Is The Dollar Under Any Threat?

BRICS nations (Brazil, Russia, India, China, South Africa) are actively working on creating a new currency that could potentially challenge the dominance of the US dollar in global trade and a reserve currency, although it could take time before the greenback is threatened as the world’s reserve currency. The project from the BRICS countries was recently confirmed by Kazem Jalali, Iran’s ambassador to Russia and is likely to be centre stage at the upcoming October 2024 Summit occurring in Russia.

Russia will hold the BRICS Summit in Kazan from October 22 to 24, 2024. During its BRICS presidency this year, Russia has said it will focus on "promoting the entire range of partnership and cooperation within the framework of the association on three key tracks – politics and security, the economy and finance, and cultural and humanitarian ties."

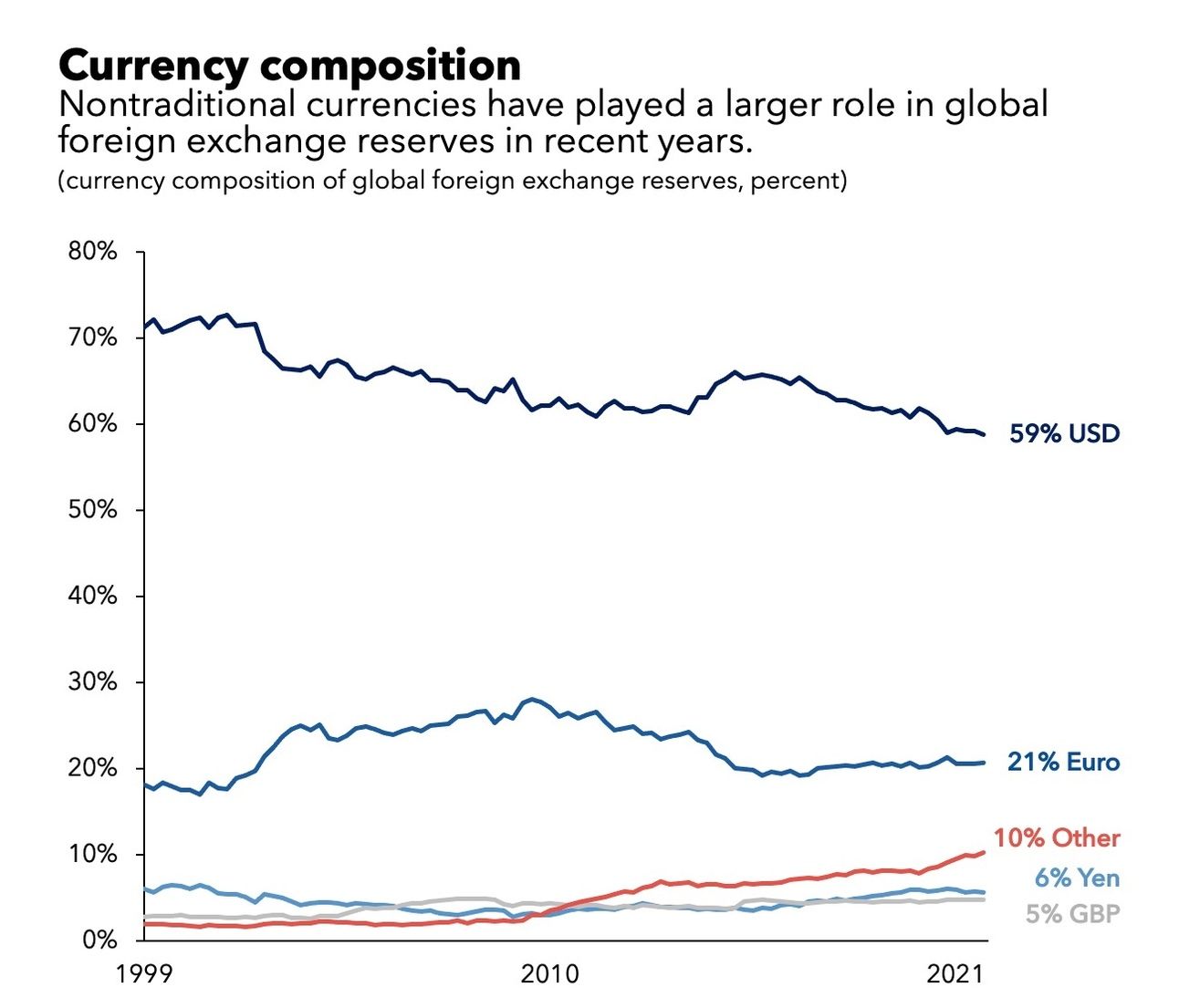

According to the U.S. Federal Reserve, between 1999 and 2019, the U.S. Dollar was used in 96% of international trade invoicing in the Americas, 74% in the Asia-Pacific region, and 79% in the rest of the world.

