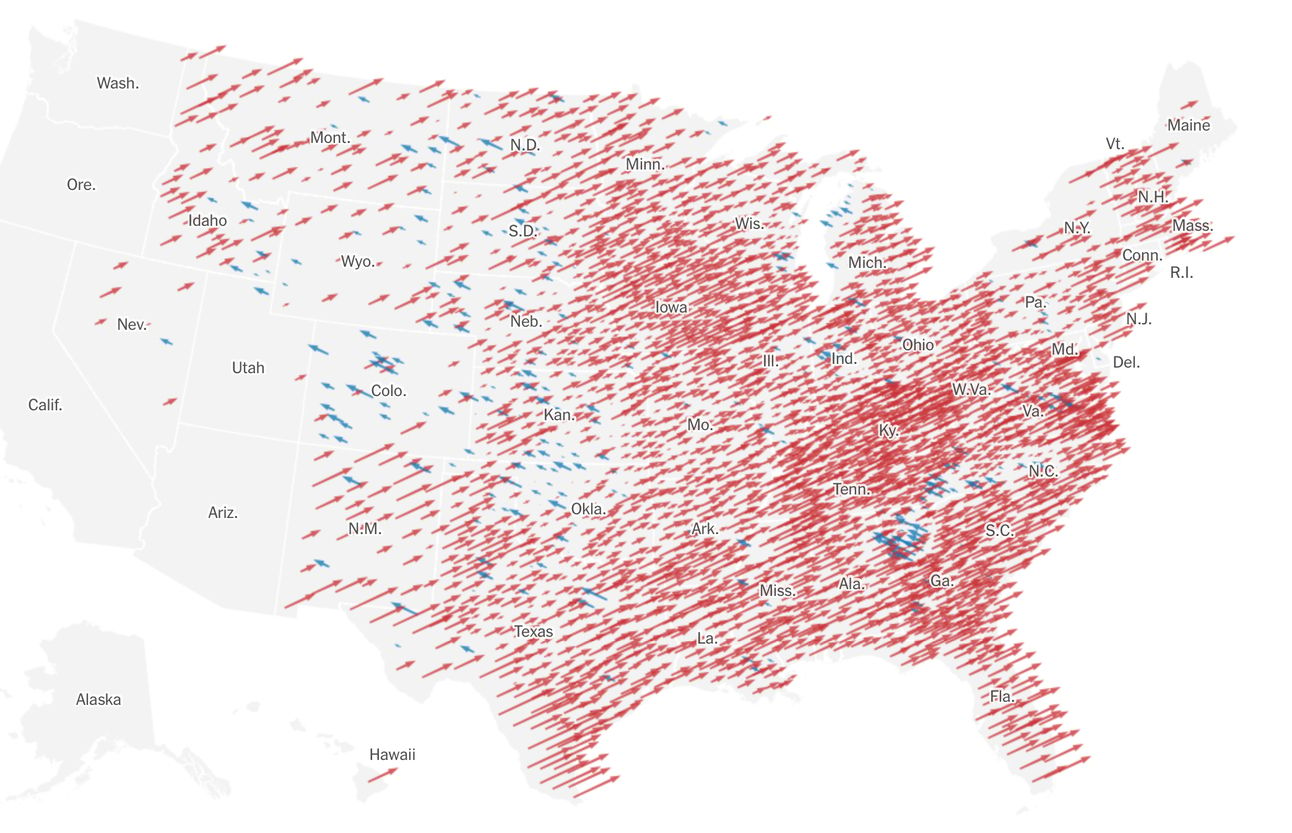

Compared to 2020, Republican votes for Trump increased substantially in areas that have reported nearly all of their results. As seen in the New York Times graphic below.

