Price Disconnect Across the Pond

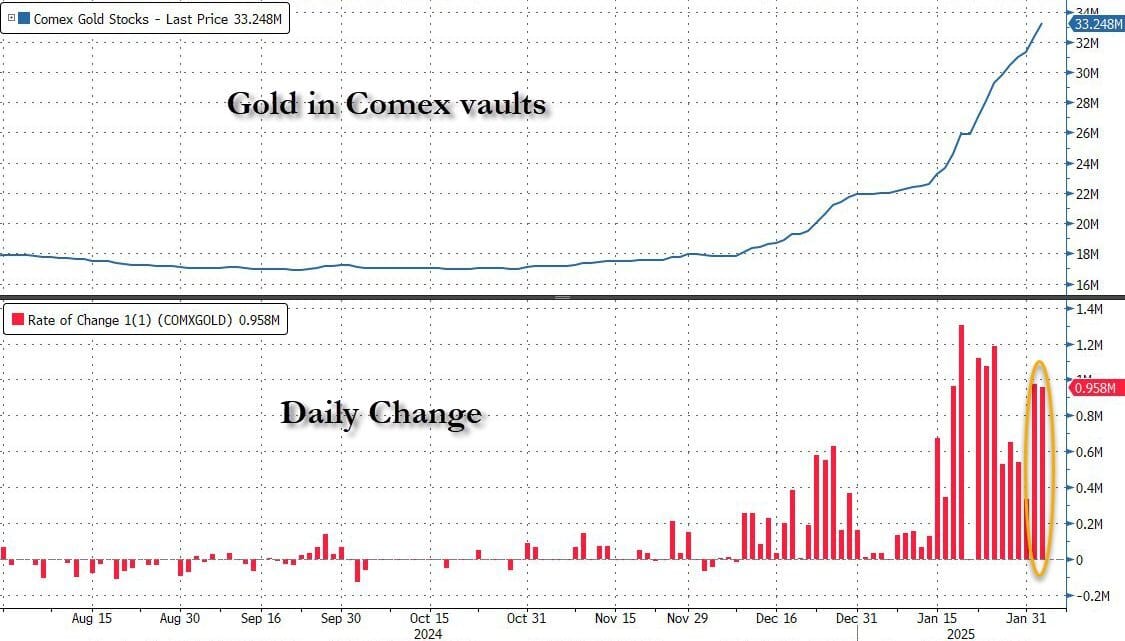

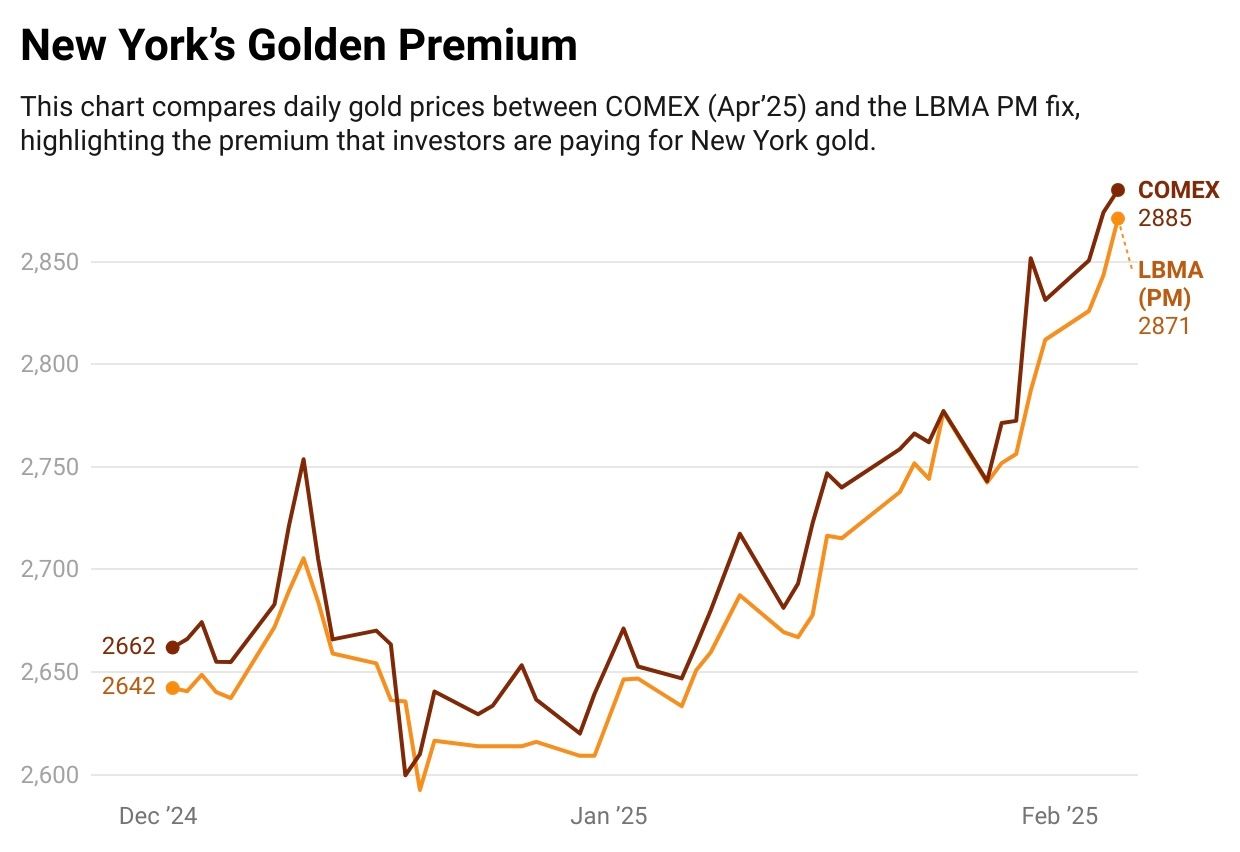

U.S. COMEX Gold futures recently surged to record premiums over London spot prices, primarily driven by geopolitical tensions, tariff fears, and physical market dislocations. JPMorgan has already capitalized on the widening spreads arranging for $4 billion in gold delivered to COMEX warehouses in February marking the second largest month delivery since 1994 according to data compiled by Bloomberg. Since November 2024, over 13.8 million troy ounces of gold have flowed into U.S. vaults, depleting London's available stock. Meanwhile, CME gold stocks in the U.S. increased by 12.2 million troy ounces—an impressive 70% rise over just two months. As a result, the world’s largest bullion market is now experiencing a shortage not seen in decades, driven by several underlying factors:

Bank of England Gold Withdrawals: Delays extended to four weeks, compared to the usual few days. Borrowers are now tapping the central bank for gold amid the exchange shortage.

LBMA Free Float Reduction: The available trading metal shrank as shipments were redirected to New York.

Central Bank Actions: Institutions were approached for gold loans to maintain liquidity.

Simultaneously, according to Reuters Asian trading hubs such as Dubai and Singapore experienced unusual outflows as banks redirected gold to exploit a COMEX premium of over $40 per ounce. Even Indian customs-free gold was airlifted to New York, contributing further to the thin liquidity in London. Kitco reported last week that the London Bullion Market Association (LMBA) insisted that liquidity and stocks are strong despite the premium being observed in the futures market. Despite reassurances, gold prices have reached an all-time high of $2,885/oz (compared to London's $2,871 spot) at the time of writing even after a 30-day pause on tariffs for Canada and Mexico announced by the Trump administration on Monday.

No one's going to hold metal in New York and have to ship it to London, or ship it to other places. They're not going to want to do it. You're going to have a segregated market—a New York market, a London market, segregated markets.