As of March 2024, over half (52.9%) of Chinese payments were settled in RMB while 42.8% were settled in U.S. dollars. Furthermore, according to data released by the People's Bank of China, China's gold reserves rose to 2264.87 tons in the first quarter of 2024, up from 2235.39 tons in the fourth quarter of 2023.This is double the share from the previous five years.

Historically, the U.S. Dollar has been the primary currency for oil trades, with nearly 100% of such transactions conducted in Dollars. However, by 2023, about one-fifth of oil trades were reportedly made using non-Dollar currencies, reflecting a slight shift in global trading patterns.

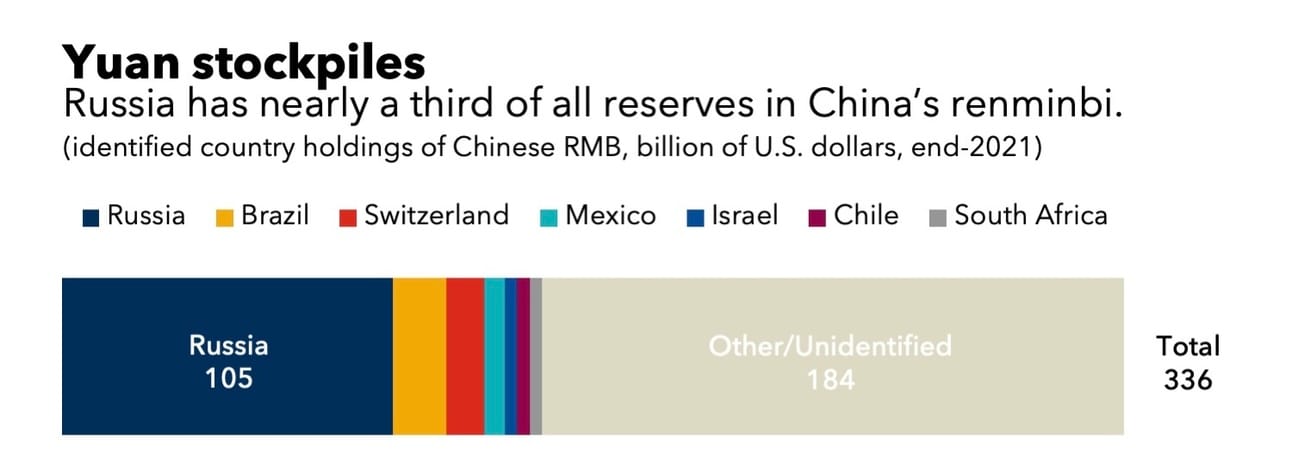

Despite low levels of direct trade with the U.S., the Dollar remains prevalent in invoicing in many countries. For example, 86% of India’s exports were Dollar-denominated, even though only 15% of Indian exports were directed to the U.S. Similarly, 47% of China’s cross-border payments were made in Dollars, despite only 17% of its exports going to the U.S., and nearly all of Brazil’s exports were invoiced in Dollars. Russia a BRICS founding member has been stockpiling China’s Yuan accounting for 31% of total outstanding renminbi.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

BRICS Bridge

What is it?

The BRICS bridge is an alternative to the SWIFT international payment system. The bridge which is meant to rival Society for Worldwide Interbank Financial Telecommunication (SWIFT) which is dominated by the dollar is focused on three key aspects according to BRICS members;

Connect member states' financial systems using payment gateways for settlements in central bank digital currencies.

Enable payments in the national currencies of BRICS countries.

Promote trade and economic integration among BRICS nations and their partners.

The development of BRICS Bridge has reportedly reached an advanced stage, with the Russian Finance Ministry and Central Bank collaborating closely with BRICS partners on the platform. This initiative is expected to be a key topic of discussion at the upcoming BRICS summit in Kazan, Russia, in October 2024. The New Development Bank is anticipated to play a central role in facilitating integration, conversion, and clearing within the platform.

The Russian Finance Ministry and the Central Bank of Russia together with BRICS partners are working on the BRICS leaders' report on now to upgrade the international forex and financial system. It will contain a number of initiatives and recommendations. Consideration of this report may result in creating a BRICS multilateral digital payment platform (BRICS Bridge), which will help bridge the gap between the financial markets of the BRICS member countries and increase mutual trade.