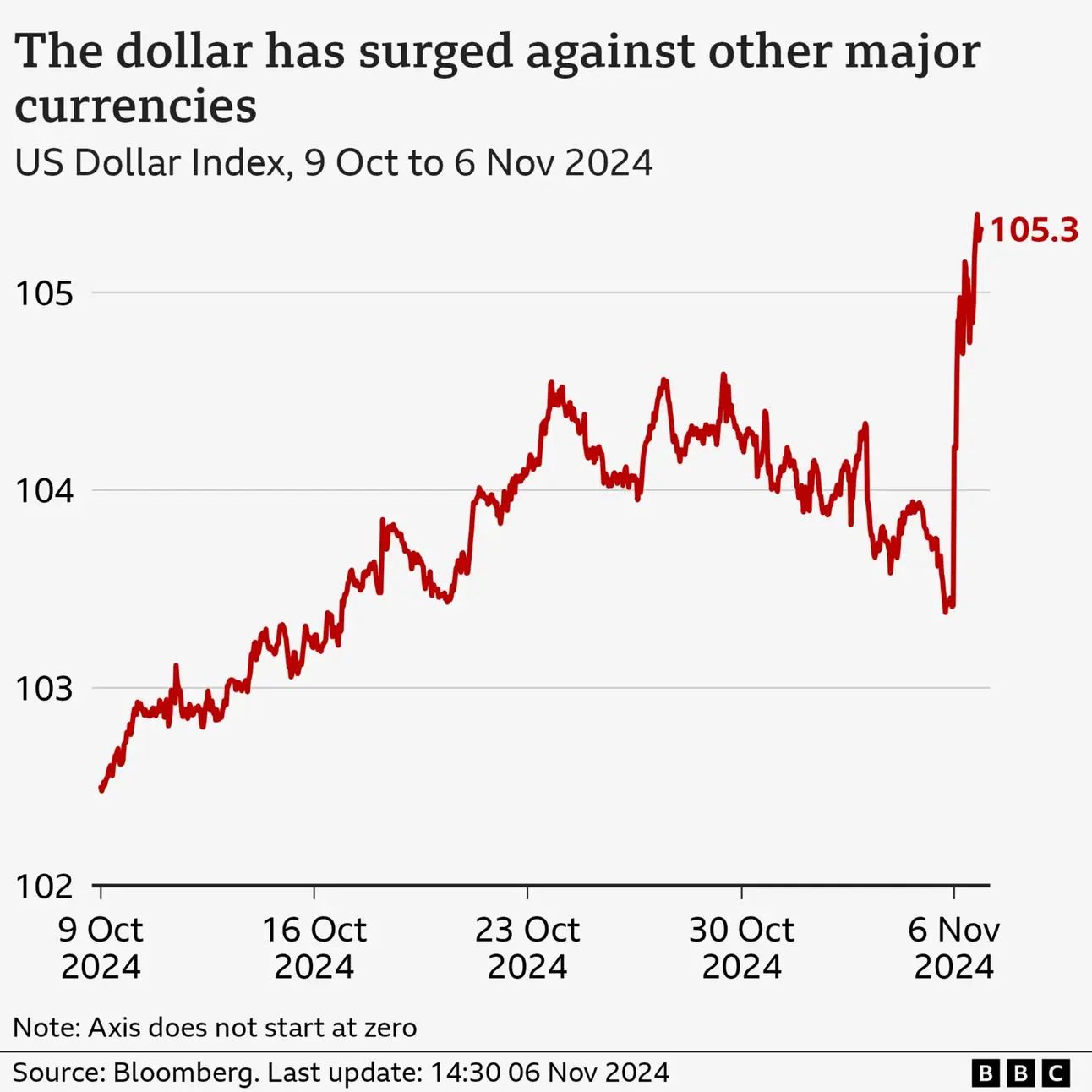

The election results were not without significant movements across currencies and commodities. Bitcoin hit a record high of $75,345 before settling at $73,720, driven by Trump’s promise to make the U.S. the “crypto capital of the planet.” The U.S. dollar saw its largest single-day increase since 2020, strengthening against major currencies like the Japanese yen, Mexican peso, and Chinese yuan.

In commodities, oil and soybean prices fell about 1.5%, copper dropped over 2%, while gold held steady near recent record levels, with commodity prices pressured by the stronger dollar and concerns over potential trade tariffs. Wednesday’s session started with a steep decline but recovered near the end of the day. Let’s take a closer look at the key headlines for commodities, currencies, and central banks since the election outcome.

Invest Wisely with The Daily Upside

In this current market landscape, we all face a common challenge.

Many conventional financial news sources are driven by the pursuit of maximum clicks. Consequently, they resort to disingenuous headlines and fear-based tactics to meet their bottom line.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable market insights that go beyond the headlines. And the best part? It’s completely free.

Commodities🛢️

Energy⛽️

Trump has pledged to boost U.S. oil and gas production and roll back green regulations as well as implementing plans to end Biden’s freeze on new LNG export permits.

Reuters reported Thursday that oil prices gained support on expectations that Trump's incoming administration may tighten sanctions on Iran and Venezuela, said Andrew Lipow, president of Lipow Oil Associates, adding that this could take oil supply off the market.

A November 6 report from Citi forecasts that Trump’s second term will be bearish for oil prices, predicting that 2025 Brent crude will drop around ~20% from the current spot price to average $60 per barrel.

Energy markets faced downward pressure due to a 9% drop in China’s crude oil imports in October, marking the sixth consecutive month of year-on-year decline, along with an increase in U.S. crude inventories.

