In partnership with

The World’s Most Important Commodity

One could argue that oil, sand (a key component in semiconductors), and copper are among some of the most essential materials found on earth. However, water remains an intriguing commodity, traded in particular structure compared to the organized trading of some of its commodity counterparts. The importance of water in all industries from mining to farming cannot be overlooked. The Food and Agriculture Organization of the United Nations estimates that 70% of all earth’s water is consumed by the agriculture sector. Just in the United States, mining operations withdraw approximately 4 billion gallons of water annually, representing 1% of the country’s total water withdrawals. The state of California is the nation's most significant source of groundwater, serving approximately 66% of the U.S. population, or 195 million people through the main basins outlined in the graphic below.

Water futures were first launched in December 2020 by the Chicago Mercantile Exchange (CME), making headlines across financial news outlets. The launch sparked discussions about the importance of water and the friction between market participants over its commodification. These contracts are cash-settled, meaning no physical water changes hands between counterparties. Each futures contract represents 10 acre-feet of water, with contract periods extending up to two years. The futures contract, detailed in the specifications below, is based on the Nasdaq Veles California Water Index. This index reflects the cash price of water at its source in California. According to the exchange operator, price discovery is determined by "the price of water rights leases and sales transactions across the five largest and most actively traded regions in California."

The index has seen a remarkable rise this year marking a staggering year-to-date gain of 115.91%. Futures prices have been trading at a premium of $5.76 to $8.54 over the index in mid December according to Veles’ Weekly Report Archive. Meanwhile, California’s water management landscape continues to evolve. A $141 million investment was approved for the Delta tunnel project, aimed at enhancing water transportation infrastructure. In multi-state negotiations over Colorado River resources, California remains at the center of discussions, as federal funding initiatives, including $65 million from the Biden-Harris Administration, focus on Northern California water projects.

In July 2021, CME released a brief document detailing the purpose and function of water futures, emphasizing their role in supporting the value chain. The exchange highlighted the growing importance of such instruments, stating, “With nearly two-thirds of the world’s population expected to face water shortages by 2025, water scarcity presents a growing climate-related risk for businesses and communities around the world.” In California, the state’s $1.1 billion water market plays a vital role in allocating limited supplies to areas and users with the greatest need.

This Holiday Season, Give Yourself the Gift of Nike Air Max.

This winter, take your footwear game to the next level with Nike's Air Max collection for men. With a diverse range of models, this collection prioritizes comfort and functionality, perfectly tailored to meet your everyday needs. Whether you're hitting the gym or heading out for a casual outing, these sneakers deliver the support you crave without compromising on style.

Find the perfect pair that matches your lifestyle and get ready to make a statement with every step. Treat yourself to a fresh pair from the collection this holiday season—you deserve it.

Why Is it Only Happening Now?

California’s water futures market on the CME is currently the only major regulated water derivatives market. However, water trading occurs in various regions worldwide, though to a lesser extent. A brief discussion on the timing of the futures introduction is provided below.

Hedging Purposes

One of the primary purposes cited by the CME is to enable participants in California's water supply chain—such as producers and consumers—to lock in a price for water, thereby minimizing their basis risk. Hedging risk has always been essential in the commodities market. Recently, water prices have faced unprecedented volatility and anticipated shortages, reminiscent of the heightened commodity financialization of the early 1980s—a period that spurred the rapid growth of organized electronic trading across other commodity classes.

CME Illustrates The Benefit of Hedging with NQH20

For example, NQH2O was $489 per acre foot on December 16, 2020 and climbed to $877 per acre foot on May 12, 2021. An unhedged buyer of water lost $388 per acre foot over that five-month span, and as a result faced significantly higher prices. However, if a cash buyer of water (a long hedger) bought May Water Futures at $500 per acre foot in December, and sold that position in May at $892 per acre foot (the Water Futures settlement price on May 12, 2021), they would experience a gain of $392 per acre foot.

For agricultural producers, the cost of irrigation can be substantial. The California Farm Water Coalition estimates that a farmer purchasing futures contracts at $600 per acre-foot could receive $10,000 in settlement funds if prices increase to $800. This amount could cover the irrigation needs for approximately 10 acres of tomatoes or 7 acres of almonds. The need for risk management tools in the water sector has grown as rising temperatures and severe droughts become more common in water-rich regions like California.

