Markets

The stress test’s extreme equity market scenarios will likely influence market sentiment and pricing even before results are published. The assumption of a nearly 50% decline in UK equities signals to investors the potential for significant market disruption under adverse conditions. As banks adjust their risk models to account for such severe scenarios, we may see changes in their equity market exposures and trading strategies specifically in the UK.

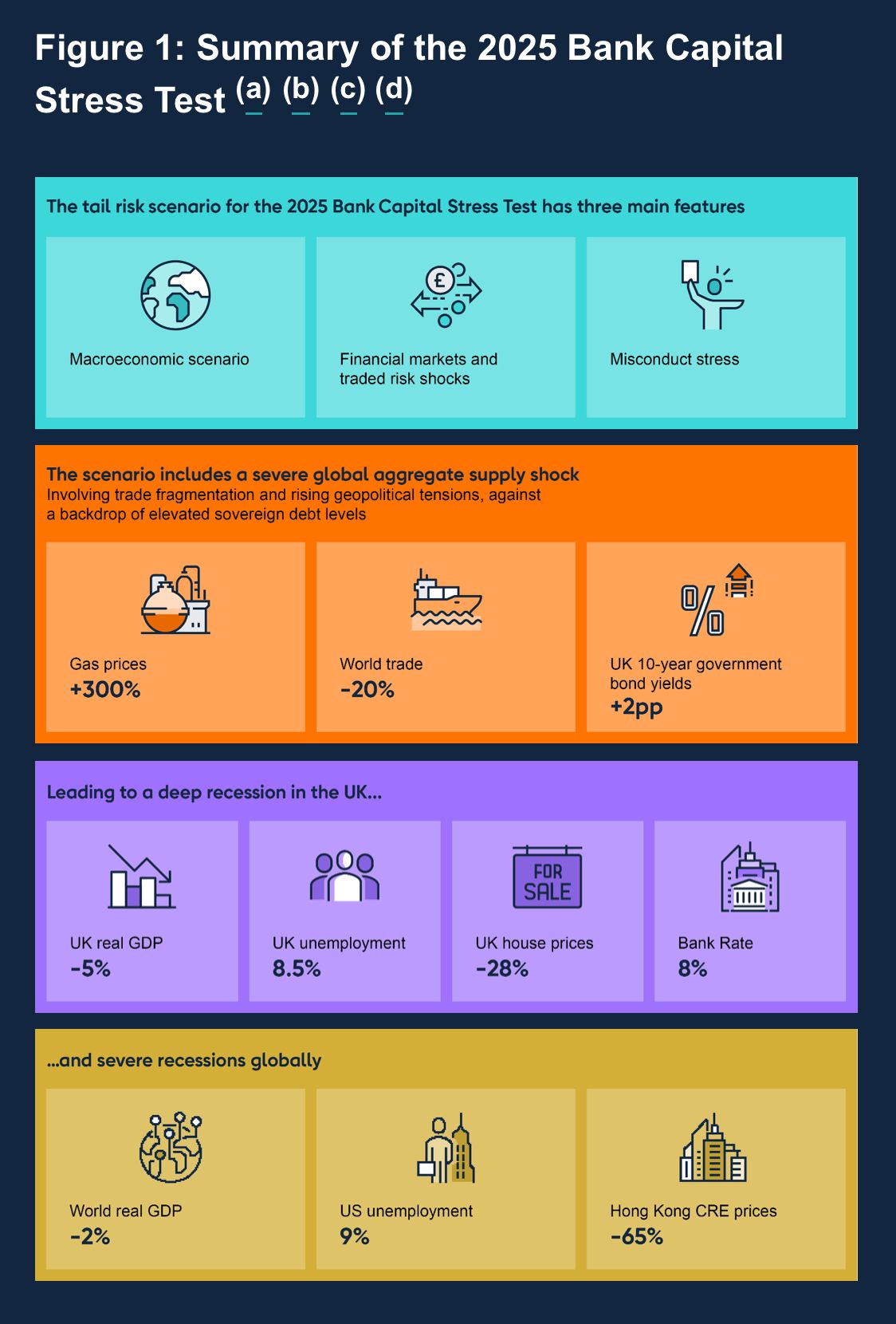

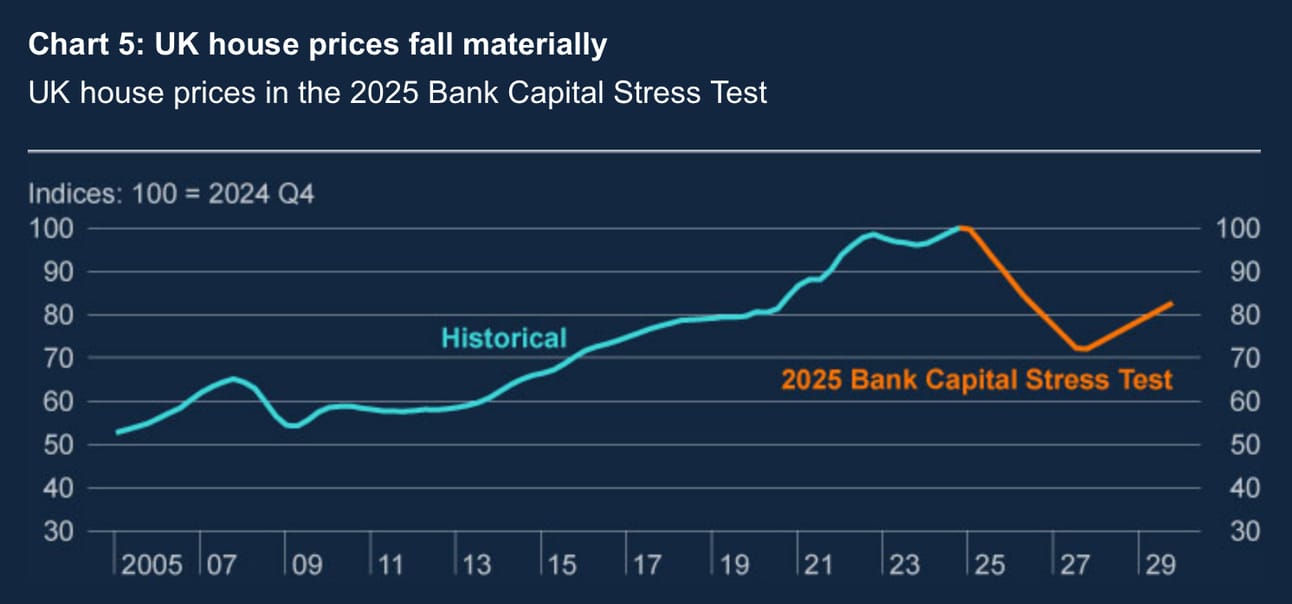

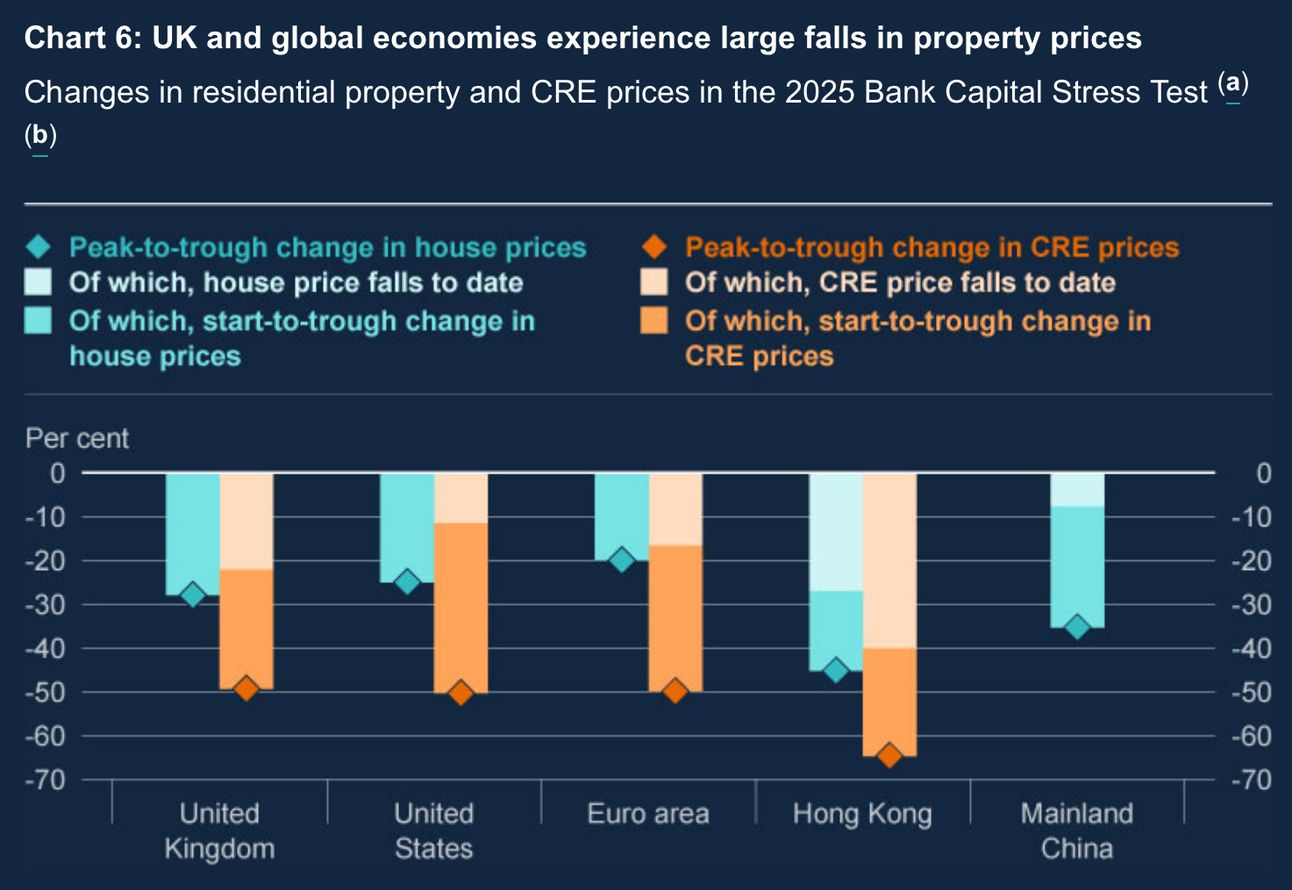

The test’s projection of sharply higher interest rates and widening credit spreads will add a new dimension to bond market dynamics. With ten-year government bond yields modelled to reach 6.4%, market participants may reassess interest rate risk, potentially leading to higher risk premiums in current bond pricing. Financial institutions might adjust their fixed-income portfolios in anticipation of potential regulatory findings. A similar shift in sentiment could play out in property markets, where the stress test envisions a 28% decline in property values. Developers and investors may take a more cautious approach, especially if banks tighten their property lending criteria based on internal stress testing. This could accelerate or exacerbate any existing cooling in English property markets, further reinforcing downside risks.

When results are published in Q4 2025, market volatility is likely to rise, particularly in the banking sector. Banks that demonstrate stronger resilience may see their stocks outperform, while those identified as having vulnerabilities could face investor pressure. The collective market response will largely depend on whether the system as a whole is perceived as adequately capitalized to withstand the severe scenarios outlined in the test.

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

Lending

The stress test results will also directly inform regulatory capital buffer requirements, with significant implications for lending capacity. If the Financial Policy Committee (FPC) and Prudential Regulation Committee (PRC) determine that current buffers are insufficient, they may increase requirements, potentially constraining lending. Conversely, if banks demonstrate substantial resilience, buffer requirements could be reduced, potentially expanding lending capacity.