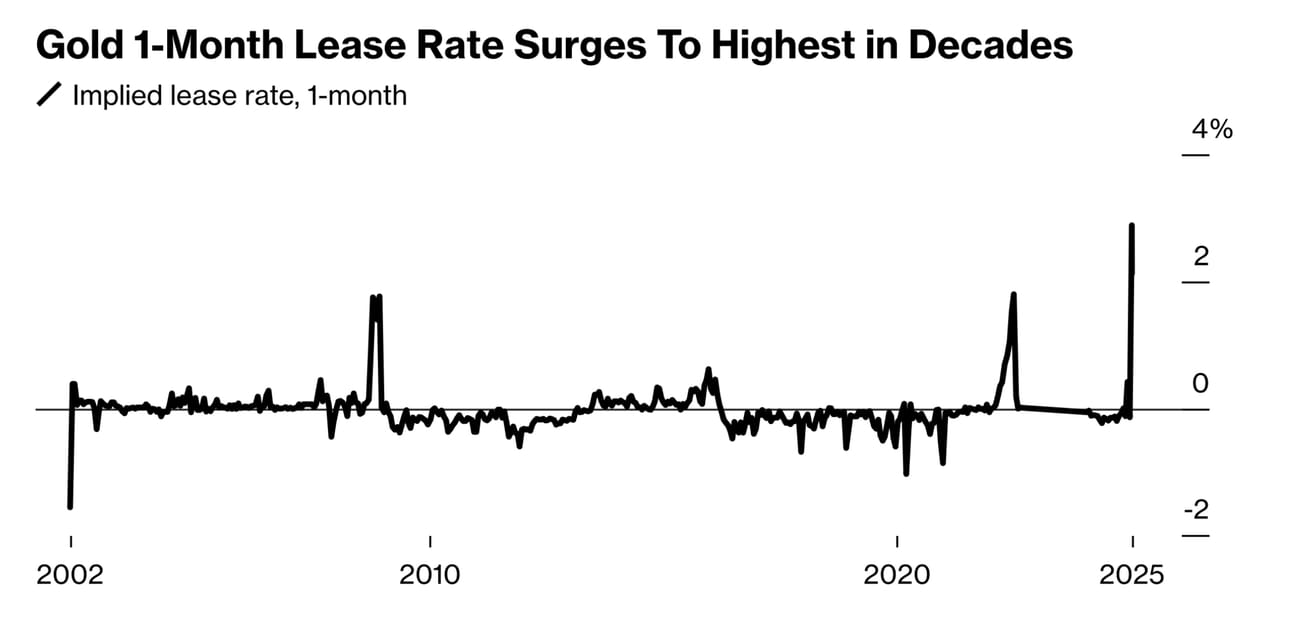

Segregated markets, as Grady put it, would likely lead to higher prices and reduced flexibility for refiners, pushing prices closer to JPMorgan's $3,000/oz price target issued in early January for late 2025. The need for market participants to borrow specific gold bars in segregated storage reduces the fungibility of gold holdings, intensifying competition for available metal. Additionally, physical delivery requirements drive further demand for borrowing, with higher storage and handling costs feeding into already rising lease rates. This dynamic could contribute to a more constrained market, potentially reinforcing upward pressure on gold prices.

Source: Bloomberg

Not to mention that there exists vast differences in the refined products that can be delivered to both COMEX and London to fulfill contracts. COMEX gold futures settle with 100-ounce bars of at least 99.5% purity, while the London Bullion Market Association (LBMA) operates on a Good Delivery standard that requires much larger 400-ounce bars. That alone creates a physical mismatch—gold refined for one market can’t seamlessly be delivered into another without additional processing (done by Swiss refiners as discussed by the Financial Times), adding cost, time, and complexity. The logistics widen the gap. COMEX deliveries flow through vaults in New York, supporting a more exchange-driven, margin-backed structure. London, on the other hand, operates as a deep, over-the-counter (OTC) market where bulk settlement and central bank reserves play a larger role. That means disruptions—whether from refining bottlenecks, transport constraints, or liquidity crunches—can cause price spreads between the two to blow out.

Fall in love with BILL, get a $200 Saranoni blanket

BILL + controllers = ❤️

We're sharing the love! Take a demo of BILL Spend & Expense and get a $200 gift card to Saranoni Luxury Blankets & Gifts.1

"Switching to BILL for our credit cards has been such an amazing decision for us! After transitioning from a competitor to BILL Spend & Expense 6 months ago, we’ve already received over $10,000 in cash-back rewards—something our previous provider never came close to offering.” – Madolen Gossett, Controller @ Saranoni

1Terms and Conditions apply. See offer page for details.

Card issued by Cross River Bank, Member FDIC, and is not a deposit product.

COMEX vs. London: The Growing Divide

Price Determination

The growing divide between the futures (COMEX) and physical (LBMA) bullion markets is driven by their differing price determination mechanisms. COMEX trades 109 paper ounces for every physical ounce, creating a synthetic market detached from bullion scarcity. This leverage enables speculative forces, such as algorithmic trading and futures rolling, to suppress or inflate prices independently of physical flows. During the recent U.S. tariff panic, COMEX futures spiked to a $50+/oz premium over LBMA as traders anticipated delivery bottlenecks.