Changing Climate

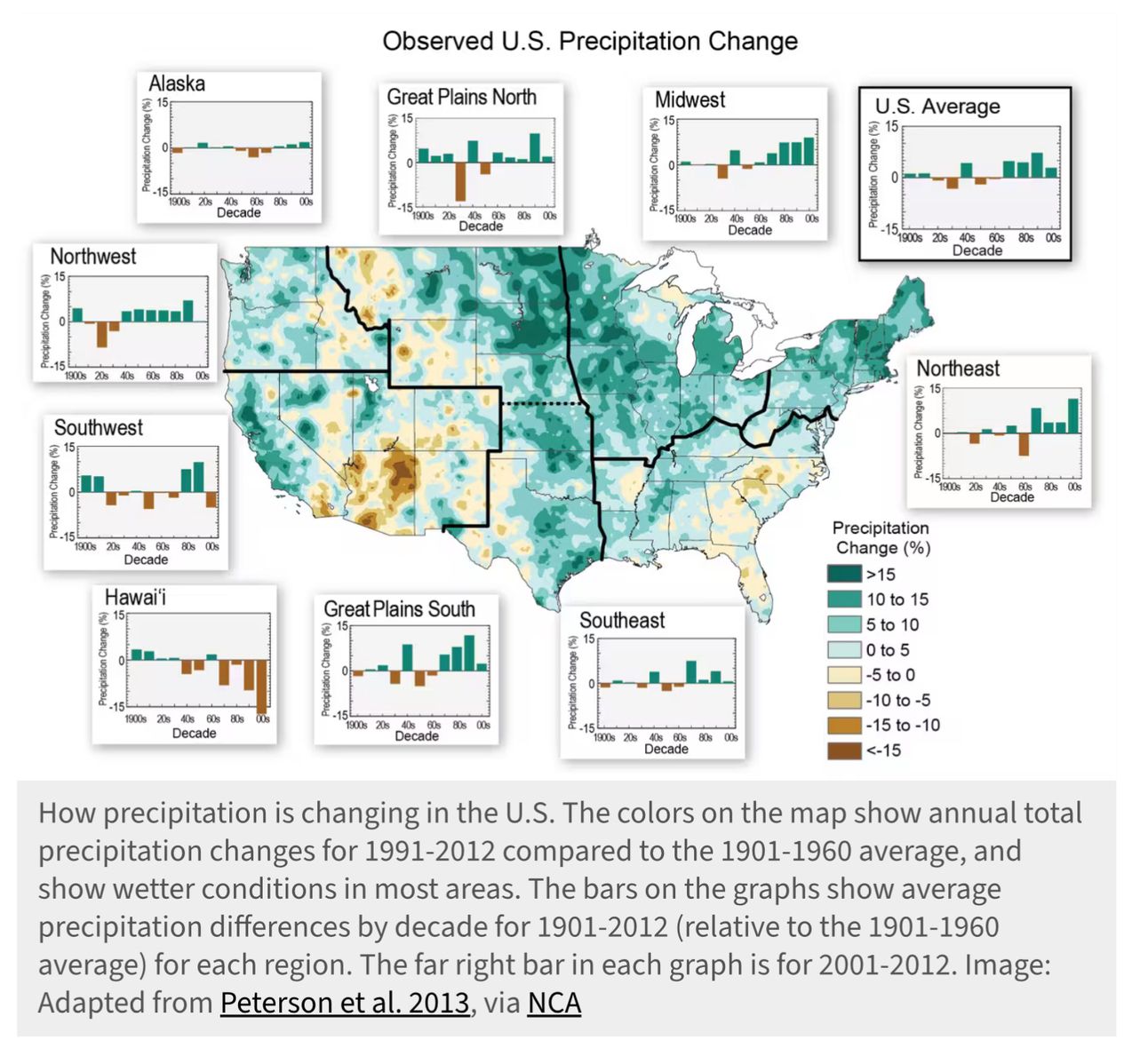

On the supply side, increasing constraints have led to the introduction of water futures contracts, driven by concerns over a potential global shortage in the coming decades. Climate forecasts predict continued pressure on water resources, with up to 40.9 million American households potentially unable to afford water services. By 2071, nearly half of U.S. freshwater basins may fail to meet monthly water demand, with some regions facing reductions of up to one-third in water supplies, according to research compiled by Columbia.