Financial institutions typically respond to stress test scenarios by adjusting their lending practices in advance of regulatory findings. The severity of the 2025 test may lead to more conservative loan-to-value ratios in mortgage lending, enhanced scrutiny of commercial real estate exposures, tighter credit standards for sectors vulnerable to supply shocks and high inflation, and increased risk premiums on lending rates for higher-risk borrowers. These adjustments would occur gradually as banks incorporate stress test scenarios into their internal risk models.

Different sectors may experience varying lending conditions based on their vulnerability to the stress scenario. In mortgage lending, the projected 28% fall in property values may prompt more cautious policies. This comes amid ongoing discussions in other markets, such as Canada’s potential shift from individual borrower stress tests to portfolio-level risk management, highlighting a global tension between prudential regulation and housing market access.

For commercial real estate, explicit stress test assumptions of price declines could lead to tighter lending conditions, with banks requiring higher equity contributions from borrowers and more conservative valuation assumptions. Meanwhile, corporate lending may face stricter standards, particularly for cyclical industries, though the Bank of England’s guidance requires banks to maintain their market share of lending during stress, reinforcing the expectation that they continue supporting the economy even in downturns.

The biennial testing approach discussed in The New Bank of England Stress Test (Part 1) may also accelerate innovation in bank lending models. With more time between major regulatory exercises, banks have greater opportunities to develop more sophisticated internal stress testing capabilities, advance risk-based pricing models, incorporate alternative data sources for credit assessment, and implement capital-efficient lending structures. As Nathanaël Benjamin, Executive Director of Financial Stability Strategy and Risk at the BoE, noted, these revisions represent “a considerable efficiency gain” that could allow banks to improve their risk management capabilities.