The BRICS bridge being currently in advanced stages does not mean it is a recent thought of BRICS members. The idea of de-dollarization has been on the rise since the Great Recession. Just before the 2008 financial crisis, BRICS nations held just over 1,500 tons of official gold reserves. Today, that figure has grown to over 6,600 tons, representing an increase of nearly 350% in just over a decade.

Considerations for SWIFT

SWIFT has seen significant growth in its messaging traffic over recent years. On November 30, 2021, SWIFT achieved a record peak of 50.3 million messages, 8.5% higher than the previous peak on February 26, 2021. In December 2022, SWIFT recorded an average of 44.8 million FIN messages per day, reflecting a 6.6% growth compared to the previous year.

As of March 2024, SWIFT reported the following breakdown of currency usage in international payments, with the U.S. Dollar‘s share being more than the next four currencies combined:

US Dollar (USD): 47.37%

Euro (EUR): 21.93%

British Pound (GBP): 6.57%

Chinese Yuan (RMB): 4.69%

Japanese Yen (JPY): 4.13%

A recent analysis by the European Central Bank revealed that most Euro transactions (57%) occur between banks within the Euro Area. Truly international transactions, involving at least one bank outside the EA, account for only 43% of Euro payments much less than what is being reported by SWIFT. When excluding intra-EA transactions, the Euro’s share in truly global payments drops to 9.4%, significantly lower than the 21.93% share reported by SWIFT. This places the Euro in a group of secondary currencies, including the GBP, RMB, and JPY, rather than as a true competitor to the greenback.

While the Euro Area trades significantly with the rest of the European Union due to the Single Market, intra-EU trade makes up about 60% of the total. In terms of extra-EA trade, the Euro Area’s trade-to-GDP ratio is around 55%, while the EU’s is 42%, both higher than the U.S. at 27% and China at 38%. Despite the EA’s sizable economy, representing 12% of the global economy (on a PPP basis), its open capital account, and sophisticated financial markets, the Euro’s relatively modest role in international payments highlights the enduring strength of the U.S. Dollar according to the Atlantic Council.