In addition to reduced precipitation contributing to declining water supplies, severe droughts also heighten other waterway risks:

The Panama Canal has reduced daily ship crossings from 36–38 to just 31 due to low water levels.

The Mississippi River experienced a 400% increase in grain shipment prices during drought conditions.

The Yangtze River (the longest in Asia) saw an 8% decline in container export volumes following severe drought.

Without a formal contract, such as those with quarterly or monthly settlements, effectively hedging drought risk is challenging and may require synthetic instruments that involve tracking errors. A changing climate has made water prices more unpredictable, which is where a futures market can play a vital role by offering price discovery and improving risk management.

Considerations for the Going Concern

The primary difference between the NQH2O contract and other tradable commodities, such as crude oil and soybeans, is that it is cash-settled rather than physically delivered. While there are concerns about potential market manipulation, the current liquidity and demand for the contract make such manipulation unlikely.

Lack of Liquidity

Trading volumes remain notably low, with daily trades averaging just 11 contracts and the maximum daily volume reaching only 53 contracts in early February. According to CME one of the key factors affecting liquidity is the market’s size limitations, as the futures market volume represents only about 8% of the average daily volume of short-term physical water trades in California. This small market size significantly impacts overall liquidity. Additionally, structural challenges such as a thin underlying spot market, insufficient price information availability, and limited water storability further impede the market’s success.

Research by Wang & Wang (2022), published in the Applied Economics Perspective and Policy Forum, identifies the primary cause of illiquidity in the water futures market as the lack of effective hedging demand, stemming from the heterogeneity and limited size of spot water markets. Additionally, the opacity of the water futures settlement index deters trader participation, while the scarcity of public information on spot water market transactions reduces its appeal to speculators.

The research highlights the high level of information asymmetry among participants, which naturally leads to lower volume and limited price discovery. Creating a cash-settled futures contract based on water prices from multiple states, similar to how Brent Crude includes various crude oils from patches in the North Sea, could improve oversight and facilitate more accurate price discovery. This approach would provide a broader, more reliable benchmark for water pricing.

Feasibility of Physical Delivery?

Including physical delivery in the contract would likely increase demand because it would allow for more direct interaction with the underlying asset. However, the flip side is that physically delivering water, especially in areas where water is scarce, would create significant ethical and practical concerns. These issues could include exacerbating water shortages and creating a market where speculative traders may gain access to water resources, raising moral questions about water as a commodity.

You can’t put a value on water as you do with other commodities. Water belongs to everyone and is a public good. It is closely tied to all of our lives and livelihoods, and is an essential component to public health.

The challenges associated with water futures markets can be extended to other essential commodities that are critical to public health and daily life, such as food and energy. However, unlike water, cash-settled futures markets for other commodities have often performed better since their inception, as illustrated in the graphic from The Conversation.

Farmers face unique difficulties when managing water resources alongside futures positions. Unlike other commodities, water cannot be forward-purchased or stockpiled, requiring farmers to secure physical supplies independently. Compounding the issue, only about 4% of California’s water is traded in physical markets, severely limiting price discovery and market transparency.

This disconnect between financial and physical water markets undermines the effectiveness of hedging strategies. During droughts, users must still buy water at spot prices, as futures contracts provide limited protection against regional water scarcity. Moreover, the site-specific nature of water pricing complicates the trading of these contracts, further reducing their utility. While physical hoarding of water is not possible, other risks exist in the market, including potential manipulation. Large traders could influence water indices by subsidizing transactions, and a single investor could control futures contracts representing up to 31% of average annual water rights transactions according to. The lack of price transparency in physical markets exacerbates these risks, making potential manipulation difficult to detect.

CFTC Implications

A piece from The American Prospect two years ago highlighted that the Commodity Futures Trading Commission (CFTC), the regulatory body responsible for overseeing derivatives markets, has not independently assessed whether water futures meet its requirements. The NQH2O contract was introduced through the CFTC’s self-certification process, which does not require prior regulatory approval. Under current rules, the CFTC would only be obligated to evaluate these contracts once there are more than 10,000 open positions—equivalent to approximately 9% of California’s annual water trade. Critics of the contracts argue that this lack of regulatory scrutiny increases the risk of market manipulation, as highlighted in a memo by concerned advocacy groups.

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.