Come for the news, stay for the laughs

Morning Brew isn’t just any newsletter—it’s your free shortcut to business news that actually matters. Fast, fun, and—dare we say—enjoyable.

No fluff, no jargon, and it takes less time to read than it does to brew your coffee (unless you’ve got a Keurig—then you might get to enjoy your Morning Brew with your actual brew).

Join over 4 million professionals who read it daily. Delivered bright and early, it’s news on your time—whether you read it when you wake up, over lunch, or before bed.

Policy

The ultimate goal of the 2025 Bank Capital Stress Test is to ensure banks “can absorb rather than amplify shocks and have the capacity to continue to serve UK households and businesses.” If successful, this should lead to a more resilient banking sector that can maintain lending during economic downturns, potentially moderating future credit cycles.

The move to biennial testing signals a maturing regulatory approach that balances thoroughness with efficiency. This evolution may continue, with future iterations potentially incorporating more targeted assessments of emerging risks like climate change or cyber security, as suggested by the Bank of England’s commitment to exploratory exercises. An interesting tension exists between market-driven and regulatory perspectives on risk. While markets may reward higher leverage and risk-taking during benign periods, the stress test imposes a longer-term perspective that could constrain excessive risk-taking. This dynamic will shape how banks balance shareholder returns against regulatory expectations, influencing capital allocation strategies and overall risk appetite across the UK and Eurozone alike.

Congratulations on making it to the end, while you’re here enjoy these other newsletters and be sure to subscribe to The Triumvirate before you go.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Interested in How We Make Our Charts?

Some of the charts in our weekly editions are created using Datawrapper, a tool we use to present data clearly and effectively. It helps us ensure that the visuals you see are accurate and easy to understand. The data for all our published charts is available through Datawrapper and can be accessed upon request.