Factor | COMEX (Futures/Paper) | LBMA (Physical) |

|---|---|---|

Primary Instrument | Futures/options contracts (paper gold) representing 100 oz each. | Physical 400 oz gold bars traded OTC, with twice-daily auctions setting spot prices |

Trading Volume | ~27M oz / day in futures (equivalent to 270,000 contracts). | ~3,248 metric tonnes/day (paper-to-physical ratio of 309:1). |

Price Drivers | Speculation, USD movements, interest rates, ETF flows. | Physical supply/demand, central bank purchases, refinery output. |

Delivery Rate | <1% of contracts result in physical delivery. | 100% physical settlement for spot transactions. |

While arbitrage typically narrows spreads, physical logistics can disrupt this equilibrium. Shipping 400 oz LBMA bars to COMEX requires recasting into 100 oz bars, incurring costs of $0.50-$1.50/oz. A historical precedent occurred in March 2020, when Swiss refinery shutdowns led to a $100/oz spread. Additionally, bullion banks like JPMorgan, use COMEX futures to suppress prices via high-frequency short-selling. Each 1% drop in COMEX futures cascades into LBMA through algorithmic arbitrage, despite physical shortages.

February has already seen COMEX vaults receive 160 tons of gold in just five days—more than double January’s total of 70 tons and marking the fastest accumulation rate ever recorded. This surge follows January’s extraordinary deliveries totaling $5.2 billion (19,001 contracts), a notable anomaly for a month that typically accounts for less than 25% of the volume seen in busier periods according to Peter Schiff. Additionally, open interest for February contracts has reached 77,750 contracts (241 tons), potentially setting the stage for the largest physical transfer in COMEX history if this trend continues. On top of all this COMEX saw 40,000+ February 2025 gold contracts (28% of registered inventory) opt for physical delivery in a market that is 99% cash settled or closed before expiration.

Central Bank Activity

Central banks have actively reduced the “free float” of gold available for immediate trading by withdrawing physical gold from LBMA vaults. For example, since Q3 2022, a total of 844 tonnes (or about 27.13 million ounces) have been pulled out of these vaults. This reduction in available gold has tightened liquidity, an effect that was made more acute in 2024 when the Bank of England reported withdrawal delays of 4 to 8 weeks as previously mentioned due to heightened demand.

In 2024, central banks not only pulled gold out of circulation but also bolstered their reserves by purchasing substantial quantities. Record buying saw 1,045 tonnes added to reserves—with countries like Poland (buying 90 tonnes) and Turkey at the forefront. This level of acquisition, which represents roughly 25% of the annual mine supply, has a direct price impact; World Gold Council models suggest that every 100-tonne purchase correlates with an approximate 2.1% increase in gold’s price. This deliberate buying also plays a key role in the evolving geopolitical landscape, as 69% of central banks have signaled further acquisitions to hedge against sanctions and challenges posed by the dominance of the U.S. dollar as per a 2025 report by Morningstar. In addition about 15 LBMA member banks control nearly 80% of trading, making the market particularly sensitive to coordinated central bank actions.

The combination of reduced free float, strategic buying, and lending practices has led to pronounced market effects:

Supply Squeezes: With an 8.9% decline in LBMA vault holdings since 2022 (844 tonnes withdrawn), the available physical gold for immediate trading has diminished significantly.

Liquidity Dependencies: Approximately 60% of LBMA market liquidity now depends on central bank gold loans. The scramble for central bank-held gold—exemplified by the 2025 rush for Bank of England-stored bullion—highlights how deeply the market’s systemic risks are intertwined with these interventions.

Bank of England Scrambles

The Bank of England who plays a key role in the London bullion market is now scrambling to intervene even though it does not operate a commercial vault. It maintains accounts for central banks that prefer storing their gold in London, where it can be readily lent or sold, and it also allows select commercial operators to hold gold accounts to boost market liquidity. Bloomberg reported early Thursday that Ramsden, the Bank of England’s Deputy Governor for Markets and Banking, noted that gold inventories in the bank’s vaults have declined by only about 2% since December. He explained, “It’s an obvious point, but gold is a physical asset, so there are real logistical and security constraints. Getting into the bank this morning was a bit trickier because there was a lorry in the bullion yard—it takes time, and the stuff is heavy.”

Meanwhile, sources report that dealers are quoting gold prices at the Bank of England at discounts exceeding $5 per ounce below the London spot price. This divergence is highly unusual, as gold at the central bank typically moves in tandem with the rest of the London market—where bullion is stored in commercial vaults managed by firms such as JPMorgan Chase and HSBC. Historically, premiums and discounts driven by central bank trading have been limited to just a few tens of cents per ounce Bloomberg reports.