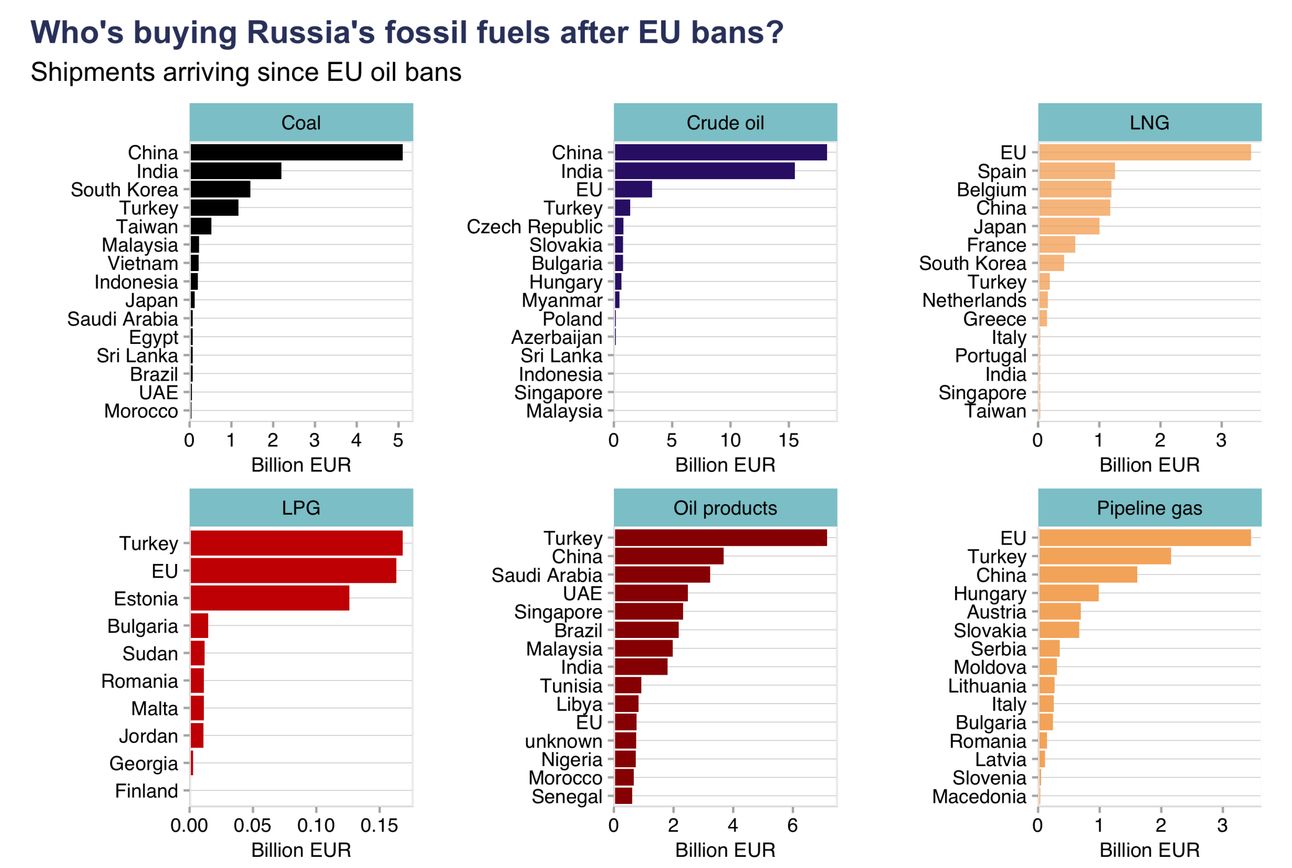

While SWIFT may not face an immediate threat, de-dollarization remains a priority for BRICS members. If Russia and China continue increasing their trade activity, especially with China being Russia’s largest export partner at an estimated value of $68.68 billion, this could accelerate efforts to reduce reliance on the U.S. Dollar in international transactions. Russia’s fossil fuels continue to be primarily purchased by Chinese authorities, highlighting a strong connection between the two BRICS members, particularly in light of recent sanctions imposed following the Russian invasion of Ukraine.

FX Street reported that, despite some lingering distrust among BRICS members regarding partner currencies, gold could serve as a bridging solution in the interim. This comes as gold reached an all-time high of $2,685 USD per troy ounce earlier this month.

Basket Reference Currency

The Initial Framework

The framework for a BRICS currency, as proposed by Yaroslav D. Lissovolik, focuses on the “R5 initiative,” which aims to strengthen the use of national currencies within the BRICS nations—Rouble (Russia), Rand (South Africa), Real (Brazil), Rupee (India), and Renminbi (China). This initiative seeks to enhance the role of these currencies in trade, investment, and long-term projects both within the BRICS+ circle and in the broader global economy. By reducing reliance on external currencies like the US dollar or euro, the R5 initiative aims to elevate BRICS currencies toward reserve currency status.

To advance this goal, Lissovolik proposes the creation of an SDR-type currency basket, known as the “R5+ currency basket.” This basket would include the most liquid currencies from BRICS+ countries and could be used by regional financing arrangements (RFAs) and development banks for various financial operations. Such a framework would facilitate greater use of BRICS currencies in global financial transactions, positioning them as viable alternatives in the international monetary system.

Regional Financing Arrangement Examples

BRICS Contingent Reserve Arrangement (CRA): Established in 2015, this arrangement provides financial support to BRICS countries (Brazil, Russia, India, China, and South Africa) facing balance of payments issues. The initial committed resources amount to $100 billion, which can be accessed under specific conditions.

Chiang Mai Initiative Multilateralization (CMIM): A cooperative arrangement among ASEAN Plus Three countries (China, Japan, and South Korea) that allows for currency swaps to provide liquidity support to member countries facing financial crises. The CMIM has a total capacity of approximately $240 billion.

Eurasian Fund for Stabilization and Development (EFSD): This fund supports member states of the Eurasian Economic Union (EEU) in achieving macroeconomic stability and funding projects aimed at economic development. The EFSD can provide loans and technical assistance to its members.

Arab Monetary Fund (AMF): An RFA among Arab countries aimed at promoting monetary cooperation and financial stability in the region. The AMF provides financial assistance, technical support, and promotes economic development through various programs.

Latin American Reserve Fund (FLAR): Established by several Latin American countries, this fund provides financial assistance and promotes economic stability in the region through currency swap agreements and lending programs.

Southern African Development Community (SADC) Regional Development Fund: This fund aims to support regional integration and development projects among member countries in the Southern African region, providing financing for infrastructure and development initiatives.

Check Out Part 2

Part 2 of our newsletter on Is a BRICS Currency in the Works? (Part 2) is available at the link below where we explore the implication for gold prices.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.