Alberta province and industry leaders are preparing for potential impacts of Trump’s U.S. presidential victory, including a possible revival of the Keystone XL pipeline project and implications for nearly $160 billion in annual exports to the U.S.

Metals🪙

Copper dropped over 4% to below $4.30 per pound, marking its largest intraday loss in five months.

Gold declined by more than 2% to $2,676.30 per troy ounce a three-week low. The precious metal is expected to be influenced by rising inflation risks, which could slow the pace of U.S. rate cuts amid new tariffs, alongside continued demand for safe-haven assets, according to Ole Hansen, head of commodity strategy at Saxo Bank.

Zinc was the worst performer among base metals. According to Mining.Com galvanizing metal prices declined as China’s steel industries could face headwinds as Trump pledged to boost local U.S. manufacturing.

Albemarle, the world’s largest lithium producer, said on Thursday it lost more than $1 billion in the third quarter and that it would slash its capital budget amid a 71% drop in prices for the electric vehicle battery metal.

Grain🌾

Archer-Daniels-Midland (ADM) shares fell 6% on Tuesday after the global grain trader lowered its 2024 profit outlook and announced it would amend previous financial statements due to new accounting irregularities, wiping out about $1.6 billion in market value and sending shares to their lowest level since January 2021.

Soybean futures hit a one-week low before recovering to close 2 cents higher at $10.03 3/4 per bushel, corn futures reached a one-month high with a 7 3/4 cent gain to $4.26 1/4 per bushel, and wheat edged up 3/4 cent to $5.73 1/4 per bushel.

Traders suggest that a tariff dispute with Beijing may not impact U.S. soybean export sales until next summer, although importers may increase purchases before Trump takes office in January. Strong demand from both importers and domestic buyers has supported corn prices, with traders awaiting the release of monthly USDA crop data on Friday.

The U.S. is projected to face a record agricultural trade deficit of $42.5 billion in 2025, according to the U.S. Department of Agriculture, as reported by Reuters on Thursday. Soybean exports to China have declined significantly, dropping from 36.1 million metric tons in 2016 and 31.7 million in 2017 to about 26.4 million metric tons last year.

Currencies💶

Americas🌎

The U.S. dollar has reached its strongest level since July, with the Bloomberg Dollar Spot Index rising 0.9% following Donald Trump’s victory, driven by increased haven demand and market expectations of potential protectionist policies.

The Mexican peso saw significant volatility, dropping to its weakest level since August 2022 at 20.81 pesos to the U.S. dollar, a 3.5% depreciation from Tuesday’s closing rate, marking a two-year low before beginning to recover.

ING’s global markets head suggests the peso could depreciate to 22 pesos per dollar in coming weeks.

The Canadian Dollar weakened significantly trading at 1.39 to the US Dollar, approaching a two-year low. A potential corporate tax rate reduction in the US to 15% (compared to Canada’s 38%) could draw investment away from Canada.

Europe🌍

The euro has seen its largest decline since the COVID-19 crisis, dropping 1.75% to $1.0740, its worst day since March 2020, and further falling to 1.0725, with earlier lows at 1.0682. Analysts now predict the euro could reach parity with the U.S. dollar.

Major financial institutions have provided bearish forecasts, with ABN Amro Bank, ING Groep, and Manulife predicting parity, Mizuho Financial Group projecting a decline to $1.03, and Deutsche Bank forecasting a drop to $1.05 by year-end.

Other Eurozone currencies also declined, with the Hungarian forint dropping 2.4%, the Czech koruna falling 2%, the Polish zloty decreasing 1.9% and the British pound declining to 1.285 against the U.S. Dollar.

Spreads between U.S. Treasuries and German Bunds widened to 200 basis points.

Central Banks🏦

Federal Reserve🇺🇸

The Fed announced a 25 basis point rate cut on Thursday, lowering the federal funds rate to 4.5-4.75% from 4.75-5.0%. This marks their second rate reduction of 2024, following September’s larger cut, as inflation continues to cool toward their 2% target.

When asked if the election outcome would influence Fed policy, Powell remained non-committal on Thursday. However, he firmly stated that he would not resign if Trump, who has previously criticized him, asked him to step down, emphasizing that it is illegal for a U.S. president to fire or demote the Fed chair.

Bank of England🏴

The Bank of England lowered interest rates by 25 basis points to 4.75% on Wednesday, marking its second rate cut in the current easing cycle, with the decision supported by an 8-1 majority vote from the Monetary Policy Committee.

UK inflation fell to 1.7% in September, below the Bank of England’s 2% target, marking a significant drop from over 11% and providing room for monetary easing.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.