One-month bullion lease rates have surged to about 4.7% in 2025, a dramatic increase from the usual near-zero levels. This rate reflects the return that bullion holders in London’s vaults can earn by lending out their metal on a short-term basis. The central bank holds over 400,000 gold bars worth $450 billion and is apparently scrambling to keep up with withdrawal requests the issues arise with the available gold to withdrawal as much is locked up in reserves causing the ongoing spread and delays.

Is Basel III to Blame?

Under Basel III regulation, physical gold has been reclassified from a Tier 3 asset—previously subject to a 50% haircut—to a Tier 1 asset with a 0% risk weighting, effectively placing its liquidity risk on par with cash and sovereign bonds. This regulatory change incentivizes banks to shift their holdings away from unallocated gold exposures (often in the form of paper gold) and toward allocated or physical gold. As a result, central banks and financial institutions have accelerated their physical acquisitions as laid out in the previous section.

At the same time, the London bullion market is facing a liquidity crunch as a direct consequence of the new funding requirements. Under Basel III, banks are now required to hold a stable funding reserve equal to 85% of the value of any unallocated (paper) gold they have on their balance sheet. Unallocated gold means that the bank holds a claim on gold without having specific bars physically assigned to it. The imposition of the 85% Required Stable Funding (RSF) ratio for unallocated gold has made it prohibitively expensive for LBMA banks to maintain fractional-reserve paper gold positions, resulting in a drastic collapse in daily trading volumes—from over 600 tonnes to just 150 tonnes by 2024.

Although the Bank of England introduced a 2021 carve-out allowing LBMA banks to apply for a 0% RSF on matched physical holdings (thereby facilitating the movement of gold from vaults in Zurich and the New York Fed to London), this UK exemption has not been sufficient to counterbalance the broader global impact of Basel III, as banks in the EU and U.S. continue to contend with stricter regulatory constraints.

On Account of the Tariffs

Trade War Considerations

The United States announced on Saturday that it would impose 25% tariffs on imports from Canada and Mexico, and 10% tariffs on goods from China, set to take effect this week. Additionally, Canadian energy imports will incur a 10% levy. In response, Canada unveiled counter-tariffs of 25% on U.S. products, Mexico pledged retaliatory actions, and China issued a statement vowing “corresponding countermeasures.” President Trump has also threatened tariffs against the European Union, which stated it would respond firmly. Notably, both the Mexican and Canadian tariffs will be delayed by 30 days as each country deploys troops to the border in an effort to address issues related to illegal immigration and fentanyl trafficking.

Tariffs tend to create inflationary pressures, which have pushed gold prices above $2,880 per ounce. Moreover, the United States’ reluctance to pursue an overly accommodative foreign policy seems to have reduced concerns about de‑dollarization—especially following the recent BRICS announcement that ended speculation over a basket‑based reference currency. In an attempt to avoid tariffs on imports, 393 metric tonnes of gold have been moved from London to COMEX vaults.

The ongoing back-and-forth of trade tensions has led investors to seek refuge in gold. While the trade conflict with Mexico and Canada has temporarily de-escalated, U.S.-China relations remain strained. In the latest development, late Tuesday night, the USPS announced it would no longer accept packages from China and Hong Kong. However, in a surprising reversal on Wednesday morning, USPS reinstated the service, stating it would work with Customs to collect new tariffs with the "least disruption" to package deliveries. Due to the friction with China, U.S. yields have risen substantially and gold has a -0.82 correlation with real yields, making it highly sensitive to changes in interest rate expectations. Trump's tariffs pose a risk of stagflation—characterized by high inflation and low growth—which could force the Federal Reserve to delay rate hikes despite rising inflationary pressures. U.S. breakeven inflation rates for both the 5-year and 10-year maturities have surged to 2.59% and 2.44%, respectively, surpassing the Fed’s 2% target. As real yields decline, the opportunity cost of holding non-yielding assets like gold diminishes, making bullion a more attractive investment relative to treasuries.

In addition to yields the U.S. dollar has also strengthened over the past year albeit has weakened in 2025, while gold prices have risen, defying their usual long-term inverse relationship. Typically, as the dollar appreciates against major currencies, gold becomes more expensive in foreign markets, leading to a decline in its price. However, in 2024, gold surged by 27% alongside a 1.6% increase in the dollar, breaking this typical pattern. Analysts attribute this anomaly to gold’s enhanced role as an inflation hedge amid persistent price pressures.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.